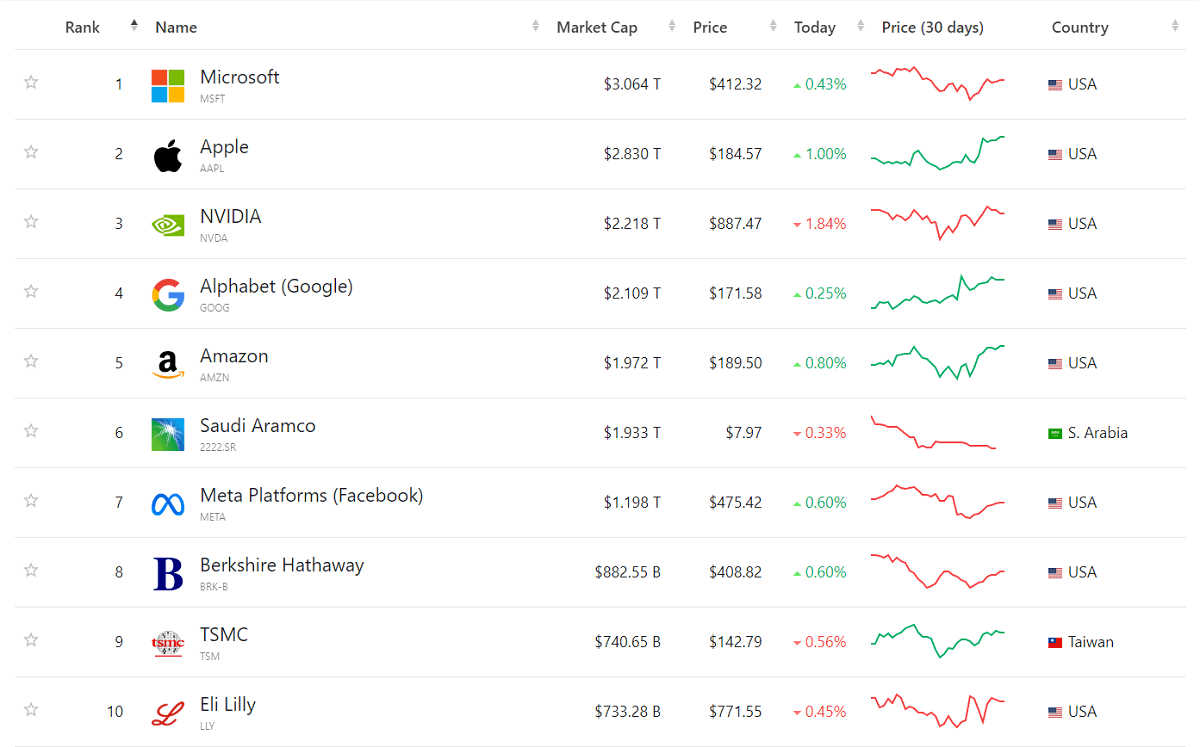

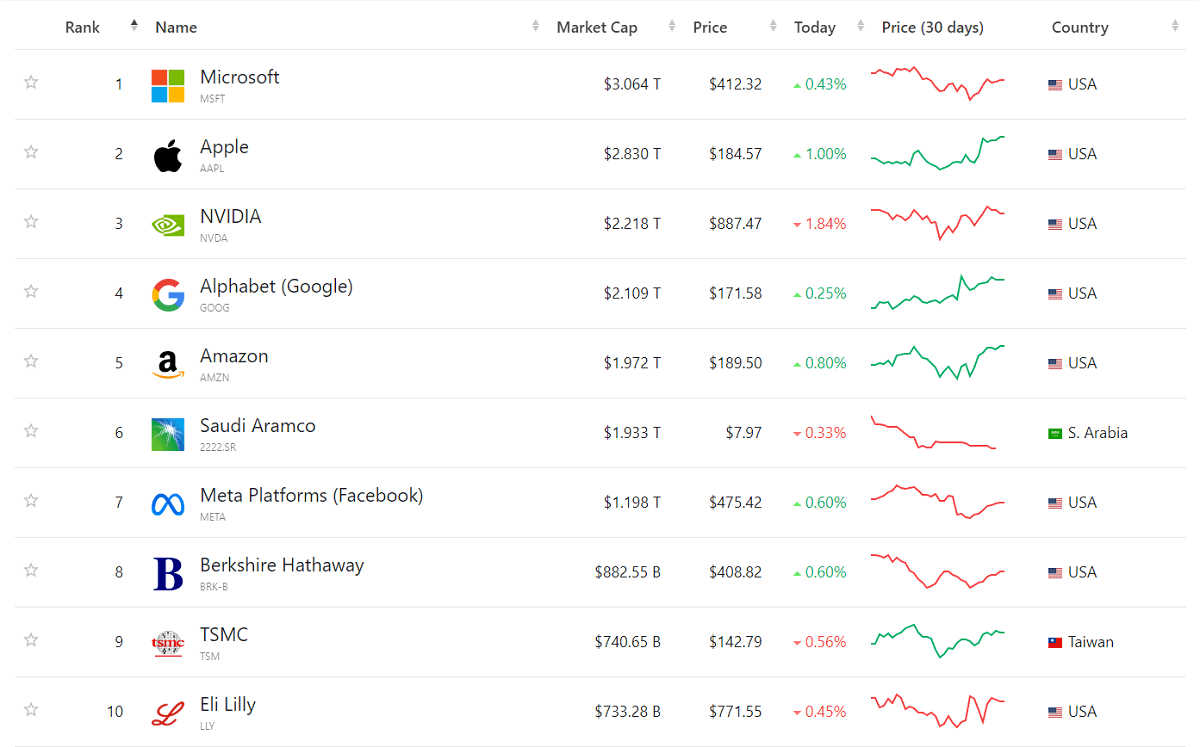

There are only a few of the most valuable companies in the world, and only one of them can reach a market capitalization of 3 trillion dollars, and that is Microsoft. As a multinational technology company that is a household name, the fact that its market capitalization has once again topped the charts shows that the company is in good shape. And as a result, many investors have turned their attention to it. Let's now examine Microsoft's growth trajectory and investment potential.

What is Microsoft?

What is Microsoft?

Its English name is Microsoft Corporation. It is a global leading technology company, headquartered in Redmond, Washington, USA. The company was founded in 1975 by Bill Gates and Paul Allen.

Its initial focus was on developing and selling operating systems for personal computers, particularly its iconic Windows, and over time it has transformed itself from a pure operating system developer into a comprehensive technology company with operations in software, hardware, cloud computing, artificial intelligence, gaming, and many other areas. And it also operates globally, offering a wide range of software, hardware, cloud computing, and productivity tools.

In the productivity software space, Microsoft's Office suite (e.g., Word, Excel, PowerPoint, etc.) has been the industry standard and is the office software of choice for offices and educational institutions worldwide. In the cloud computing space, Azure Cloud Service is one of the world's leading cloud computing platforms, offering a range of cloud computing, data analytics, artificial intelligence, and IoT solutions for businesses and developers.

And in the field of gaming, the Xbox series of games has maintained its competitiveness in the gaming market and also acquired several game studios, such as Bethesda and Mojang, to further consolidate its position in the gaming industry. It has also expanded its presence in the technology industry by diversifying its business and making strategic acquisitions.

