Imagine you're cruising along the market, your trades steady, your strategy in place, when suddenly—bam—your stock surges, seemingly out of nowhere. It's not just any price increase; it's a gamma squeeze, and it's reshaping the way your portfolio behaves.

But before you get too excited (or worried), let's break down this intriguing market phenomenon. Are you prepared to ride the wave or will you get caught in the whirlpool? Here's what you need to know about gamma squeezes and how to prepare your portfolio for them.

What Exactly Is a Gamma Squeeze?

A gamma squeeze might sound like some complex technical term reserved for seasoned traders, but in reality, it's just a market force that can cause a rapid and dramatic price surge. The 'gamm' refers to the rate of change in an option's delta (the sensitivity of an option's price to changes in the stock's price).

Essentially, when the stock price starts to rise, market makers—who sell options—are forced to buy more shares to hedge their positions. This buying creates a feedback loop that drives the price even higher, causing the gamma squeeze.

It's like a rocket launch: one small ignition of options buying, and before you know it, the stock shoots upwards at breakneck speed.

The Unexpected Impact on Your Portfolio

So, what does a gamma squeeze mean for you, the trader? Well, imagine your portfolio is like a carefully built house. A gamma squeeze is the equivalent of a sudden gust of wind that could either blow the roof off or lift the house to new heights. If you're holding stocks that are caught in a gamma squeeze, expect volatility. While there's potential for large gains, especially if you're already in a long position, there's just as much chance for swift, unpredictable losses if the squeeze is short-lived.

For those with short positions or unhedged options, a gamma squeeze can be downright catastrophic, as the price moves swiftly against you. It's a rollercoaster ride where the seatbelt is your risk management strategy.

Spotting a Gamma Squeeze Before It Hits

What if you could anticipate the squeeze before it strikes? With a little market savvy, you can. The first red flag to watch for is unusual options activity. High open interest in call options—especially out-of-the-money calls—can indicate a brewing gamma squeeze. As these options near expiration and the stock price climbs, market makers will scramble to hedge their positions by buying more stock, triggering the squeeze.

You'll also want to keep an eye on stock volume. When an influx of options activity aligns with rising stock volume, that's your signal that something may be in the works. Throw in a stock with significant short interest, and the potential for a gamma squeeze becomes even more likely. It's like seeing the storm clouds gather before the storm hits.

How to Manage the Risks of a Gamma Squeeze

The thought of profiting from a gamma squeeze might seem enticing, but let's not get carried away just yet. Managing risk is the name of the game. You'll want to position yourself with protective measures to avoid getting caught off-guard. Stop-loss orders, for example, can act as a safety net, preventing large losses if the squeeze turns on you. Diversification also plays a role; the more varied your portfolio, the better it can withstand the volatility of individual stocks.

One of the most critical things to remember is that gamma squeezes don't last forever. They can skyrocket in a matter of hours, but often as quickly as they begin, they lose steam and reverse direction. Timing is everything in this high-stakes game.

