Have you ever wondered whether all the information you've gathered about a stock is already reflected in its price? Can an investor truly beat the market, or is it simply a matter of luck? The Efficient Market Hypothesis (EMH) challenges these questions by proposing that asset prices always fully reflect all available information. According to this theory, the market is so efficient that no investor can consistently outperform it by using any information that's already publicly known. This hypothesis not only reshapes the way we think about trading, but it also redefines how we approach investing altogether.

But if the market is truly efficient, what does that mean for your investment strategy? Should you abandon active research, or can you still find ways to beat the system? To answer these questions, we need to explore the three forms of EMH and understand how each one impacts the way investors navigate the market. By delving into these forms, we can uncover the true nature of market efficiency and its far-reaching implications for investment decisions.

Efficient Market Hypothesis' Basics

The Efficient Market Hypothesis was put forwarded by Eugene Fama, an American economist, in the 1960s. It's a theory that proposes financial markets are "efficient" in incorporating all available information into the prices of securities. According to the hypothesis, asset prices—whether for stocks, bonds, or other financial instruments—always reflect all relevant information. This suggests that the market operates in such a way that it is virtually impossible for any investor to consistently outperform it through expert analysis, stock-picking, or insider knowledge.

Simply put, the idea behind this hypothesis is that the market, in all its complexity, quickly absorbs and reflects new information, which ensures that prices always represent a true reflection of an asset's value at any given moment.

At first glance, this might seem at odds with the common strategies that many investors adopt, especially those who dedicate time to research and analysis. If the Efficient Market Hypothesis holds true, then why bother analysing the financials of a company or tracking market trends? After all, if all public and private information is already embedded in Stock Prices, then active trading or investment strategies based on individual research would be futile.

The core of EMH challenges this conventional approach, suggesting that no investor, not even the most knowledgeable or experienced, can consistently beat the market over time. This leads to the crucial question: if the market is truly efficient, does it make sense to pursue active investment strategies at all, or should investors embrace a more passive approach?

