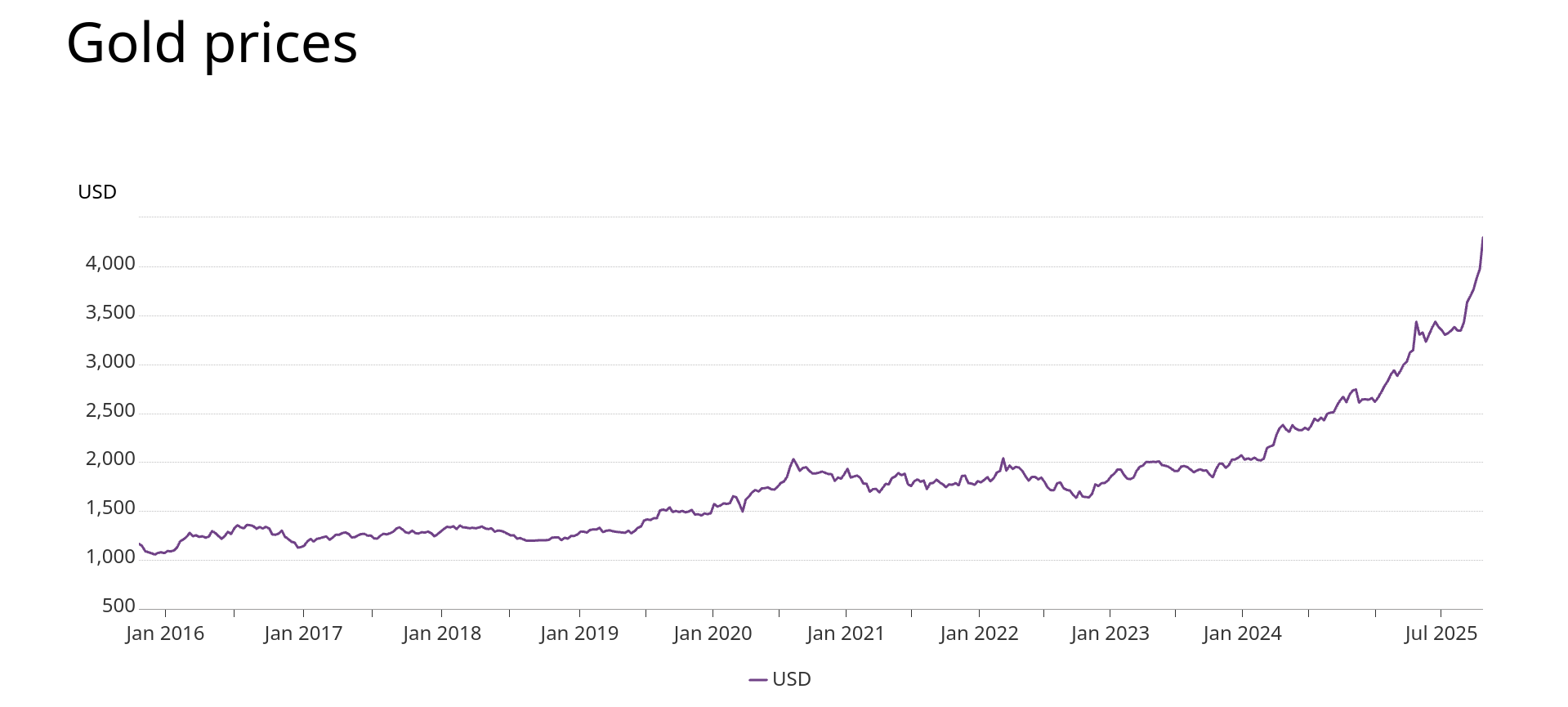

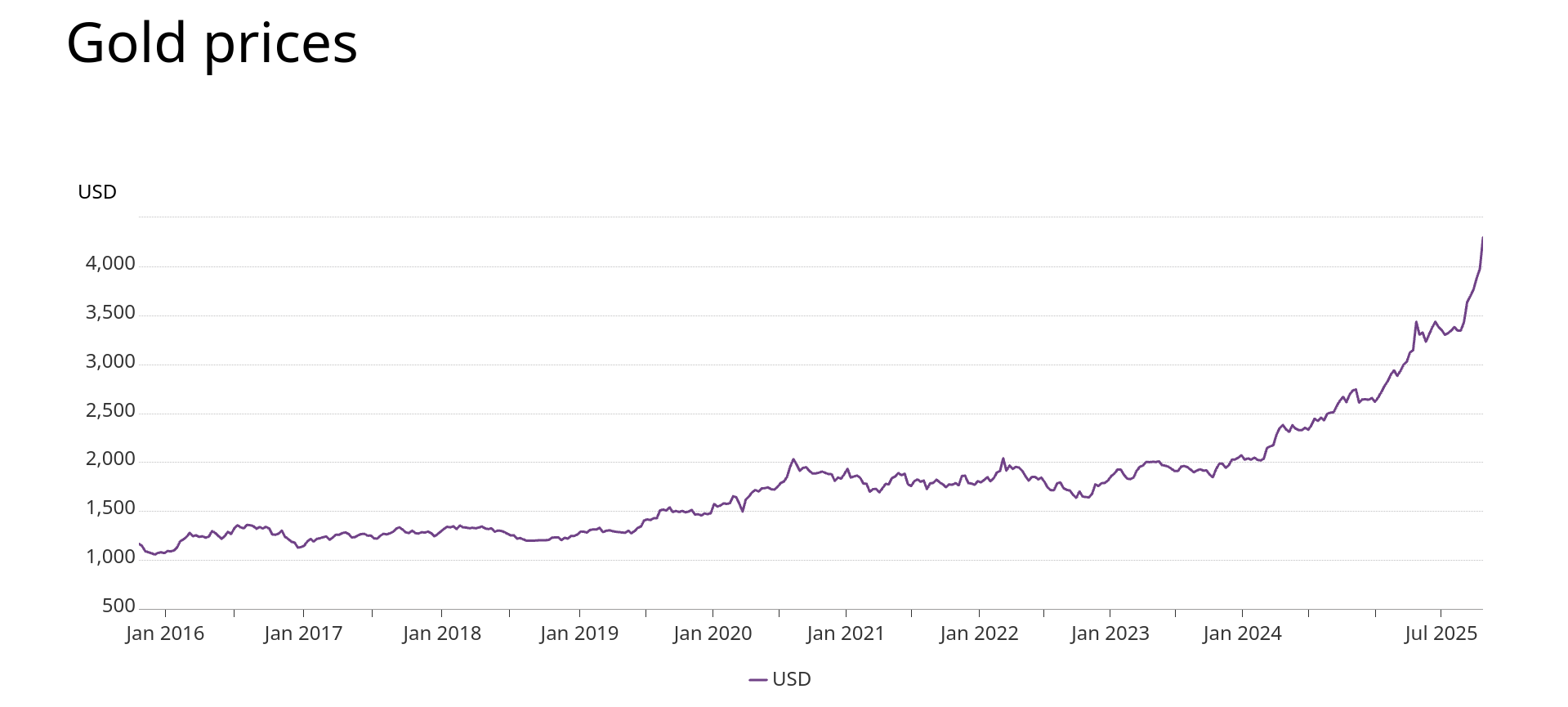

Many newly-married couples in Asia are finding it a headache to buy gold jewellery as store prices have surged. Meanwhile, on the international market the price of gold has broken past USD $4,300 per troy ounce in late 2025.

Not only is it setting record highs, it is climbing seemingly every day. This sharp rise is causing worry not only among investors but also ordinary consumers. After all, gold is deeply tied to currency value, inflation and global instability. With so much at stake, let’s examine the reasons behind gold’s surge and what responses investors and household buyers should consider.

Understanding Gold Price Fluctuations

Over the past five decades, since the era of fiat currency (when the U.S. dollar and gold were decoupled), large and sustained price gains in gold have often signalled shifts in global currency confidence and the relative strength of the United States. But it is not solely a story of U.S. decline, supply and demand imbalances, geopolitical risks, and investor risk-aversion all play critical roles as well.

For instance, when on August 15 1971 the U.S. suspended dollar convertibility into gold, the price of gold was about USD $35 per ounce. Within two years it exceeded USD $100 per ounce, a striking rise that reflected shaken confidence in the dollar as a global reserve.

In the oil-shock era of the 1970s, following massive increases in energy and inflation, gold rose rapidly, from about USD $250 by 1978 to roughly USD $850 by January 1980. At that time, U.S. inflation reached around 14% and unemployment exceeded 7%, prompting the then-Paul Volcker-led Federal Reserve to raise the federal funds rate to nearly 20%. Gold’s profits during that era became labelled “the U.S. is in trouble, gold rises”.

