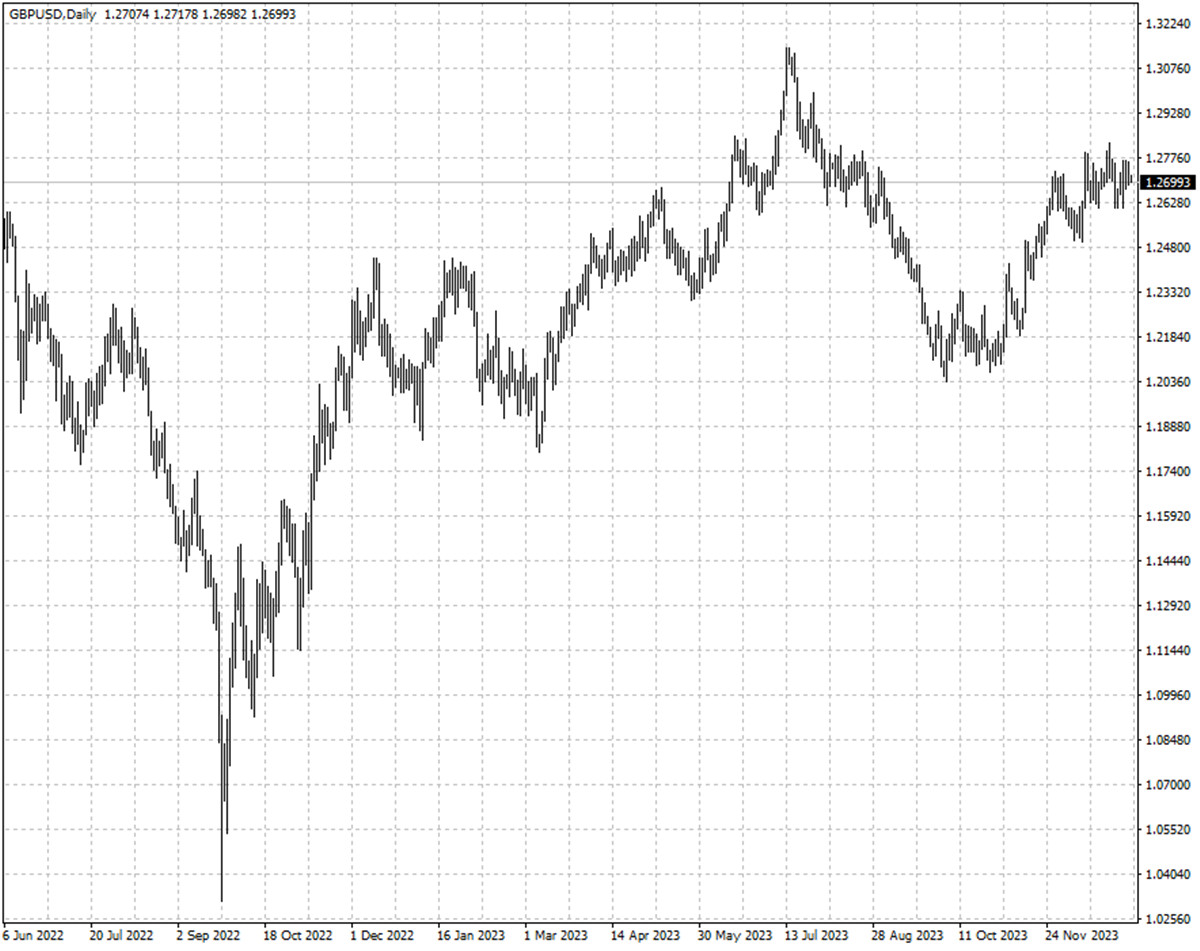

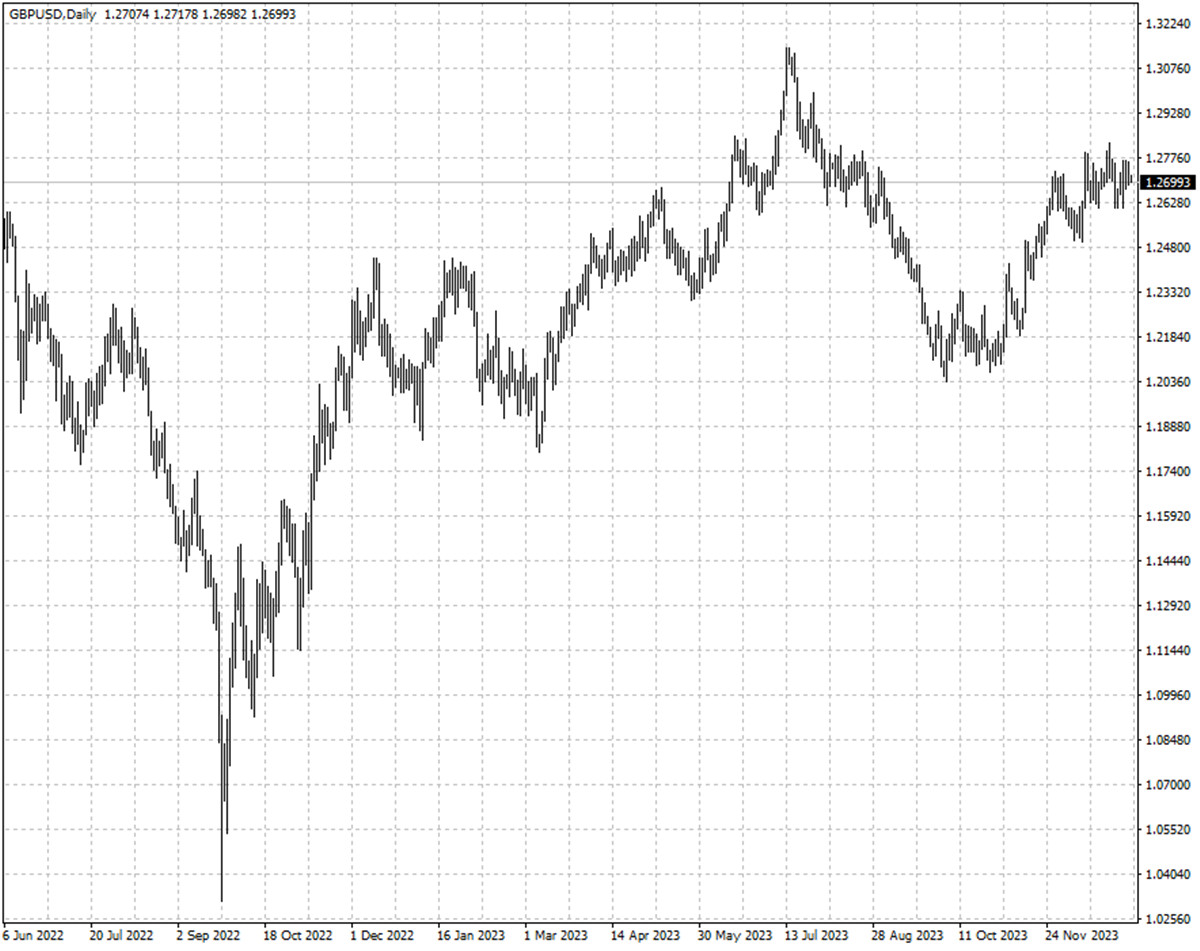

Sterling has pared some of its great gains that it notched over 2023 due to a

US dollar rally but a stream of signs of adapting to higher interest rates are

encouraging amid political and economic uncertainties.

Data showed on Thursday net borrowing by British consumers was the highest in

nearly 7 years in Nov and lenders approved the most mortgages since June.

Also the UK’s service sector experienced a robust growth in the previous

month and hit a 7-month high with its composite PMI perched at the highest since

May.

Traders expect around 140 bps of rate cuts in 2024, slightly lower than the

roughly 150 expected from the Fed and the ECB, and that the BOE will unlikely

act in Q1 despite of British business leaders’ urge.

