The Williams Indicator (WR) is known as an indicator for short-term trading and is a pretty powerful indicator. It is also an indicator with a story,and there is a real case about this indicator.

What is the Williams indicator?

What is the Williams indicator?

Its original name is Williams Overbought and Oversold Indicator,which was invented by Hall of Fame trader Larry Williams. There may be newbies who may not know how good this person is,but there is something that everyone may have more or less heard of: How I Made a Million Dollars". This book is about how to turn $10.000 into over a million dollars in less than 12 months. And that's what Larry Williams is best known for. It's that in 1987. in the Robbins World Cup of Futures Trading,he won the world championship with 11.376% APR.

One might question that it was a simulated competition with no credibility,right? It wasn't. Robbins Futures Trading World Cup is a famous real-time, real-money competition with credibility. Each participant needs 10.000 dollars of real money to compete. This competition is very transparent and fair,and until now, no participant could closely follow his performance.

Ten years later,his daughter, Michelle Williams, took the strategies and indicators he taught her and applied them to the futures market. She won the 1997 World Championship with an annualized rate of 1.000%, which is an exaggeration given that she was only 16 or 17 years old at the time.

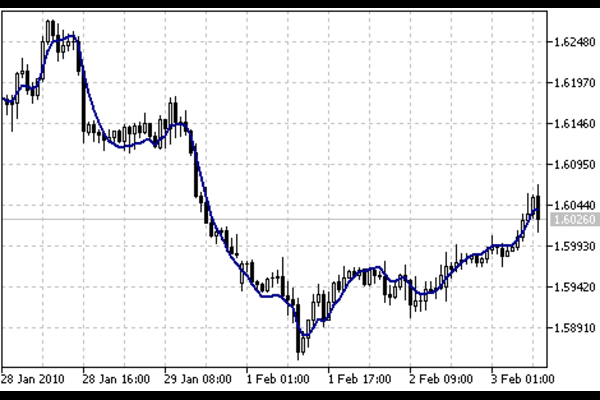

WR is a measure of whether a stock is currently overbought or oversold based on the latest stock price fluctuations,which in turn provides investors with a trend reversal signal. It is expressed from 0 to 100. with 0 being the high, -100 being the low, and -50 being the midpoint.

Simply put,in theory,when the Williams Index goes to -20. it means that the market price goes to an overbought area. On the contrary,the Williams goes to 80. which is oversold.

It is important to note that the Williams Index is overbought and overbought, and it is not recommended to be used directly to fish for the top and bottom. As we all know,overbought is the market to do good power is too strong,there is a chance to fall back. Oversold do fade too much power; there is a chance to go back up.

Williams Indicator Detail

| Features/Uses |

Descripción |

| Type |

technical analysis Indicators |

| Founder |

Larry Williams |

| Basis of Calculation |

Based on the highest and lowest prices in a given period, |

| Numerical Range |

Ranges from -100 to 0, usually expressed as a percentage. |

| Oversold Level |

Usually set to -80 |

| Overbought Level |

Usually set to -20 |

| Targets |

Identifies overbought and oversold conditions and potential market reversal points. |

| Signal |

Markets from -20 to 0 are overbought; markets from -80 to -100 are oversold. |

| Used in combination |

Used in conjunction with other technical indicators and analytical methods, such as the RSI |

| Timeframe |

Daily and hourly charts for a variety of trading strategies |

| Alerts |

Warns of overbought and oversold conditions in advance and does not reverse immediately. |

Williams indicator principle

The first step is to measure the price range. The calculation of this indicator relies on the highest and lowest prices during a certain period. This period is usually set by the user,for example, 14 trading days. By measuring the highs and lows of the price during this period,WR is able to reflect the range of the market.

WR then calculates the relationship between the current price and the range of highs and lows. Specifically,it uses a formula to calculate:

WR=(Highest of Highest-Current Price)/(Highest of Highest-Lowest of Lowest)*100

Here,the highest price in the highest price is the highest price in the past certain period,while the lowest price in the lowest price is the lowest price in the past certain period. The current price,on the other hand,is based on the calculation period you choose,which can be either the closing price or the market price.

WR then determines how overbought and oversold the market is based on the calculated values. The range of values for this indicator is usually 100 to 0. This is usually expressed as a percentage. Within this range,there are a number of flags that can help determine what is going on in the market:

When the indicator value is between -20 and 0. it usually indicates that the market is overbought,which means that the price may fall or reverse.

When the indicator value is between 80 and 100. it usually indicates that the market is oversold,suggesting that prices may rise or reverse.

