When the stock market tumbles and stocks hit a sharp decline, traders are often confronted with the term "limit down." This mechanism, designed to halt trading temporarily, is intended to curb panic and prevent excessive losses. But what does it mean for investors trying to navigate the situation? Should you sell quickly to avoid further losses, or is it the perfect time to buy, hoping for a rebound?

In this article, we'll break down the concept of limit down, explore how it affects stock selling, and examine whether it's ever a smart move to buy stocks when they hit that threshold. Whether you're looking to protect your portfolio or seize potential opportunities, understanding the dynamics of this mechanism is essential for making well-informed decisions in volatile market conditions.

Limit Down's Definition

In the stock market, the term "limit down" refers to a situation where the price of a stock or other traded asset falls to the maximum allowable drop set by the exchange within a single trading day. Once this threshold is hit, the price is effectively frozen, and no further declines are permitted. It also means no further trading can take place, whether buying or selling. On most exchange platforms, it's typically marked by a green light to alert traders quickly.

For example, let's say a stock closes at £100 on the previous day. If the price falls by 10% to £90 the following day, the limit down rule would kick in. At this point, the stock cannot fall below £90. no matter how many sell orders are placed at a lower price. The exchange simply won't allow it.

This mechanism is mainly applied to regular stocks in order to prevent excessive volatility in the market. However, there are exceptions. For certain types of stocks—such as newly listed companies on the growth boards or in emerging markets—this mechanism is often waived for the first few days of trading. This is designed to help the market more rapidly assess the true value of these stocks, while also easing the new company's transition into the market.

Moreover, some financial products, like overseas exchange-traded funds (ETFs), are not subject to this limit down restriction. The reason behind this exception is to ensure higher market liquidity, allowing investors to trade more flexibly, especially in the early stages. By not imposing such limits, these financial instruments can more accurately reflect the supply and demand in the market, facilitating better trading conditions for global investors in a variety of market environments.

In general, limit down is often triggered by negative news or mass sell-offs from investors, reflecting a broader sense of pessimism in the market. When investors become concerned about a particular stock or the overall economy, negative sentiment can quickly spread, causing Stock Prices to drop sharply within a short period and hit the exchange's lower price limit.

This phenomenon not only highlights the market's immediate reaction to specific events or economic conditions but also reveals a deep-seated anxiety about future prospects. The limit down mechanism is designed to curb excessive price swings and prevent more severe panic in the market.

By setting a maximum threshold for price declines, this mechanism effectively helps to prevent drastic market fluctuations caused by panic selling or unexpected bad news. It plays a key role in stabilising market sentiment and reducing the risk of irrational decisions driven by fear, thereby safeguarding the market's overall health and long-term stability.

At the same time, the limit down rule promotes fairness and stability in the market. By imposing restrictions on price movements, it limits the potential for market manipulation, such as large-scale trades or other tactics used to artificially inflate or deflate stock prices. This helps prevent abnormal price fluctuations and protects ordinary investors from potential market manipulation.

This mechanism not only helps to reduce extreme price fluctuations, preventing market panic and speculative behaviour, but it also enhances the overall stability of the market. By ensuring that prices more accurately reflect a company's fundamentals and the supply and demand dynamics, it maintains fairness and transparency in the market.

