Any investor who pays attention to U.S. stocks can't help but notice Tesla. As an electric car and energy company, its fluctuating stock price has often caught the attention of the market. Its innovative business model, advanced technology, and the influence of the company's founder, Elon Musk, have made it a high-profile stock. Today, we'll take a look at Tesla's history and investment potential.

Tesla's Founder and History

Tesla's Founder and History

Many people are under the impression that its founder is Musk. But it is actually an electric car manufacturing company founded by Silicon Valley engineers Martin Eberhard and Marc Tarpenning, established in 2003. and named after Nikola Tesla, the inventor of alternating current.

Founders Martin Eberhard and Marc Tarpenning's goal was to build a high-end luxury electric sports car to demonstrate the potential of electric vehicles. However, lacking sufficient capital, they had to seek investment and eventually found billionaire Elon Musk. So in 2004. Musk invested $6.5 million in a Series A round of financing and became the company's largest shareholder and chairman.

Elon Musk has had a significant impact on the company's direction and strategy since joining Finger. Not only did he provide financial support as an investor, but he was also personally involved in the company's design and engineering decisions. In August 2006. Musk proposed a roadmap for the company's development, a “three-step” strategy, which has become the core of the company's development approach.

The “three-step” strategy consisted of the following: Phase 1: Build an expensive, niche sports car, the Roadster, and use the proceeds to develop a cheaper model. Phase 2: Use the proceeds from Phase 1 to build a cheaper, mid-sized Model S and Model X. Phase 3: Develop an affordable, best-selling Model 3 with zero-emission energy options.

Based on this three-step strategy, between 2003 and 2008. Tesla introduced the Roadster, a high-end niche electric sports car, as its first entry into the automotive industry. The automotive industry is then a technology- and capital-intensive industry that can be extremely challenging for start-up companies.

At the time, it had gaps in its manufacturing processes, supply chain management, and branding compared to traditional car companies with years of history. In addition, the cost of batteries was as high as $1.000 per kWh, and the industry was not mature enough to make production costly. So the company decided to launch a high-end electric sports car first in order to subvert people's perception of the short range of electric cars in a high-flying way.

In July 2006. Tesla officially launched the Roadster sports car. Developed in partnership with Lotus Cars of the United Kingdom, the roadster started at $98.000 with a 100-kilometer acceleration time of about 3.7 seconds and a range of 400 kilometers. Upon its launch, the car was favored by many Hollywood stars and socialites, such as Silicon Valley executives.

However, due to bottlenecks in the supply chain and core component technology, the Roadster's production costs spiraled out of control, and output suffered. Under the leadership of CEO Martin Eberhard, the company's team was too focused on technology development and performance enhancement and neglected production arrangements and product control, resulting in serious delays in the product schedule.

In June 2007. only two months before the Roadster went into production, the company still had not completed the development of the core component, the two-gear transmission. In addition, due to the lack of scale in supply chain purchasing, the production cost of the initial 50 Roadsters rose from an average of $65.000 to over $100.000. causing some pre-orders to be canceled.

Founder Eberhard was removed as CEO in August 2007 due to management failures and out-of-control expenses. Musk took over the day-to-day operations of the company and, in subsequent years, successfully launched several highly popular electric car models, such as the Model S, Model X, Model 3. and Model Y. The company's successes have been recognized by the public.

These models were loved by consumers worldwide and fueled the company's rapid growth. Meanwhile, Musk continues to invest in Tesla to ensure that the company has enough money to innovate and expand. Under Musk's leadership, the company has not only achieved great success in electric vehicles but has also ventured into energy storage and solar energy.

Despite the company's rapid growth and extraordinary achievements, Musk's management style and the way the company operates have caused some controversy. For example, he has adopted a high-pressure policy at work, requiring his employees to work overtime to meet high production goals. This style can be stressful for employees, but in some cases, it has contributed to the company's success.

Overall, Tesla's history is the story of a startup that became a global electric car giant. It has not only been characterized by successes and breakthroughs but has also been accompanied by challenges and controversies. But regardless, it has become one of the leaders in electric vehicles and sustainable energy.