For example, it has further expanded its business by acquiring companies such as Nokia's cell phone division and the business social platform LinkedIn. The acquisition of LinkedIn enhanced its presence in the professional social space, while the acquisition of Nokia's cell phone division helped it experiment with innovation in the mobile device market.

Looking at its revenue streams, it can be divided into two categories: products and services, which cover the company's three core businesses: productivity and business processes, intelligent cloud services, and the personal computer category. By diversifying its business structure, Microsoft is able to compete in different areas at the same time and maintain its leading position in the technology industry.

The Productivity and Business Processes segment includes key products and services such as the Microsoft Office suite, LinkedIn, a social platform for business, and Microsoft Dynamics, a customer relationship management software that provides common office tools such as Word, Excel, PowerPoint, and Microsoft Dynamics, a subscription-based service. The Microsoft Office suite provides common office tools such as Word, Excel, PowerPoint, and Microsoft 365. a subscription-based service, to help users realize online collaboration and productivity enhancement.

LinkedIn, as the world's largest professional social networking platform, provides recruitment, advertising, and subscription services to help professionals and enterprises establish connections. Microsoft Dynamics is enterprise resource planning and customer relationship management software, supporting enterprises to optimize sales, marketing, customer service, financial management, and other business processes to improve work efficiency and business growth.