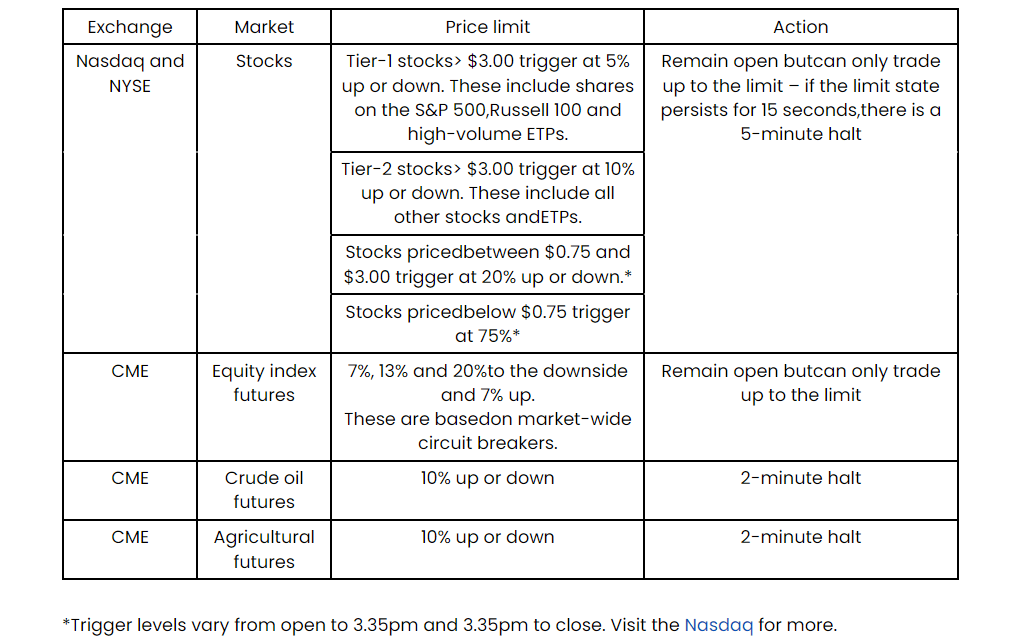

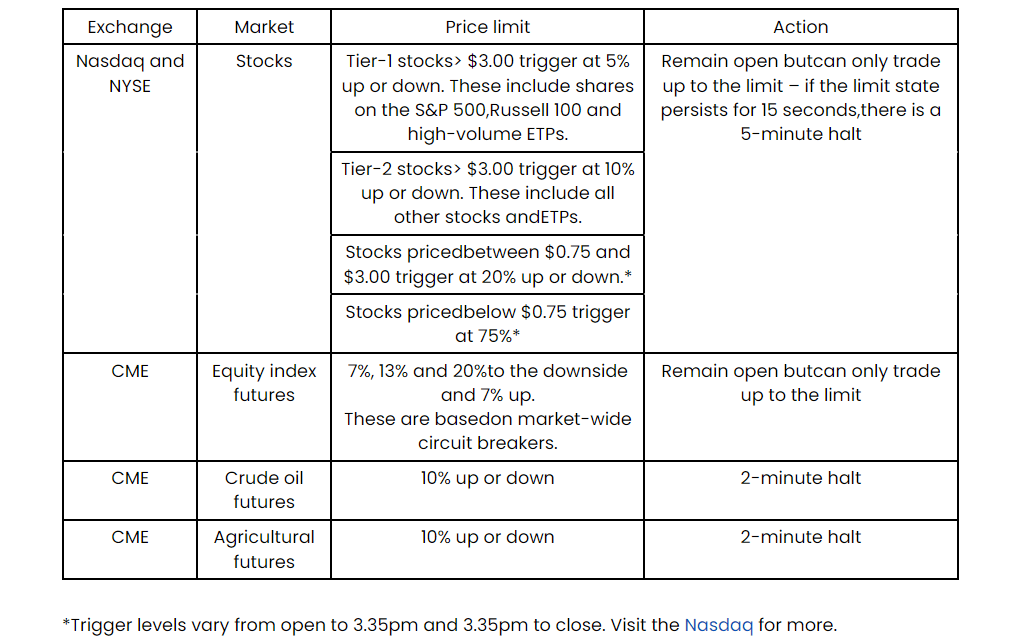

In summary, the limit down rule serves as an effective regulatory tool. By limiting sharp price movements, it helps to steady market sentiment and mitigate the risks posed by sudden price changes. However, it's important to note that stock exchange regulations vary from country to country, so investors must familiarise themselves with local trading rules when participating in foreign markets.

Limit Down's Effect on Selling Stocks

When a stock hits the limit down threshold, many investors often rush to sell, driven by pessimistic market sentiment. At this point, there's typically a lot of selling pressure, as investors fear further declines and are eager to offload their holdings. However, selling at this price level isn't always straightforward. There are usually a large number of sell orders queued up, while buy orders are relatively sparse. As a result, despite the strong desire to sell, actual transactions can be quite limited.

If you want to sell a stock during this period, it's generally advisable to place your order before the market opens. This is because the stock exchange operates on a "price priority, time priority" system. When sell orders are priced the same, the order's time of placement becomes crucial. The earlier you place your order, the higher the chance it will be executed.

At critical moments, such as when a stock is near its limit down, using a market order can increase your chances of execution. Market orders typically get priority over other types of orders, meaning they are more likely to be filled quickly when the stock hits the set limit price. This can help reduce the time you wait and increase the likelihood of your trade being executed.