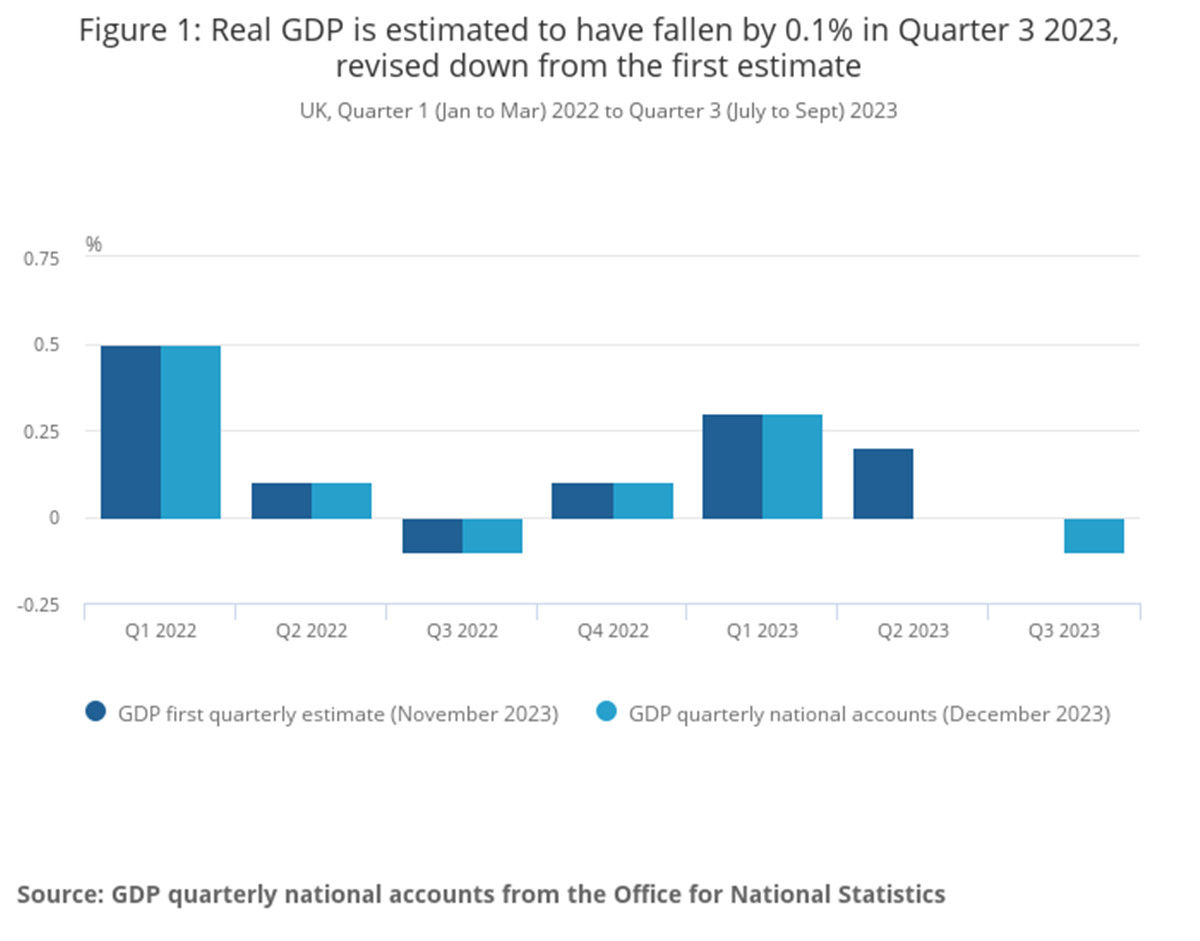

“Grey gloom” summed up economist forecasts for the country, according to the

FT’s annual survey. Even so, it is noted that a similarly downbeat outlook this

time last year turned out to be overly pessimistic.

Pimco’s baseline scenario is that the UK outlook will resemble that in the

rest of Europe: broadly stagnant growth, continued normalisation in inflation

and rate cuts at some stage.

Cost of living crisis

The UK economy may no longer looks like an outlier, but economists surveyed

by a FT poll said voters will continue to struggle with high prices ahead of the

next election.

Almost all respondents to the survey predicted growth would stagnate or at

best hit 0.5% in 2024. Chancellor Jeremy Hunt said last month people should

“throw off our pessimism and declinism about the UK economy”.