During the 1980s and 1990s, as the U.S. economy regained strength and inflation fell, gold’s price consolidated and drifted in a range (roughly USD $300-400) for many years despite major geopolitical events (Cold War end, Gulf War, 9/11).

Then from around 2005, gold broke out of its long sideways pattern, driven by factors such as emerging-market resource inflation (iron ore, crude oil), major monetary easing, and rising global demand. From about USD $400 in 2005 to USD $600+ in 2007, then through the financial crisis into 2011 at USD $1,800+ per ounce. The recent run to over USD $4,300 in 2025 marks a new chapter rather than a simple repeat of old patterns.

Reasons for the Gold Price Spike

Reasons for the Gold Price Spike

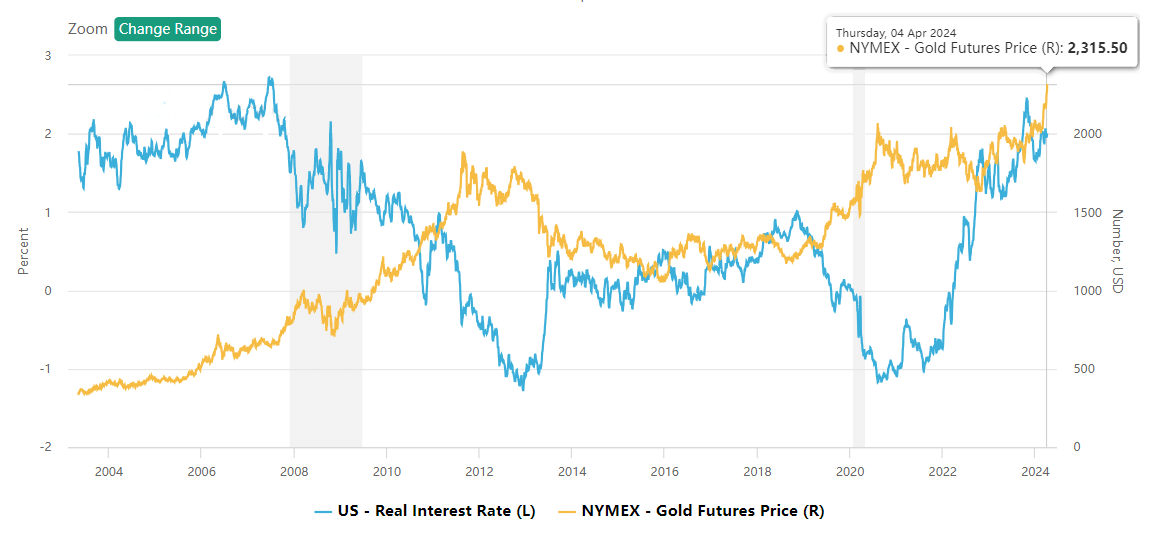

U.S. Real Interest Rates

One of the strongest influences on gold’s price has been U.S. real interest rates (nominal interest rate minus inflation). Because gold pays no yield, when real yields rise, the opportunity cost of holding gold increases, making bonds and other interest-bearing assets more attractive instead. Conversely, when real rates fall or turn negative, gold tends to become more appealing. Empirical data shows a strong negative correlation between U.S. real yields and gold prices.

As of mid-2025, U.S. 10-year real yields are estimated around +1.5-2% (varying by measure). Meanwhile gold has surged from about USD $3,300 per ounce in early 2025 to over USD $4,300 per ounce by October.

This inverse relationship helps explain part of the recent rally, investors anticipate future rate cuts, which lowers real yields and thus supports gold.

