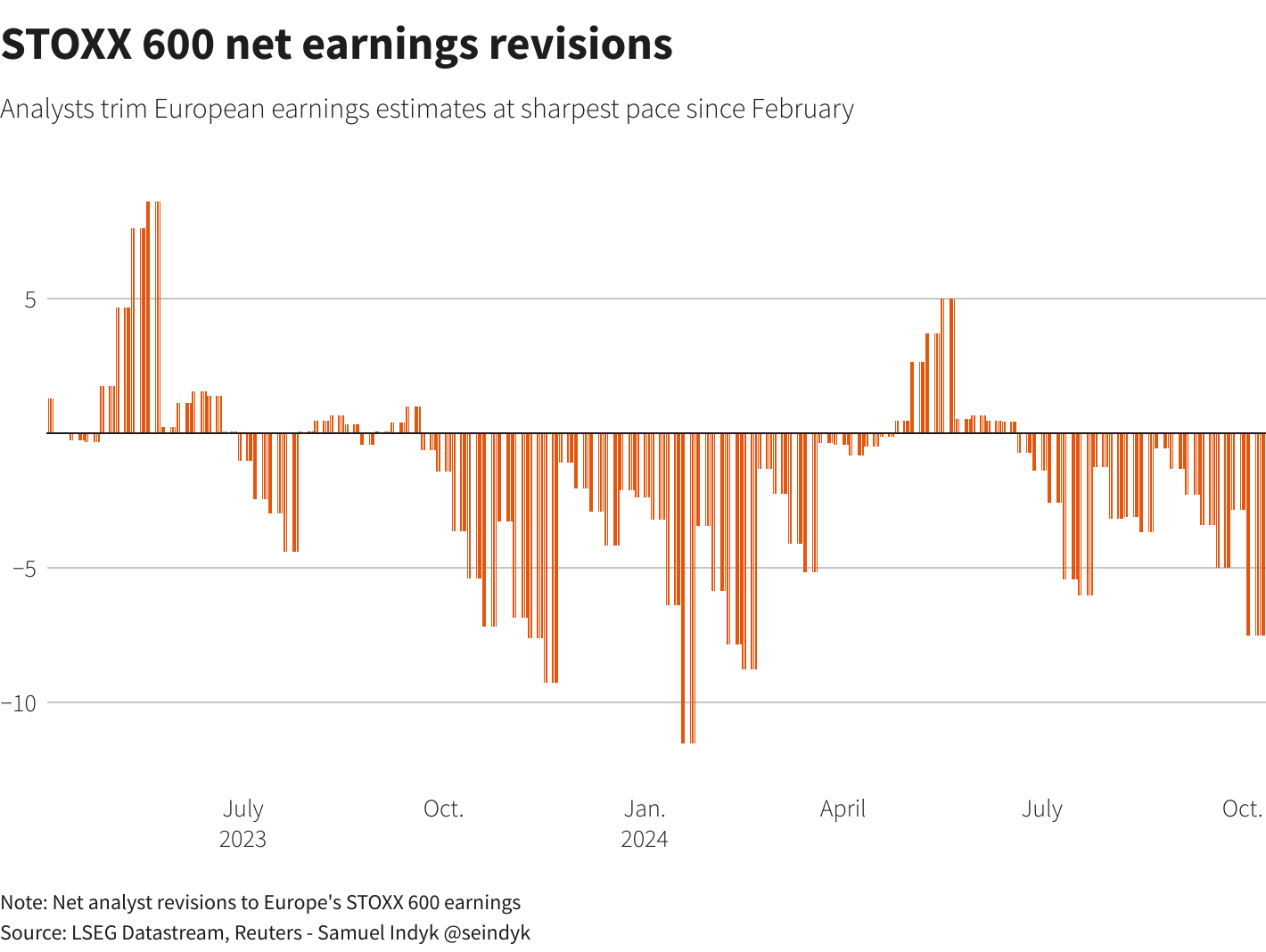

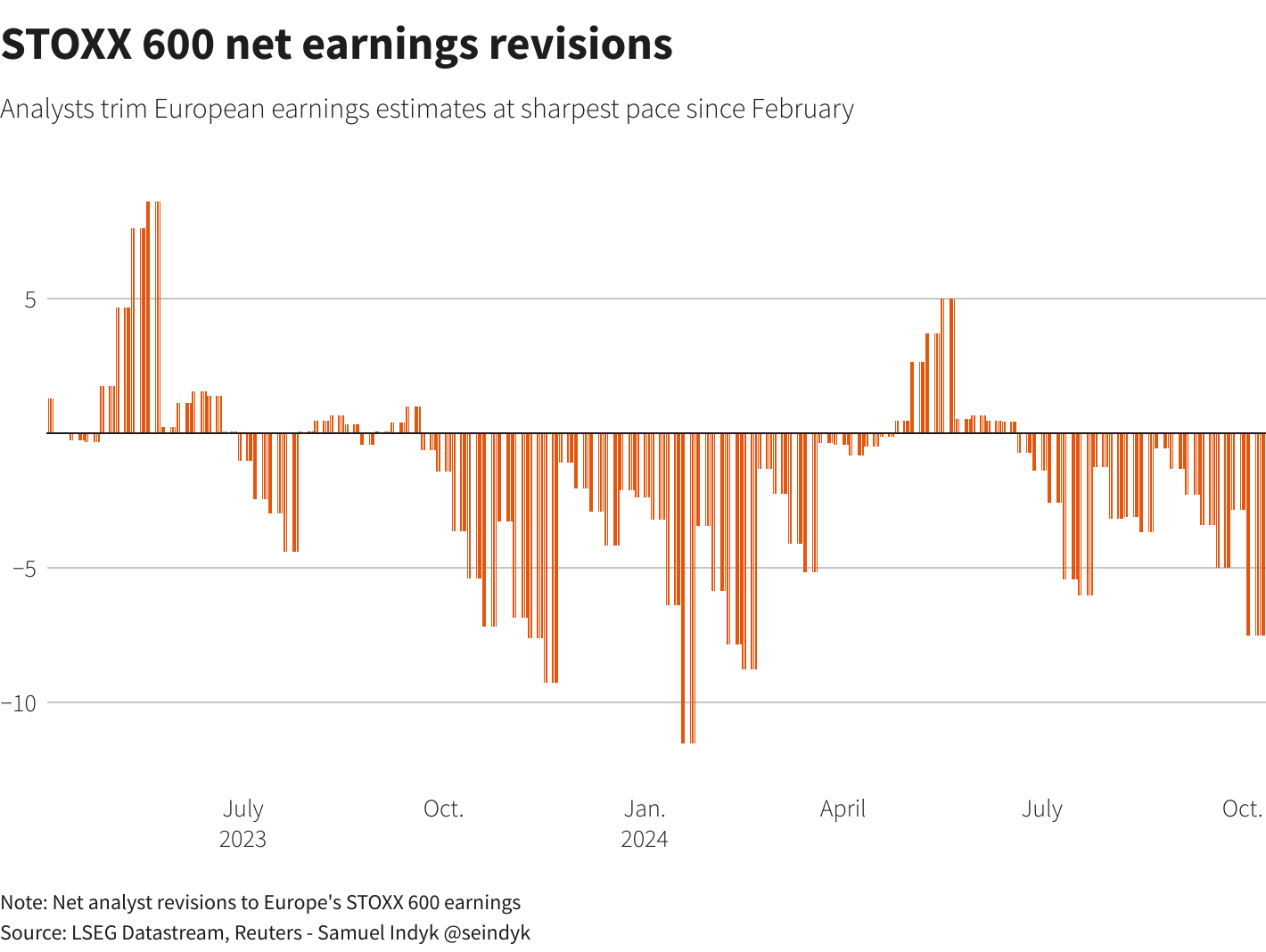

Analysts have sharply downgraded estimates for European corporate earnings this week at the fastest pace in seven months. Despite the downward revisions, growing optimism around the global economic outlook could shield stocks from harsh reactions if companies fall short of expectations.

