When exploring investment opportunities, you'll often come across the term "listed companies." While you may have encountered it before, understanding its true meaning is essential for making informed decisions. Listed companies are those that have their shares traded on a public stock exchange, offering investors the chance to buy and sell shares in the open market. But why does this matter to you, and how can you evaluate these companies effectively?

Here's what you need to know about listed companies, their benefits, and how to evaluate them before deciding to invest.

Listed Company's Definition

In simple terms, a listed company is one whose shares are available for purchase on a public stock exchange, like the London Stock Exchange (LSE) or the New York Stock Exchange (NYSE). But the process of becoming listed isn't as easy as just signing up. It involves an Initial Public Offering (IPO), where the company offers shares to the public for the first time in exchange for capital to fuel growth, pay off debt, or fund new projects.

Now, what's the benefit for the company? Being listed on the exchange doesn't just bring in cash; it brings credibility. Publicly traded companies are held to rigorous reporting standards. They must disclose their financials, governance practices, and sometimes even their long-term strategies. This transparency means that, as an investor, you can dig into the company's health before deciding whether to buy in.

Listed Company's Key Features

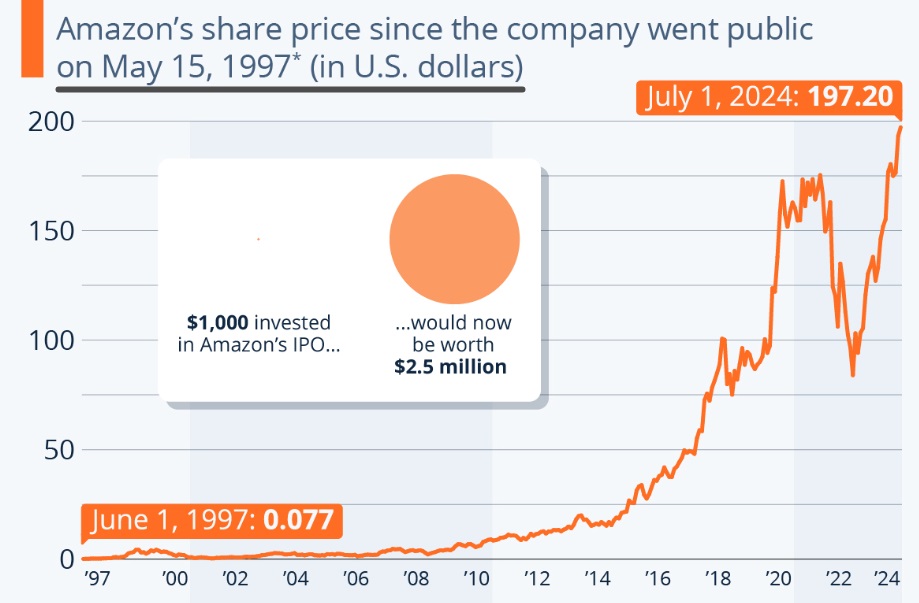

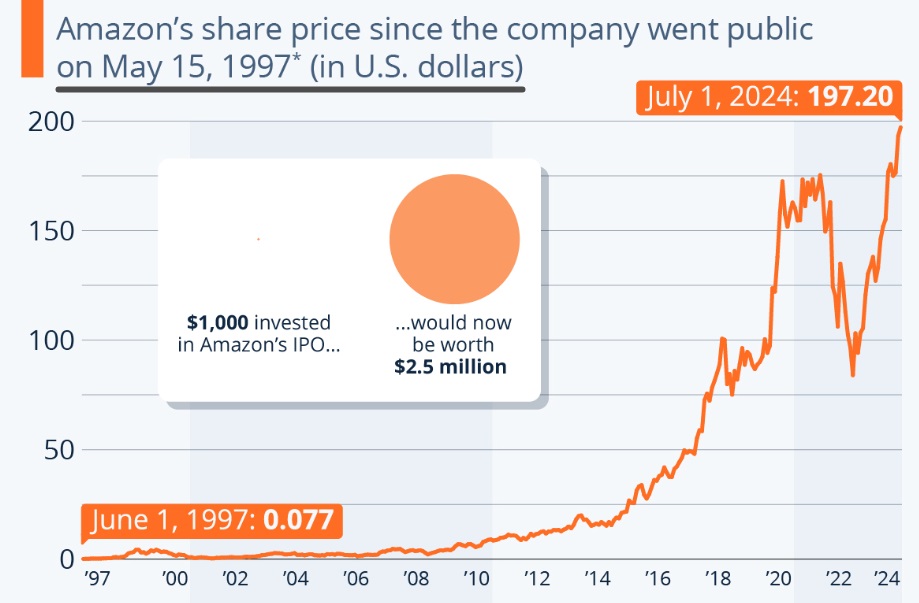

One of the most important features of a listed company is the ability to raise capital quickly. Through an Initial Public Offering (IPO), a company can sell shares to the public, gaining access to funds that can be used for expansion, new projects, or paying off debt. Take Amazon, for example—when it went public in 1997. it raised the capital needed to scale its operations, which eventually helped turn it into the global giant we know today.