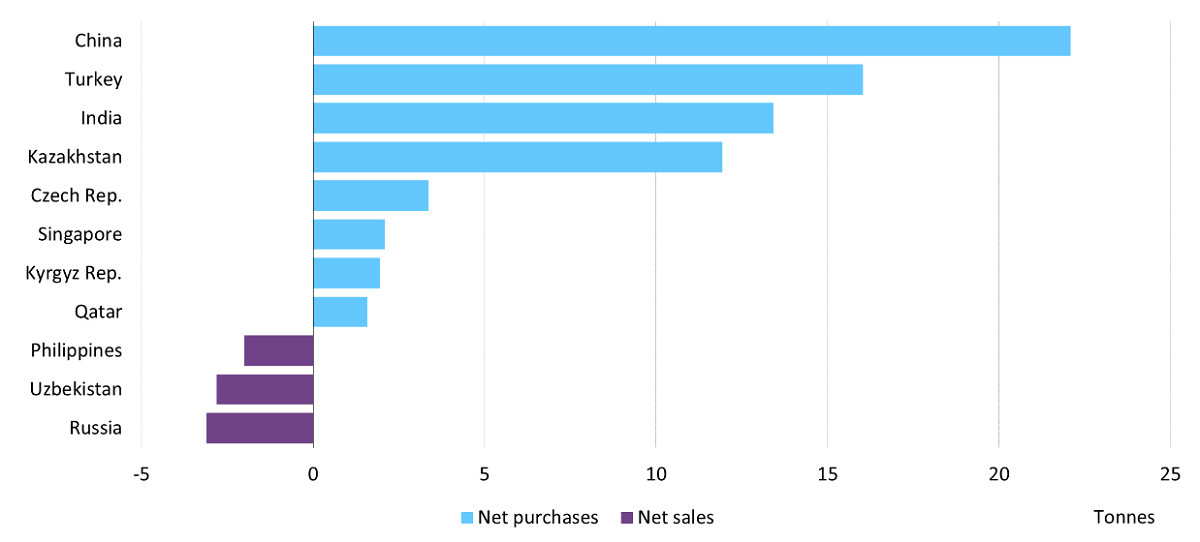

Central Bank Buying

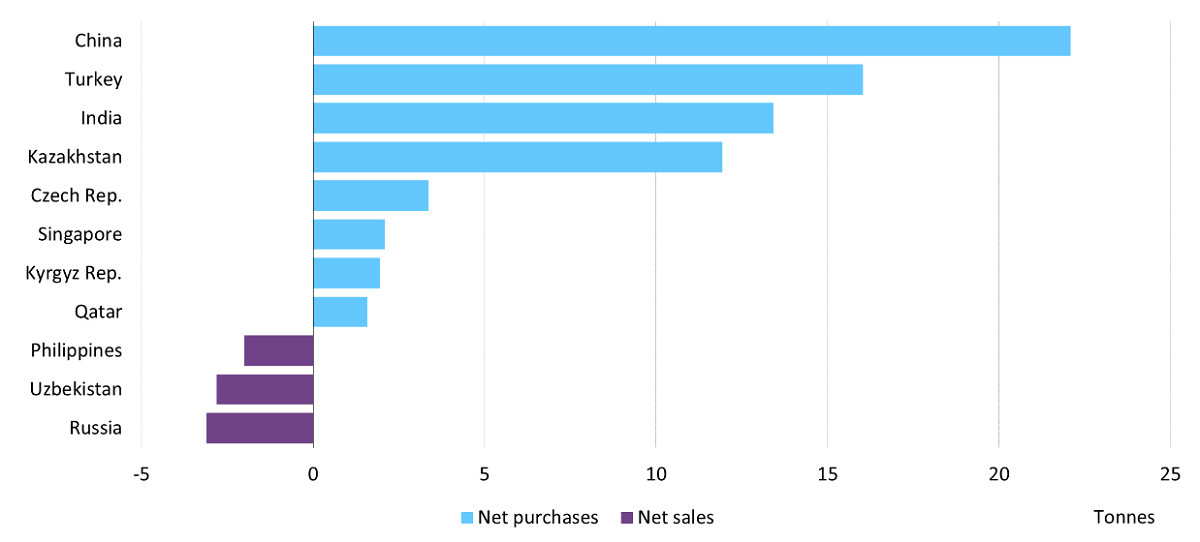

Another major driver is global central-bank behaviour. Gold remains a strategic reserve asset for many countries, and shifts in reserve allocation matter for the market. The World Gold Council and other trackers show official-sector net gold purchases exceeding 1,000 tonnes annually in recent years, 1,037 t in 2023 and 1,044 t in 2024.

In Q1 2025 alone, central banks added 244 t of gold.[1] This strong accumulation behaviour is a structural base for gold prices rather than just speculative flows. Analyseers highlight that emerging-market central banks are buying as part of reserve diversification (away from the U.S. dollar), and that official sector demand now accounts for roughly 20% or more of global gold demand (versus ~10% in the 2010s).

Geopolitical / Safe-Haven Demand

A third major theme is the safe-haven or hedge role of gold. As geopolitical tensions rise, economic uncertainty deepens and currencies become volatile, investors often turn to gold. In 2025 the rally has been underpinned by concerns over U.S. - China trade and technology friction, government shutdowns, growing global debt and weaker U.S. dollar.

