When it comes to understanding economic trends and the forces driving financial markets, one concept that often catches the attention of economists and investors alike is the M1 M2 scissors gap. While it may sound complex at first, this phenomenon is rooted in the basic definitions of money supply and provides valuable insights into the health of an economy. In simple terms, the M1 M2 scissors gap refers to the divergence between two key measures of the money supply: M1 and M2. But what does this gap really mean, and why does it matter?

The M1 M2 Scissors Gap's Definition

At its core, the M1 M2 scissors gap refers to the divergence between two key measures of the money supply: M1 and M2.

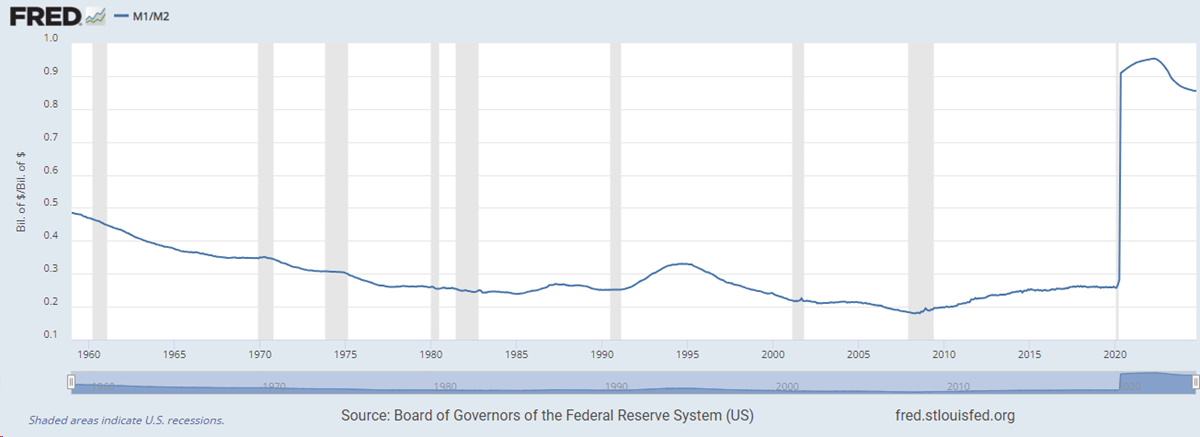

M1 represents the most liquid forms of money, which includes currency in circulation, demand deposits (like checking accounts), and other highly accessible forms of money.

M2. on the other hand, is a broader measure that includes everything in M1. plus less Liquid Assets such as savings accounts, time deposits, and money market securities.

