When it comes to building a diversified and stable investment portfolio, bank stocks often emerge as an attractive option. Offering the potential for consistent dividends and steady capital growth, they appeal to long-term investors seeking reliable income streams and a share in the profitability of the banking sector.

However, as with any investment, bank stocks come with their own set of risks—economic conditions, interest rate changes, and regulatory challenges can all have a significant impact on their performance.

In this article, we'll delve into the various factors that make bank stocks an appealing long-term investment, as well as the risks that investors should be aware of before diving in. Whether you're new to investing or looking to expand your portfolio, understanding the intricacies of such stocks will help you make informed decisions.

Bank Stocks' Definition

Bank stocks refer to the shares of companies in the banking industry that are listed on the stock market. These entities are primarily engaged in financial services, including but not limited to deposits, loans, investment banking, credit card services, and asset management. They are often seen as a barometer of the economy, with their performance and share prices being influenced by macroeconomic factors.

They are a major investment class in the financial market, allowing investors to share in the sector's profitability and growth. Some banks are known for their dividend policies, distributing a portion of their profits to shareholders. Additionally, some may implement share buyback programs to boost share prices.

In essence, investing in such stocks can yield profits from two fronts: dividends and capital gains. For those interested in dividends, the dividend yield is crucial, with higher yields being more desirable. However, it's important to consider whether the share price will also grow. Generally, bank stocks have lower price growth rates. For higher profit from dividends, one must consider the quality of the bank.

If investors are the dividend income from bank stocks, it's important to understand how a bank generates its profits. These profits primarily come from lending to customers, managing deposits, making investments, and offering other financial services. To assess a bank's profitability, three key metrics are commonly used: Net Interest Margin (NIM), Return on Equity (ROE), and Return on Assets (ROA). These indicators provide insight into how efficiently the bank is operating and generating returns for its shareholders.

NIM is a core business metric for banks, representing the difference between the net interest income from loans and investments and the interest paid on deposits. A higher NIM is generally a positive indicator of a bank's profitability, though it can be influenced by market interest rates, economic conditions, and financial management.

ROE measures a bank's ability to create value for shareholders by comparing net profits to shareholder equity. For banks, ROE is often affected by capital structure and the cost of liabilities. ROA measures the efficiency of a bank in using its total assets by comparing net profits to total assets. A higher ROA indicates a bank's ability to generate profits from its operations effectively.

ROE focuses on shareholder equity, while ROA focuses on total assets. If ROE is high but ROA is low, it could suggest that the bank is not fully utilising all of its resources. Banks typically generate profits through lending and investing, so their capital structure and cost of liabilities can impact these metrics. Investors should compare these ratios with other banks in the industry to assess performance and determine a bank's strengths or weaknesses in profit and asset utilisation.

Bank Stocks: Dividend Yield Rankings

| Company |

Dividend Yield |

Country |

| LT Group |

15.35% |

Philippines |

| Banco Bradesco |

14.74% |

Mexico |

| Bancolombia |

12.24% |

Colombia |

| Banco do Brasil |

11.19% |

Brazil |

| BNK Financial Group |

10.63% |

South Korea |

| Chongqing Rural Community |

10.54% |

China |

| CITIC Bank |

10.14% |

China |

| China State Construction Engineering |

9.96% |

China |

| Woori Financial Group |

9.74% |

South Korea |

| Regional Securities Ltd. |

9.71% |

Mexico |

| Moneta Money Bank |

9.66% |

Czech Republic |

| ING Bank |

9.49% |

Netherlands |

| Bank of China |

9.38% |

China |

| Banco de Chile |

9.23% |

Chile |

| Industrial and Commercial Bank of China |

9.15% |

China |

| China Minsheng Banking Corp. |

9.13% |

China |

| Communications System |

9.08% |

China |

| Everbright Bank |

9.04% |

China |

| Agricultural Credit Bank |

9.01% |

France |

| Agricultural Bank of China |

8.96% |

China |

| Korea Industrial Complex |

8.92% |

South Korea |

| Commercial Bank |

8.70% |

Czech Republic |

| DGB Financial Group |

8.67% |

South Korea |

| Santander Bank |

8.04% |

Brazil |

| Nordea Bank |

7.91% |

Finland |

Bank Stocks' Dividends

Dividends are a form of return on stock investments. When purchasing shares, it's important to consider the bank's dividend yield, which is the ratio of the annual dividend to the stock price. For investors seeking steady income, a higher dividend yield from bank stocks can be appealing. However, it's crucial not to focus solely on dividends but also to evaluate other essential factors such as the company's fundamentals, financial health, and potential for future growth.

