The volatility of the stock market and the rise and fall of interest rates

seem to be closely related to the same key factor, which is the 10-year US

Treasury yield. Why does the change in this indicator cause market anxiety so

much? What is the relationship between the 10-year US Treasury yield and

financial market volatility?

A Treasury bond, as its name implies, is a loan from a country that borrows

money from the public and promises to pay interest within a certain period of

time and repay the principal at maturity. US bonds are bonds issued by the US

government. When you lend funds to the US government, you actually receive an

IOU.

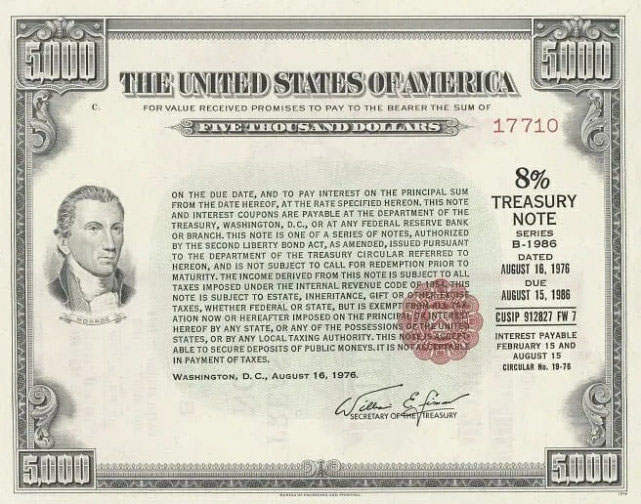

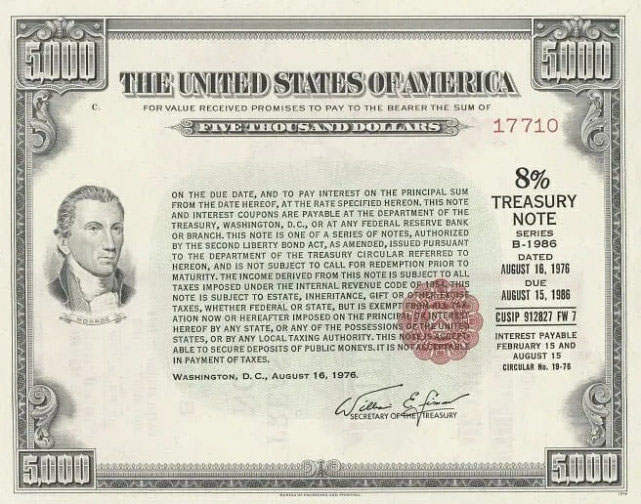

This is a Treasury bond issued by the United States in 1976. It can be seen

that the face value of this Treasury bond is $5000. It records important terms

such as the starting date of the loan, the loan term, the loan maturity date,

and the loan interest rate. This promissory note is endorsed by the US

government, and as the US dollar is the world's common currency and the US

government has a high reputation, it is considered a risk-free asset.

So what is the magic of 10-year US Treasury yields?

US bonds have different borrowing terms at the time of issuance, ranging from

one month to 30 years. Short-term US Treasury bonds are susceptible to policy

and market influences, with frequent fluctuations, while long-term US Treasury

bonds have high levels of uncertainty and low liquidity. The ten-year US bonds

have high liquidity, so their yield is widely considered a risk-free yield; that

is, the circulating interest rate of any fund is based on the yield of the

Treasury bond, and the yield of investing in other assets should be at least

higher than this level; otherwise, investors can directly choose to buy US

bonds.

The yield on 10-year US Treasury bonds is also the basis for bank credit loan

rates, including mortgage loans. But some people may wonder, Why does not

everyone buy US bonds when their yields are so high? To understand this issue,

it is first necessary to distinguish between coupon rates and yield to

maturity.

For example, if the coupon rate of a US bond is 2%, it means that the buyer

can receive a 2% return upon maturity. If someone purchases $100 in US bonds,

they will receive an interest rate of $2 after one year. The interest rate of US

bonds is already fixed at the time of purchase, written into contracts and IOUs,

and will not change with future changes. But what we see as US bond yields is

constantly changing because US bonds are traded in the secondary market.

Assuming someone urgently needs money six months after purchasing US bonds,

they will sell their holdings of US bonds to others in the secondary market for

$98. The buyer received the principal and interest after six months, totaling

$102. So, the buyer earns a profit of $4, resulting in a yield to maturity of

4.08% for US bonds. This indicates that the yield of US bonds varies with

changes in US bond prices. The higher the price, the lower the yield, and the

lower the price, the higher the yield.

The current 10-year US Treasury yield is calculated based on the current

transaction price. For example, if the price of a 10-year US bond is $88.2969,

the face value is $100, and the coupon rate is 2.75%, the buyer will receive

interest income of $1.375 after holding it for one year. If redeemed at face

value, the annual yield will be 4.219%. The yield of US Treasury bonds is

inversely proportional to their price, and when investors buy US Treasury bonds

in droves, they push up their prices, resulting in a decrease in US bond yields.

On the contrary, if people are optimistic about US bonds and sell more than they

buy, the price of US bonds will decrease and the yield will increase. The

significant increase in US bond yields is mainly due to the Federal Reserve's

interest rate hike, which has led to investors selling US bonds.

Knowing what 10-year US bonds are, let's discuss the relationship between

10-year US bond yields and financial market volatility.

-

The reverse relationship between interest rates and bond prices

When the yield of 10-year US Treasury bonds increases, bond prices decrease

because newly issued bonds may offer higher interest rates. This has led to

increased volatility in the bond market, as investors holding existing bonds may

see a decrease in their bond market value.

-

Expected inflation rate

The yield of 10-year US Treasury bonds is usually influenced by the expected

inflation rate. If the market expects inflation to rise, investors may demand

higher interest rates to offset the impact of inflation, thereby pushing up bond

yields. This may lead to fluctuations in the financial market, especially on the

stock market, as high inflation rates may weaken purchasing power and have a

negative impact on corporate profits.

-

Hedge demand

Ten-year US Treasury bonds are usually considered a safe haven asset, and

when financial markets experience instability or increased risk sentiment,

investors may transfer funds to the bond market, leading to an increase in bond

prices and a decrease in yields. In this case, the performance of the bond

market may deviate from that of the stock market, which is also one of the

relationships between the 10-year US Treasury yield and financial market

volatility.

-

central bank Policies

The central bank's monetary policy will also affect the yield of 10-year US

Treasury bonds. If the central bank raises interest rates, bond yields may rise

because the market expects interest rates to rise. This may trigger fluctuations

in the financial market, especially in the stock and real estate markets, as

high interest rates may suppress borrowing and investment activities.

-

International factors

Events in the global economy and financial markets can also affect 10-year US

Treasury yields and financial market volatility. For example, international

trade tensions, geopolitical events, or global economic downturns may lead

investors to seek safety, thereby affecting the US bond market and other asset

markets.

What is the relationship between interest rate hikes and rising US bond

yields?

Raising interest rates means raising the benchmark interest rate, which will

also increase the interest rates of various financial assets in the United

States, such as bank deposits. For investors, if the deposit interest rate was

1.5% in the past year, they can now earn 3% interest. However, the interest rate

on US Treasury bonds is fixed, assuming a one-year rate of 2%, which is lower

than the deposit rate after interest rate hikes. In order to obtain higher

returns, investors often sell US bonds and deposit their funds in banks,

resulting in more people selling US bonds than buying them in the market,

leading to a decrease in US bond prices and an increase in yields. That's why,

as the Federal Reserve begins to raise interest rates, US bond yields continue

to rise.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.