Beyond that, being listed provides liquidity. This means that investors can buy and sell shares easily on the stock exchange. For example, if you wanted to invest in Apple, you could do so in just a few clicks, knowing that there's an active market for its shares. This ease of buying and selling is attractive to investors and boosts the company's ability to attract investment.

Being listed brings a high level of transparency to a company's operations. A listed company must adhere to strict regulatory requirements, including the publication of quarterly earnings reports, annual financial statements, and timely disclosures of any major changes. This allows investors to make informed decisions based on up-to-date information about the company's performance. Tesla, for example, is required to disclose everything from its quarterly revenue to any shifts in leadership, ensuring that shareholders are always in the loop.

Furthermore, a listed company must meet corporate governance standards to maintain investor trust. This includes having a board of directors that oversees the management team. The board's role is to ensure that such companies operate ethically and with transparency, which helps mitigate any potential conflicts of interest or corporate mismanagement. These safeguards protect shareholders and help maintain the integrity of the company.

The shareholder structure of a listed company is another notable feature. Once a company becomes publicly traded, its ownership is spread across a diverse range of shareholders. These investors—ranging from large institutions to individual retail investors—can exert significant influence on the company's direction. Through voting on key issues, such as mergers or changes in corporate strategy, shareholders shape the future of the company. For example, when Facebook wanted to acquire WhatsApp, shareholders had a voice in approving the deal, influencing the company's long-term strategy.

A listed company's market value is also driven by its stock price, which fluctuates based on investor sentiment and market conditions. The stock price of such a company reflects how investors perceive its prospects. Positive news, such as strong earnings, can send the stock price up, while negative reports can cause it to fall. This market-driven valuation offers a real-time snapshot of the company's worth and its standing in the financial world.

Listed Company's Investment Considerations

Compared to private companies, one of the greatest advantages of a listed company is its ability to be bought and sold on the open market. This means investors can trade shares of listed companies, providing an opportunity to earn a profit from fluctuations in stock prices. The liquidity and accessibility of these stocks create an appealing investment avenue.

However, it's essential to understand the key factors that come with this type of investment. The main attraction of such companies is their transparency. Being public entities, they are required by law to disclose their financial performance regularly. This makes it easier for investors to gauge the health of the company and assess its potential for future growth.

A crucial factor to consider is the company's performance. Listed companies publish quarterly and annual reports that offer insights into their financial standing—revenue, profits, liabilities, and growth prospects. For example, if you invested in a company like Tesco, which regularly publishes detailed reports on its performance, you'd be able to track whether its sales are growing or declining. This transparency is key to understanding if the company is on a healthy trajectory or facing challenges.

Diversification is another important consideration for investors. By holding stocks in various industries, investors can cushion the impact of any single company's poor performance. For instance, if you had shares in HSBC, a bank, as well as AstraZeneca, a pharmaceutical company, the downturn of one sector could be offset by growth in the other. This spread of investments across multiple sectors—technology, healthcare, energy, or finance—helps reduce the overall risk in your portfolio.

Timing plays a pivotal role in the stock market. For example, when the COVID-19 pandemic struck, companies like Zoom Video Communications saw their stock prices skyrocket as demand for remote communication soared, while companies in the travel and hospitality sector, such as easyJet or British Airways, faced steep declines. Understanding market trends, alongside a company's position within its sector, can help you determine the optimal time to buy or sell shares.

The Risks: What Investors Should Keep in Mind

However, while the ability to buy and sell shares offers potential for profit, it also introduces various risks. Investing in a listed company requires more than just a simple transaction—it demands thorough consideration and careful analysis of a range of factors. To make informed investment decisions, investors must assess the company's performance, market conditions, and broader economic trends to ensure their investment aligns with their financial goals.