Once you've purchased bank stocks and want to receive dividends, you need to make sure you hold the shares until the ex-dividend date, and be aware of the dividend policy and important dates. Dividend policies vary by company, with different banks and publicly listed firms setting their own criteria. The length of time you need to hold the shares to qualify for dividends is typically outlined in the bank's specific dividend policy.

Banks usually set an ex-dividend date or a record date, and only those who own the stock before this date are eligible for dividends. Therefore, it's essential to purchase and hold the shares ahead of the record date. Once you meet this requirement, you will be entitled to receive the dividend.

The bank will then pay the dividend to eligible shareholders within a certain period after the ex-dividend date. Some banks even offer shareholders the option to receive their dividends in cash or as additional shares, so you can choose based on your preferences. It's also important to note that some companies may pay dividends multiple times over the course of the year, not just once.

After the ex-dividend date, there's a payment date when the dividend will be paid directly to eligible shareholders. The entire process — including the ex-dividend date, record date, and payment date — is known as the dividend cycle. These dates are typically provided in financial reports, dividend policy documents, or official announcements, so it's important to stay informed and take the necessary steps in a timely manner.

Following the dividend payout, the bank's stock price may adjust, as investors often sell their shares once they've received the dividend, or because market expectations about the company's future performance shift. In such cases, it's important for investors to carefully consider these price changes and assess their investment goals and strategies in order to better align with their long-term objectives.

Dividends also come with tax considerations. For example, if the shares are held for less than a year, a 10% income tax applies; if held for less than a month, the tax rate increases to 20%. Additionally, after the dividend payment, the bank may announce future plans, such as further dividends or share buybacks. This information is critical for investors to make informed decisions, taking into account their investment goals, risk tolerance, and the prevailing market conditions.

Bank Stocks' Price Drop

The drop in bank Stock Prices can be influenced by a range of factors, from internal company issues to broader economic and market conditions. A bank's profitability is largely reliant on net interest income — the difference between the interest earned on loans and the interest paid on deposits. When interest rates fall, banks may struggle to maintain strong net interest income, which can lead to a decrease in their stock prices.

The banking sector is often closely tied to economic cycles. During periods of economic slowdown or recession, the risk of loan defaults tends to rise, and both businesses and consumers may reduce their demand for credit. This can negatively affect the bank's profitability. If a bank holds a large volume of non-performing loans or faces a higher risk of defaults during a downturn, investors may become concerned about the bank's asset quality, causing its stock price to fall.

With the rapid growth of technology and the rise of digital banking, traditional banks are facing increased competition from FinTech companies. These new entrants into the financial services sector could threaten the established profit models of traditional banks. Additionally, the banking industry is heavily regulated, and any changes in government policy or regulatory measures can significantly affect a bank's operations, leading to investor concerns.

Macroeconomic indicators such as employment rates, inflation, and GDP growth also impact the performance of bank stocks. Changes in overall market sentiment can further influence bank stock prices. If investors are pessimistic about the economic outlook or the future of financial markets, they may pull back from investing in bank stocks. As such, investors should carefully consider these factors when making investment decisions, ensuring a well-rounded assessment of both risks and opportunities.