Tesla's Market Capitalization

Tesla's Market Capitalization

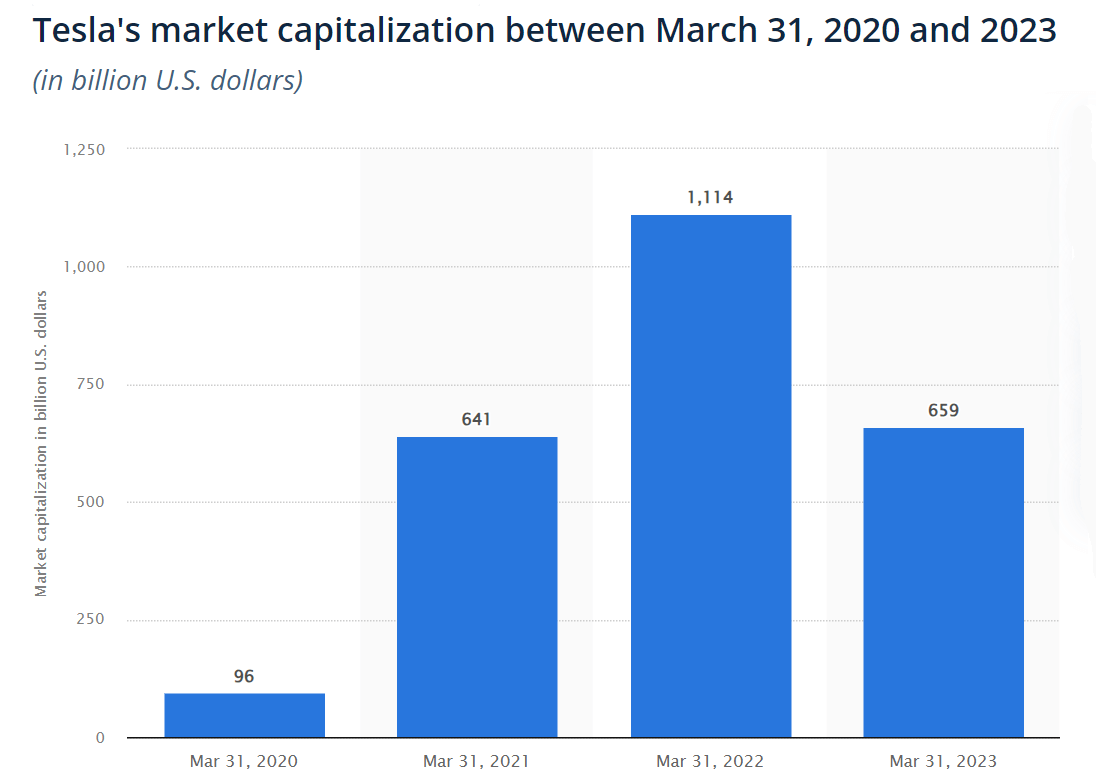

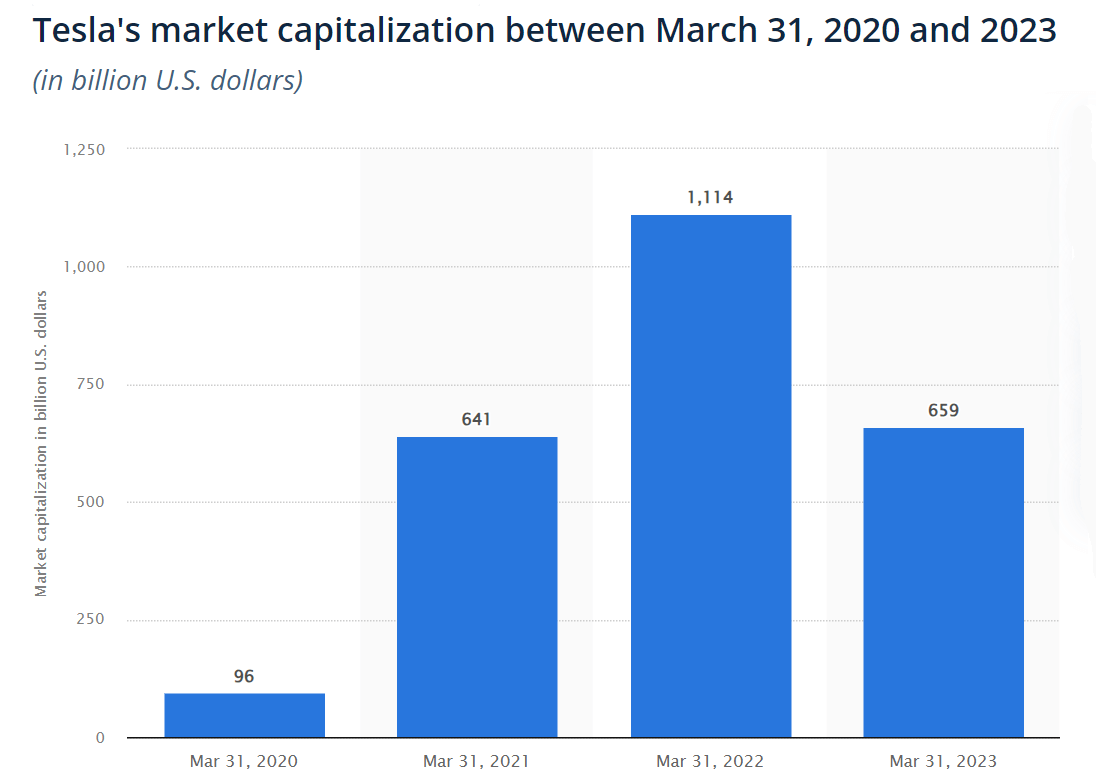

As one of the world's most valuable automakers, its market capitalization fluctuates with market volatility. It is affected by a number of factors, including the performance of its electric vehicle business, production and delivery volumes, market demand, technological innovations, regulatory policies, macroeconomic conditions, and Tesla's investments and research and development in renewable energy.

On June 29. 2010. Tesla became a publicly traded company with its initial public offering (ipo) on NASDAQ. At this time, the company's stock price was set at $17 per share, and the IPO raised a total of about $226 million. The company's market capitalization was relatively low at the time because it was a startup focused on the production of the Roadster, a high-end electric sports car.

In the first few years after the IPO, its market capitalization has fluctuated at low levels. This was due to the company's difficulties with production and supply chain management and its limited product lineup. On the production side, the Roadster had high production costs and supply chain issues, which led to the company struggling to achieve profitability throughout the years.

