As an investor, you're always looking for ways to maximise your returns and make informed decisions. But what if a company you've invested in suddenly starts buying back its own shares? It sounds like an intriguing move, doesn't it? Instead of using its cash for new projects or expanding operations, the company is essentially investing by reducing the number of shares on the market. This strategy, known as a share buyback, has become increasingly popular, but why should you care? Understanding how stock buybacks work and why companies choose this path can provide valuable insights into your investments and potential market movements.

What is Share Buyback

One of the most well-known advocates of share buybacks is Warren Buffett. He has often emphasised that repurchasing shares can be a smart move when a company's stock is trading below its intrinsic value. Buffett argues that buybacks are an effective way to allocate capital, especially if the company's shares are undervalued. In his own words, he once stated, "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price," but when prices are low, buying back shares can be a great opportunity. So, what exactly is a share buyback?

A share buyback happens when a company buys back its own shares, usually because it believes its stock is undervalued. It's like a company looking at its shares and thinking, "These are worth more than what the market is showing." By buying back shares, the company reduces the supply of available stock, which often drives up the price of the remaining shares.

For example, if Apple decides to buy back 5% of its shares, those remaining shares become more valuable because there's now less of them in the market. Essentially, it's a way for the company to reward investors without handing out cash directly. Instead, shareholders may see their shares increase in value over time.

In short, this strategy is like a company betting on its own future, saying, "We believe in what we're doing and in the value of our stock." And that can be a powerful signal for investors. It's an interesting twist—companies trying to make their shares more desirable by taking them off the market. But does it work?

Share Buyback's Impact on Stock Prices

When a company repurchases its own shares, it does more than just reduce the number of shares in circulation—it can significantly influence the stock price and overall market perception. The immediate effect is often an increase in the value of the remaining shares. This is due to a combination of reduced supply and the market's interpretation of the buyback as a positive signal.

From a fundamental perspective, fewer shares outstanding means that earnings are distributed across a smaller pool, which can lead to an increase in earnings per share (EPS). This is particularly advantageous for investors, as it can enhance the attractiveness of the company's financial performance. In turn, this might prompt institutional investors and analysts to revise their outlook, boosting demand for the stock and driving up the price.

Additionally, a buyback programme often signals to the market that the company's leadership believes the stock is undervalued. This can instil confidence among investors, especially if the company has a strong track record of growth or stability. The psychological impact of a buyback should not be underestimated—when a company actively invests in its own future, it conveys a message of self-assurance, which can positively influence investor sentiment.