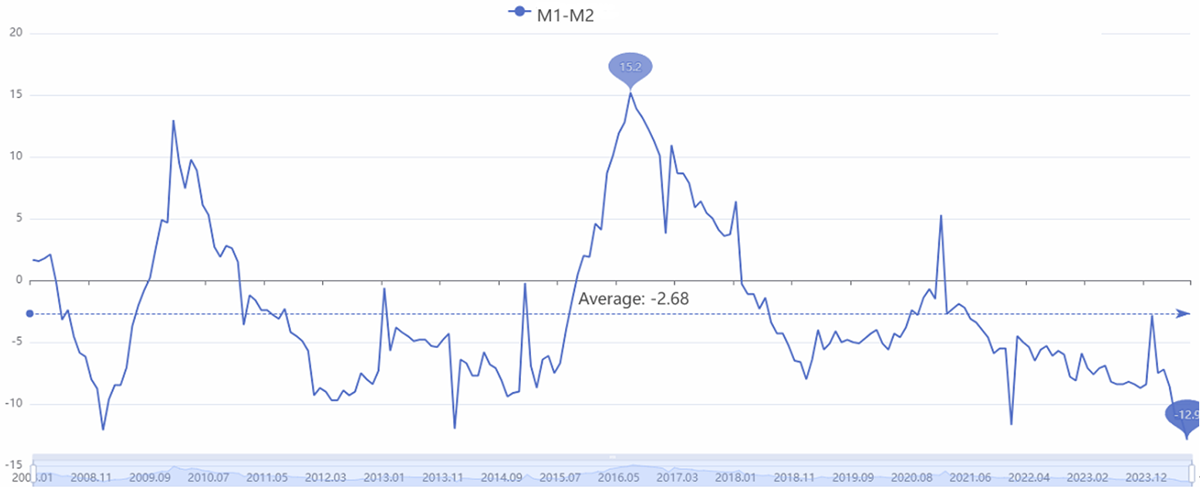

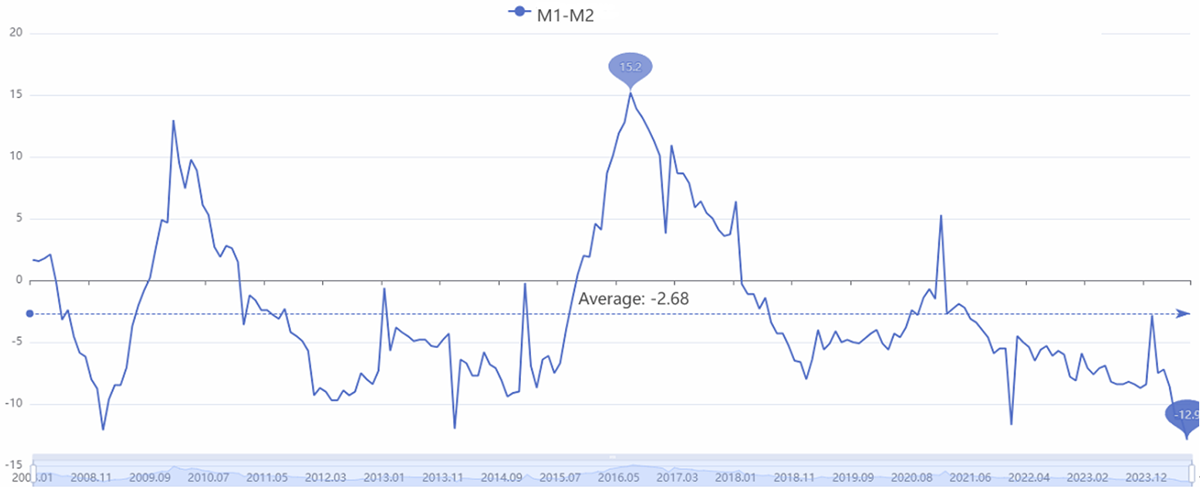

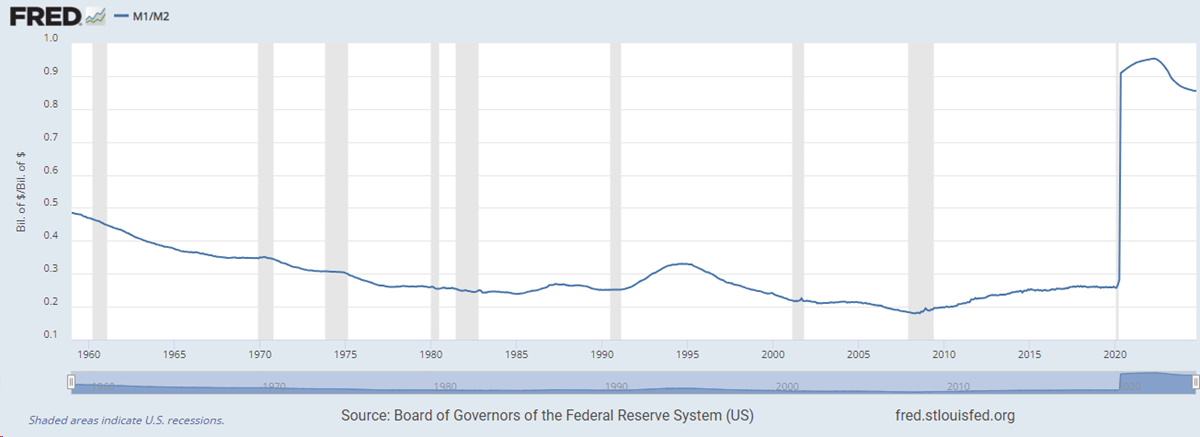

The scissors gap occurs when the growth rate of M1 significantly outpaces that of M2. This phenomenon highlights an important trend in the economy: more money is being moved into highly liquid forms (i.e., cash or money readily accessible for spending), while savings or investments (which form part of M2) are growing at a slower rate. In essence, people are holding onto more money, ready to spend or use it, but they are not saving or investing at the same pace.

This gap, therefore, offers a snapshot of the economic mood—are people feeling more inclined to spend, or are they hoarding their savings? And perhaps more importantly, what does this mean for inflation and economic stability?

The M1 M2 Scissors Gap's Implications for Inflation and Economic Growth

As we shift from the basic concept of the scissors gap to its practical implications, we begin to see its relevance in the broader economic context. The key takeaway here is that a widening M1 M2 gap often signals inflationary pressures.