The intelligent cloud services segment, on the other hand, mainly consists of its server products, cloud services (Azure), GitHub, etc. Azure is Microsoft's cloud computing platform that provides a wide range of cloud services such as infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS), which cover areas such as computing, storage, databases, machine learning, and artificial intelligence.

The company offers comprehensive cloud solutions for enterprises and developers through Azure, catering to business needs of all sizes and industries. In addition, its cloud services include support for developer communities, such as the GitHub platform, which provides developers with features such as code hosting, collaboration, and version control.

The business area of personal computers covers three main areas. The first is Windows computers, which include the Windows operating system, which is the most commonly used PC operating system worldwide and is widely used in all types of personal computers. Secondly, there is the company's own Surface line of tablets, which are devices that are known for their superior software and hardware integration, providing excellent productivity tools.

Finally, Microsoft has also launched its Xbox line of consoles in the gaming space, which have a large user base worldwide and have become a major player in the gaming market. Through these businesses, the company has maintained a strong market position in the personal computer segment.

By specific distribution, these three businesses account for 33%, 31%, and 36% of the company's revenue, respectively. This balanced revenue structure helps to diversify risks and avoid a significant impact on the company's operations due to the impact on a single source of revenue. At the same time, this diversified business layout also ensures the stable development of the company.

Among these three core businesses, the fastest growth in the previous year was in Intelligent Cloud Services, with revenue growth reaching 21%. It is foreseeable that the company will continue to vigorously develop the field of cloud services, as the cloud computing market has great potential for future development, bringing more opportunities and revenue growth for the company.

Overall, Microsoft, as a diversified and competitive technology company, has maintained steady growth in various business areas, especially in the cloud service area. At the same time, its stable revenue structure and diversified businesses provide the company with resilience to risk.