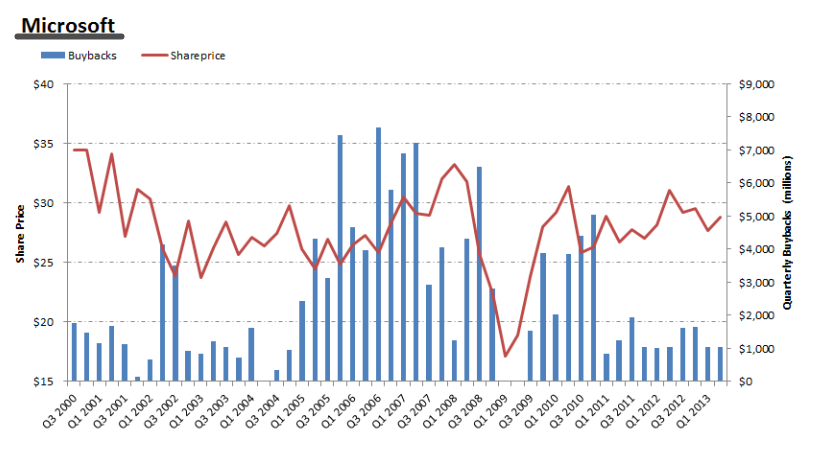

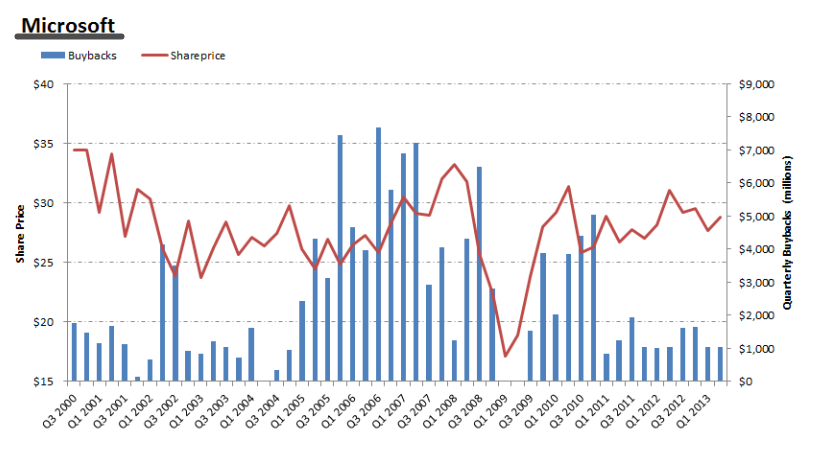

Take Microsoft as an example. Over the years, Microsoft has initiated multiple rounds of share repurchases, particularly when its stock price was trading below perceived value. This strategy helped increase the value of remaining shares, attracting more investors and contributing to the stock's long-term growth trajectory. The result? Increased shareholder wealth and market-driven validation of the company's financial strategy.

However, it's important to note that the impact of a stock repurchase on share price isn't always immediate or guaranteed. Other market forces—such as broader economic conditions, sector performance, and investor sentiment—also play a role. A repurchase, while beneficial, may not prevent a decline in stock value if external factors lead to broader market downturns.

Share Buyback vs Dividend

While a stock repurchase can certainly have an immediate and positive effect on share prices, enhancing shareholder value through price appreciation, the decision to repurchase shares is often part of a broader strategic choice between two key methods of returning value to shareholders—share buybacks and dividends.

Both approaches aim to reward investors, but they differ significantly in their execution and impact. Understanding when and why a company might favour one over the other can provide deeper insight into its overall financial strategy and long-term vision.

Dividends are straightforward—a company distributes a portion of its profits directly to shareholders, typically on a regular basis. This approach provides immediate cash returns, making it an appealing choice for income-focused investors who rely on dividends for steady income. For example, Unilever, a company known for its consistent dividend payouts, has long been a favourite for those seeking regular income from their investments.

On the other hand, share buybacks operate differently. Rather than paying out cash to shareholders, the company repurchases its own shares from the open market. This strategy reduces the number of shares outstanding, often increasing the value of the remaining shares. It's a more flexible option, as companies can adjust the amount spent on buybacks depending on cash flow and market conditions.

Why might a company choose buybacks over dividends? One of the key reasons is tax efficiency. In many jurisdictions, capital gains (such as profits made from selling appreciated stock) are taxed at a lower rate than dividends. For shareholders in high-tax brackets, this makes buybacks an attractive alternative, as the increase in share value can be realised at a more favourable tax rate than receiving dividend payouts.

