Chinese equities retained upward momentum on Thursday.The head of China's Securities regulator was replaced on Wednesday,in order to stabilise stock market according to Xinhua news agency.

Global equities climbed to a more than two-year peak with the S&P 500 and Nasdaq 100 closing at a record high on the previous session,as strong earnings offset renewed jitters related to US regional banks.

However,some analysts have questioned how long the tech boom can possibly last.The Magnificent Seven are facing high bars to sustain gains after the group doubled its value last year.

The reporting season has been mixed.Despite a still-blistering overall performance,Apple sales in China was weaker than feared and tesla is burdened by plunging demand for EVs and the impact of price cuts on margins.

JPMorgan’s quantitative strategists last week noted this is drawing similarities with the dot-com bubble,raising the risk of a selloff.They added that the broader index will likely outperform the group in the near future.

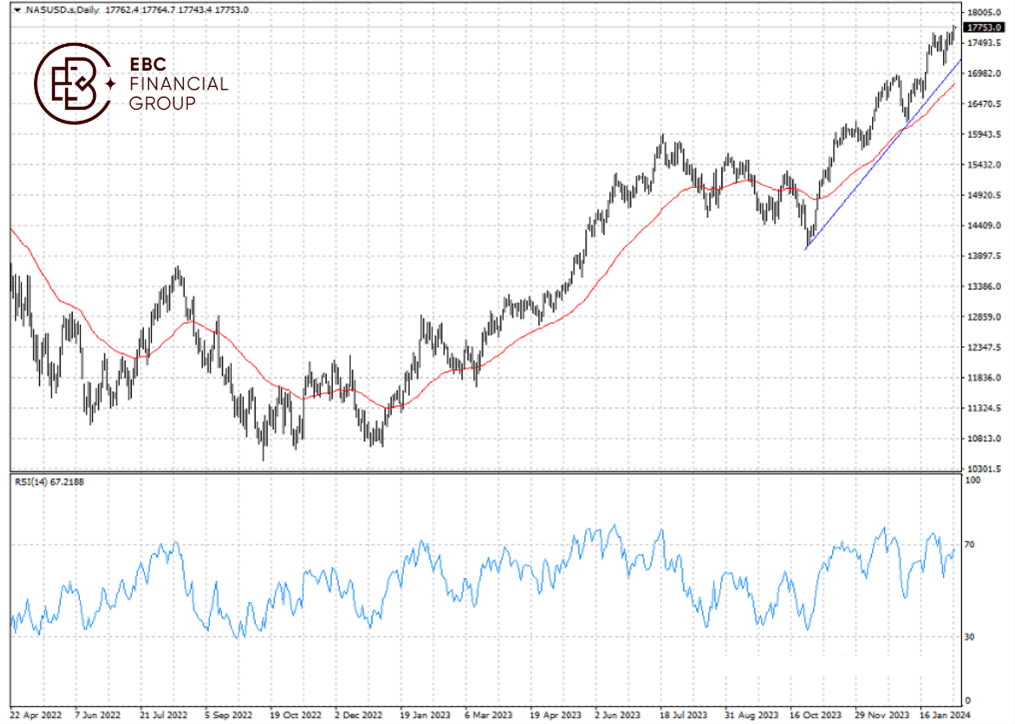

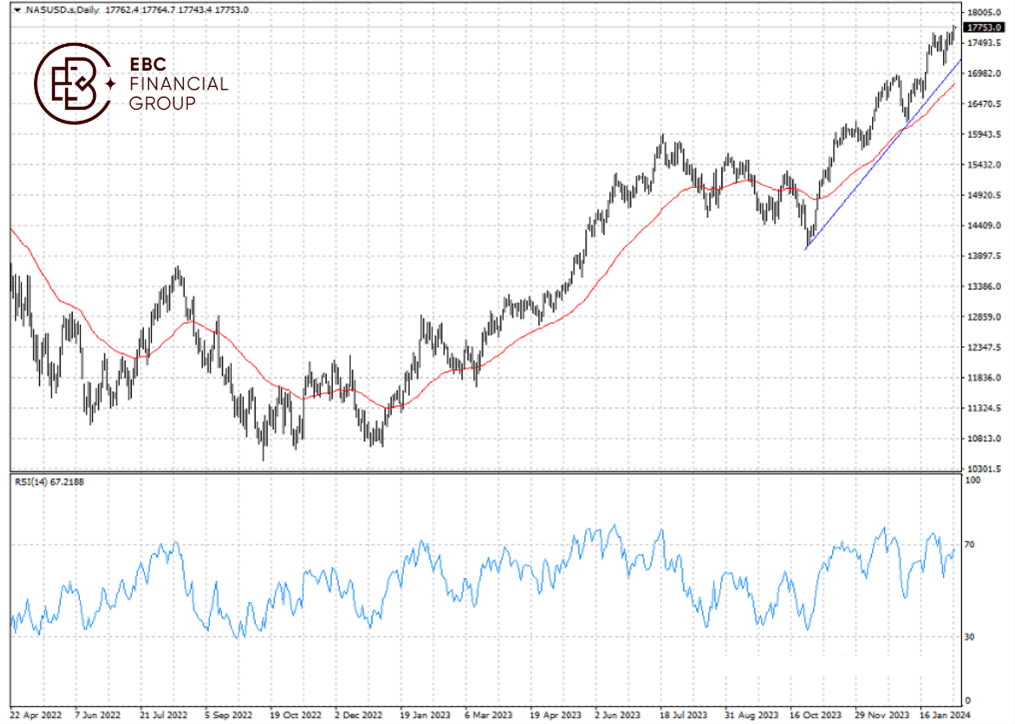

Wagers on declines in tech-heavy Nasdaq 100 Futures have been completely erased.Citi warned that investor positioning in the popular sector is so bullish that any selloff could trigger a wider rout.

The index had little difficulty in defying resistance levels.Technical indicators clearly show that it is poised for more gains down the road.Still it might work to go short on an RSI above 70 for quick money.

Disclaimer:This material is for general information purposes only and is not intended as(and should not be considered to be)financial,investment or other advice on which reliance should be placed.No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security,transaction or investment strategy is suitable for any specific person.