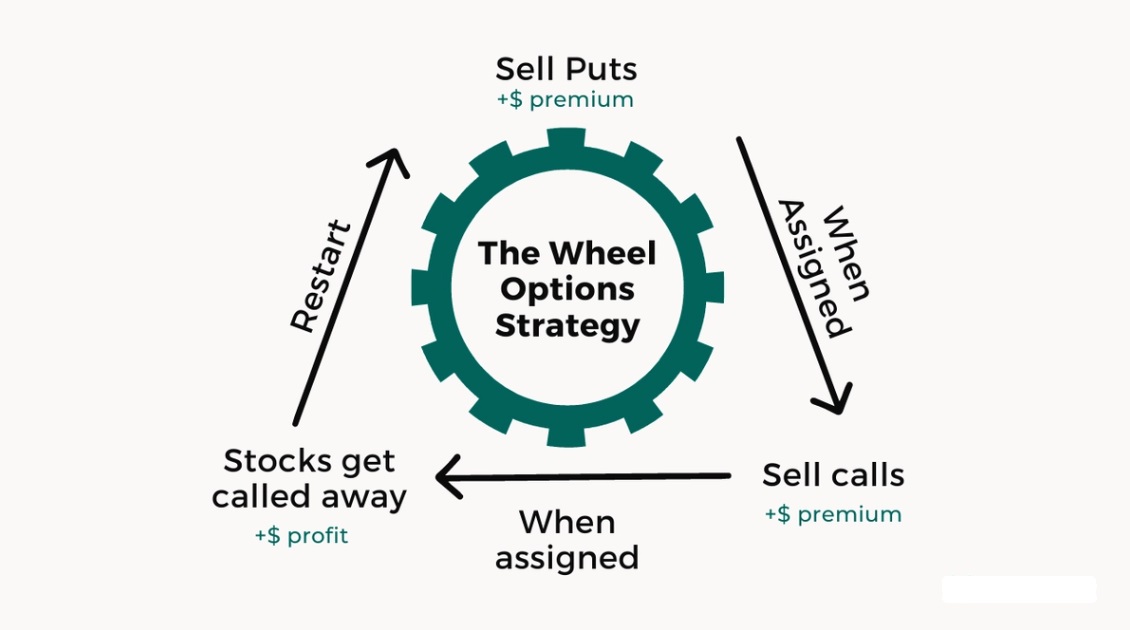

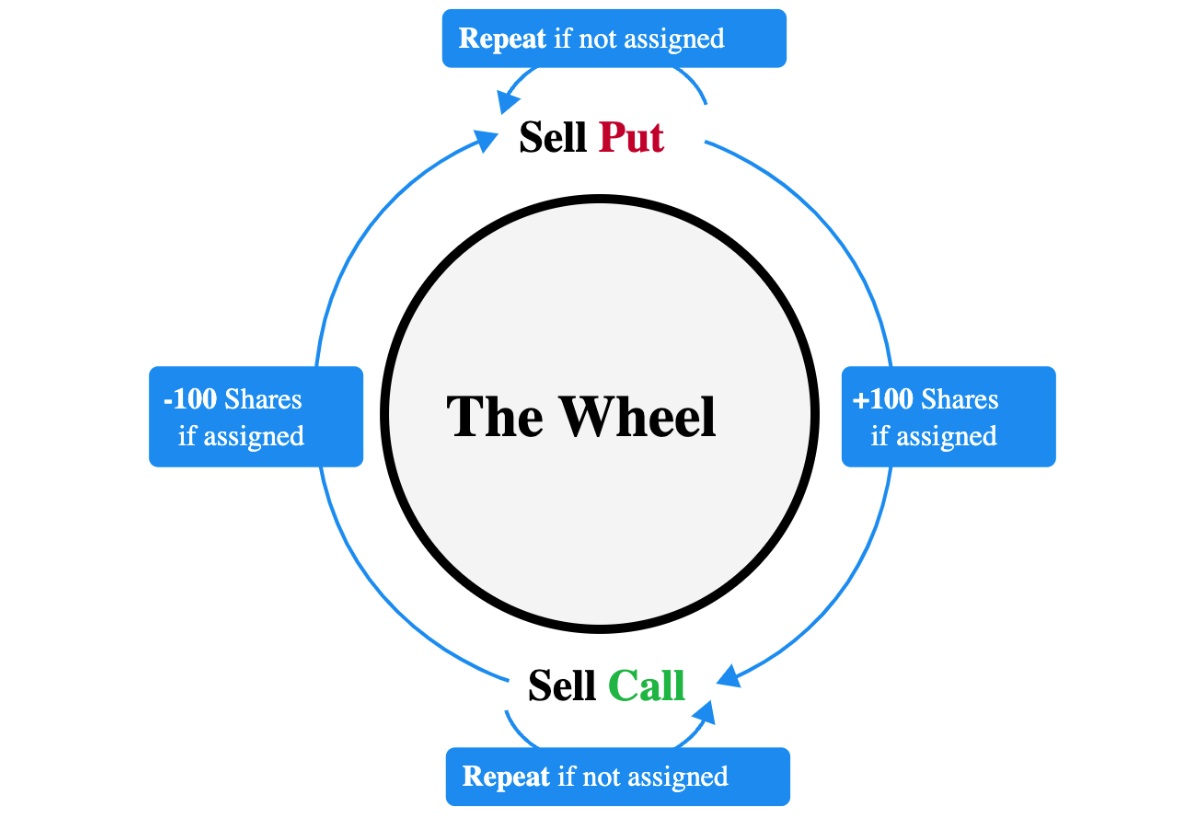

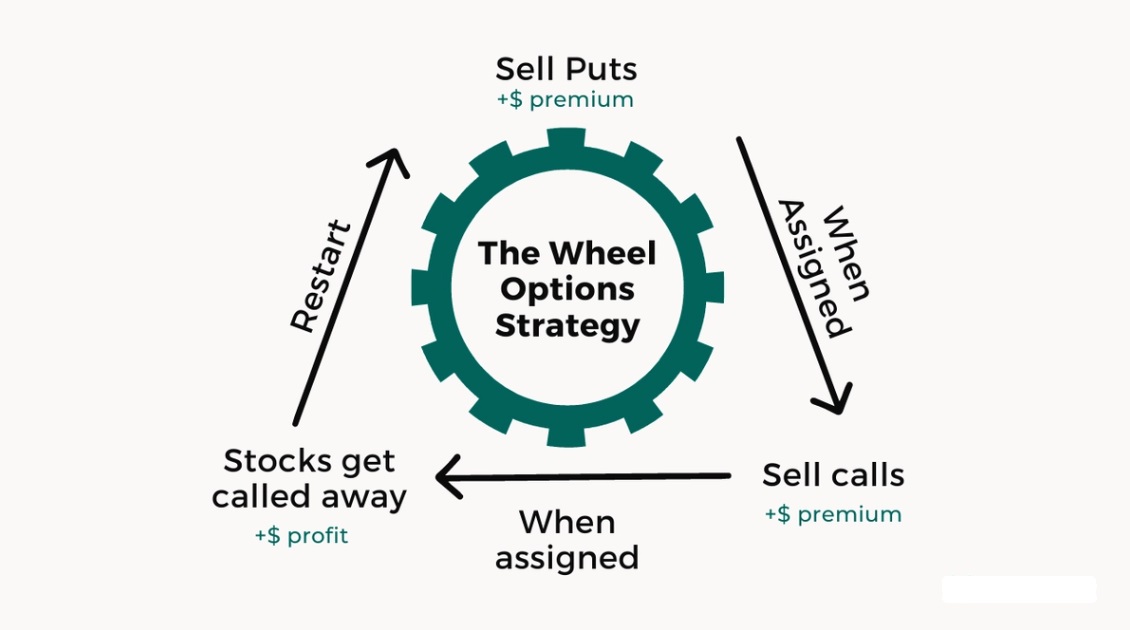

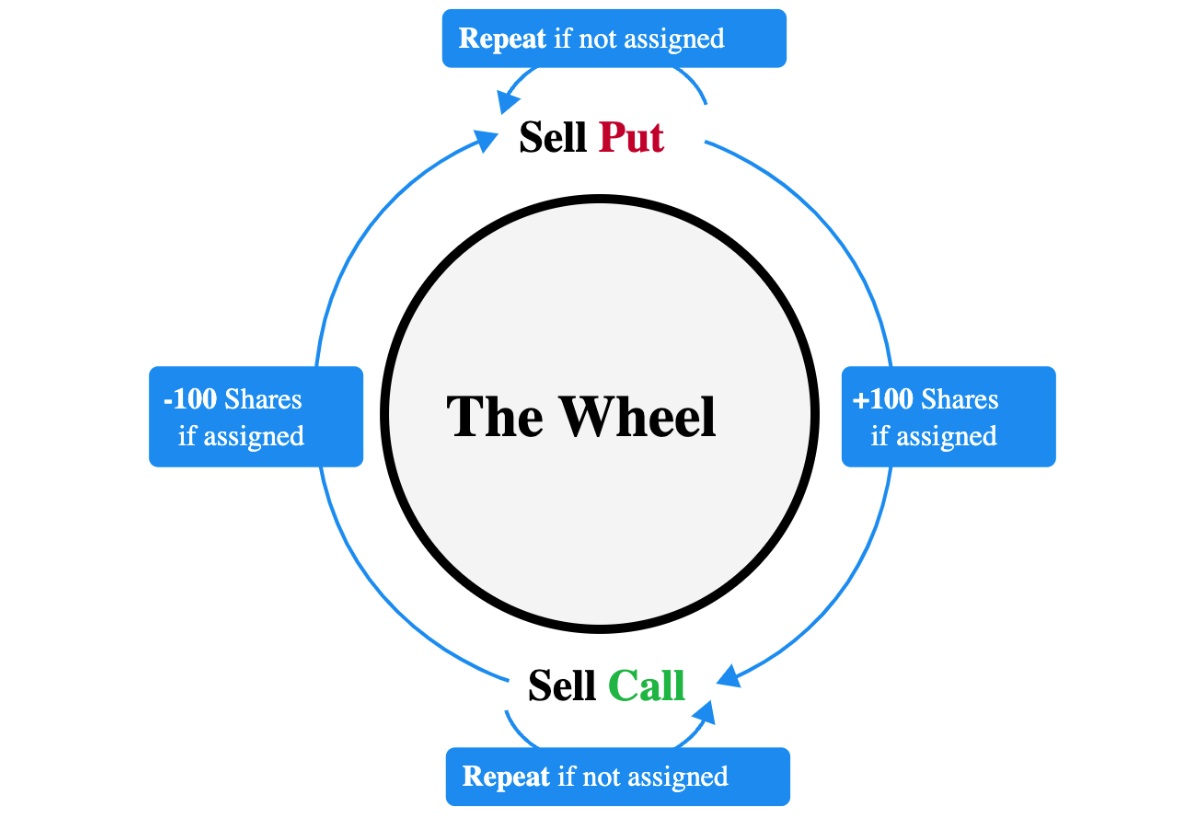

The Wheel Strategy is an options trading approach that combines the selling of cash-secured puts with the writing of covered calls. It's a relatively straightforward strategy that seeks to generate income in a volatile or sideways market. Traders use it to profit from options premiums while potentially acquiring stocks at discounted prices. The strategy is designed to work best with stable, high-quality stocks, which typically experience low levels of volatility. Essentially, the wheel strategy works in a cyclical fashion: you start by selling a cash-secured put, and if the stock is assigned to you, you sell covered calls until the stock is called away.

While many strategies focus on capital gains or speculative movements in the market, the wheel strategy is unique in that it seeks to generate a consistent income stream through options premiums. This regular income is often an attractive feature for those looking for a less volatile, more predictable investment approach.

While many strategies focus on capital gains or speculative movements in the market, the wheel strategy is unique in that it seeks to generate a consistent income stream through options premiums. This regular income is often an attractive feature for those looking for a less volatile, more predictable investment approach.

How to Execute the Wheel Strategy Step-by-Step

The process of executing the wheel strategy is straightforward but requires a clear understanding of how both puts and calls work in the options market.

Sell a Cash-Secured Put

The first step is to sell a cash-secured put option. This involves selling the right for someone to sell you shares at a set price (the strike price) before the expiration date. You need to have enough cash in your account to buy the stock if it's assigned to you. The income generated from selling the put comes in the form of the premium you receive for writing the option.

