In April 2025, President Donald Trump announced a series of sweeping tariffs to address the United States' trade imbalances and protect domestic industries.

However, these measures, including a universal 10% import tariff and higher duties on specific countries, have elicited varied reactions worldwide, reshaping economic relationships and prompting strategic adjustments among trading partners.

Overview and Rationale Behind the Trump Tariffs

On April 5, 2025, the Trump administration implemented a 10% tariff on all imports into the United States, citing the need to rectify large and persistent trade deficits and counteract unfair trade practices by other nations. This baseline tariff was set to increase further for countries in which the U.S. have significant trade imbalances. For instance, higher tariffs were imposed on goods from 57 major trading partners, including China, the European Union, Japan, and Vietnam, starting April 9, 2025.

The administration justified these tariffs by invoking the International Emergency Economic Powers Act (IEEPA), declaring that the substantial trade deficits posed a national emergency. President Trump argued that these measures were necessary to protect American sovereignty, strengthen national and economic security, and promote fairer trade practices.

For context, Treasury Secretary Scott Bessent and White House adviser Peter Navarro have downplayed immediate economic concerns, predicting a long-term economic boom resulting from these policies. However, critics argue that the tariffs follow flawed economic reasoning and risk triggering a global recession. Economists highlight that such protectionist measures disrupt established trade norms and could lead to retaliatory actions, further exacerbating economic instability.

The administration also highlighted concerns over currency manipulation and the imposition of value-added taxes by other countries that disadvantage U.S. exports.

How the Trump Tariffs Impacted Global Trading?

1) Immediate Market Reactions

The announcement of the tariffs led to significant volatility in financial markets. Major U.S. stock indices experienced sharp declines, with the S&P 500 plunging more than 11% over two days, erasing over $6 trillion in market value.

The Nasdaq and Russell 2000 indices entered bear market territory, while the Dow Jones and S&P 500 approached similar levels. Sectors traditionally considered resilient, such as utilities and insurers, also faced steep declines.

2) Global Response and Retaliation

The international community responded swiftly to these trump tariffs. China, for instance, imposed a 34% tariff on U.S. goods, escalating tensions and contributing to fears of a full-scale trade war.

These actions have affected bilateral trade but also have broader implications for global economic stability. Goldman Sachs projects that these trump tariffs could reduce China's GDP growth by at least 0.7 percentage points in 2025, prompting expectations of further fiscal easing measures by Chinese policymakers to offset the negative impact.

Other countries, including Canada and Mexico, also announced countermeasures, targeting various U.S. exports. These retaliatory actions have further strained diplomatic relations and introduced new complexities into global trade negotiations.

3) Impact on Global Trade Dynamics

As mentioned, these tariffs represent a substantial shift in U.S. trade policy, moving toward a more protectionist stance. This approach has disrupted established trade norms and agreements, compelling countries to reevaluate their trade strategies and alliances.

For example, the European Union and Asian nations have explored strengthening their trade relationships independently of the United States, aiming to mitigate the impact of U.S. tariffs and reduce reliance on American markets.

4) Impact on Consumer Prices and Spending

Moreover, the tariffs have raised concerns about inflationary pressures on consumer goods. With the average U.S. import duty rising to 22% — a level not seen since 1910 — prices for imported products are expected to increase significantly.

This escalation will potentially weaken consumer spending, a critical driver of the U.S. economy. Economists warn that rising prices and disrupted supply chains could lead to stagflation, characterised by stagnant growth and high inflation.

5) Sector-Specific Effects

Lastly, specific industries have been more acutely affected by the trump tariffs. The technology sector, heavily reliant on global supply chains, faces increased costs due to higher tariffs on imported components.

Similarly, the agricultural sector faces retaliatory tariffs from trading partners, leading to decreased exports and financial strain on farmers. These sector-specific challenges underscore the broader economic disruptions caused by the tariff implementations.

