According to the latest Bank of America survey, Asian fund managers remain largely bullish on Japanese stocks, showing resilience despite growing uncertainty around Japan’s political and monetary policy outlook.

Sentiment towards Chinese investments has balanced out. While investors still see potential in China’s economy, they have scaled back expectations for additional stimulus from Beijing, especially following Trump’s victory.

The survey revealed that Japan holds the highest concentration of overweight positions among Asian fund managers, with 45% favoring Japanese stocks. Japan’s stock market saw a late-October rally but has since stabilized.

Analysts suggest that Trump’s anti-China stance could drive more funds into Japan, with Morgan Stanley reinforcing its preference for Japanese shares over Chinese ones.

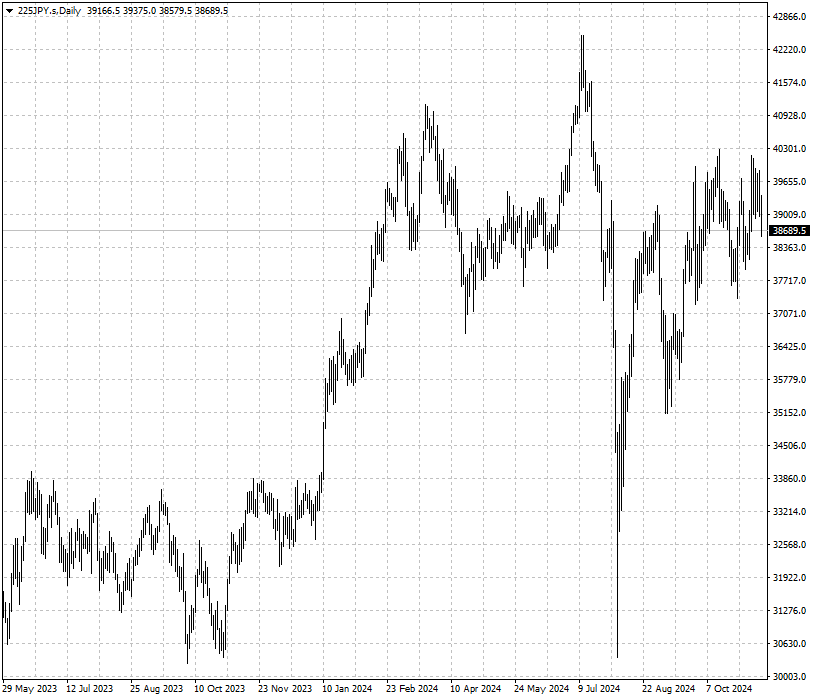

The Nikkei index has risen approximately 16% so far this year, on track to achieve its second consecutive year of gains. In a sign of confidence in Japan’s market, Berkshire Hathaway has raised $1.9 billion in yen-denominated bonds, signaling its intent to increase its Japanese investments.

However, not all market participants share the same optimism about Japan’s future growth. Societe Generale strategist Frank Benzimra cautioned that Japan might face a slowdown in earnings growth after the strong post-pandemic recovery.

While Benzimra sees a short-term dip in Chinese assets, he remains positive on China’s long-term prospects, maintaining an overweight position. He believes that China's policy adjustments will continue to support its equity market recovery.

Cautiously Positive

Japan’s growth engine is shifting from exports to consumer spending. As deglobalization takes hold, a stronger yen is becoming increasingly important to balance the economy.

Even if Japanese companies manage to navigate higher tariffs and the rising “pick-a-side” rhetoric from China hawks, doing business in China may no longer be as lucrative as it once was.

A Reuters poll conducted in October revealed a slim majority of economists expect the Bank of Japan (BOJ) to hold off on rate hikes for the remainder of the year, although nearly 90% anticipate a rate increase by the end of March.

Nicholas Smith, a strategist at CLSA, sees a six-month boost for Japan as “animal spirits” drive growth in the financial sector. He believes global capital spending is poised to recover, benefiting Japan in the process.