A market order will execute at the best available price in the market at that moment—often the limit down price in such situations. Moreover, using a market order can help reduce the risk of slippage (the difference between the expected and actual execution price). However, because the price is locked during a trading halt, slippage is typically not a concern here.

During rapid price fluctuations, market orders can provide more precise opportunities to enter or exit the market close to the target price, minimising potential losses due to volatile price movements. In this way, investors can act faster and more effectively, optimising their trading outcomes.

When buy orders start to accumulate at the price floor, the chances of selling increase. A significant number of buy orders can help push the price back up or absorb the selling pressure, thus altering the market's supply and demand dynamics. Therefore, investors should closely monitor the order book, paying attention to the strength and duration of buy orders. By placing a sell order when the price starts to reverse, investors can seize favourable selling opportunities, either to lock in profits or minimise losses as market sentiment improves.

For those holding a larger quantity of shares, selling in smaller batches can be an effective strategy. This method increases the likelihood of at least some of the stocks being sold, especially in volatile or low-confidence markets. By breaking up the holdings into smaller sell orders, investors can avoid the market being overwhelmed by a large single sell order, while also increasing the chances of completing transactions. Additionally, this approach allows investors to sell gradually as the market picks up, helping to optimise the timing and price of the exit.

At times, market sentiment may shift during the trading day, leading to a rebound. In such cases, the price cap might be lifted, giving the stock price an opportunity to rise again. Investors can take advantage of this by selling at a slightly higher price after the market rebounds. Therefore, staying alert to market movements and seizing any rebound opportunities, while being patient for the right selling moment, is crucial to reducing losses and securing better prices.

In summary, selling stocks during a price floor scenario is a challenging task, particularly when market sentiment is deeply pessimistic. To increase the likelihood of a successful sale, investors need to make quick decisions, act promptly, and employ effective trading strategies. Methods such as breaking up sell orders, keeping an eye on the order book, and using test orders can significantly improve the chances of completing a transaction, thereby minimising losses and achieving a reasonable selling price in such situations.

When buy orders start to accumulate at the limit down level, the chances of selling increase. A significant number of buy orders can help push the price back up or absorb the selling pressure, thus altering the market's supply and demand dynamics. Therefore, investors should closely monitor the order book, paying attention to the strength and duration of buy orders. By placing a sell order when the price starts to reverse, investors can seize favourable selling opportunities, either to lock in profits or minimise losses as market sentiment improves.

For those holding a larger quantity of shares, selling in smaller batches can be an effective strategy. This method increases the likelihood of at least some of the stocks being sold, especially in volatile or low-confidence markets. By breaking up the holdings into smaller sell orders, investors can avoid the market being overwhelmed by a large single sell order, while also increasing the chances of completing transactions. Additionally, this approach allows investors to sell gradually as the market picks up, helping to optimise the timing and price of the exit.

At times, market sentiment may shift during the trading day, leading to a rebound. In such cases, the limit down restriction might be lifted, giving the stock price an opportunity to rise again. Investors can take advantage of this by selling at a slightly higher price after the market rebounds. Therefore, staying alert to market movements and seizing any rebound opportunities, while being patient for the right selling moment, is crucial to reducing losses and securing better prices.

In summary, selling stocks during a limit down scenario is a challenging task, particularly when market sentiment is deeply pessimistic. To increase the likelihood of a successful sale, investors need to make quick decisions, act promptly, and employ effective trading strategies. Methods such as breaking up sell orders, keeping an eye on the order book, and using test orders can significantly improve the chances of completing a transaction, thereby minimising losses and achieving a reasonable selling price in such situations.