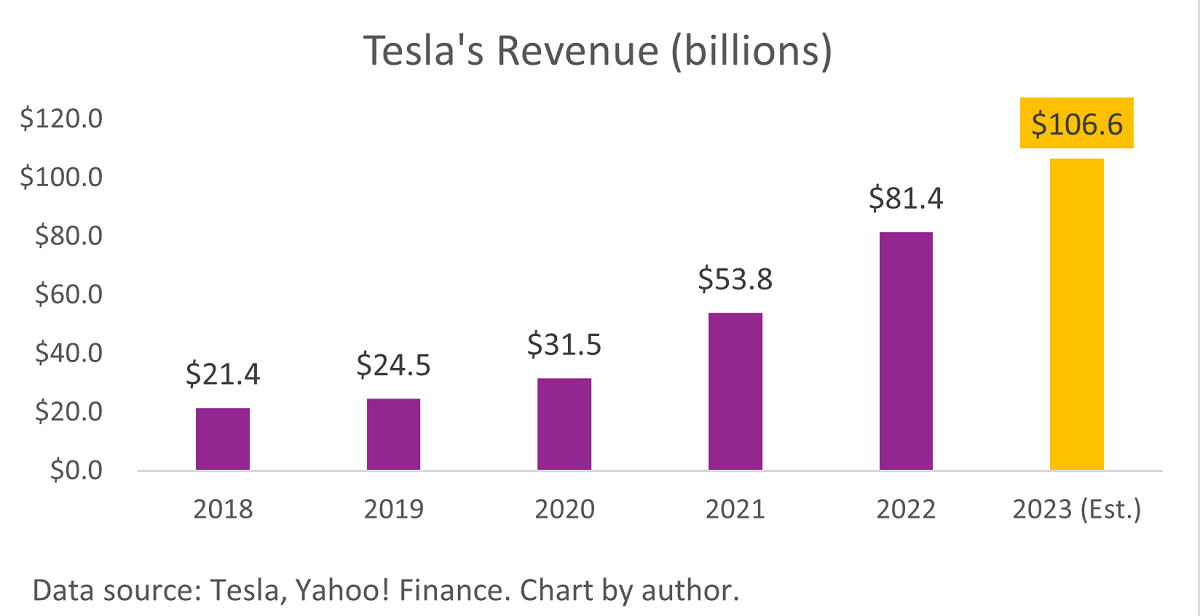

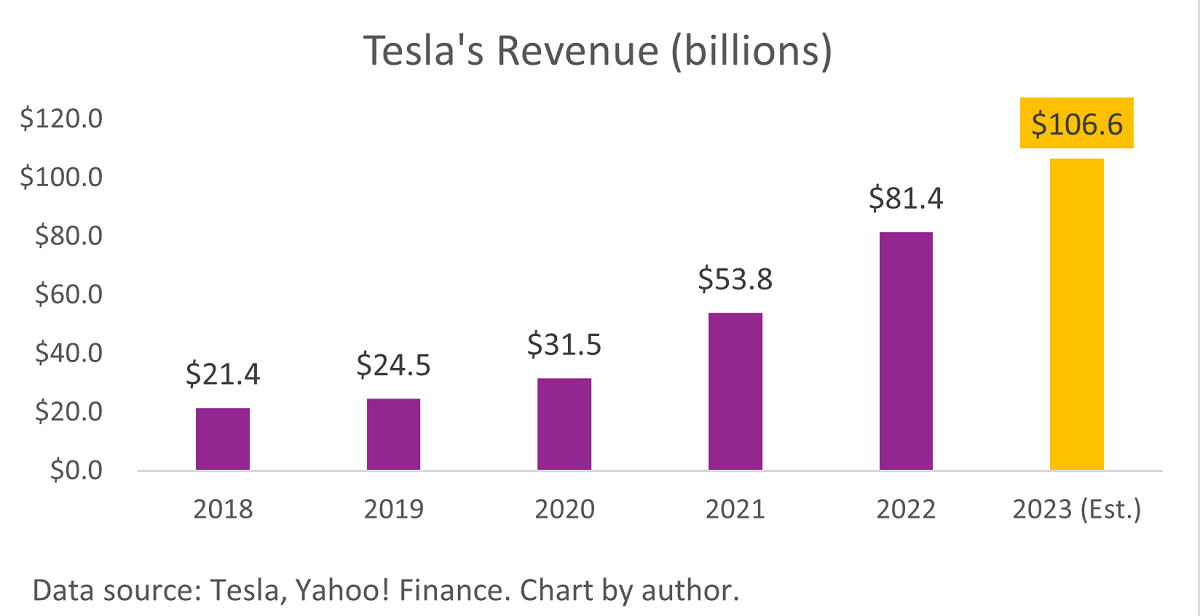

It wasn't until 2012 that the company launched the Model S electric sedan, which was a huge success in the market. The car won over consumers with its outstanding performance, range, and design and was seen as an innovative representative of the electric car market. Its success has also boosted the company's sales revenues and profits, boosting investor confidence in the company. As the company's performance continued to improve, Tesla's market capitalization began to rise steadily.

2017 saw the official launch of the more affordable electric car, the Model 3. The launch of this car marked an important breakthrough for the company in the mass market. Due to its relatively affordable price and the quality and technology of the company's brand, this car attracted a lot of attention and purchases from consumers.

As sales of the Model 3 increased, the company's revenues and profits improved further, which had a positive impact on the company's market capitalization growth. The success of the Model 3 made investors more optimistic about the company's future prospects, which in turn drove the company's market capitalization up further.

The company then began to aggressively expand its business globally, including building factories in China and Europe. For example, it built the Shanghai Superfactory in China, which is its key production base in the Chinese market. It also built the Berlin plant in Europe. The construction of these plants has significantly increased the company's production capacity and enhanced its competitiveness in the global market.

