The US economy, often hailed as one of the largest and most dynamic in the world, has a history marked by innovation, adaptation, and global influence. Over the past two centuries, it has evolved from a primarily agrarian economy into an industrial powerhouse, and more recently, into a leading force in technology and services. The US has not only been a model for economic growth but has also set trends that have shaped global economic practices and institutions.

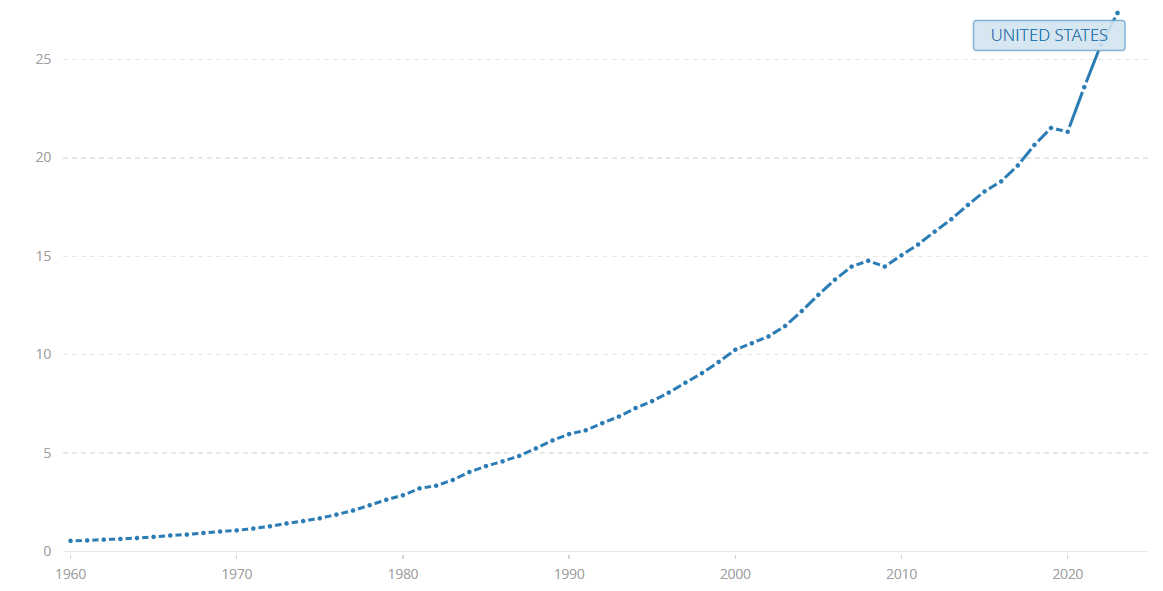

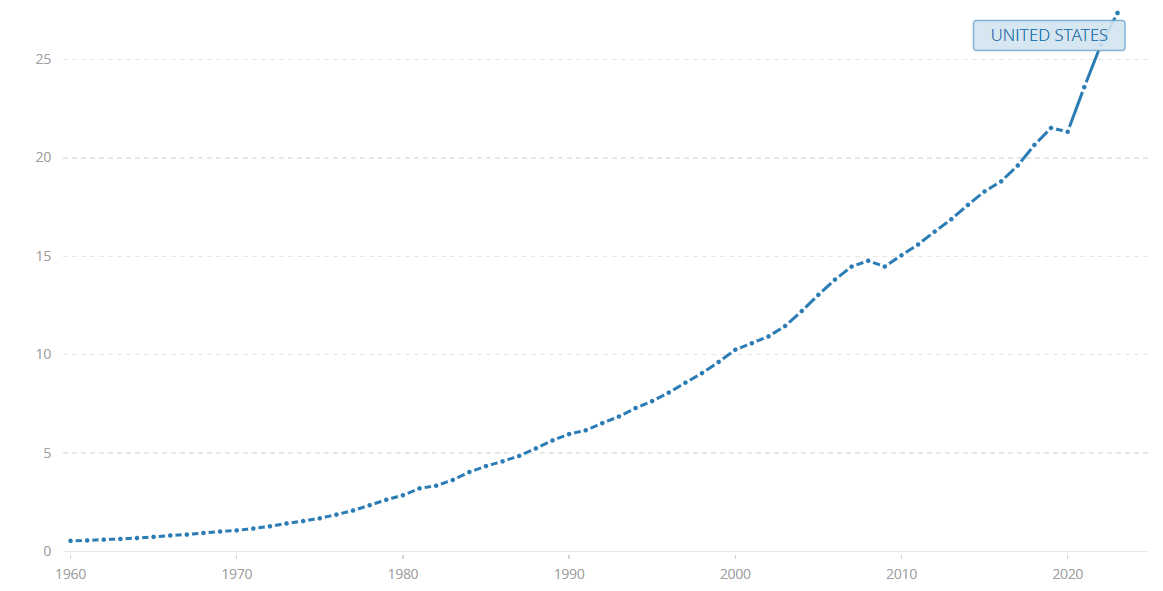

As of 2024. the US economy continues to wield significant influence in global markets, with a GDP that accounts for a substantial portion of the world's total output, bolstered by a diverse economy encompassing everything from technology and finance to manufacturing and agriculture.

In this article, we'll take a closer look at the history, key industries, and current state of the US economy. From its early growth after independence to its status as a global leader today, we'll explore the sectors that drive its economic strength and the challenges it faces in the modern landscape.

US Economy's Historical Background

In 1783. the United States emerged victorious in the Revolutionary War, gaining independence from Britain and marking the beginning of a new chapter in its economic development. Though the early years of independence saw the US economy in its infancy, the country quickly found its footing thanks to its rich natural resources and expanding markets. By harnessing its vast lands and mineral wealth, America laid the foundation for an economy full of potential.

By the mid-19th century, particularly after the Civil War ended in 1865. the US economy underwent a significant transformation. The post-war reconstruction period marked a shift from an agrarian economy to one driven by industrialisation. The rapid rise of factories and railroads spurred industrial productivity and accelerated urbanisation, helping the US evolve into a modern, industrialised economy led by cities.

In 1913. the US financial system reached a key milestone with the establishment of the Federal Reserve. This event marked the formal maturation of the country's financial system. The creation of the Federal Reserve System (Fed) provided stability through sound monetary policies, improved financial oversight, and enhanced the economy's ability to weather economic fluctuations. This solid foundation enabled the US to take its place as a major player on the global economic stage.

Although early 20th-century predictions suggested that powers such as the UK, Russia, the US, and Germany would dominate the global power structure, the World Wars and the wave of globalisation altered this landscape. Both World Wars and the subsequent shifts in global power allowed the US to rapidly rise from a major industrial nation to the world's economic hub. With its formidable economic strength, technological innovation, and financial infrastructure, the US soon became the leader of the global economy, influencing both global financial systems and political dynamics.

