The dollar was steady on Wednesday

2024-01-10

Summary:

Summary:

USD steadied ahead of US inflation data; potential impact on Fed policy. The futures market suggests a 64% chance of rate cuts in March.

EBC Forex Snapshot

10 Jan 2024

The dollar was steady on Wednesday ahead of US inflation data later this week

that could influence the Fed's policy. Future market indicates a 64% probability

of rate cuts in March.

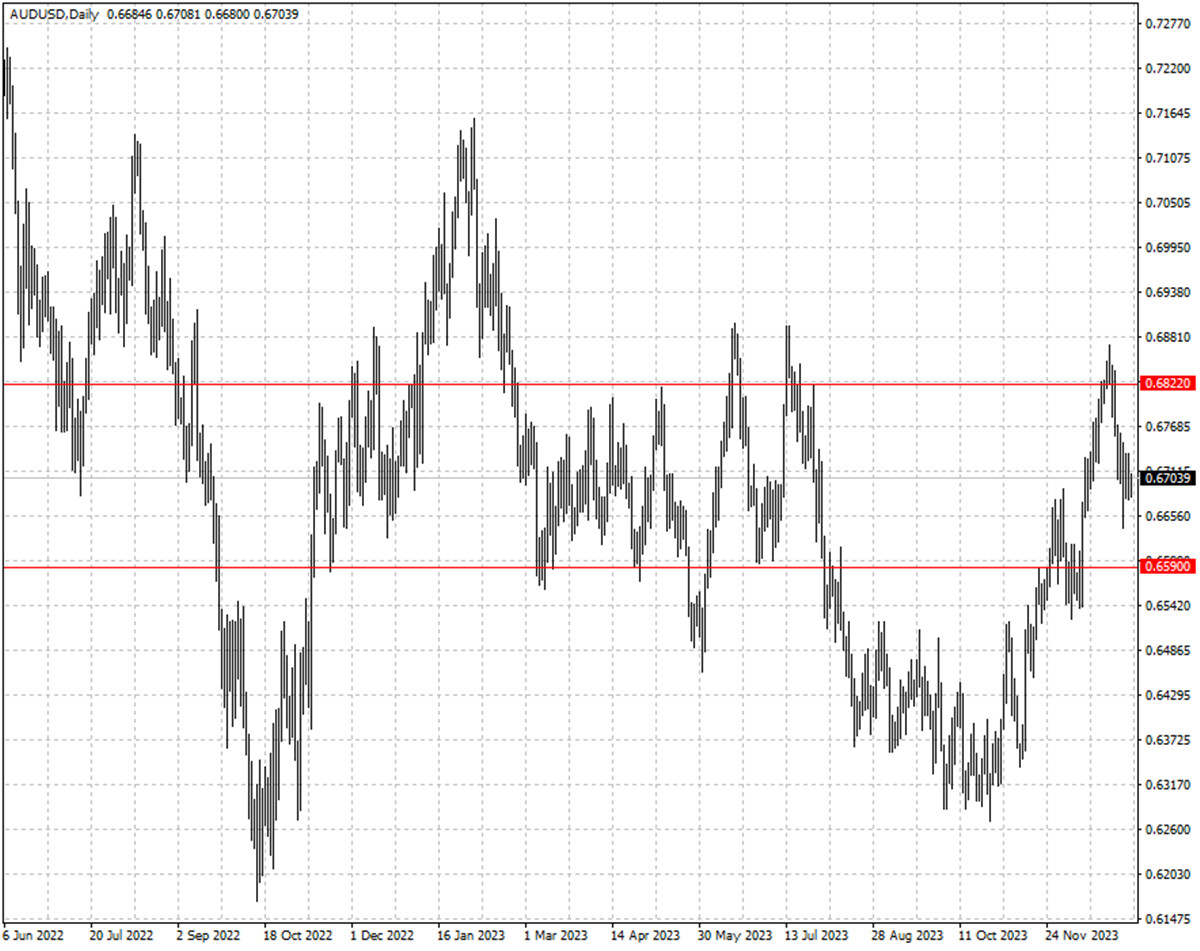

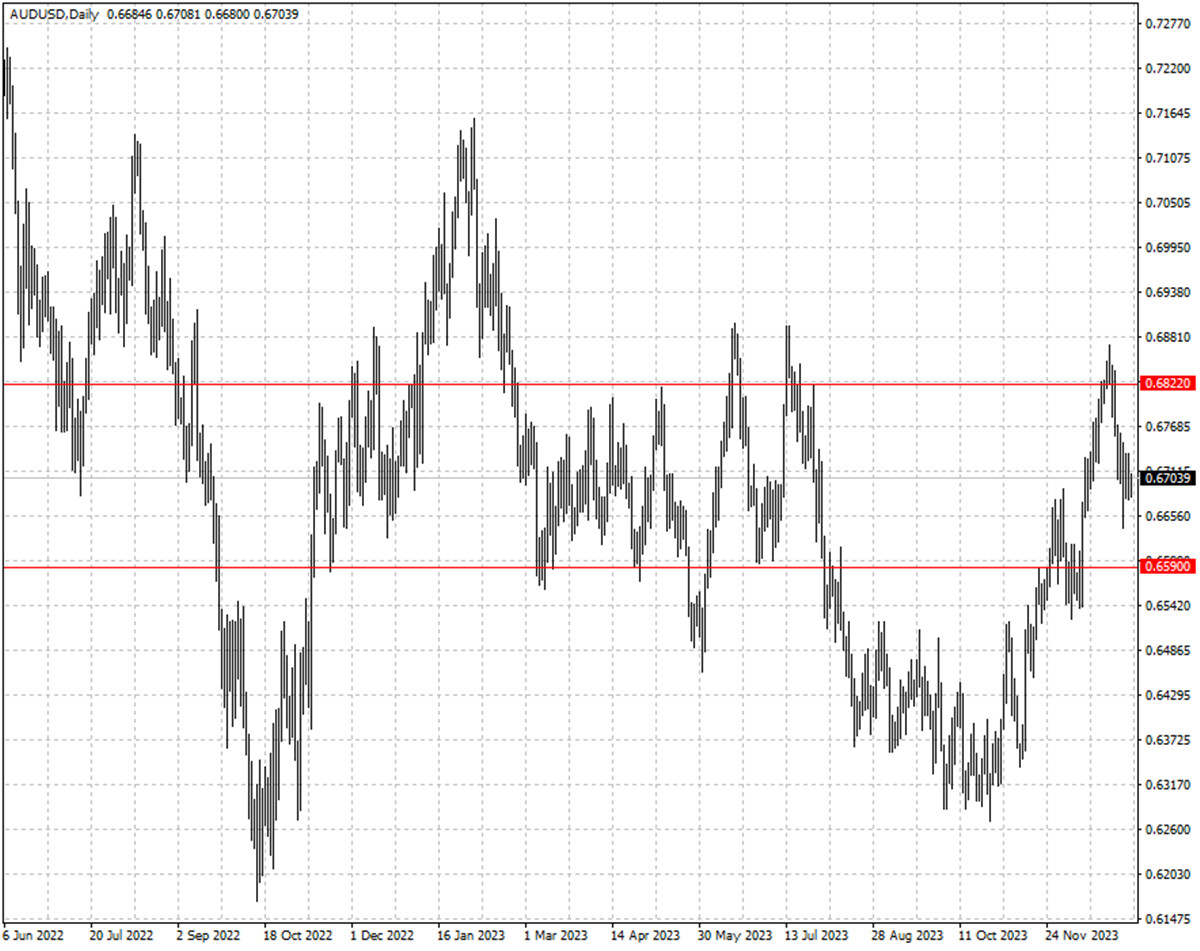

The Australian dollar edged up despite cooling inflation. The headline

consumer price index was 4.3%, the lowest level since Jan 2022. Economists had

forecast the reading to be 4.4%.

New bank loans in China likely rose in Dec, bringing 2023 lending to a new

record high, a Reuters poll showed. Analysts expect more easing early this year

to support the fragile economy.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 2 Jan) |

HSBC (as of 10 Jan) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0833 |

1.1150 |

1.0824 |

1.1088 |

| GBP/USD |

1.2527 |

1.2848 |

1.2599 |

1.2819 |

| USD/CHF |

0.8333 |

0.8667 |

0.8358 |

0.8659 |

| AUD/USD |

0.6691 |

0.6900 |

0.6590 |

0.6822 |

| USD/CAD |

1.3114 |

1.3387 |

1.3237 |

1.3477 |

| USD/JPY |

139.48 |

144.94 |

141.15 |

146.89 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.