Although past conflicts (such as the 2022 Russia-Ukraine war or the 2020 COVID-19 shock) did spur short-term gold jumps, the persistence of buying in 2025 reflects not just episodic crisis but a broader shift in market sentiment, in other words, gold’s safe-haven role is becoming more structural rather than purely tactical.

Additional Influences

In addition to the three main themes above, observers identify several other influences:

Rising jewellery demand in Asia (especially India and China), wholesale demand in China rebounded in 2025.

Slower growth in mine supply as ESG/permits tighten and cost pressures mount.

Greater flows into gold-backed ETFs, digital-gold platforms and trading vehicles.

Currency depreciation in emerging markets (so domestic gold prices rise even if global USD-price is unchanged).

De-dollarisation/reserve diversification trends in some countries.

How Should Investors and Consumers Respond?

Given the powerful mix of factors driving gold’s rise, understanding how to respond is important for both ordinary buyers (such as jewellery or bullion purchasers) and investment-oriented investors. Below are key considerations:

Clarify your objective and risk profile

Whether you’re buying gold jewellery as part of cultural tradition or acquiring bullion as a hedge or portfolio asset, the logic differs and so do the risks (liquidity, storage, purity, cost differential).

Choose the right vehicle

Options include physical bullion, coins, jewellery, gold-backed ETFs, gold futures or digital gold platforms. Each has distinct cost, liquidity, counter-party or physical-storage risk considerations.

Monitor timing and valuations

While gold has already surged (for example, from ~USD $3,300/oz in early 2025 to ~USD $4,300+/oz by mid-Oct) the market may experience pull-backs if real yields rise, the U.S. dollar strengthens or inflation expectations fade. Such dips can present buying opportunities, but don’t use them as a justification to buy without an underlying strategy.

Keep it part of a diversified portfolio

While gold is a strong hedge, it should not dominate your allocation. Alternatives such as equities, bonds, real estate remain key. If gold has run ahead, think carefully about how much exposure is appropriate for your mix.

Understand local/regional factors

For Malaysian or Southeast Asian buyers in particular: local currency depreciation and import or consumption-tax duties may raise jewellery cost. Ensure your pricing compares to international benchmarks and that you understand storage/security costs for physical bullion.

Outlook & scenario table:

| Time Horizon |

Possibility |

Key Drivers |

| Short-term (next 3-6 months) |

Medium |

Geopolitical shock, inflation surprise, central-bank buying |

| Medium-term (6-18 months) |

High |

Continuing economic uncertainty, inflation persistence, monetary easing |

| Long-term (>18 months) |

Medium |

Supply constraints, currency shifts, reserve diversification |

Conclusion:

Despite elevated prices, the structural drivers supporting gold remain intact in 2025. That said, markets rarely move in a straight line, periods of consolidation or pull-back are likely. Buyers should only commit after sizing up their objective, cost, liquidity and alternatives. If you buy, choose credible platforms/venues, avoid over-paying for jewellery mark-up, and treat gold as part of a broader portfolio strategy rather than a “get rich quick” scheme.

Outlook: What Could Happen Next?

Looking ahead to the rest of 2025 and into 2026, several scenarios are plausible:

If the Federal Reserve begins one or more interest-rate cuts (or signals they are forthcoming), real yields could decline further, a positive for gold. Indeed, by mid-2025 gold has already risen ~60% year-to-date.

If geopolitical or trade tensions escalate (for example between the U.S. and China), safe-haven demand may spike. Some analysts are now forecasting gold could move toward USD $5,000 per ounce or higher in medium-term. [2]

-

Conversely, if inflation falls faster than expected, the U.S. dollar strengthens and real yields rise, then gold prices could pause or retrace. Stay alert to those “if-cases”.

Summary:

| Time-Horizon |

Possibility |

Reasons |

| Short-term |

Medium |

Geopolitical shock, rate-cut surprise |

| Medium-term |

High |

Monetary easing, inflation persistence, reporting weakness |

| Long-term |

Medium |

Structural supply issues, reserve diversification, currency shifts |

As always: gold is not guaranteed to rise continuously. Returns may be volatile, and premium/mark-up on jewellery or physical purchase should be understood.

Disclaimer: This material is for general information only and is not intended as financial, investment, or other advice on which reliance should be placed.

Sources:

[1] http://gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2025/central-banks

[2] https://www.reuters.com/world/china/gold-tops-4200-first-time-us-china-trade-tensions-fed-cut-bets-2025-10-15/

Reasons for the Gold Price Spike

Reasons for the Gold Price Spike