Limit down's impact on a stock: Is it worth buying

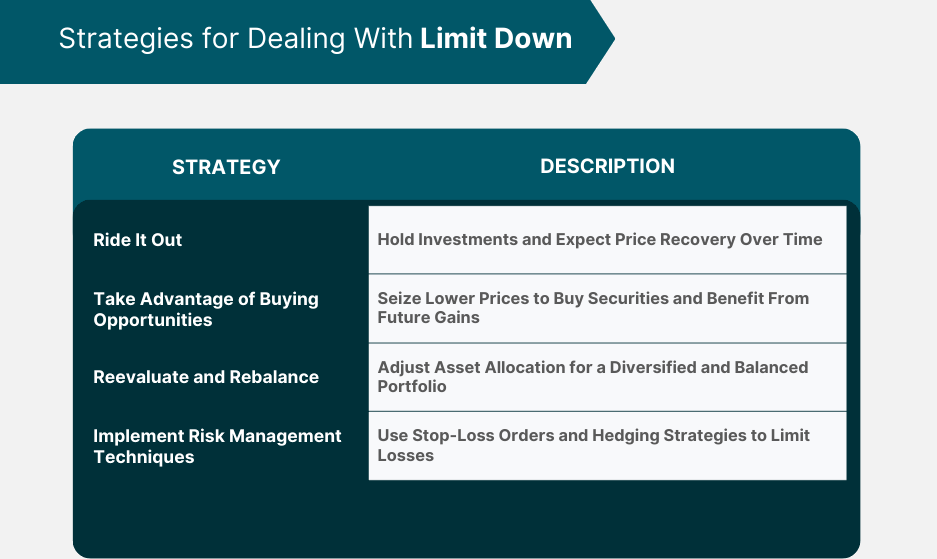

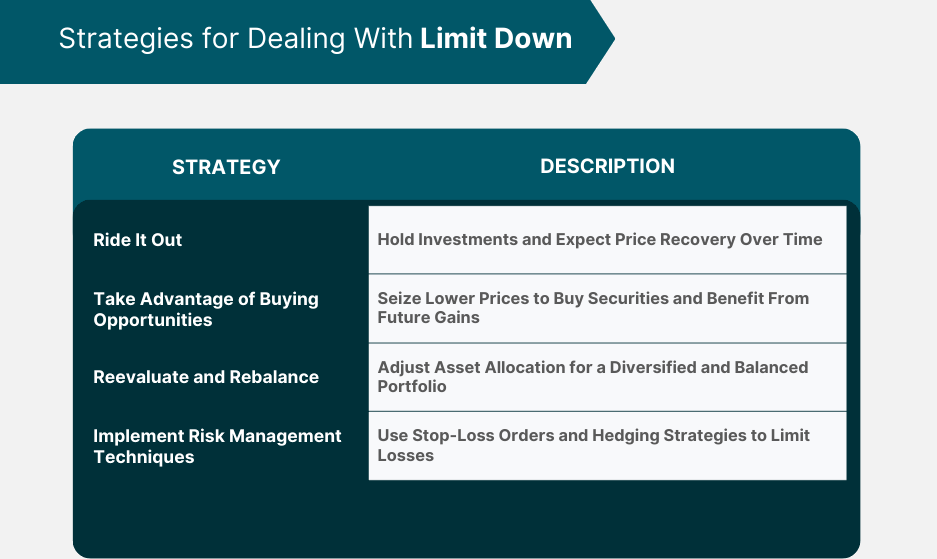

When a stock hits its limit down level, most investors typically opt to sell, fearing further losses. However, some see this as an opportunity to buy, even attempting to catch the bottom of the market. While these investors tend to be more cautious, mindful of the potential for the price to continue falling, they also believe that such situations often hide significant opportunities—if one understands the underlying reasons behind the decline, profits can be made.

The investors who are most likely to take this approach are long-term investors. They focus on the fundamentals of a company rather than being swayed by short-term price fluctuations. For them, the investment value of a stock largely depends on the company's ability to generate sustainable profits. While the market may be driven by emotional ups and downs, it is the company's long-term performance and earnings potential that ultimately determine its stock price trajectory.

Therefore, when considering whether to buy a stock at its limit down level, the key factor is the relationship between the company's earnings and the stock price. If the company has shown consistent profitability, a sharp drop in the stock price could present a chance to buy at a discount. In this case, the price decline might simply reflect market sentiment rather than any fundamental weakness in the business.

If the broader market is down but the specific company's fundamentals remain strong, the price drop may just be a result of overall market conditions. In such cases, there could be an opportunity to buy into a solid stock at a lower price. However, if the company's earnings are clearly deteriorating and the stock continues to decline without showing signs of recovery, investors may be facing the risk of "catching a falling knife"—a situation where further losses are likely as the stock continues to slide.

In summary, buying stocks at limit down levels can present a tempting opportunity, but it's essential to look beyond the immediate panic. A focus on long-term fundamentals, such as consistent earnings growth, can help investors determine whether the price decline is temporary or indicative of deeper issues. While it's crucial to exercise caution, for those with a long-term investment outlook, these situations may offer valuable entry points.