The First World War, which broke out in 1914. saw the US initially adopt a neutral stance until 1917. when it officially entered the conflict. After the war, the US adopted an isolationist policy, limiting its involvement in international affairs and causing international trade's share of GDP to fall to its lowest point in history. This policy reflected the country's focus on domestic issues and a relative detachment from global matters. However, this isolationism was short-lived, as the shifting global landscape and the onset of the Second World War forced the US to reassess its international strategy.

The Second World War fundamentally reshaped the global economic and political order. During the conflict, the US demonstrated exceptional manufacturing capability, becoming a crucial support to the Allies. After the war, the US quickly displaced the UK as the world's dominant superpower, and the dollar replaced the pound as the primary global currency. This era marked the establishment of the US's leadership in the global economic system and the reshaping of international financial structures.

In 1944. the Bretton Woods system was established, tying the dollar to gold and positioning it as the principal international currency, with other currencies pegged to the dollar. This arrangement placed the dollar at the heart of the global economy and supported the US's post-war economic recovery. Although the system ended in the 1970s due to economic pressures, the dollar retained its position as the world's leading currency and continues to play a pivotal role in global finance.

Entering the 21st century, the acceleration of globalisation brought international economies and financial markets closer together. China's rise further solidified America's dominant position in the global economy. China's economic growth not only spurred global trade and investment but also strengthened the ties between the US and other major economies, bolstering the dollar's influence on the global stage. This period of globalisation, alongside China's ascent, has allowed the US to maintain its crucial role in international finance and economics while also presenting new challenges and opportunities.

In conclusion, the US rapidly rose to global prominence through war-time benefits, sound monetary policy, and globalisation. Successful industrial transitions and vast capital accumulation solidified its leadership. However, the consequences of fiscal and monetary expansion, the ongoing issue of a soft landing, and a lack of public confidence in the economic outlook all contribute to the uncertainties surrounding the future of the US economy.