When M1 grows rapidly compared to M2. it indicates that a larger portion of the money supply is circulating in the economy rather than being stored in savings. This typically happens when people have more disposable income or when confidence in the economy leads to higher consumer spending. In such scenarios, the risk is that too much money circulating can lead to an increase in demand for goods and services without a proportional increase in supply, which leads to demand-pull inflation. Simply put, too much money chasing too few goods.

This inflationary trend is especially pronounced when people start spending their money faster, creating upward pressure on prices. For example, during times of economic uncertainty or crisis, people may pull their savings out of banks and prefer cash on hand, pushing up the money supply in highly liquid forms. This trend can result in price inflation, making everyday goods and services more expensive, and eroding the purchasing power of currency.

On the flip side, if the M1 M2 gap narrows, it may signal a more cautious economic environment. A narrowing gap could suggest that consumers and businesses are holding onto their savings, potentially due to uncertainty or a shift towards more conservative spending and investment habits. This scenario can support economic growth over the long term, as people are saving and investing more, leading to capital formation and long-term stability.

Here, we can begin to see the immediate relationship between the gap and inflation or economic growth, setting the stage for understanding how these shifts play out in the financial markets.

The M1 M2 Scissors Gap's Impacts on Financial Markets

Now that we understand the broader economic implications of the M1 M2 scissors gap, let's explore how it influences the financial markets. After all, changes in the money supply affect not just inflation but also investor sentiment, asset prices, and market stability.

A widening M1 M2 gap often leads to increased market volatility. This happens because the expectation of inflation generally results in investors re-evaluating their strategies. For instance, when the gap widens significantly, the stock market may experience a dip as inflation fears grow. Investors, anticipating a rise in interest rates or a decrease in purchasing power, may shift their portfolios to safer assets like bonds or gold, which are traditionally seen as hedges against inflation.

Similarly, a widening gap can also have significant impacts on foreign exchange markets (forex). As more money is circulating in the economy, the value of a currency could weaken, as an oversupply of currency often leads to devaluation. For example, if the gap is growing in a particular country, the central bank might decide to raise interest rates to cool down inflation, which in turn can affect the strength of the national currency in global markets.

On the other hand, a narrowing gap could signal a more stable economic outlook. In this case, the markets may become more confident, driving interest in growth stocks and possibly spurring investor optimism. This would likely be reflected in increased capital investment in the economy, which can fuel corporate profits, creating a cycle of positive economic feedback.

The dynamics between the M1 M2 gap and financial markets clearly show how this seemingly simple indicator has far-reaching consequences across various asset classes. Financial professionals and investors keep a close eye on these trends, as the right strategies depend heavily on reading the signals given by changes in the money supply.

The M1 M2 Scissors Gap's Key Sources and Data Analysis

To fully understand the M1 M2 scissors gap and its impact on the economy, it's crucial to track it accurately. Thankfully, there are several key sources that help monitor and measure changes in the money supply.

Central banks, such as the Bank of England or the Federal Reserve, provide regular reports and statistics on M1 and M2. These reports give economists and market participants a clear view of how the money supply is evolving. For example, the Federal Reserve releases data on M1 and M2 growth each month, providing an up-to-date snapshot of liquidity trends in the U.S. economy. Similarly, the Bank of England publishes quarterly reports on money supply and other related financial statistics.

Alongside these official sources, economic think tanks and financial research firms also analyse the data to offer expert insights. Publications from institutions such as the National Bureau of Economic Research (NBER) often provide detailed studies on the implications of changes in the money supply, including the M1 M2 gap. By examining these reports, you can gain a deeper understanding of how changes in the gap could signal shifts in the economy.

Moreover, financial analysts and economic experts frequently share their assessments in industry reports or on financial news platforms, providing market forecasts and guidance on how to interpret shifts in the M1 and M2 data.

This wealth of information from trusted sources helps ensure that decisions, whether made by policymakers or investors, are based on accurate and up-to-date data, reducing the risk of misinterpreting economic signals.

In conclusion, the M1 M2 scissors gap is a vital tool for economists and investors alike, offering valuable insights into liquidity trends, inflationary risks, and overall economic health. Whether you're monitoring it to predict inflation or adjusting investment strategies based on market conditions, understanding the nuances of this gap can provide you with a clearer picture of the economic landscape. Keeping an eye on central bank reports and expert analyses will ensure you stay ahead of the curve, allowing you to make well-informed decisions that respond to the shifting tides of the financial markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.