The Nikkei 225 steadied above 33,000. Tokyo's benchmark briefly hit a high

not seen since 1990 on Monday as Treasury yields and the dollar began to lose

ground this month.

Japanese equities have delivered 30 years of false dawns, but it has become a

sought-after with Buffett’s stamp of approval. Berkshire Hathaway has racked up

lucrative profits since building the trading house stakes.

The company just sold yen bonds a second time this year, sparking speculation

that the legendary investor is looking to scoop up more Japanese shares.

The market is by far one of the best performers globally, but half of the

listed Japanese companies still trade at below book value, and in aggregate hold

20% more cash than their market cap.

The rally was partly driven by a robust earnings season. Japanese

corporations reaped the benefits of a weaker yen and from passing on costs to

consumers.

Insatiable appetite

Analysts say upward revisions to Japan's corporate earnings outlook are

supporting share prices. The index will continue its torrid rally this year into

2024, according to a Reuters poll.

The median forecast for the Nikkei's level in mid-2024 was 35,000, with

responses ranging from 31,143 to 39,500 but some stagnation is expected for

equities in the latter half of next year.

Masayuki Kichikawa, chief macro strategist at Sumitomo Mitsui DS Asset

Management in Tokyo, forecast the Nikkei to reach 39,500 in June and 40,900 by

end-2024.

The most bullish forecaster pointed to pent-up demand in both business

investment and consumer demand, particularly for services, which will drive EPS

growth.

Many respondents suspect the yen may have bottomed out with the BOJ

approaching the end of super-accommodative stimulus and the Fed tightening cycle

peaking out.