Historical Comparison and Forecast

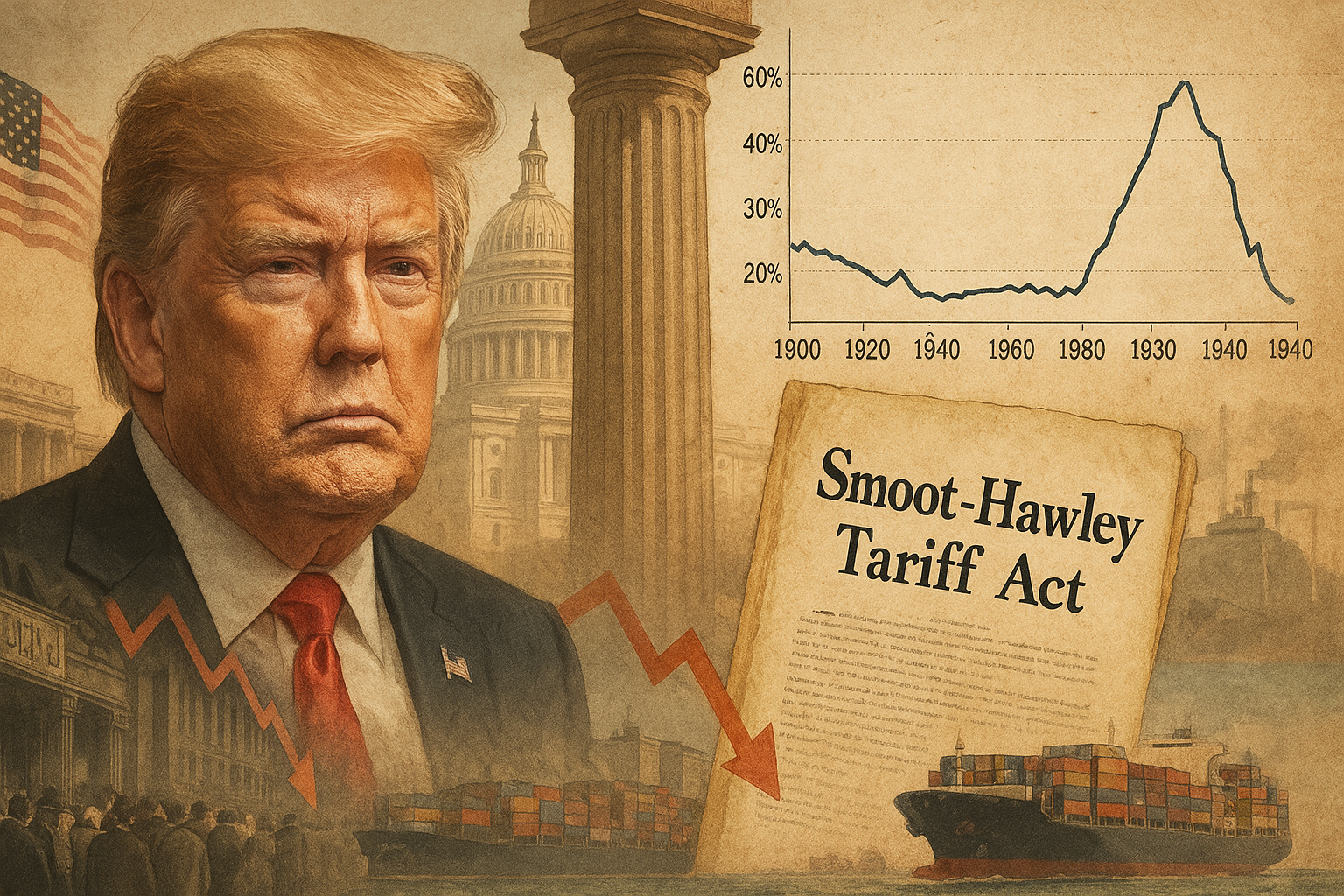

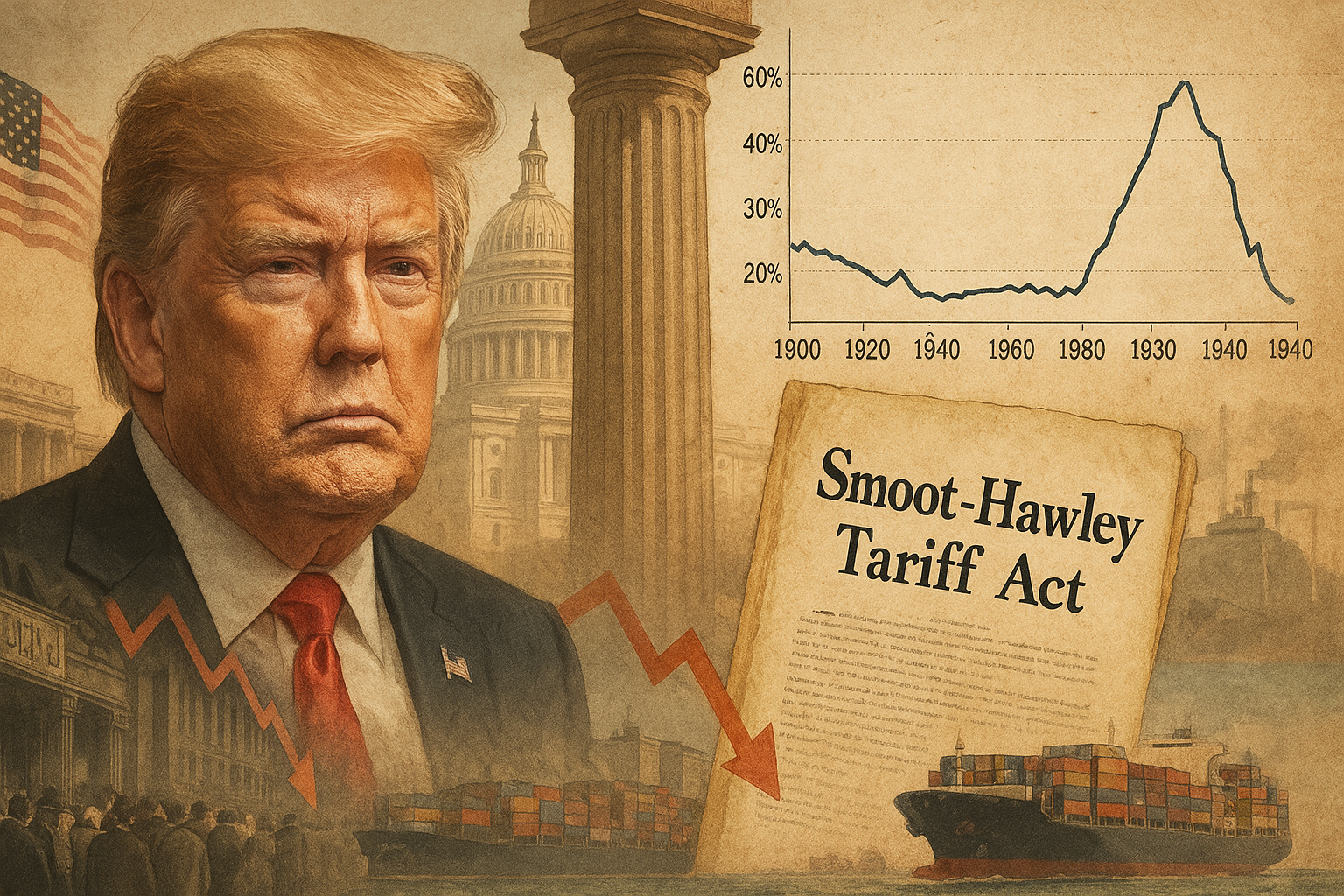

The scale and scope of the 2025 tariffs are unprecedented in recent history, drawing comparisons to the Smoot-Hawley Tariff Act of 1930, which is widely believed to have exacerbated the Great Depression. Economists warn that similar protectionist measures could lead to prolonged economic stagnation and reduced global trade.

For instance, economists and financial institutions have expressed apprehension about the potential negative impacts of the tariffs. JPMorgan increased the probability of a global recession to 60%, forecasting a 0.3% decline in U.S. GDP in the fourth quarter of 2025 and a rise in unemployment to 5.3% by 2026.

The Yale Budget Lab estimated that the tariffs would lead to a 2.3% increase in the price level, equating to an average loss of $3,800 per household in 2024.

Conclusion

The tariffs introduced by the Trump administration in April 2025 have profoundly impacted global trade, leading to economic uncertainty and prompting significant shifts in international trade relationships.

While intended to address trade imbalances and bolster domestic industries, these measures have also introduced challenges that continue to unfold, affecting economies and industries worldwide. As the situation evolves, continuous monitoring and analysis will be essential to fully understand and address the long-term economic impacts of these measures.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.