US Economy's Key Sectors

In 2023. the US economy demonstrated unexpected resilience, largely driven by robust consumer spending. Despite the challenges posed by rising interest rates, American consumers continued to spend strongly, providing vital support for economic growth. This sustained consumer expenditure not only fuelled economic activity but also helped stabilise the overall economic performance, ensuring ongoing expansion.

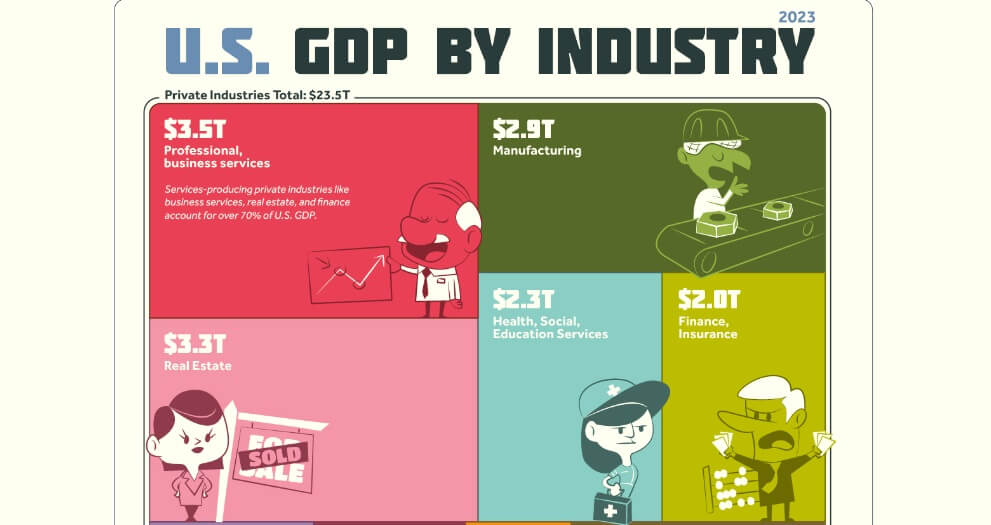

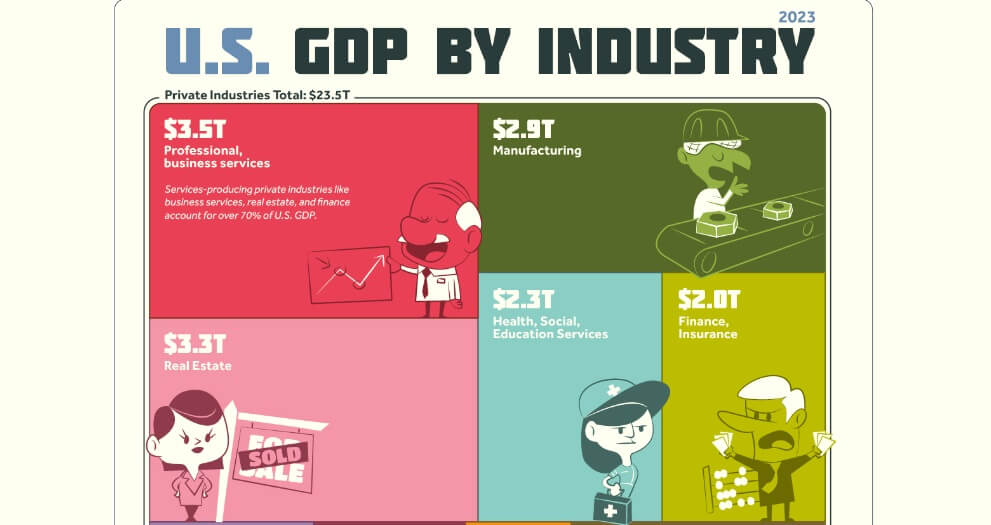

The US is home to the world's largest consumer market, which is the primary engine behind its economic growth. The services sector is at the heart of the American economy, making up more than 80% of the GDP. This broad sector includes finance, healthcare, education, retail, information technology, and entertainment, with each playing a crucial role in driving economic activity.