Globally, Te's electric vehicle sales continued to grow, which further boosted the company's market capitalization. At the same time, its leading position in electric vehicles and renewable energy was further strengthened as the global focus on sustainable energy and environmental issues continued to grow. It also maintains its leading position in the market with its innovative capabilities in battery technology, autonomous driving, and sustainable energy.

These were years of high growth for the company, and in 2021. it took its market capitalization past the trillion-dollar mark. This milestone moment marks a new level of success for it. And it reflects investors' confidence in the company's future growth, as well as the rapid growth of the electric vehicle industry and the sustainable energy sector.

Unlike other companies that have experienced changes in market capitalization, the company's CEO, Elon Musk, has played a major role in the company's decision-making, product launches, and marketing strategies and has had a significant impact on the market and investors in terms of product launches, social media interactions, and more. This “Musk effect” has also contributed to the company's market capitalization growth.

From 2022 to the present, Tesla's market capitalization has experienced ups and downs, partly due to the market's adjusted expectations for electric vehicles and renewable energy. In addition, global supply chain issues and increased competition in the market have also had an impact on its market capitalization. As of early 2024. its market capitalization had fallen to approximately hundreds of billions of dollars.

But what's important to realize is that even though it only has about a 1% share of the North American electric vehicle market, its market capitalization exceeds the combined market capitalization of all other automakers. And overall, the company's market capitalization has grown rapidly, doubling 100-fold since it went public in 2010. even after years of being unprofitable.