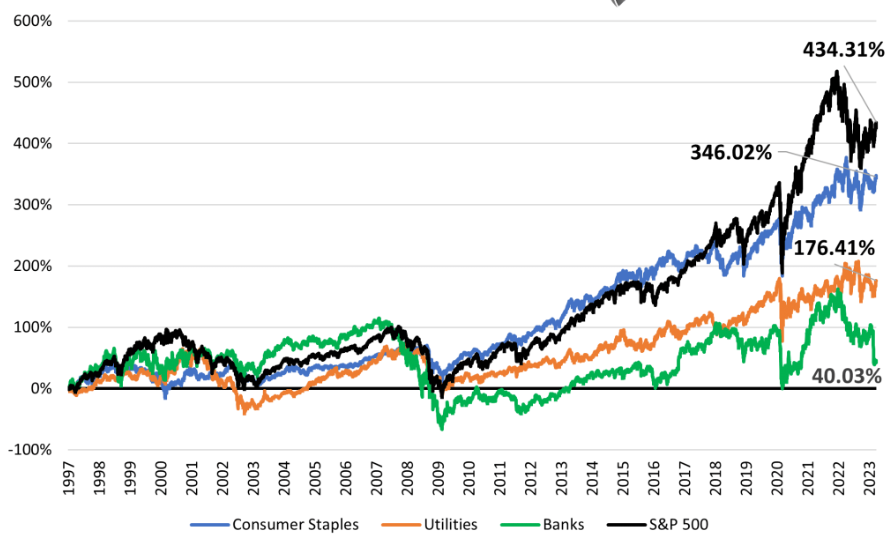

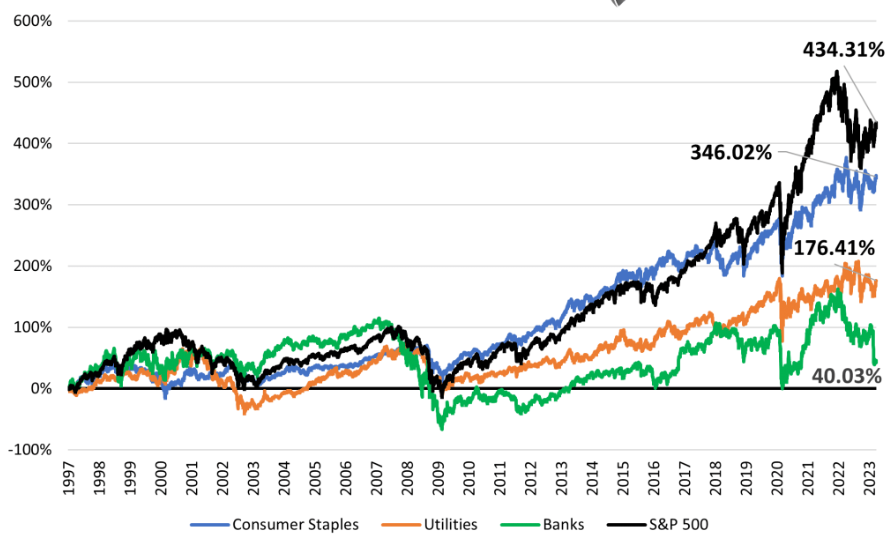

Bank Stocks' Potential for Long-Term Investment

When assessing whether bank stocks are a good option for long-term investment, several key factors should be taken into account. The performance of the banking sector is closely tied to overall economic growth, meaning that if investors are confident about the economy's future, they may decide to retain such stocks for sustained returns. Some of these stocks provide consistent and reliable dividends, which makes them especially attractive to investors looking for both capital appreciation and regular income.

Many banks maintain a reliable dividend policy, providing investors with a steady cash return. These dividends can help provide consistent cash flow, especially during times of market volatility. If an investor identifies a bank with solid financial health, stable profitability, and robust risk management practices, it may be an attractive option for long-term investment.

However, it's important to remember that the banking sector is not without its risks. Interest rate fluctuations can impact bank profitability significantly. A rise in interest rates can boost lending and investment profits, but a decrease may put pressure on a bank's earnings. Additionally, the banking industry is subject to extensive regulation, meaning that any changes in the regulatory landscape can have a profound effect on bank operations. Investors should keep a close eye on these regulatory changes when considering investments in this sector.

The banking sector is also vulnerable to macroeconomic conditions and market volatility. If an investor expects uncertainty and instability in the market, they should approach bank stock investments with caution.

For those interested in investing in bank stocks, understanding the fundamentals of the specific banks and their business models is essential. Effective risk management strategies are also crucial. Diversifying your portfolio across various sectors and asset classes will help mitigate overall investment risks. Regularly reviewing your portfolio and adjusting based on market conditions and personal circumstances is also important.

In summary, while bank stocks can certainly form part of a long-term investment strategy, investors must be mindful of the risks involved. A clear understanding of the sector's dynamics, combined with a careful assessment of personal financial goals and risk tolerance, is key to making informed and successful investment decisions.

Bank Stocks: Top Quality in India

| Company |

CMP (INR) |

Market Capitalisation (INR) |

| SBI (State Bank of India) |

574.05 |

512,317,000,000 |

| IDFC Bank |

916.75 |

638,593,000,000 |

| HDFC Bank |

1,520.70 |

846,548,000,000 |

| Bank of Baroda |

141.6 |

73,226,000,000 |

| Industrial Bank of India (IBI) |

1,264.10 |

97,996,000,000 |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.