Efficient Market Hypothesis' Three Forms

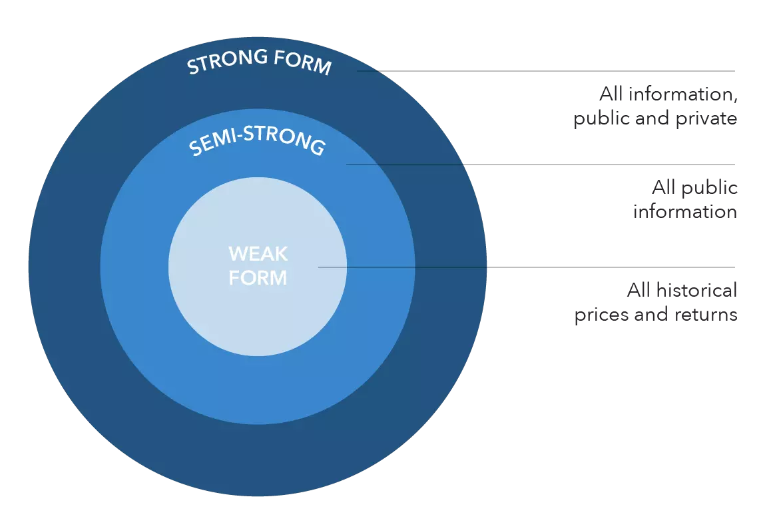

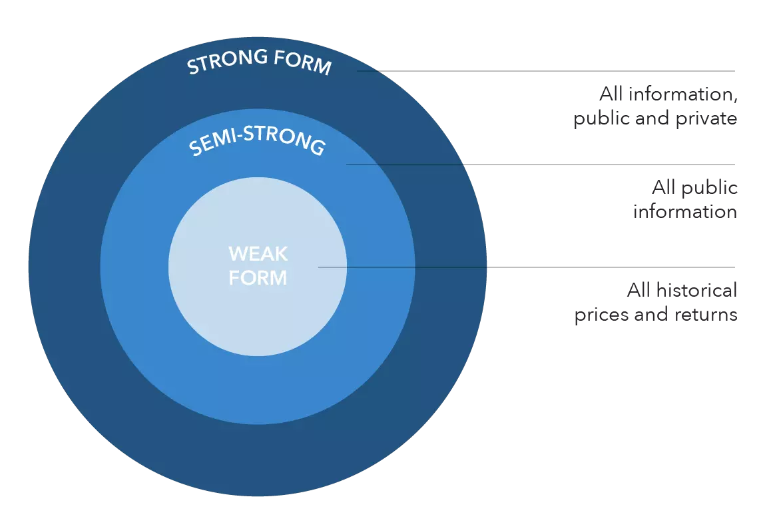

The Efficient Market Hypothesis is divided into three distinct forms: weak, semi-strong, and strong. Each form represents a different level of information efficiency, which in turn influences the type of investing strategy that might be most effective in that market environment. These three forms provide a framework for understanding how various types of information are reflected in asset prices, and they help investors assess the relative efficiency of the markets they are operating in.

The weak form of Efficient Market Hypothesis suggests that all past trading information—such as historical stock prices, trading volumes, and price movements—is already reflected in the current market price of a stock.

In other words, technical analysis, which relies on historical price data to forecast future price movements, would be ineffective since past market data cannot predict future prices. This form challenges the traditional belief that historical patterns or trends can provide an edge over the market, as the market already prices in all past information.

The semi-strong form of Efficient Market Hypothesis goes a step further. It posits that not only is all historical data reflected in stock prices, but also all publicly available information. This includes company financial reports, news releases, economic data, and even rumours circulating in the market.

According to this form, any new public information is immediately absorbed by the market, and as such, fundamental analysis, which involves evaluating company performance through financial statements and other public data, would not give an investor a consistent advantage. It implies that no matter how diligently an investor studies a company's fundamentals, the price of its stock will always adjust to reflect that information almost instantly.

Finally, the strong form of Efficient Market Hypothesis represents the most extreme version of market efficiency. This form asserts that all information, including both public and private (or insider) information, is fully reflected in stock prices.

Under this theory, even investors with access to non-public, privileged information would be unable to gain an advantage, as any such information would already be incorporated into the market price. This suggests that not only are markets highly efficient, but they are also immune to manipulation or Insider Trading, a view that has sparked considerable debate. While the strong form is controversial and far less widely accepted, it highlights the theoretical extremes to which the EMH can be taken, challenging the very notion of privileged market access.

Efficient Market Hypothesis' Implications for Investors and Investment Strategies

The implications of the Efficient Market Hypothesis for investors are profound and far-reaching. One of the key takeaways from EMH is the question of whether active or passive investment strategies are more appropriate in an efficient market. If markets truly reflect all available information in real time, the idea of consistently beating the market through stock picking or market timing becomes highly questionable.

Passive strategies, such as investing in index funds or exchange-traded funds (ETFs), have gained popularity as a result of EMH. By simply investing in a broad-market index that reflects the overall performance of the market, investors avoid the complexities and risks of trying to identify undervalued or overvalued stocks. Over time, this passive approach offers the potential to match market returns, often with lower costs and fewer risks compared to active investing.

For active investors, however, EMH presents a challenge. It suggests that trying to outperform the market through analysis or strategy is likely to be an inefficient use of resources, as all known information is already reflected in market prices. While some investors may argue that short-term market inefficiencies can still be exploited, such opportunities are thought to be rare and quickly corrected by the market. EMH advocates caution, pointing out that transaction costs, taxes, and fees associated with frequent trading can erode any potential gains that might be made from attempting to "beat" the market.

Nonetheless, the theory also invites investors to consider the concept of market anomalies—temporary inefficiencies that may arise due to factors such as investor sentiment, news events, or economic crises.

While EMH suggests that these inefficiencies are unlikely to last long, some active investors argue that there may still be opportunities for short-term profits if one is able to identify and capitalise on these fleeting discrepancies. However, even for those pursuing active strategies, EMH underscores the importance of understanding the market's natural tendency to correct itself and the limitations of trying to outsmart it.

In conclusion, whether an investor chooses to embrace active or passive investing, the Efficient Market Hypothesis offers a thought-provoking framework for understanding how information influences market prices. By acknowledging the market's inherent efficiency, investors can recalibrate their expectations and focus on long-term, diversified investment strategies rather than trying to predict short-term market movements. EMH encourages a shift away from the pursuit of individual stock picking, highlighting the value of understanding broader market trends and the inevitability of market efficiency in driving asset prices.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.