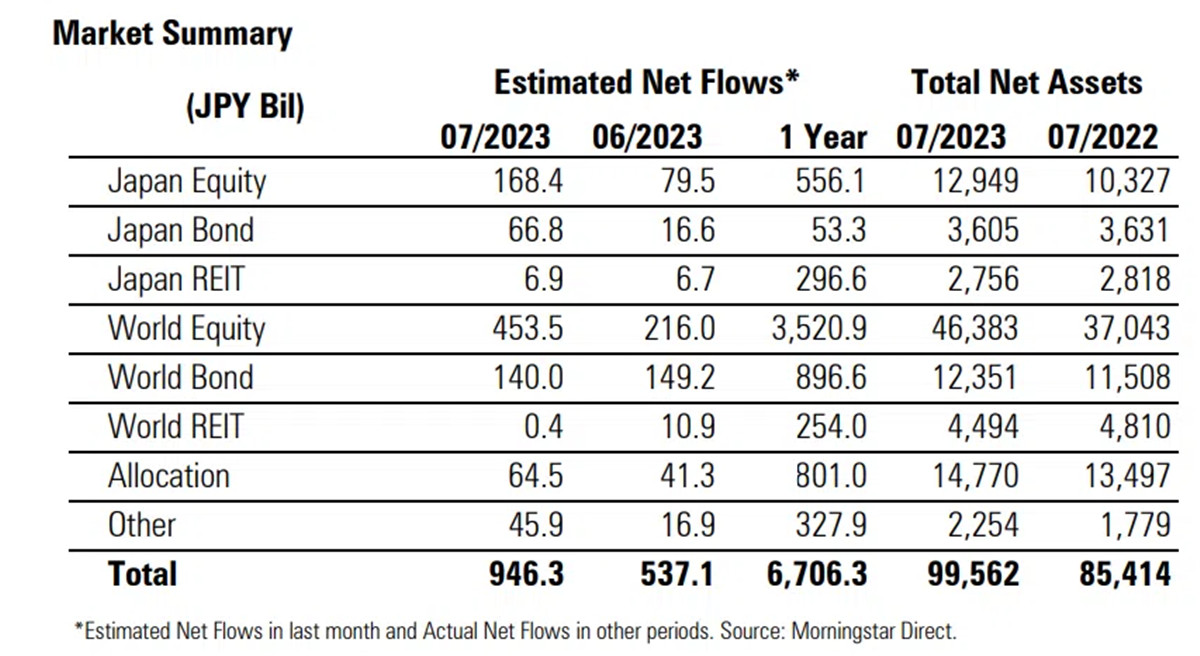

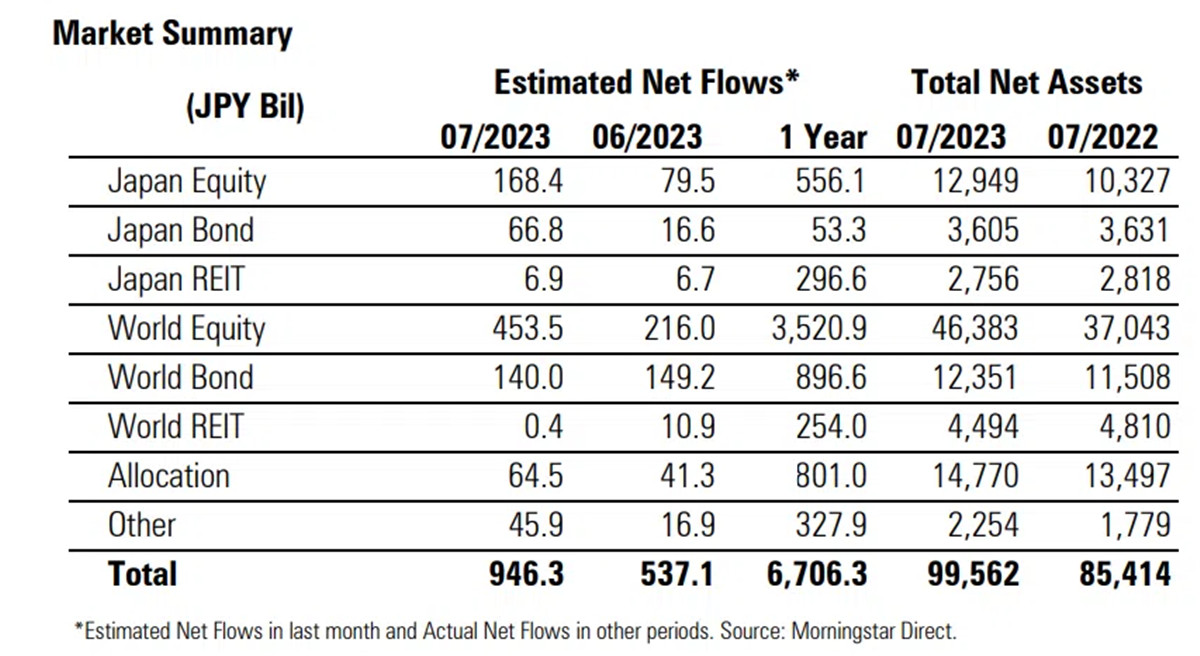

Net inflows to Japan hit ¥946.3 billion last month, the largest amount this

year and closing in on the record high last December, according to Morningstar

Direct data.

Equity funds in particular recorded strong momentum as both Japan equities

and world equities more than doubled their net inflows compared with June.

Profit-taking reasons

Not all money managers adopt the buy-and-hold strategy like Buffett, so

overseas capital could take their money off the table anytime if the rally looks

markedly overstretched.

Companies that missed analyst forecasts since the start of the current fiscal

year in April have seen share-price drops of about 6%, more than the average

over the past decade, according to an analysis by Rie Nishihara, chief Japan

equity strategist at JPMorgan.

"There was a bit of overreaction to superficial earnings numbers” due to

those who are not familiar with the market, said Masashi Akutsu, chief equity

strategist at BofA Securities.

Policy normalisation is also keeping investors on tenterhooks. Japan's big

employers are going to keep up salary rise in 2024, adding to pressure on the

BOJ to act sooner than later.

Rengo, Japan's largest trade union confederation, said it would demand a pay

hike of "5% or higher" next year. Meanwhile Kishida has been pushing for pay

hikes with his approval ratings plunging.

That means the tailwinds for Japanese multinationals from a weaker yen could

start to dissipate. And the BOJ will have to reduce its bloated balance sheet

eventually.