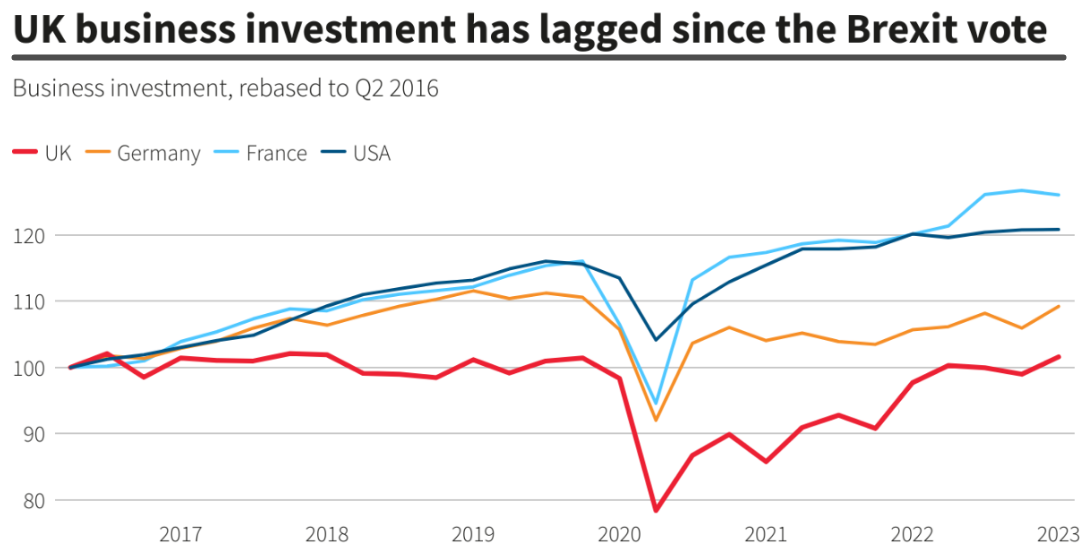

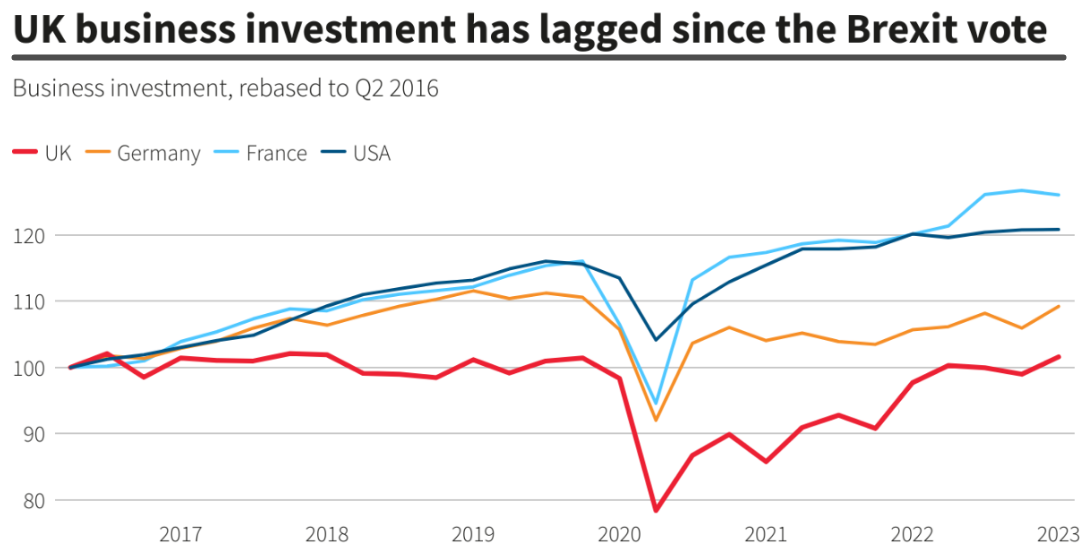

One of the main risks is market volatility. Stock prices can swing dramatically due to factors beyond a company's control. For example, the Brexit referendum in 2016 caused significant fluctuations in the stock prices of British companies. Stocks like Barclays and Royal Mail experienced sharp drops following the announcement of the vote, due to fears over the UK's economic future. Even when the company's fundamentals are strong, external events can send its stock price on an unpredictable path.

The performance of the company itself is another major risk factor. Even with the transparency that listed companies provide, management decisions can cause substantial shifts in the stock price. Take the example of Carillion, a construction giant that was listed on the London Stock Exchange. Despite showing positive financial results over the years, poor management decisions, combined with large-scale debts, led to its collapse in 2018. Investors who held onto Carillion shares suffered significant losses, showing how even major listed firms can face sudden downfalls.

Market sentiment is another risk to consider. The stock market is often swayed by emotions such as fear or greed, rather than just rational analysis of a company's performance. A great example of this is the rise and fall of Bitcoin stocks, like those of NVIDIA, which surged as crypto mining boomed. However, when the cryptocurrency market experienced a sharp decline, the sentiment surrounding these stocks plummeted as well, causing massive drops in their value, even though their fundamental business had not changed much.

Lastly, liquidity risk can also pose challenges. While shares of most large companies can be bought and sold relatively easily, some stocks may be less liquid, especially those of smaller companies. For example, if you tried to sell shares in a niche company like Fever-Tree, which produces premium mixers, during a market downturn, you might struggle to sell at a price you're happy with, particularly if the stock isn't as actively traded as major players like Unilever or GlaxoSmithKline.

Listed Company's Advantages and Risks

| Aspect |

Advantages |

Risks |

Liquidity

|

Easy to trade stocks

|

Liquidity risk in smaller stocks |

| Transparency |

Regular financial reports |

Management issues can affect prices |

| Performance |

Insight into growth/decline |

Internal issues may cause losses |

| Diversification |

Spread risk across sectors |

Market sentiment can drive volatility |

| Timing |

Profit from market trends |

Market volatility |

To sum up, investing in listed companies offers many advantages, such as liquidity, transparency, and the potential for both capital gains and dividends. However, it's not without risks. Market volatility, regulatory challenges, and the pressures of maintaining shareholder satisfaction can all impact on a company's performance. By conducting thorough research into a company's financial health, management, and growth prospects, investors can make more informed decisions. With careful consideration, investing in such companies can be a rewarding addition to any investment portfolio.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.