The BOJ announced further adjustments to its YCC policy on Tuesday, allowing

10-year government bond yields to increase above 1% in a move that follows the

chronic weakening of the yen.

The board also revised up its price forecasts to project inflation well

exceeding its 2% target this year and 2024, paving the way for end of

ultra-loose monetary policy. Still the yen dipped below 150 per dollar.

Japan’s core inflation in September fell below 3% for the first time in more

than a year on the back of lower imported fuel prices. Some economists warned

that Japan’s above-target inflation could be stickier.

In October, the Japanese Trade Union Confederation said it was seeking bigger

wage increases during next year’s negotiations.

Prime Minister Fumio Kishida has also pledged to raise minimum hourly wages

from ¥1,000 to ¥1,500 by the mid-2030s.

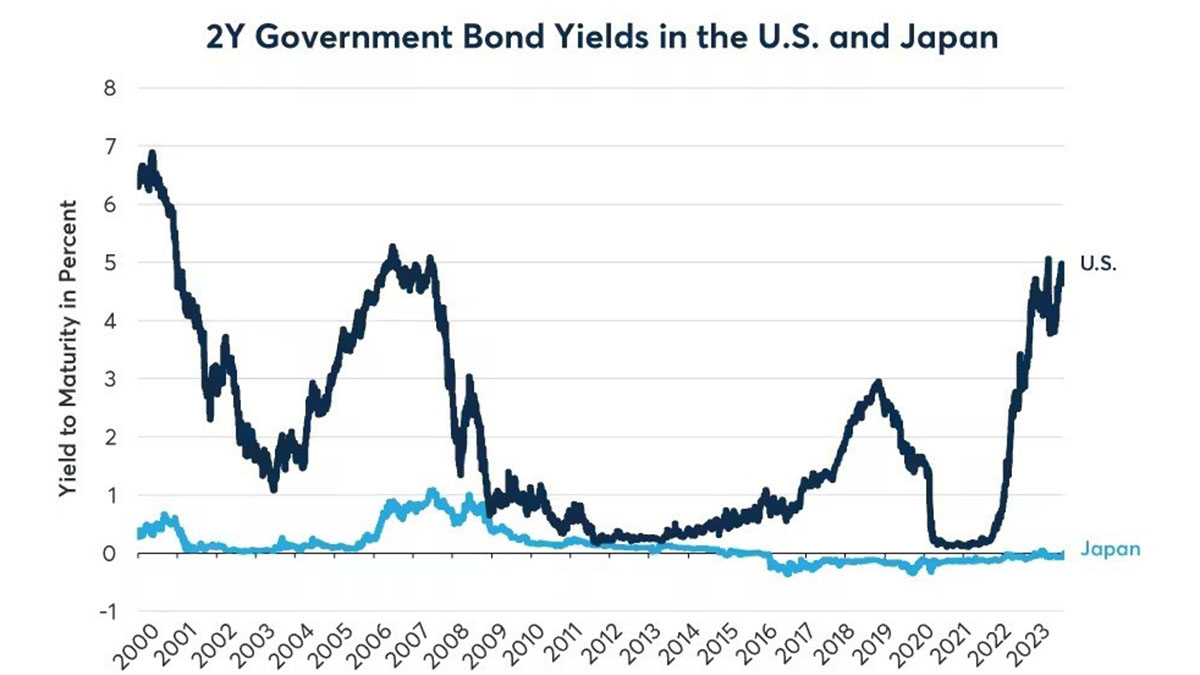

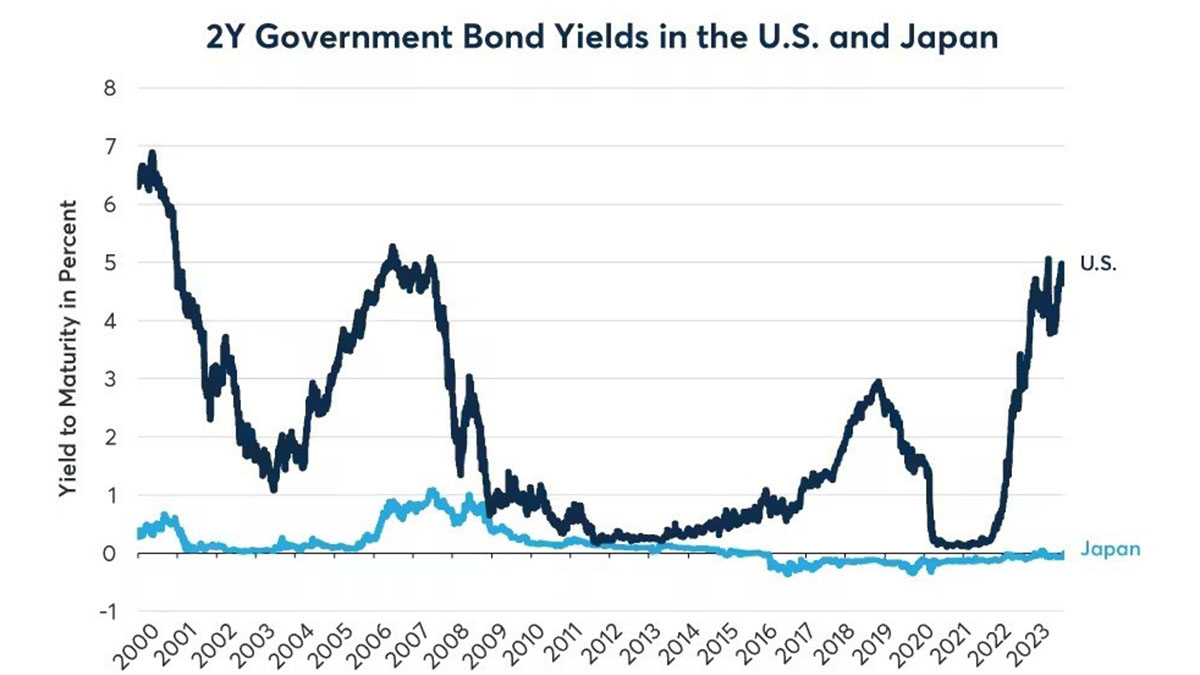

Despite repeated assurances by Ueda that ultra-low interest rates will stay,

nearly two-thirds of economists polled by Reuters expect the BOJ to end negative

rates next year.

Fallout risk

There are risks to making an adjustment only three months after the last

tweak but it is deemed necessary as 10-year yields are approaching 1% amid a

backdrop of rising US rates.

The 10-year Treasury yield remains slightly below the key psychological

level. The Fed could deliver another hawkish pause this week, potentially

extending bond selloff.

That means additional bond buying would be required to defend the current

policy framework, thereby raising questions about the viability of easing

programme.

While the latest decision reduces the need to ramp up bond buying, the

governor may help push long-term rates higher to levels inconsistent with

economic fundamentals, jeopardizing its goal of achieving stable inflation.