Microsoft's Market Capitalization and Share Price Development

Microsoft's Market Capitalization and Share Price Development

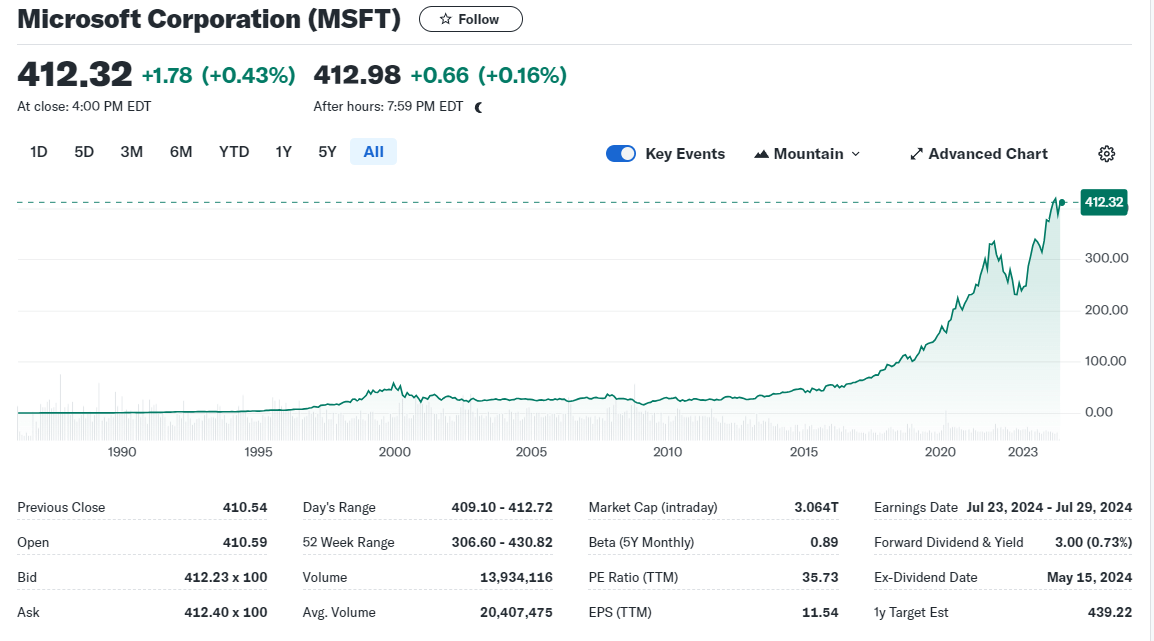

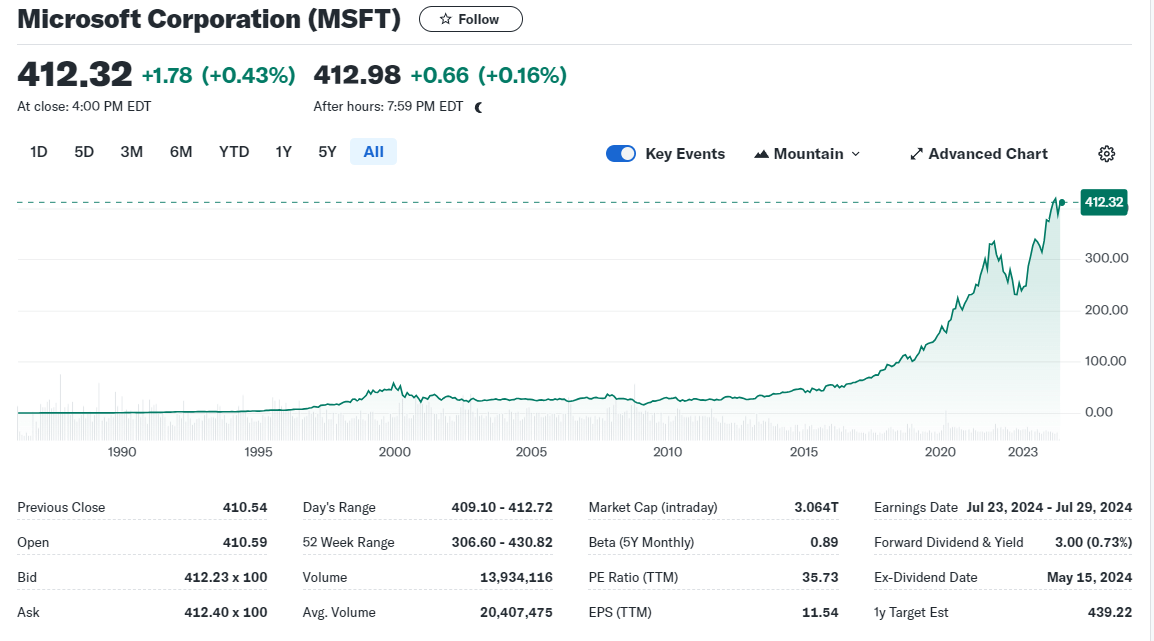

As a leading global technology company, Microsoft's market capitalization and stock price have shown strong growth over the past few decades. Of course, there have naturally been downturns over the course of nearly 50 years of growth. For example, its stock price experienced large swings in the late 1900s and early 2000s. And it was a pretty long period of lows, with the stock price not starting to grow significantly since 2000 until after 2014.

On March 13. 1986. Microsoft made its initial public offering (IPO) on the Nasdaq Stock Exchange under the ticker symbol MSFT. The IPO price at the time was $21 per share, and about 3.5 million shares were issued, raising about $61 million for the company. According to the calculation, its market capitalization at the time of the IPO was about US$780 million.

Benefiting from the rapid growth of the Internet and the enthusiasm for technology stocks, its share price continued to rise in the following years. With its dominant position in the field of personal computer operating systems and its success in software and services, the company achieved significant market share and revenue.

In December 1999. its stock price reached an all-time high of $59.97. And with a market capitalization of $620 billion, it became the world's largest company by market capitalization during this period. This marked its passage over other large technology companies such as IBM and General Electric as the leaders in the technology sector.

The tech bubble burst period that followed saw its share price go through a longer period of stagnation at the same time. During the same period, the company also experienced challenges such as antitrust lawsuits, increased competition in the market, and questions about its business model. And during the financial crisis of 2008. the company's stock price suffered a significant drop.

However, the company's financial position remained relatively strong and less affected than that of some other technology companies. The company eventually adapted to market changes and began to expand into new business areas, such as cloud computing and enterprise services, to maintain its leading position in the technology industry.

After 2010. Microsoft gradually regained its growth momentum through strategic transformation, including entering emerging areas such as cloud computing and refocusing on productivity tools and enterprise services. In particular, the company's focus on cloud services (Azure) and enterprise services led to a steady rise in its share price and market capitalization after Satya Nadella became CEO.

And after a period of volatility and competition, the company has achieved steady growth through strategic realignment and business diversification. Particularly through success in the cloud (primarily Azure) and continued innovation in productivity software, gaming, and business services.