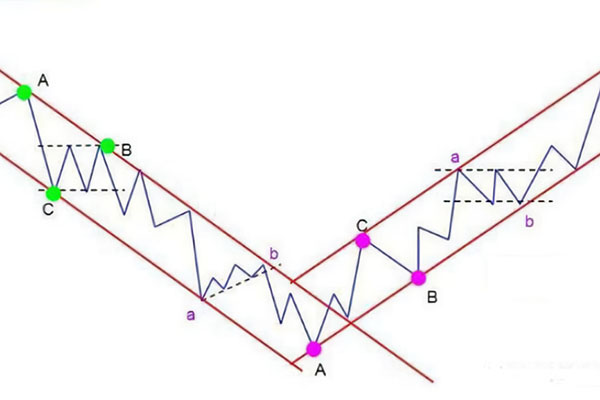

The ideal situation would be if this occurs after a prolonged decline, as it often signals extreme market panic and selling pressure. However, it's particularly worth noting if it happens after consecutive limit downs. In such cases, it could reflect an intensification of market sentiment, potentially laying the groundwork for a rebound.

Technical support levels, derived from past price movements and technical analysis, are key thresholds that are typically difficult to breach. When a stock hits its limit down, if the price approaches a technical support level and touches it without significantly breaking below the line, this often indicates that the stock might rebound within this price range.

In such instances, investors might consider short-term trading strategies, aiming to profit from a potential bounce near the support level. This approach allows for quick profit-taking during a price rebound. However, to minimise risk, it's crucial for investors to closely monitor market trends and technical indicators to ensure the support level is solid and reliable.

If the stock price fluctuates around this level and doesn't fully hit the price floor, it typically indicates that buying and selling forces are relatively balanced. However, if the stock price repeatedly touches or falls below the limit down threshold, and the trading volume significantly increases, it could signal some buying pressure that is countering the selling pressure. This might suggest a shift in market sentiment, and investors should pay close attention to the buying strength to determine whether a rebound or a market bottom could be on the horizon.

This could imply that market concerns over the stock are gradually easing, and buying activity is starting to pick up. Trading within this range might present opportunities, but if market sentiment remains fearful, compounded by negative news, the risks could still be considerable. Therefore, investors need to carefully assess the market mood and associated risks before making any decisions.

It's important to note that buying stocks at this point comes with a high level of risk. If you decide to enter, it's advisable to do so with a small position to mitigate the potential downside. Once you've bought, it's crucial to monitor the market closely and set stop-loss orders to limit potential losses if the stock continues to fall. If the stock hits another limit down or continues to perform poorly the following day, you should be prepared to cut your losses swiftly.

Occasionally, there may be a short-term rebound opportunity. If the stock price shows a noticeable recovery before the close, it could indicate an improvement in market sentiment, with buying interest strengthening. In such a case, investors may want to consider taking profits and seizing the rebound opportunity.

By selling early in the rebound phase, investors can effectively capitalise on short-term market fluctuations and reduce the risks of holding onto a stock at its limit down. This strategy not only helps lock in profits during a market recovery but also mitigates potential losses in uncertain market conditions, ultimately enhancing overall investment returns.

Additionally, purchasing stocks during such times typically comes with heightened risks, making risk management all the more crucial. For beginners or those with a lower tolerance for risk, it's advisable to steer clear of such trades to avoid unnecessary losses. If you're unfamiliar with this type of strategy, practising with simulated trading can be a valuable way to build experience and get a feel for the process. Once you've gained sufficient understanding and confidence, you can move on to real trading, which will help mitigate risks when the stakes are higher.

In conclusion, identifying investment opportunities following a limit down requires careful analysis of factors like the stock's position, price movement, and the broader market environment. By understanding these key elements, investors are better equipped to spot potential opportunities in the market. A deeper examination of the underlying causes and subsequent trends can help pinpoint the best entry points, ultimately maximising potential returns.

Limit Down's Definition and Trading Strategies

| Category |

Meaning |

| Definition |

Stock price hits the maximum daily drop limit set by the exchange. |

| Trigger Conditions |

Price decline reaches the exchange's set limit. |

| Selling Strategy |

Pre-set orders, monitor trends, use market orders. |

| Buying Strategy |

Assess fundamentals, support levels, and market sentiment. |

| Risk Control |

Watch for rebounds, set stop-losses, minimise losses. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.