If Assigned, Buy the Stock

If the stock's price falls below the strike price of the put option, it is assigned to you, meaning you will buy the stock at the agreed-upon strike price. In this case, you are acquiring the stock at a price that is typically lower than its current market value, which provides an inherent margin of safety.

Sell Covered Calls on the Stock

Once you own the stock, you move to the second part of the wheel strategy: selling covered calls. This involves selling a call option on the stock, granting someone else the right to buy your shares at a specific strike price before the expiration date. In exchange for this right, you receive another premium. If the stock price rises above the strike price, your shares will be called away, and you will sell them at the strike price, thus completing one "cycle" of the wheel strategy.

Repeat the Process

If the stock isn't called away (meaning the stock price remains below the strike price of the call), you keep your shares and continue to sell more covered calls. If the stock is called away, you repeat the process by selling another cash-secured put.

Key Benefits of the Wheel Strategy for Income Generation

The wheel strategy offers several advantages, particularly for those seeking a consistent income. By repeatedly selling options, you generate premiums regardless of whether the stock price moves in your favour. This can be especially beneficial in a flat or sideways market, where capital appreciation is hard to achieve but premiums from options can still be earned.

Moreover, the strategy allows you to buy stocks at a discount, as the cash-secured put offers the chance to acquire shares at lower-than-market prices. In addition, even if you are assigned the stock, you still receive premiums from the covered calls you sell, further enhancing your overall return.

Moreover, the strategy allows you to buy stocks at a discount, as the cash-secured put offers the chance to acquire shares at lower-than-market prices. In addition, even if you are assigned the stock, you still receive premiums from the covered calls you sell, further enhancing your overall return.

Common Mistakes to Avoid When Using the Wheel Strategy

Although the wheel strategy is relatively simple, there are several common mistakes traders can make when implementing it. One such mistake is not having enough cash to cover the purchase of the stock when the put is assigned. If you don't have sufficient capital to buy the stock, you may be forced to close your position prematurely, potentially at a loss.

Another mistake is choosing the wrong stocks. The wheel strategy works best with high-quality, stable stocks, but some traders may be tempted to sell options on more volatile or speculative stocks, increasing their risk. It's crucial to choose stocks with solid fundamentals and a relatively stable price history.

Is the Wheel Strategy Suitable for Beginner Options Traders?

For beginner traders, the wheel strategy can be an excellent way to start engaging with options trading, especially if they have a long-term view on stock ownership. The strategy's relatively straightforward nature and potential to generate income through premiums make it attractive. However, beginners must be cautious, as it still involves risks—particularly if the underlying stocks are volatile or if there's not enough capital to cover potential stock assignments.

Overall, the wheel strategy can be a great introduction to options trading for beginners, provided they start with careful stock selection and a solid understanding of how options work.

Who Should Avoid the Wheel Strategy?

Despite its advantages, the wheel strategy may not be suitable for everyone. Those who cannot afford the required capital to purchase stocks when they are assigned should avoid this strategy. Additionally, traders who cannot tolerate the risk of owning stocks during downturns may find the wheel strategy less appealing. The strategy works best when you are willing to hold the underlying stocks for extended periods, which might not suit more speculative or short-term traders.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

While many strategies focus on capital gains or speculative movements in the market, the wheel strategy is unique in that it seeks to generate a consistent income stream through options premiums. This regular income is often an attractive feature for those looking for a less volatile, more predictable investment approach.

While many strategies focus on capital gains or speculative movements in the market, the wheel strategy is unique in that it seeks to generate a consistent income stream through options premiums. This regular income is often an attractive feature for those looking for a less volatile, more predictable investment approach.

Moreover, the strategy allows you to buy stocks at a discount, as the cash-secured put offers the chance to acquire shares at lower-than-market prices. In addition, even if you are assigned the stock, you still receive premiums from the covered calls you sell, further enhancing your overall return.

Moreover, the strategy allows you to buy stocks at a discount, as the cash-secured put offers the chance to acquire shares at lower-than-market prices. In addition, even if you are assigned the stock, you still receive premiums from the covered calls you sell, further enhancing your overall return.