Among these, finance and technology stand out as particularly influential, with global reach. The US is not only the centre of global financial services and technological innovation but also hosts some of the world's leading companies, such as Apple, Google, and Goldman Sachs, which hold a commanding presence in global markets.

The structure of the US economy is heavily reliant on a free market system, a well-developed financial framework, and a thriving technology sector. While the federal government oversees taxation and public spending, the Federal Reserve operates independently, managing monetary supply. This division has led to a complex policy landscape. For instance, the current interest rate decisions by the Federal Reserve have sparked considerable debate, especially in relation to the upcoming presidential election.

The US has consistently been at the forefront of technological innovation, particularly in fields such as information technology, biotechnology, and clean energy. Silicon Valley remains the global epicentre of technological development, drawing in both investment and talent. The country's leadership in these areas, especially in IT, biotech, and artificial intelligence, not only fuels economic growth but also attracts significant global investment.

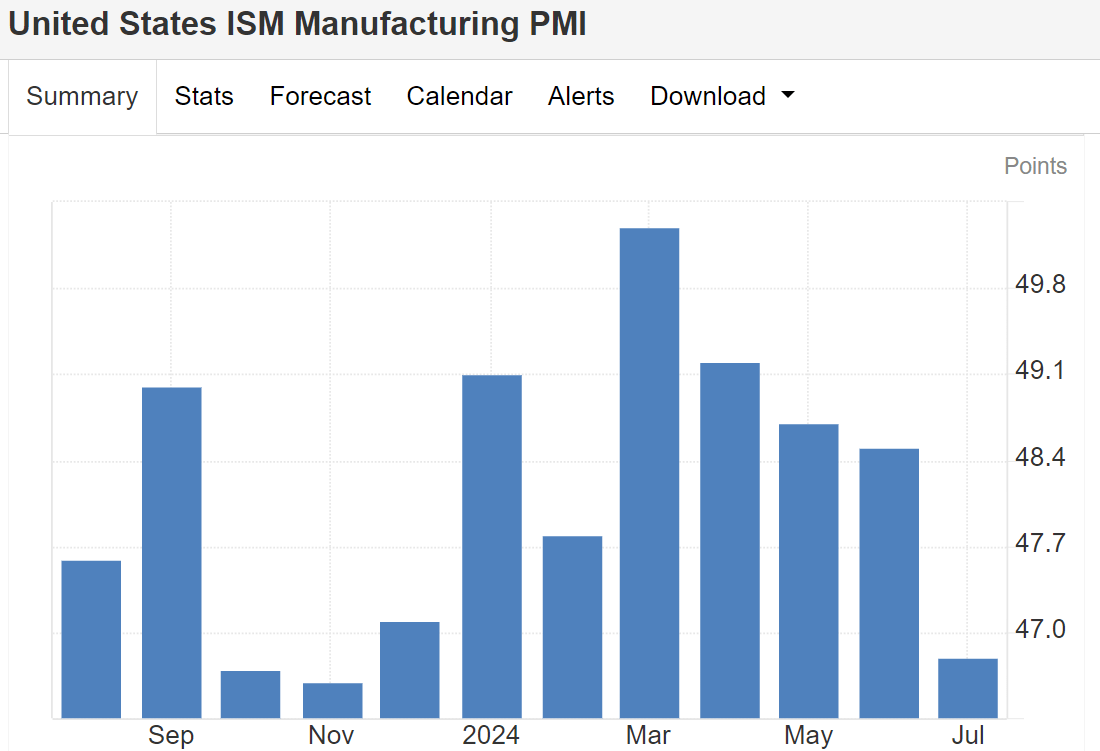

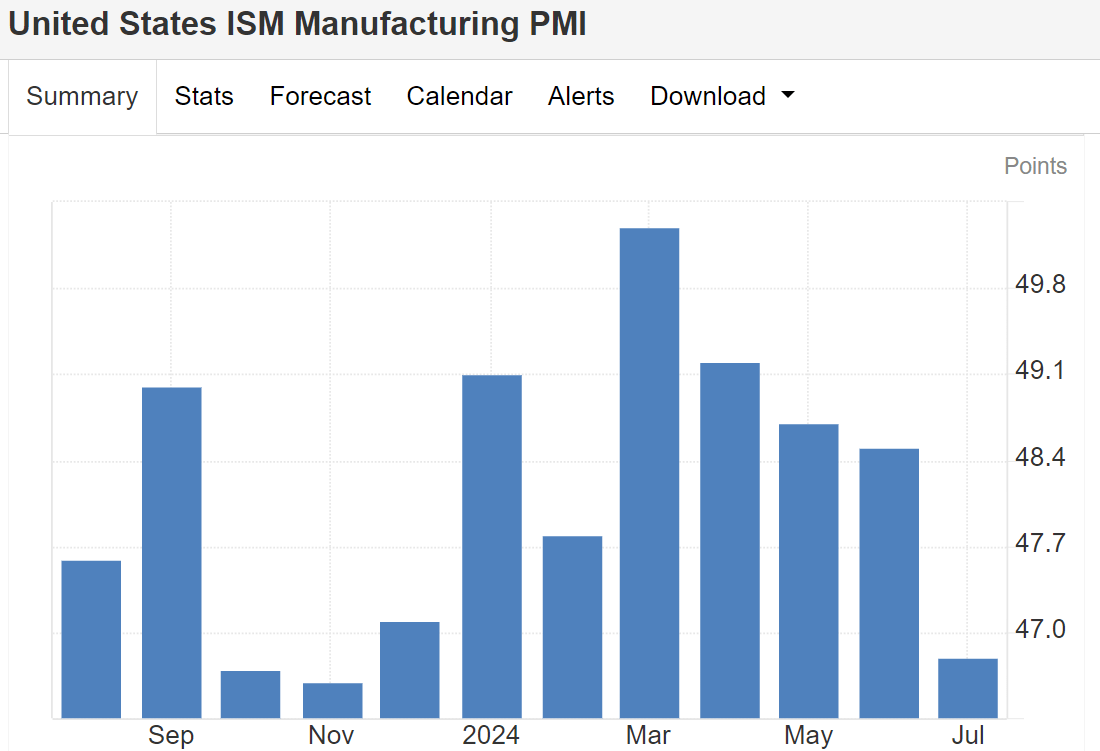

While services dominate the US economy, manufacturing still plays a critical role. The country's manufacturing sector spans industries such as aerospace, automotive, machinery, electronics, and chemicals. Although manufacturing's share of GDP has declined, it remains a key driver of innovation and high-value production, particularly in advanced technologies.

American manufacturing is distinguished by its emphasis on high-tech, high-value products, especially in the aerospace, electronics, and automotive sectors. These industries not only contribute to technological advancement but also influence the economic structure and global competitiveness of the US. Despite the dominance of services, the innovation and high-end products of the manufacturing sector continue to be essential for the long-term growth and international competitiveness of the American economy.