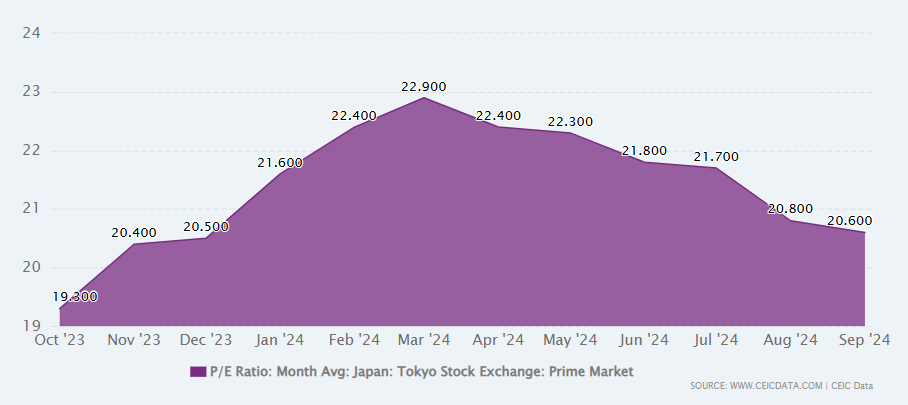

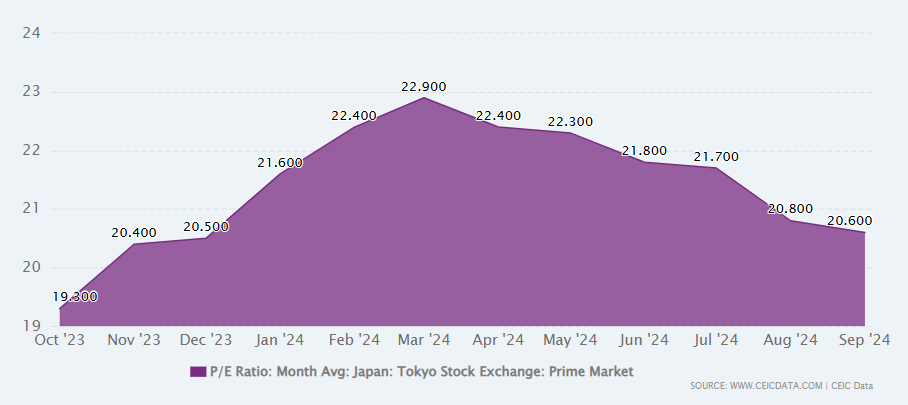

Aggregate earnings for the quarter ending in June exceeded expectations, with double-digit year-over-year growth. The index is currently trading at a multiple of 20.6x, roughly in line with the 10-year average.

Concerns persist that Shigeru Ishiba and his party may lack the strength to disrupt the economy’s momentum or reverse the progress made on corporate governance reforms and restructuring efforts that have attracted foreign investors.

Despite these concerns, an increasing number of global funds appear to believe Japan is at a turning point. However, the level of confidence is still not high enough to trigger significant reallocations of capital into the country.