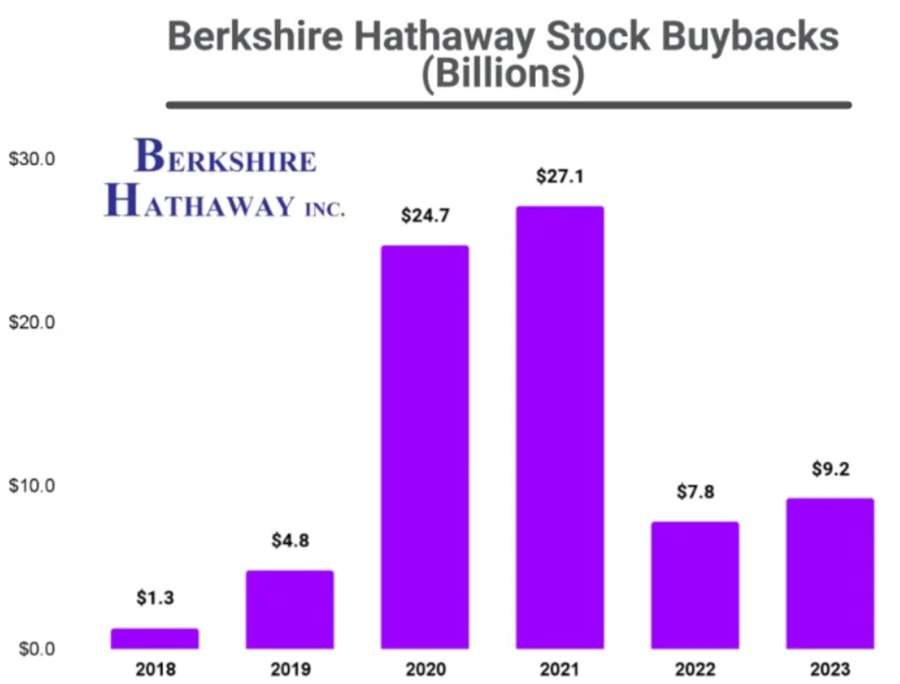

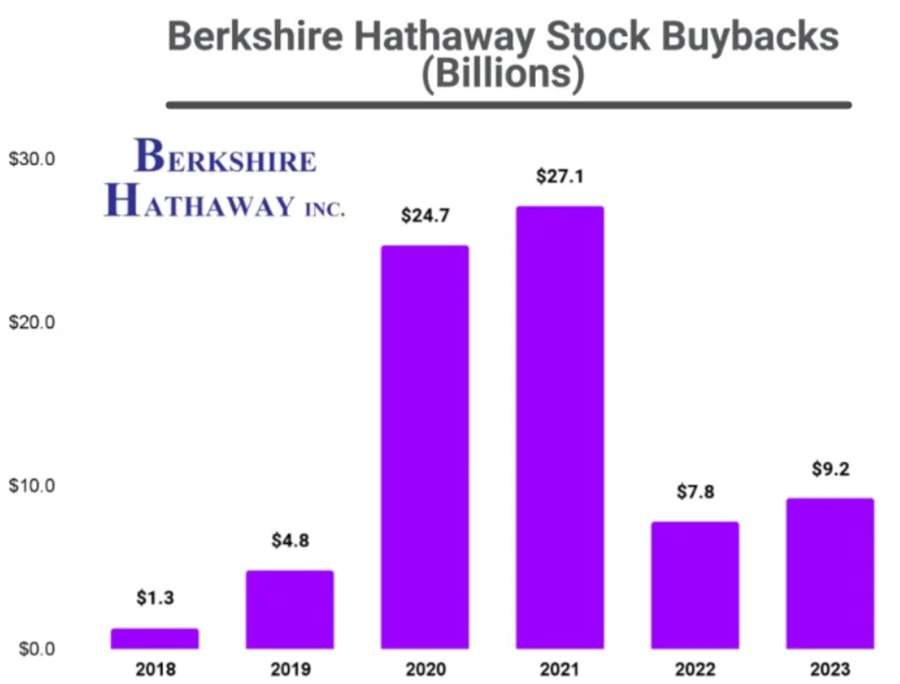

Additionally, buybacks can signal that a company believes its stock is undervalued. When a company buys back shares, it may be sending a message that it has strong confidence in its prospects. For instance, Berkshire Hathaway, led by Warren Buffett, has consistently used buybacks when the stock is perceived as undervalued, viewing them to create long-term value for shareholders.

However, both strategies have their drawbacks. While dividends provide immediate returns, they may not be sustainable if a company faces cash flow problems or if it needs to reinvest heavily in growth. Conversely, while buybacks can drive up share prices and offer tax advantages, they may be seen as less favourable during times of economic uncertainty, as investors may prefer the predictability of regular income.

Ultimately, the choice between dividends and buybacks comes down to a company's financial strategy, market conditions, and investor preferences. Some companies, like Apple, blend both strategies—offering dividends while also engaging in significant share repurchases, creating a balanced approach that appeals to a broad range of investors.

Share Buyback vs Dividend

| Aspect |

Share Buyback |

Dividend |

| Definition |

Company buys back its own shares. |

Company pay cash to shareholders. |

| Impact |

Increases share value. |

Provides immediate income.

|

| Taxation |

Lower tax (capital gains). |

Higher Tax(income tax).

|

| Flexibility |

More flexible. |

Less flexible.

|

| Signal |

Confidence in stock value. |

Stability and profitability.

|

| Investor Type |

Growth-focused investors. |

Income-focused investors. |

| Examples |

Apple, Berkshire Hathaway. |

Unilever, Coca-Cola. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.