Gamma Squeeze vs. Short Squeeze: The Battle of the Squeezes

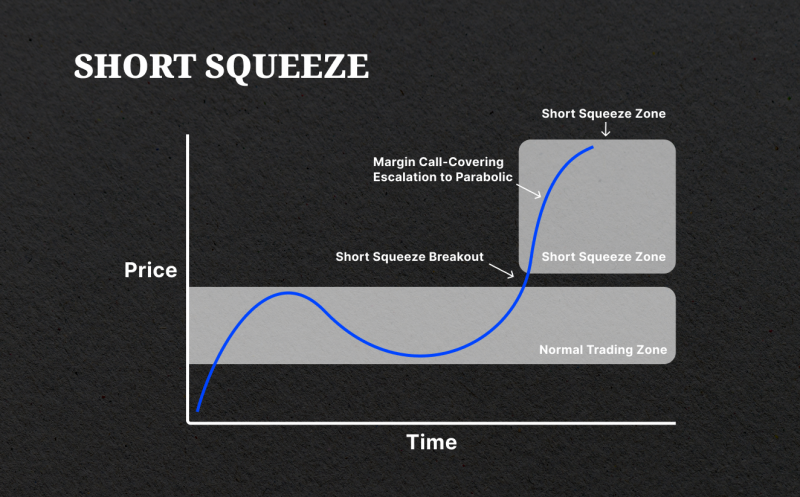

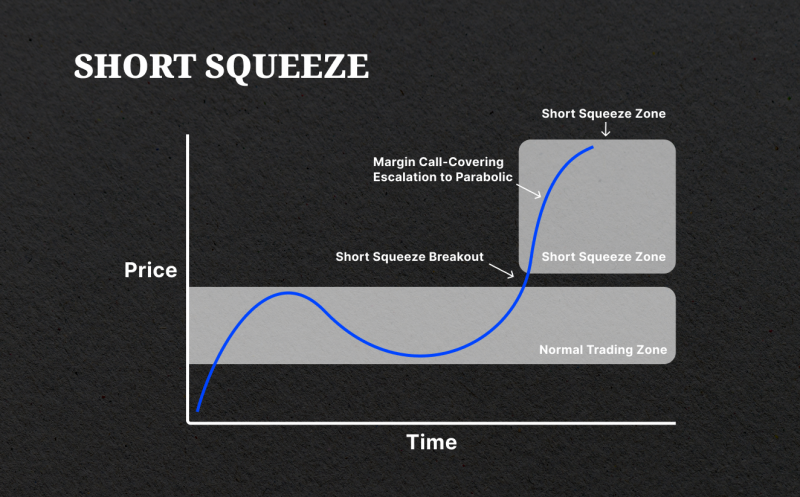

If you've been around the trading world long enough, you've probably heard the term short squeeze. But what's the difference between a short squeeze and a gamma squeeze, and how do they stack up?

A short squeeze is triggered when short-sellers are forced to buy back shares they've borrowed because the stock price is rising unexpectedly. This buying pressure pushes the price even higher, creating a squeeze. A gamma squeeze, however, is driven by options activity, where market makers need to buy stock to hedge their positions as the stock price rises.

Both squeezes can lead to sharp price increases, but the underlying mechanics are very different. A gamma squeeze is primarily influenced by the options market, whereas a short squeeze is triggered by the actions of short sellers. Understanding these distinctions can help you predict which squeeze might be on the horizon.

Can You Profit from a Gamma Squeeze?

Yes, absolutely! But as with any trading strategy, it's not without risk. The key to profiting from a gamma squeeze lies in recognising the early signs and positioning yourself correctly. Out-of-the-money call options are a popular choice for traders hoping to capitalise on a squeeze, as they can offer significant returns if the price moves sharply in your favour.

However, timing is everything. These opportunities can be fleeting, and entering too early or too late can be costly. Remember, gamma squeezes tend to be brief and intense. Staying on top of market movements and having a clear exit strategy is vital.

Protecting Your Portfolio from a Gamma Squeeze

To stay ahead of the game, ensure your portfolio is equipped for the unpredictability of a gamma squeeze. Keep a close eye on stocks with significant options activity and short interest. Watch for signs of price volatility that could indicate a squeeze is coming. And most importantly, use protective measures like stop-loss orders to limit potential damage.

If you're feeling particularly risk-averse, consider diversifying your holdings or investing in sectors less likely to be impacted by such rapid price movements. And never underestimate the importance of a well-thought-out risk management strategy—it's your best friend in the world of squeezes.

Conclusion

In the fast-paced world of trading, being caught off guard by a gamma squeeze can leave even seasoned traders scrambling. But with the right knowledge and preparation, your portfolio can not only survive but thrive during this volatile phenomenon. Stay informed, manage your risk, and know when to act, and you'll be ready to face the next gamma squeeze head-on.

Remember: trading is as much about knowing when to act as it is about knowing when to hold back. By understanding the mechanics of a gamma squeeze and staying vigilant, you can turn potential risk into opportunity.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.