"Expectations have come down quite a bit," noted Frederique Carrier, head of investment strategy at RBC Wealth Management. "If numbers are better than expected, I would expect the market to react quite positively." This suggests that while the bar has been lowered, any earnings surprises could still generate positive momentum for European shares amidst cautious investor sentiment.

Cheap valuations and light positioning also offer opportunities. European

companies trade close to a record discount against their US counterparts at

about 37%, based on the P/E ratio.

Citi strategists highlight that investors are slightly net short Eurostoxx

futures, one of just three indexes from a number that they track that is seen as

bearish against the backdrop of mostly bullish equity positioning.

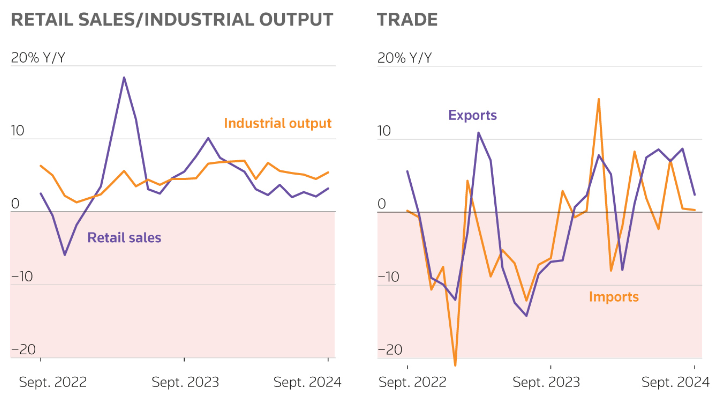

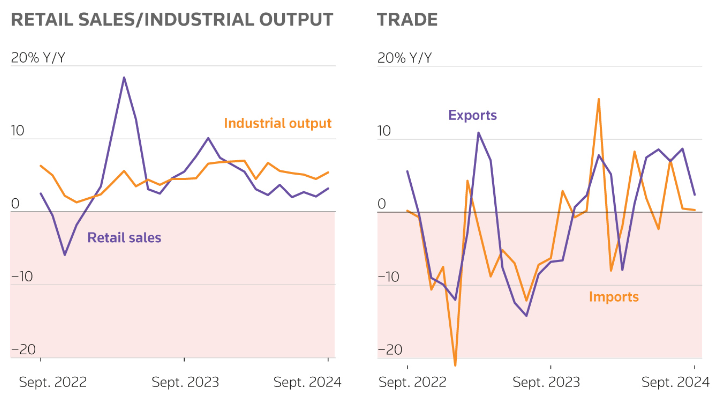

High interest rates have sapped growth in Europe for nearly two years. The

most recent data, including industrial output and bank lending, is pointing to

more of the same in the coming months.

Few signs of de-escalation in Ukraine and the Middle East means European

businesses remain under strain. Their operation costs risk jumping if major

energy supply disruption materialises.

The health of China's economy matters more for them that depend more on

exports than their US rivals, which generate most of their revenue in their vast

home market.

China’s Growth Outlook Dims Amid Policy Pressure

China's economy is likely to expand 4.8% in 2024 and growth could cool

further to 4.5% in 2025, a Reuters poll showed, maintaining the pressure on

policymakers as they consider more stimulus measures.

That poll showed a broadly pessimistic outlook when compared to the previous

one in July, when economists predicted 2024 growth of 5.0%. A prolong property

crisis still looms.

The country has rarely failed to reach its growth target. The last record

dates back to 2022 when the pandemic knocked growth to 3%, sharply lower than

the goal of around 5.5%.

Analysts polled expect the PBOC to cut the one-year LPR by 20 bps in Q4 and

reduce banks' RRR by 25 bps. But it is highly uncertain how much further

monetary easing could assuage investor concerns.

China's stock market slumped into correction on Thursday as traders set the

bar high. Beijing has refrained from unleashing fiscal firepower that could

justify a sustainable rally.

The sentiment improved after data showing Q3 GDP growth of 4.6% which

slightly exceeded the 4.5% expected by economists. Particularly, retail sales

grew 3.2% from a year ago – a four-month high.