Traders can base their trading decisions on the value of the WR. For example,when the indicator is at or above-20. it may be a sell signal; when the WR is at or below-80. it may be a buy signal. Keep in mind,however,that it is usually necessary to use it in conjunction with other indicators and analytical methods in order to get a more complete picture of the market.

The principle is to determine how overbought and oversold the market is by measuring the relationship between the current price and a range of prices over a certain period of time,thus providing a potential market reversal signal.

Usage method

First of all,when its value is between -20 and 0. it means that the market may be in an overbought state,and this is the time to consider selling. On the contrary,when it is between 80 and 100. the market may be in an oversold state,and this is the time to consider buying. But remember,this is just an early warning and does not necessarily mean that the market will immediately reverse.

Secondly,it can also help us spot divergence. Divergence is when the value of the WR is not in line with the price action. For example,if the price makes a new high but the WR does not,this is a signal that it is overbought. Conversely,if the price makes a new low but the WR does not make a new low,this is an oversold signal. These divergence signals can be used as early warning signals of a market reversal.

Again,using multiple time frames can help us get a more complete view of the market. For example,look at the WR values on the daily and hourly charts at the same time. This can help us confirm trends and signals and reduce the risk of false signals. It is also possible to customize the period length and overbought or oversold levels of the WR to suit your trading strategy and market conditions. Some traders like to set the period to 12. 14. or 21. depending on the time frame. Also,overbought and oversold levels can be adjusted to suit different market conditions.

It's best to use it in conjunction with other technical indicators and analytical methods to improve the accuracy of trading decisions. Combining moving averages, the relative strength indicator (RSI), MCAD, and other indicators can provide a more comprehensive market analysis.

wr short term best data

The optimal WR parameters for the short term (i.e., the period for which the WR mark is calculated) will vary depending on market conditions and individual preferences,but in general,short-term traders are likely to opt for shorter periods such as 14 or 21. These periods are suitable for short-term trades because of their ability to react quickly to market price movements.

Of course, it should be understood that there is no single "best" parameter. Since market conditions are constantly changing,the parameters that are appropriate for the current situation may not be applicable in other situations. When using WR,it is advisable to backtest and observe in real time in order to find the most suitable trading cycle. At the same time,it is important to combine other technical indicators and analytical methods in order to make a more comprehensive decision,rather than relying on a single indicator.

wr short line best data example

| Parameter setting |

Period (n) |

Overbought level |

oversold level |

| Setting 1 |

7 |

-10 |

-90 |

| Setting 2 |

9 |

-15 |

-85 |

| Setting 3 |

10 |

-20 |

-80 |

How to set the Williams indicator most accurately

Its settings can vary depending on trader preferences and market conditions,so no single setting is considered the most accurate. Below are some common setup suggestions for reference only,keeping in mind that the optimal setup may vary from situation to situation:

First,regarding cycle length,typically WR's cycle length is set in the range of 14. This means that it will calculate the price range over the last 14 cycles. However,this is not set in stone,and for short-term traders, it may be necessary to set the period shorter,such as 7 or 9.

Secondly,the overbought and oversold levels can be adjusted. The default overbought and oversold levels for WR are -20 and -80. respectively. However,these levels can also be adjusted to suit your trading strategy. Some traders may set the overbought level to -10 or -15. and the oversold level to 90 or 85.

In addition,WR does not exist in isolation and usually needs to be used in conjunction with other technical indicators and analytical methods. For example,WR can be used along with indicators such as moving averages, the relative strength indicator (RSI), MCAD, etc. to get a more comprehensive market analysis.

Williams Indicator 42 and 12 Bonding Stock Picking Formula

This actually refers to the practice of traders setting different periods on their own to generate fast and slow lines. Some do this by selecting 12 and 42 days,while others select 23. 34. and 89 day lines.Let's look at the 42 and 12 bonding stock picking formulas below:

The formula for WR is as follows:

WR=[(Hn-C)/(Hn-Ln)]*-100

Where:

WR:the value of the Williams Index.

Hn:the highest price in the past n trading days.

Ln:the lowest price in the past n trading days.

the closing price of the current trading day.

So,it's all about finding the high and low prices over 42 and 12 trading days,as well as the closing price of the current trading day. Just bring these numbers into the formula above.

It is important to note that since there are fast and slow lines,they can produce golden and death crosses. A golden cross in an oversold area and a death cross in an overbought area can be used as early warning signs of a trend reversal.

Williams Indicator 42 and 12 Bonding Stock Picking Formula

| Parameter setting |

Period (n) |

Overbought level |

oversold level |

| Setting 1 |

42 |

-20 |

-80 |

| Setting 2 |

12 |

-15 |

-85 |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.

What is the Williams indicator?

What is the Williams indicator?