The US is also one of the world's largest agricultural producers, with significant exports in key commodities like corn, soybeans, wheat, beef, and pork. Although agriculture contributes a smaller portion to GDP, it remains vital for US exports and the rural economy.

As one of the largest energy producers globally, the US has made remarkable strides in the oil and gas sectors. Revolutionary technologies in shale oil and gas extraction have transformed the US from a net importer of energy into a net exporter, which has had a profound impact on global energy markets. The US's energy production not only satisfies domestic demand but also holds considerable sway in international markets, influencing global energy prices and strengthening its strategic position in global energy supply chains.

In conclusion, the US economy is highly diversified, with the services sector at its core, while manufacturing, agriculture, energy, and technological innovation also play vital roles. The primary drivers of economic activity are consumer spending and services, while manufacturing and technological progress remain essential for structural upgrades and long-term growth.

US Economy's Current State and Trends

The US economy in 2024 is at a crossroads, showing both resilience and vulnerability amid rising inflation, geopolitical tensions, and shifting global trade dynamics. While recent years have seen a recovery from the pandemic's effects, the economy is now slowing, with growth moderating. The role of the Federal Reserve, inflation control, and labour market shifts are critical factors.

Additionally, the possibility of a second term under Donald Trump—often referred to as "Trump 2.0"—could significantly reshape the direction of economic policies in the coming years. The US economy has seen significant recovery following the pandemic-induced recession, but growth is expected to slow to around 2% in 2024. This deceleration can be attributed to the impact of the Federal Reserve's monetary tightening policies, rising interest rates, and global supply chain disruptions.