It may also offer a signal of fear for speculators on the prowl. The collapse

of the RBA’s yield target in 2021 shows the risks of giving the impression a

central bank is on the run.

Changing the upper limit as a precaution against the impact of soaring US

yields would render YCC meaningless, said Shigeto Nagai, former head of BOJ’s

international department.

Kentaro Koyama, a former BOJ official, warns that the pressure on YCC could

be extremely strong by the next meeting in December given the inflation outlook

and rising market expectations for normalization.

Yen weakness

Most economists surveyed by Bloomberg think Ueda wants to see more evidence

of wage growth before finally scrapping negative interest rates.

He has argued that the main factor pushing up prices is a rise in import

costs. There is no consensus within policymakers on how it would dismantle the

policy crafted under Haruhiko Kuroda.

Traders give up waiting for the yen to bounce as the dollar has dominated the

pair. Options pricing suggested that a dramatic rally is unlikely to take place

anytime soon.

Implied volatility at most tenors touched 18-months lows in Oct and skew

shows a steady decline in the relative popularity of dollar/yen puts over the

year to date.

The yen’s poor performance bitterly disappointed amid escalated conflict in

the Middle East. Even with intervention risk, it might only stop the currency

from falling rather than reverse the trend.

But Invesco’s fund manager Tony Roberts has cut positions in Japan exporters

as he does not expect the yen to weaken much more further from here.

The Bank of Singapore said “we think there will be scope for the yen to

significantly outperform in 2024 when we expect the Fed to cut rates and the BOJ

to speed up normalizing policy.”

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.