Wall Street is preparing cautiously for Tuesday's election as U.S. voters pick their next president, a decision that could set the economic course for the next four years.

Speculation leans slightly toward a Trump win in some circles, but professionals are hesitant to invest heavily in financial markets amid a close race in the latest polls.

Analysts noted that only seven out of the 50 states are truly competitive this year, with the remaining states firmly leaning Democratic or Republican. Pennsylvania, in particular, is viewed as the most pivotal battleground.

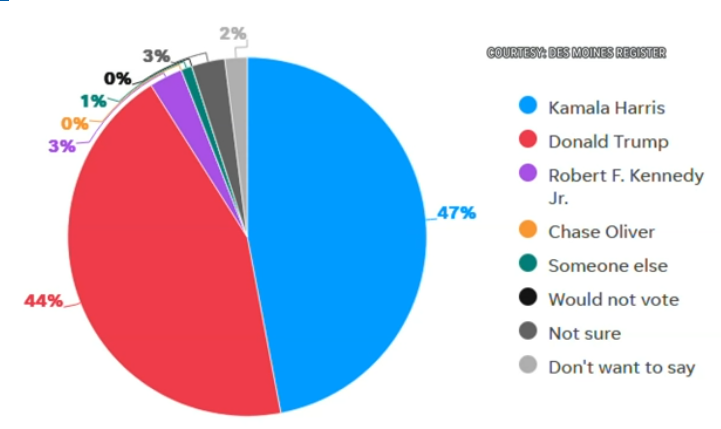

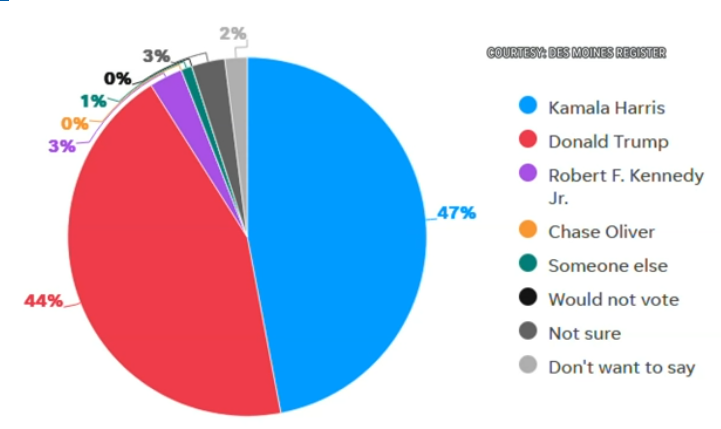

Harris has unexpectedly pulled ahead of Trump in a new Iowa poll, largely due to support from likely women voters, marking a surprising shift in this traditionally red state. This change was highlighted in the latest Des Moines Register/Mediacom Iowa Poll released on Saturday.

Meanwhile, concerns over potential political unrest have led officials to step up security measures for Election Day and its aftermath, anticipating that Trump may quickly contest any unfavorable result.

Patience

Election Day will be quickly followed by the Fed's policy decision, along with a significant wave of earnings reports from major corporations. Given the high level of uncertainty, traders are reminded that patience is key.

As exit polls start rolling in, early attention will likely turn to the bond and currency markets. Last week, a CME index measuring implied volatility across key currencies reached its highest level since early last year, indicating increased caution. Additionally, data from the CFTC shows that large speculators went net long on VIX futures for the first time since January 2019, signaling heightened expectations of market swings.

John Schlegel, head of positioning intelligence at JPMorgan Chase, noted that many prime brokerage clients have been scaling back their positions to prepare for potential volatility. Meanwhile, Berkshire Hathaway's cash reserves surged to a record $325.2 billion in Q3, as Warren Buffett continued to hold off on major acquisitions and pared down significant equity holdings.

Gold

Bullion reached new highs last month, driven by uncertainties in the Middle East and the approaching U.S. election. Interestingly, it’s been moving in tandem with the U.S. dollar—a sign that safe-haven demand remains exceptionally strong.

Investment flows were key to the metal's 13% gain in Q3, with total demand

for ETFs, bars and coins reaching the strongest levels since Russia's invasion

of Ukraine in 2022, said the WGC.

The increase was underpinned by stronger investment flows from the West,

including more high-net-worth individuals, that helped offset waning appetite

from Asia, the report showed.

Rising Treasury term premium underscores fear of a second Trump presidency.

His economic policies are widely seen as inflationary at a time when US

borrowing is highly elevated.