Weak consumer price growth in September underscores heightened deflation

risk. The recovery story eventually hinges on local demand as the US is pushing

for decoupling.

Divergent outlook

The frail consumption has taken a toll on many businesses, with luxury brands

in the firing line. Those shares continued to tumble after LVMH reported another

sharp fall in quarterly sales.

The French company's sales in Asia outside of Japan fell 16% in Q3. Global

demand. The miss reflects the fact that earnings downgrades in the sector are

still ongoing, said Carole Madjo at Barclays.

L'Oréal took the hit as well, seeing sluggish growth in Q2. China's middle

class is cautious on loosening their purse strings, which has been a drag on

French stocks in 2024.

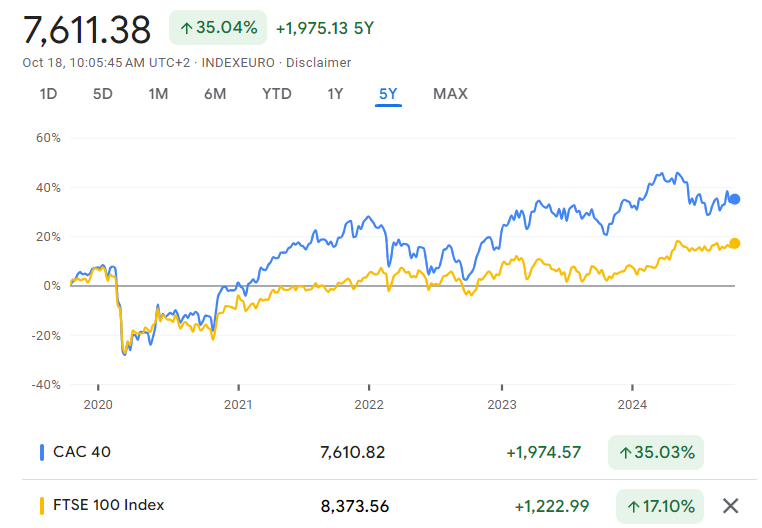

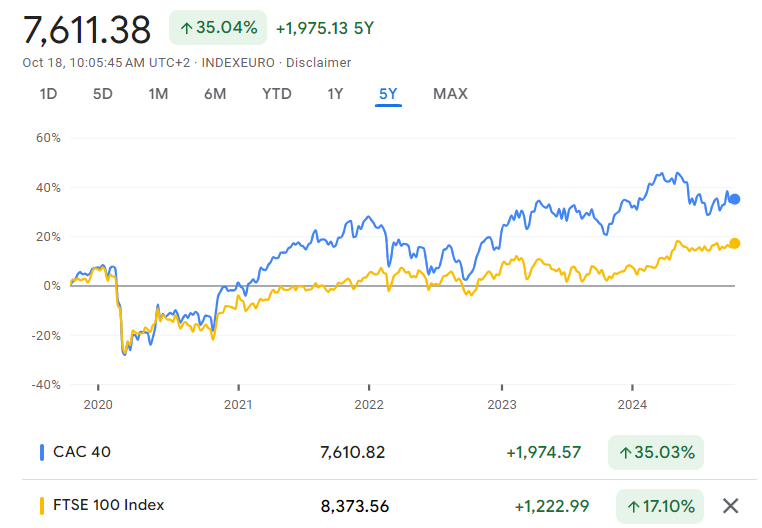

The CAC 40's yearly return of around 1% is overshadowed by that of 8.5% in

the FTSE 100. That compares to French stocks growing 15% more than their UK

peers last year.

The UK market benefits from its larger exposure to bank stocks. European bank

stocks have climbed more than 25% during the past year, but they remain one of

the cheapest for a sector in the region.

The lenders may rally even more amid a surge in stock buybacks and dividends,

according to Goldman Sachs Research. Their diversified business can offer a

buffer against falling interest rates.

The DAX 40 is on course to lead gains among its two peers for a second

straight year though carmaker stocks struggle. China's ambition of manufacturing

upgrade has enhanced industrial equipment sales from Germany.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.