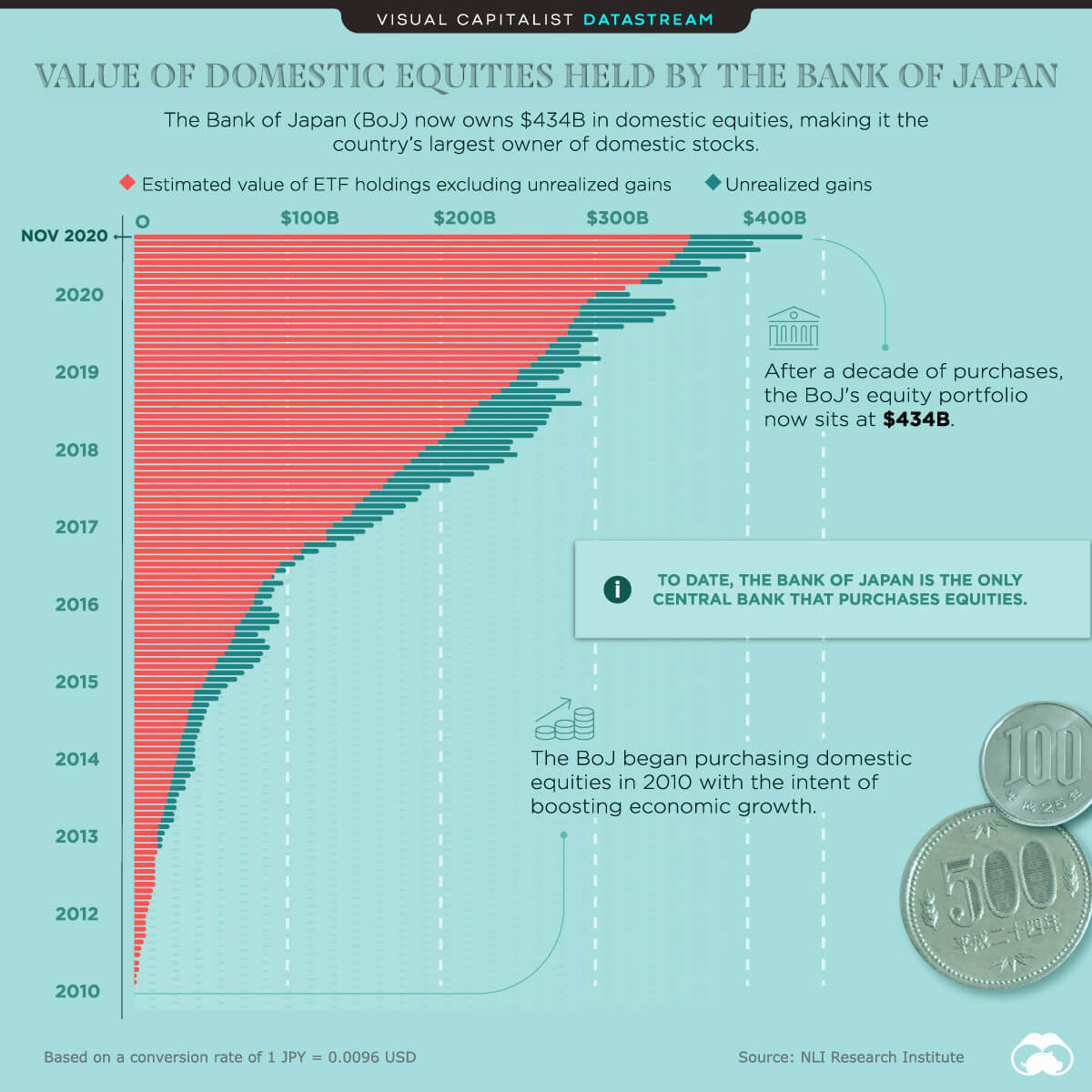

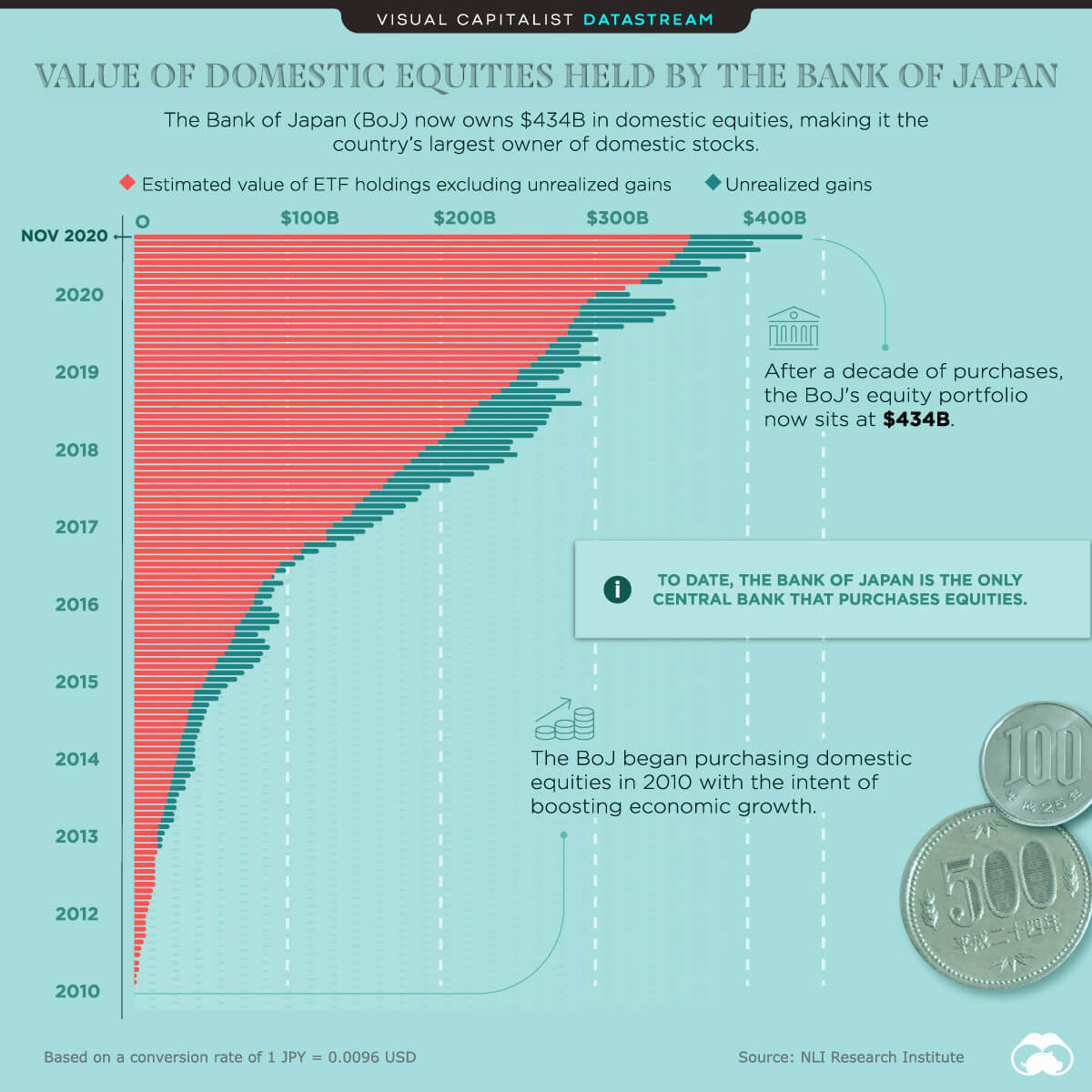

The central bank became the biggest owner of Japanese shares in late 2020

through its aggressive asset purchase programme, so it holds a massive amount to

be offloaded.

“Selling J-REITs and ETFs could trigger a big shock in financial markets,”

Yamaoka, the former BOJ official, said. “It’s going to be tough to exit in that

way during Governor Ueda’s tenure.”

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.