Compared to its $50 billion market capitalization in 2019. Tesla's market cap has grown dramatically in just a few years, reflecting the market's huge interest and investment confidence in electric cars and sustainable energy. So despite its volatile market cap, overall, its leadership in electric vehicles and renewable energy has led it to be seen as one of the key players in the future of the transportation and energy industries.

Tesla Stock

Tesla Stock

Its stock price has experienced significant growth over the past decade or so, which has made Tesla stock (ticker: TSLA) a popular investment target for investors. However, many believe its stock is overvalued, including company CEO Elon Musk himself, who has suggested that the stock may be overpriced. However, that hasn't stopped investors from continuing to buy its stock, leading to a continued rise in its share price.

This is due to the fact that it has not only excelled in the electric vehicle sector but also has significant businesses in clean energy and autonomous driving. These innovations and market prospects have attracted the attention of investors. While its stock may be overvalued, its potential in areas such as electric vehicles, clean energy, and autonomous driving is promising.

Tesla stock experienced huge gains during the epidemic, due in part to market optimism about the electric vehicle and clean energy sectors and its leadership in these areas. However, since November 2021. its stock price has begun to fall, accumulating a 65% decline. So far this year, its shares are also down 41%.

This was due to the poor performance of its Q4 2023 earnings report, which led to a 13% plunge in the stock price. The market capitalization has shrunk by $250 billion in a month, about a 30% drop. As seen in the earnings report, the company fell short of expectations, including lower-than-expected performance in both revenue and earnings per share. At the same time, the company's gross margins have declined, affecting the company's profitability.

Moreover, the company has also been adopting a price-cutting strategy for a long time in order to maintain sales growth, which has led to profit compression. As seen in the earnings report, the company's sales grew by 17% in the fourth quarter of 2023. but revenue grew by only 3.5%, showing the huge impact of price cuts in addition to price cuts on the company's revenue and profitability. And it has also faced the challenges of high margins and reduced demand over the past year, putting further pressure on its price cuts, and gross margins have continued to fall as a result.

The company's management is also cautious about the future, expecting 2024 to be a year of slow growth and recognizing that the company faces many challenges. Investors therefore weigh up its potential opportunities and risks, including its potential for innovation in electric vehicles, clean energy, and autonomous driving, against current market challenges and earnings pressures, which have been a significant factor in the share price decline.

That said, investors could be rewarded handsomely over the long term if Tesla is able to achieve its innovation and growth goals. That's because it's one of the market leaders in the electric vehicle space, with broad market demand and a favorable reputation for its innovative designs, strong brand presence, and ever-improving technological prowess.

And the market expects electric vehicles to grow from about 10% of vehicle sales today to more than 50% in the following five years. As the industry as a whole grows fivefold, the companies at the forefront of this disruption will sell a lot of cars. They will generate massive profits and unlock massive shareholder value. And in this space, Tesla will be the investment with the most guaranteed returns.

Sure enough, just last week, it released its Q1 2024 earnings report, and as a result, its stock price has risen dramatically. It also showed that while its stock price is volatile today, true value investors recognize its fundamental value and consider it a stock worth investing in for the long term.

Tesla stock has been known for its high volatility and significant price swings, which are influenced not only by aspects of business growth, financial performance, and innovative advances in the electric vehicle market and clean energy sector but also by market sentiment and overall economic conditions.

Overall, Tesla has great investment potential as one of the leaders in electric vehicles and sustainable energy. However, when investing, investors should have a thorough understanding of the company's business, financial situation, market trends, and potential risks and make decisions based on their own risk tolerance. Meanwhile, as with other investments, investors should avoid over-concentration in a single stock to diversify their risks.

Tesla Market Capitalization and Stock

|

Time period

|

Market Capitalization

|

Stock

|

|

2010–2012

|

Listed on NASDAQ in 2010 with a low cap. |

1.7 dollars per share (price at IPO) |

|

2012–2017

|

The market cap grew with Model S's success. |

The share price climbed from $2 to $24. |

|

2017-22020

|

The market cap grew with Model S's success. |

Peak of 239.57 in December 2020. |

|

2020-22023

|

The market cap topped $1 trillion, leading auto. |

The highest point was $381.59. |

|

2023-present

|

swings with economic and competitive pressures. |

Currently at $168.29 |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Tesla's Founder and History

Tesla's Founder and History Tesla's Market Capitalization

Tesla's Market Capitalization Tesla Stock

Tesla Stock