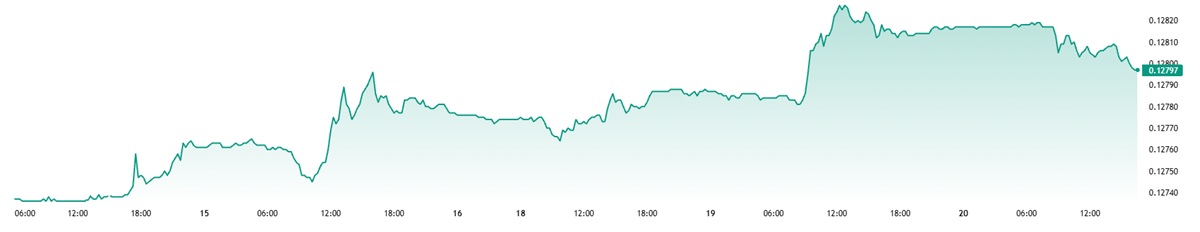

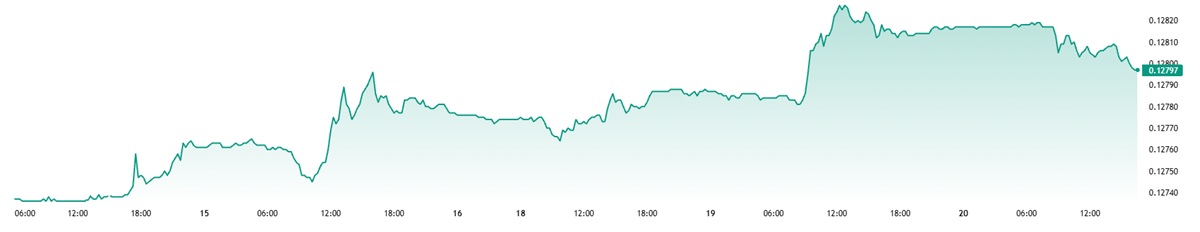

The Hong Kong dollar (HKD) has snapped back sharply in mid-August, with USD/HKD briefly touching around 7.79 on 19 August 2025—its strongest level in roughly three months—before edging back above 7.80 on 20 August. The move has revived debate about the drivers of HKD, how the Linked Exchange Rate System (LERS) channels capital-flow pressures, and whether the rally can last. This article unpacks the mechanics behind the surge, the role of equity inflows and liquidity, and the policy signals to watch from the Hong Kong Monetary Authority (HKMA) and the US Federal Reserve.

What Set off the HKD Rebound?

Equity demand was the first spark. Southbound Stock Connect saw record buying mid-month, with net purchases of HK$35.9bn on 15 August, the highest daily tally on record. Robust and persistent southbound demand mechanically increases the need to swap into HKD to fund purchases, tightening HKD liquidity at the margin and supporting the currency.

As HKD liquidity tightened, HIBOR firmed, reducing the negative HKD-USD rate gap that had previously encouraged carry trades against HKD. Higher local interbank rates raise the opportunity cost of short-HKD funding, helping the currency gravitate away from the weak end of its band. Market commentary and data show HIBOR firming in August after earlier softness when liquidity had been abundant.

The combination of stronger equity-related demand and firmer HIBOR likely forced partial unwinds of long USD/HKD positions. Bloomberg reported the HKD strengthening to the middle of its fixed trading range for the first time since May, consistent with a positioning shake-out.

How the Linked Exchange Rate System Channels these Forces

Under the LERS, HKD trades within 7.75–7.85 per US dollar, with the HKMA buying USD at 7.75 (strong-side CU) and selling USD at 7.85 (weak-side CU) to keep the rate in the band. When demand for HKD rises—e.g., from stock inflows—the exchange rate tends to firm toward the strong side, and the HKMA may end up selling HKD (buying USD) if the CU is triggered, expanding the Aggregate Balance (AB) and easing local rates. Conversely, pressure toward 7.85 sees the HKMA buy HKD (sell USD), shrinking the AB and pushing rates up. These automatic stabilisers explain why liquidity (AB) and HIBOR are tightly linked to exchange-rate pressures.

Recent HKMA minutes summarised these dynamics in 2Q–3Q: equity-related demand pulled HKD firmer in April/May, the strong-side CU was triggered four times with the HKMA selling HK$129.4bn to the market, and the AB rose to about HK$174bn—which temporarily softened HIBOR before the August re-tightening.

Where does HKD Go from here?

US monetary policy: The Fed's path determines the USD side of the rate differential. If US policy eases faster than Hong Kong's base rate, the HKD carry headwind diminishes, reducing pressure toward 7.85. If the Fed stays tighter for longer, the incentive to fund in HKD can re-emerge.

Southbound flows durability: If mainland investors keep buying Hong Kong equities at scale, structural demand for HKD persists. Reuters and Bloomberg both flag the acceleration of southbound flows in 2024–2025. a supportive medium-term trend, though inherently market-dependent.

Local liquidity management: The AB and HIBOR will ebb and flow with HKMA operations as the CUs are tested. A smaller AB tends to lift HIBOR and tighten HKD funding, while a larger AB does the opposite. Monitoring the AB in daily HKMA data offers a timely read on liquidity direction.

Given the banded regime and the still-fluid backdrop for US rates and China-related risk sentiment, the most likely path is continued two-way trading inside 7.75–7.85. with the exchange rate leaning firmer when equity inflows pick up and softer when global USD strength or rate differentials widen. Bloomberg's coverage of the mid-August bounce underscores that the rally was flow- and rates-driven rather than a regime shift.

Practical watch-list for HKD observers

Daily Southbound net purchases (HKEX/press and financial wires) to gauge equity-led HKD demand.

HKMA Aggregate Balance and CU triggers, which foreshadow HIBOR moves.

HIBOR–SOFR gap, the cleanest proxy for carry pressures.

Macro headlines on the Fed and China growth, which shape global USD tone and Hong Kong risk appetite.

Conclusion

The August swing reminds us that HKD is not a free-floating currency but a conduit for capital-flow and rate-differential forces within a well-tested currency-board framework. The recent firming to ~7.79 came from a confluence of record Southbound inflows, firmer HIBOR, and positioning squeezes, not from a change in the peg. Looking ahead, unless there is a decisive, dovish turn from the Fed or a sustained, oversized wave of mainland equity demand, HKD is likely to range-trade within the 7.75–7.85 band, with short bursts toward the strong side when flows and funding align. For investors and treasurers, the message is clear: track flows, funding, and the HKMA's liquidity footprint—they remain the three pillars of HKD behaviour.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.