And so on November 26. 2018. Microsoft's market capitalization surpassed Apple's for the first time, making it the world's most valuable company. It has also continued to grow steadily since then and has topped the global market capitalization list in subsequent years. This achievement signifies its continued leadership in the technology sector and its success in all areas of its business.

After that, its share price went through the roof, showing continuous and explosive growth. Until November 2021. it had reached an all-time high of $336. At the same time, the company's market capitalization has remained high, consistently among the highest in the world. As of May 2024. its share price has risen to $420. while also becoming the most valuable company in the world once again with a market capitalization of $3.064 trillion.

Overall, Microsoft's market capitalization and share price performance have been stable and consistently growing, thanks to its diversified business in several areas and its innovations in emerging technologies. And its consistent and stable value-added performance has made it one of the most valuable and investor-favorite companies in the world.

Microsoft's Investment Value Analysis

Microsoft's Investment Value Analysis

This is because it has a leading edge in a number of areas, and it has especially excelled in areas with great potential for future growth, such as artificial intelligence and cloud services. Its stellar share price performance has attracted many investors, especially those interested in the technology sector, to favor it.

However, its current share price may be slightly higher than reasonable through different valuation methods. This could be due to the market's high expectations of its future growth potential, as well as its leadership in areas such as cloud computing and artificial intelligence. Thus, despite the higher valuation, it also indicates that investors are willing to pay a premium for its long-term growth prospects and strong business capabilities.

And its stock's price-to-earnings (P/E) ratio is also higher than the market average, which raises concerns among some investors about whether its valuation is too high, especially in times of market volatility. However, this higher P/E actually reflects the market's expectation of its future growth potential.

As a global leader in the tech industry, Microsoft has solid growth prospects in areas such as cloud computing, artificial intelligence, productivity tools, gaming, and business services, which keeps investors optimistic about its future earnings. As a result, its higher price-to-earnings ratio is often seen as a vote of confidence in its ability to sustain growth in the future.

It is important to realize that it has a strong financial position, demonstrating solid revenue growth and strong cash flow. For example, its Q1 2024 earnings report showed more than $60 billion in revenue, up 17% year-over-year, and more than $20 billion in net income, up 20% year-over-year. This allows it to maintain steady investment and innovation in its key business areas.

It also has a low debt-to-equity ratio, which means its financial structure is relatively robust and it can pay off all of its debt within one year of free cash flow. This financial stability and flexibility provide the company with the ability to remain resilient in times of market volatility, as well as ample financial security to grow and invest in new opportunities in the future.

And Microsoft's dividend growth has remained steady, underscoring the company's financial strength and focus on shareholder returns. Of course, as of now, the dividend yield is relatively low because of its high share price. The current dividend yield really isn't attractive enough if it's for investors looking for a high yield.

However, its potential for long-term dividend growth is worth investors' attention as it reflects the company's financial strength and commitment to shareholder returns. The company's ability to increase its dividend in the future continues to grow as it continues to maintain profitable growth and ample cash flow. This provides a positive signal to investors seeking a stable and long-term investment opportunity that they have the opportunity to benefit from the company's business success and steady growth.

And as a steadily growing tech giant, Microsoft is a worthy long-term investment target. While its share price may fluctuate with market volatility, its ability to diversify its business and continue to innovate is expected to continue to deliver strong returns to shareholders over the long term.

Therefore, regular fixed investment is a good choice. Long-term investors can invest in a regular fixed amount, which not only diversifies risk across different market cycles but also reduces the impact of market volatility on their investments and is likely to yield more stable returns over the long term.

Overall, while Microsoft's stock valuation may be high, these factors may support its higher valuation given its solid growth, diversified businesses, and technology leadership in key areas. However, investors should still carefully evaluate the market environment and their own risk tolerance when considering an investment.

Microsoft's growth path and investment value

|

Time period

|

Financial Performance

|

Investment Potential

|

|

1975-1999

|

Steady Growth |

Become a tech giant. |

|

2000-2010

|

Share price volatility |

Explore new frontiers. |

|

2010-2015

|

Revenue Growth |

High potential for cloud services |

|

2016-2024

|

Revenue and Net Profit Improvement |

Solid long-term growth |

|

2024 and beyond

|

Strong financials, possible dividend increase |

Stable returns on regular investments |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is Microsoft?

What is Microsoft? Microsoft's Market Capitalization and Share Price Development

Microsoft's Market Capitalization and Share Price Development Microsoft's Investment Value Analysis

Microsoft's Investment Value Analysis