Typically, higher bond yields put gold markets under pressure, but

presidential candidates that have shown few concerns about the ballooning budget

deficit will help deter who tend to buy the dip.

yen

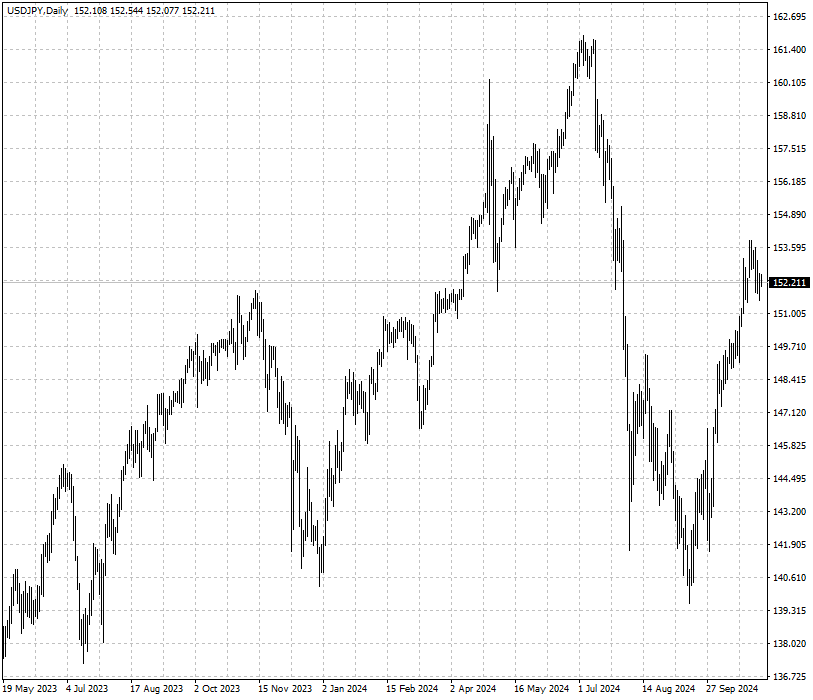

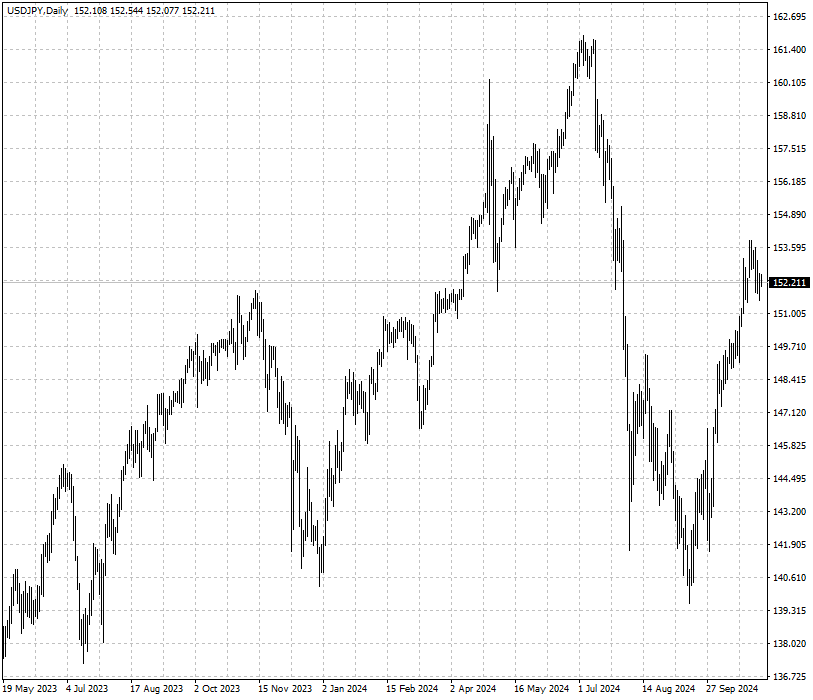

Japan's record ¥3.02 trillion current account surplus, deep yen liquidity and

relatively low inflation all help make the world's third-most traded currency

attractive as a store of value.

Gold hovers around record levels, potentially limiting big gains in the event

of a market meltdown, while the yen is trading at historically cheap levels. The

Swiss franc lacks the liquidity of the yen.

Ales Koutny, the London-based head of international rates at Vanguard, sees

potential for the yen to rise against the Swiss franc "as the rhetoric with

tariffs in Europe is much higher than versus some of the friendly Asian

countries."

If the yen's current weakness adds to inflation, the odds of a hike later in

the year will likely increase. Market positioning suggest there are less

bearishness on the currency compared with earlier in the year.

"The yen is still a safe haven," said Naomi Fink, chief global strategist at

Nikko Asset Management. "If we saw de-risking, I would still expect the yen to

appreciate and yen-funded ‘carry trades' to unwind."

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.