Hunt is expected to announce more tax cuts in the March Budget, a part of a

Thatcherite package PM Sunak pins hopes on to revive his premiership. The

opposition Labour Party is around 20% ahead in opinion polls.

But economists warned in the survey a "living standards disaster" will be

inevitable even if Sunak delayed the election until the last possible date of

Jan 2025.

The Resolution Foundation said household disposable income per person was

expected to fall by 1.5% in 2024, the steepest fall in an election year since

1974, if a vote is confirmed.

Britain's public finances are under strain after huge spending during the

COVID pandemic and after the Russia-Ukraine war, and thus limited room for

further cuts or other stimulus.

As such, the pressure is mounting on policymakers to take caution. Despite

the mortgage pain, the central bank said last month that it is not thinking

about cutting rates as the outlook for inflation remains uncertain.

Business and consumer confidence could be subdued until Britain’s next

government clarifies Fiscal Policy to improve the woeful growth prospects. That

in turn plagues the pound looking to extend its gain from last year.

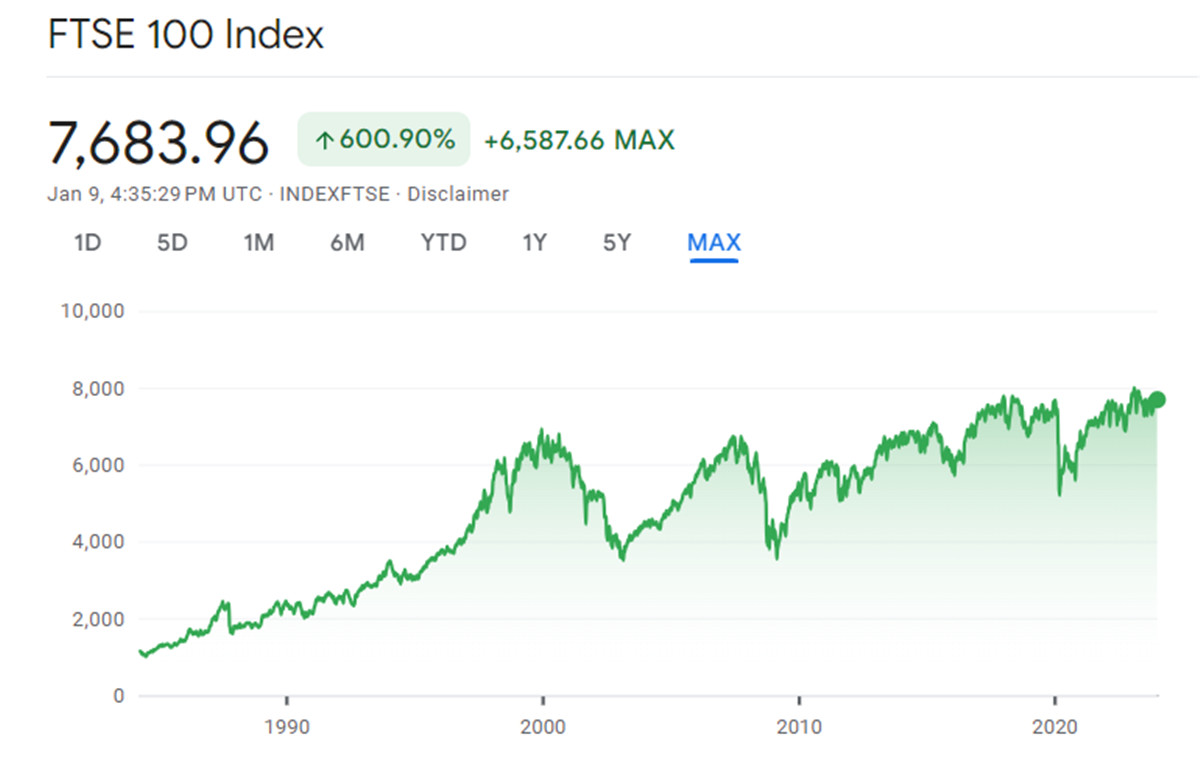

Unloved stock market

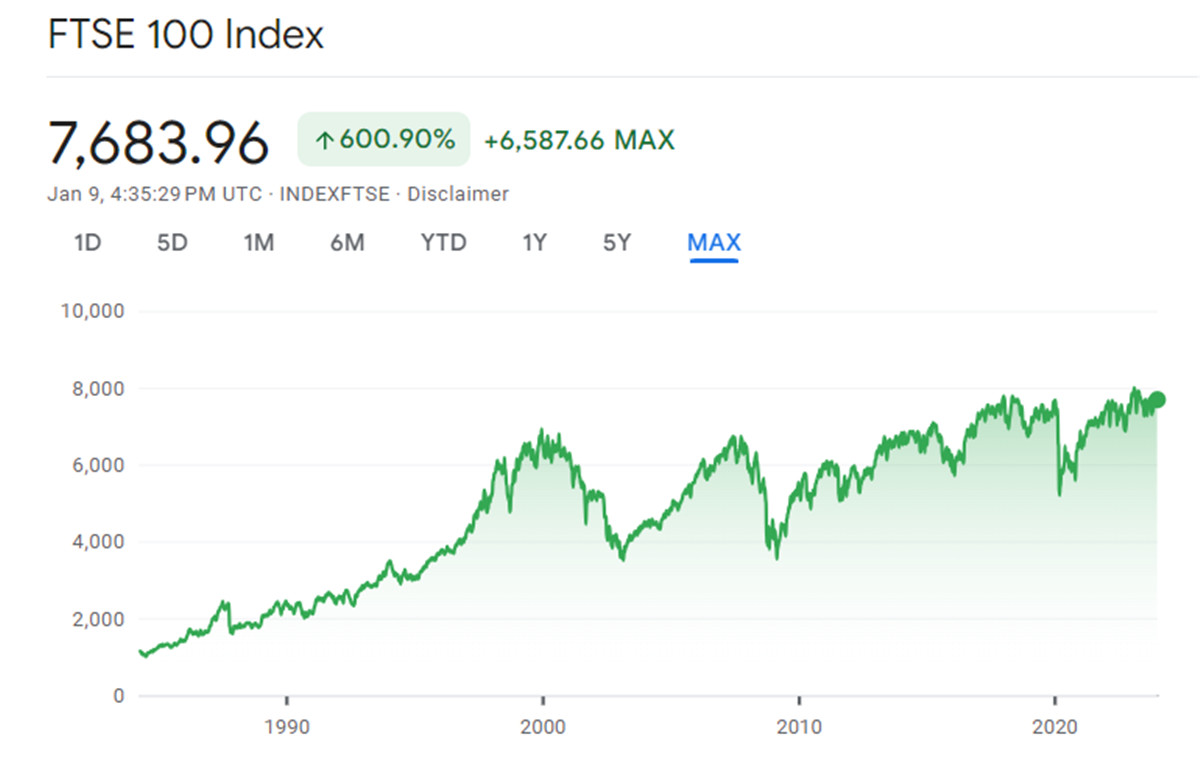

The FTSE 100 just celebrated a bitter 40th birthday last week. It has been a

global laggard for decades, having registered a meagre gain of around 10% since

the end of 1999.

Cheapness of the market is not an assurance of catch-up given the relative

lack of technology exposure. Investors are increasingly looking beyond the

country for a better return.

British retail investors had sold down £11.9bn worth of shares in

London-listed companies by the end of October, the largest outflow in 20 years,

according to the latest data from the Investment Association.

Increasing cost of living and the poor performance relative to other stock

markets are blamed for the exodus. A Charles Schwab survey said the biggest

reason for pulling money off the platform was to pay bills.

Asset managers have launched the lowest number of funds for UK investors in

two decades as the regime shift in rates is impacting how portfolios are

restructured, according to data from Morningstar.

The latest official data to the end of 2022 shows that British retail

ownership of UK equities had hit a historic low though foreign ownership of

those assets had surged.

UK equities are shunned with few signs of consumer health and things may not

look up in the next six months, said Michael Field, equity markets strategist at

Morningstar.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.