If Trump returns to the presidency, his economic approach—focused on deregulation, tax cuts, and promoting US manufacturing—could drive short-term economic growth, although the long-term sustainability of this approach remains uncertain. The shift in policy could lead to changes in fiscal policy, which may affect government spending and business investment.

Inflation remains a key challenge for the US economy, despite significant efforts by the Federal Reserve to manage it. Inflation reached a 40-year high in 2022 and has stabilised around 4% by late 2023. The Fed's response has been a series of interest rate hikes, which have contributed to higher borrowing costs across the economy. However, Trump's policies, if he returns to office, may seek to reduce these interest rates or focus on policies that stimulate growth through tax cuts and deregulation. This could help bring down costs in some sectors but also risks pushing inflation back up, depending on the balance of his proposed fiscal stimulus.

The US labour market remains strong, with low unemployment and growing wages in certain sectors like healthcare and technology. However, the shift towards remote and hybrid work continues to reshape industries. If Trump's economic vision prevails, a focus on boosting domestic manufacturing through incentives and tax cuts may result in job creation in traditional industries, especially in manufacturing and energy.

Nevertheless, there are concerns about how automation, trade policies, and wage growth will impact workers in more traditional sectors. A "Trump 2.0" administration could focus on bringing jobs back to the US through protectionist policies, which may face challenges in balancing economic growth and worker displacement.

Consumer spending has been one of the driving forces of the US economy, but with inflationary pressures and rising interest rates, consumer confidence is fluctuating. High-income earners continue to drive luxury spending, but many middle-income households are feeling the strain of higher costs. In this environment, Trump's focus on reducing taxes and promoting business growth could help boost consumer confidence and disposable income, but it could also deepen income inequality, which may create long-term economic challenges. Consumer behaviour in the next year will likely be influenced by the political climate and the economic policies of the current or future administration.

Trade is a key area of focus for the US economy, with shifting relationships with China, Europe, and other global powers influencing market dynamics. Trump's approach to global trade has been characterised by protectionism, with tariffs on Chinese goods and a focus on reshoring manufacturing jobs.

A "Trump 2.0" administration could escalate trade tensions further, particularly with China, which may affect the broader US economy. These policies could lead to higher prices for certain goods, particularly electronics and other imported products. However, Trump may also pursue new trade agreements that benefit US manufacturing, which could stimulate growth in some sectors.

The technological and clean energy sectors are likely to play a crucial role in driving future US economic growth. The Biden administration's focus on green energy and infrastructure has led to increased investment in renewable energy. However, Trump's economic agenda may prioritise energy independence through increased fossil fuel production and a focus on deregulation, which could conflict with Biden's clean energy investments. This contrast could influence the direction of technological innovation and infrastructure development in the US.

Under Trump's leadership, the push for domestic energy production and deregulated markets might spur short-term growth in energy and traditional industries, but it could also delay the transition to more sustainable, long-term energy solutions.

The US housing market is facing challenges due to higher interest rates, which have slowed down home sales and reduced affordability. Home prices remain high, especially in urban areas, and the rental market is experiencing increased demand. Trump's approach to the economy, which may include tax incentives for homebuyers or changes in housing regulations, could influence the market. However, if trade tensions or inflationary pressures continue, the housing market may remain subdued despite these potential policy changes. The future of the housing sector will depend on how both economic policies and interest rates evolve in the coming year.

As the US economy moves through 2024. it faces a mix of challenges and opportunities. The Federal Reserve's policies on inflation, interest rates, and economic growth will play a central role, but the potential for a "Trump 2.0" presidency could reshape the economic landscape significantly. Trump's focus on deregulation, tax cuts, and trade protectionism could spur short-term growth, particularly in manufacturing and energy sectors, but it may also introduce long-term risks, particularly in terms of income inequality and trade relations. Ultimately, the direction of the economy will depend on the balance of these factors and how businesses, consumers, and policymakers respond to both current and future challenges.

US Economy's Current State and Trends

| Topic |

Current Situation |

Trends & Challenges |

| Economic Performance |

26% of global GDP, strong |

Slower growth, recession risk |

| Consumption & Services |

Strong spending |

Reliant on spending & services |

| Manufacturing & Tech |

Competitive, innovative |

Tech driving growth |

| Inflation & Employment |

High CPI, rising unemployment |

Inflation & job market issues |

| Fed Policy |

Tight policy, rate cut expected |

Possible adjustments |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.