Tepid Earnings

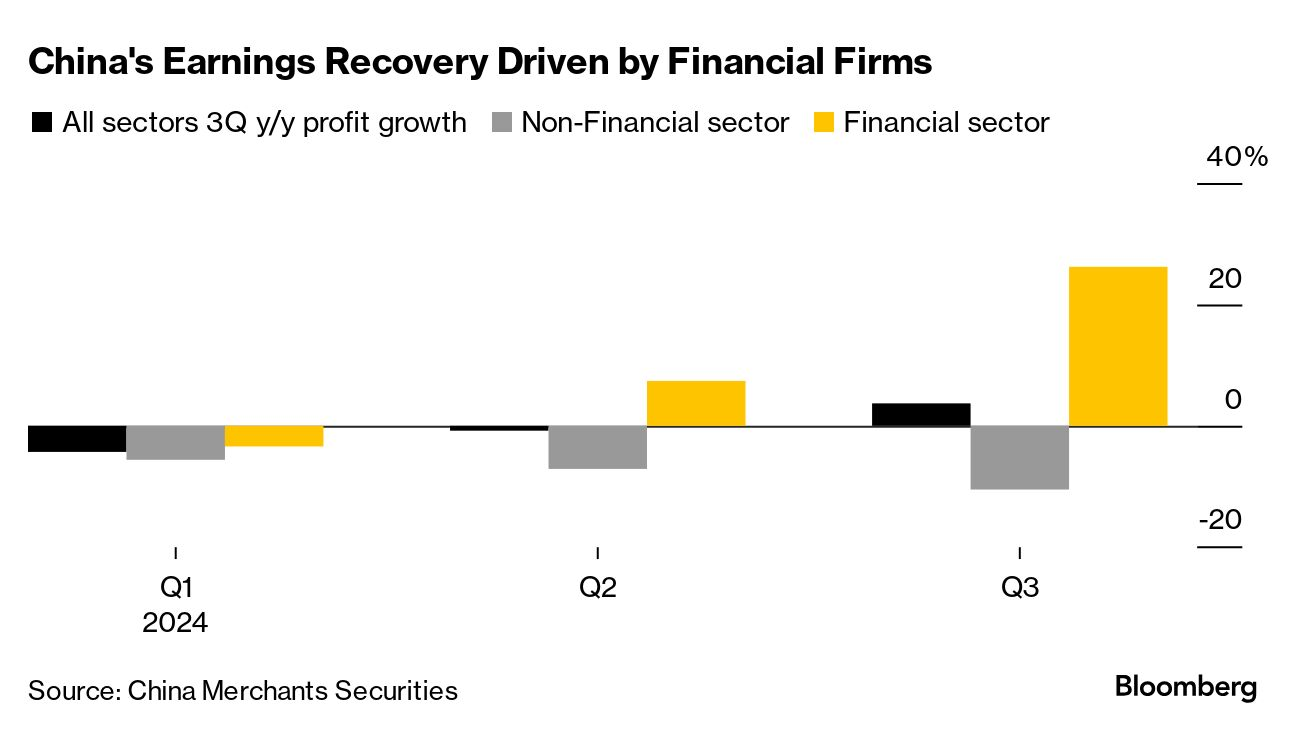

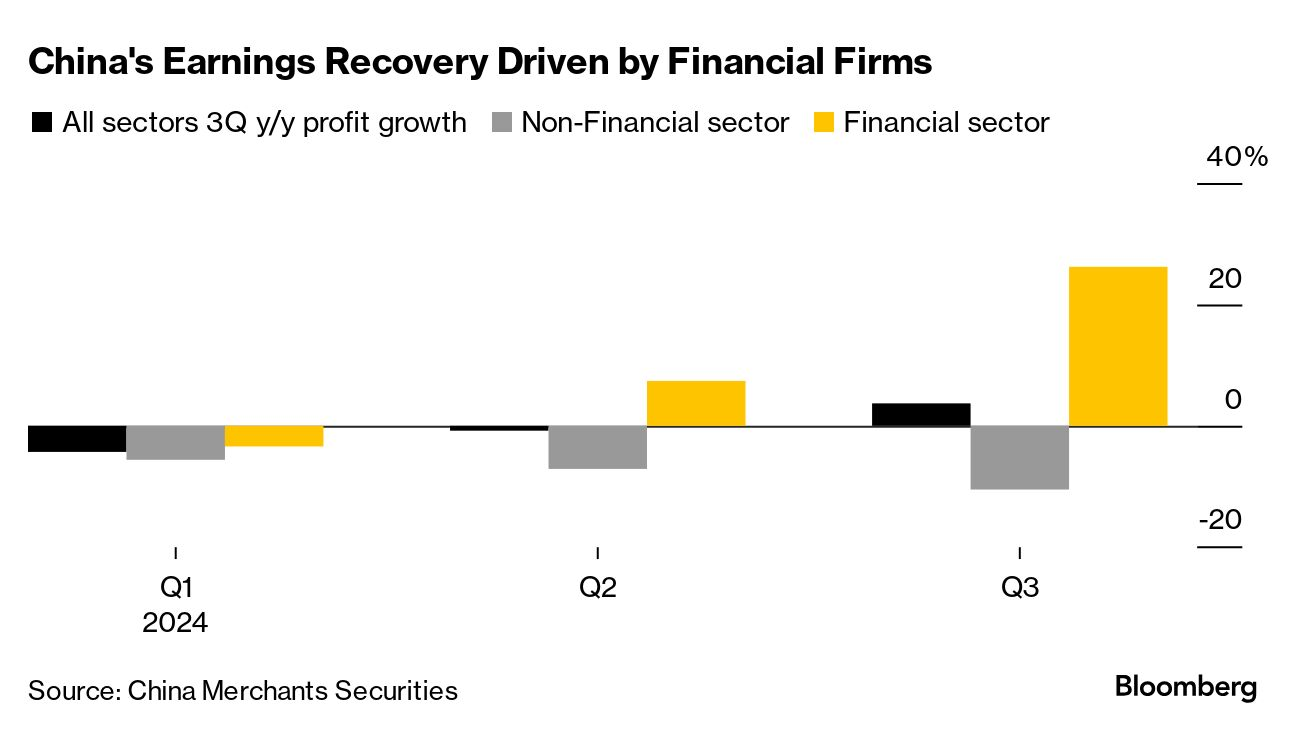

Chinese earnings returned to growth in Q3 but a closer look at the numbers

reveals a picture that's far less encouraging. Beyond the financial sector,

profits declined at a steeper pace.

According to UBS Securities, insurance and brokers reported 233% profit

growth in the three months from a year earlier due to their investment returns,

while non-financial earnings dropped 9%.

While the stimulus drive may filter through to corporate performance in the

months to come, analysts say the boost may be limited unless policies address

weak domestic demand.

Local consumer giants continued to struggle. Kweichow Moutai missed

estimates, while appliance maker Midea Group met the consensus with the benefit

of hefty forex related gains.

Still some positive signs are emerging. Alibaba Group said it recorded

"robust growth" in sales and a "record number" of shoppers over this year's

Singles' Day sales period.

China also announced on Tuesday that two days will be added to the public

holiday calendar next year in the effort to lift spending. Unfortunately,

Washington remains a major headwind.

Some US pension money may have returned to Hong Kong and Mainland China in

recent months, but that could quickly reverse under Trump. And the flows may

well divert to Japan by default.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.