Euro has little to offer against a resurgent dollar

2024-02-07

Summary:

Summary:

USD to EUR volatility stabilizes, and the market closely watches US CPI data. A Reuters survey indicates potential USD strength, yet the EUR maintains upward momentum. EUR to USD sees some rebound, but technical pressure warrants attention.

The dollar was little changed against the euro on Wednesday, having retreated from its highest level since mid-November. US CPI due next week will be closely watched for cues on interest rate path.

Euro zone consumers have trimmed their expectations for inflation over the next 12 months, a ECB poll showed. But those for three years rose slightly to 2.5%, above the central bank’s goal.

Policymakers do not need to rush cutting interest rates, according to Governing Council member Boris Vujcic. “We still see also quite a lot of resilience in the services and what we call domestic inflation.”

He added that rate cuts will help the bloc's stagnant economy, but big structural issues like Germany's lagging performance and volatile energy markets cannot be fixed in that way.

A resurgent dollar is more likely to stay strong than not over the coming months, according to a Reuters survey. Strategists polled predicted the greenback would weaken from current levels in the next three, six and twelve months.

They expected the single currency to gain more than 4% at $1.12 in 12 months and the yen to strengthen more than 9% to 135.50 per dollar. The forecast remained almost the same as that in December.

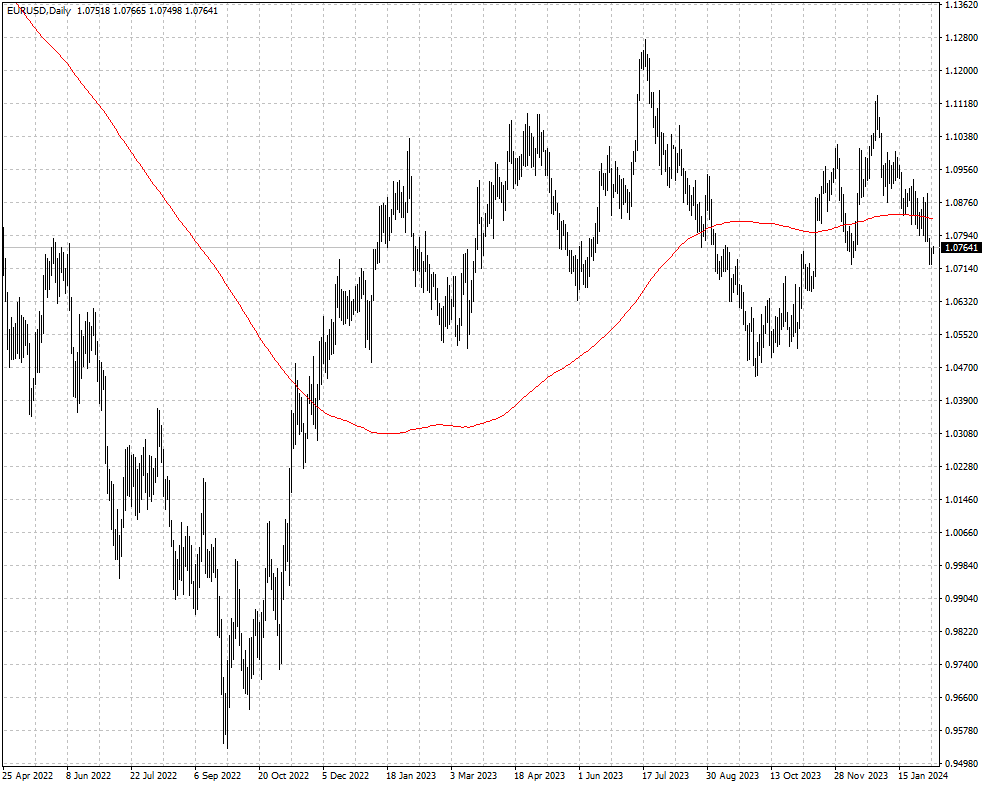

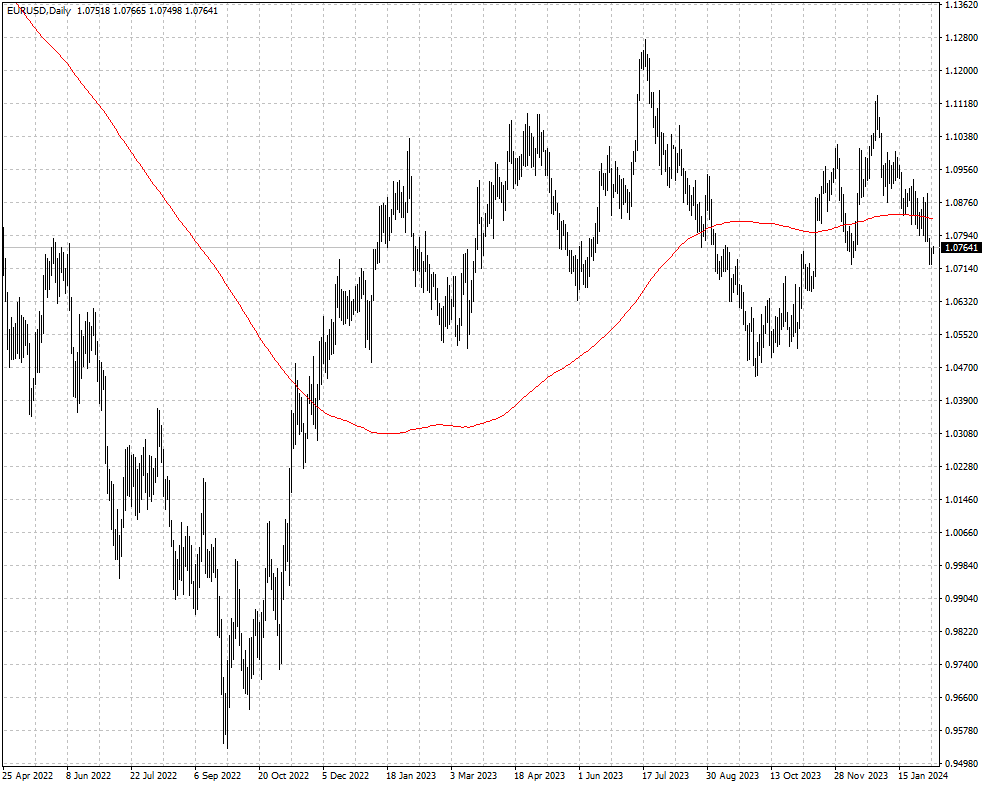

The euro rallied after the double-bottom pattern shaped up. The risk is moderately tilted to the upside but continued ascent will be tested by 1.0780 and the 200 SMA.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.