When it comes to technical indicators, traders often debate which tool gives the clearest edge. Two names that frequently surface in trading rooms and strategy guides are the Elliott Wave Oscillator and MACD. Both measure momentum, both help with timing trades, yet they serve different purposes. So, which is better for your trading style?

The answer depends on what kind of trader you are and how you interpret market structure. In this article, we'll break down the key characteristics of each, how they work, their strengths and weaknesses, and which is better suited for various trading approaches.

Understanding the Elliott Wave Oscillator

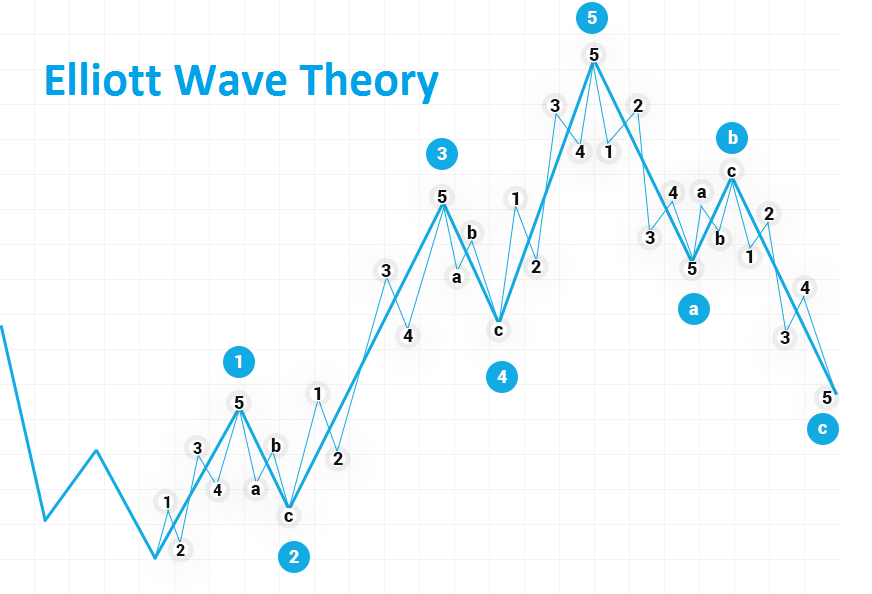

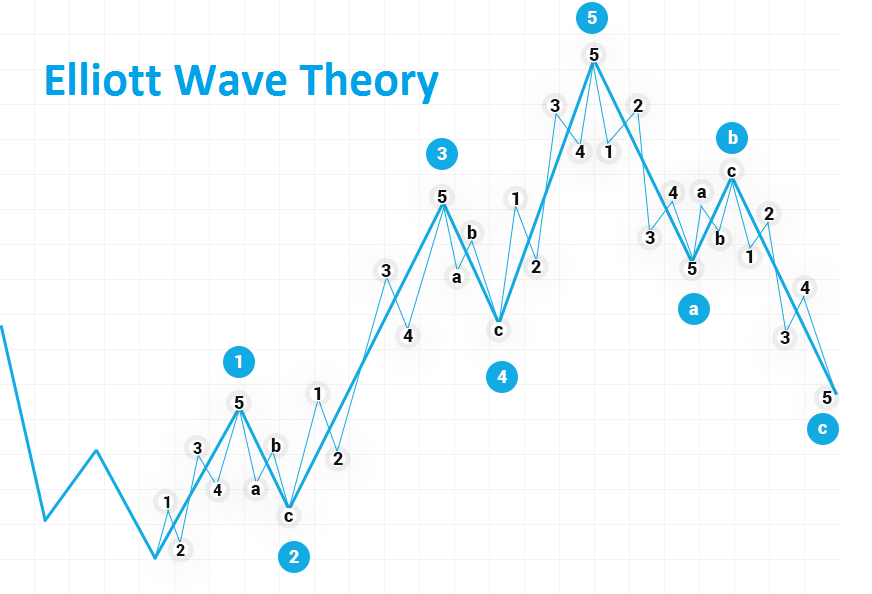

The Elliott Wave Oscillator is based on Elliott Wave Theory, which seeks to categorise price movement into patterns or waves that repeat over time. It is calculated by subtracting a 35-period simple moving average from a 5-period moving average. The result is a histogram that oscillates above and below a zero line.

This oscillator is used to support wave counting. It helps traders identify where a market might be within a five-wave trend or a three-wave correction. The peak of the oscillator often corresponds with the third wave, while the fifth wave shows a divergence. This divergence can be a sign that a trend is losing strength.

Many traders use the Elliott Wave Oscillator not just to confirm wave counts, but also to understand when momentum is likely to shift.

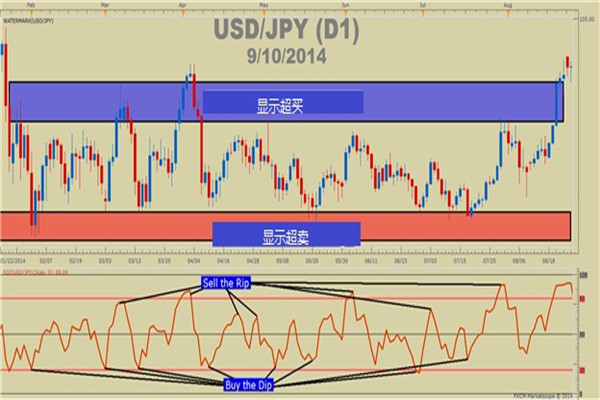

MACD stands for Moving Average Convergence Divergence. It compares two exponential moving averages, typically 12 and 26 periods, and then plots the difference between them. This result is the MACD line. A signal line, usually a 9-period EMA of the MACD line, is also plotted.

When the MACD line crosses above the signal line, its viewed as a bullish signal. When it crosses below, it suggests bearish momentum. MACD is widely appreciated for its simplicity, and many traders use it to confirm trend changes or to identify entry and exit points.

Unlike the Elliott Wave Oscillator, MACD is not built for wave theory. Instead, it's more flexible and suits those who want quick, clear momentum signals without the need for in-depth pattern analysis.

Core Differences Between the Two

The most important difference lies in the purpose. The Elliott Wave Oscillator supports pattern recognition based on wave theory. It helps advanced traders identify whether they are in a trending wave or a corrective one. Meanwhile, MACD is a general-purpose indicator that flags momentum shifts through moving average crossovers.

Another key difference is the learning curve. The Elliott Wave Oscillator requires a deeper understanding of wave counts, patterns, and divergence setups. MACD, on the other hand, is beginner-friendly and often built into basic trading platforms with default settings.

When Should You Use the Elliott Wave Oscillator?

If you are someone who wants to map out entire market cycles and anticipate trend continuation or reversal points based on wave counts, the Elliott Wave Oscillator is worth considering. It gives insights into the strength and structure of market moves, which can help in building a longer-term outlook.

It is particularly useful when trading in a market with a strong trend, as the histogram clearly shows which wave phase the market may be in. If you're in wave three, you may want to ride the trend. If you see a weak wave five with divergence, you may want to prepare for a reversal.

However, it is not ideal for choppy or sideways markets where wave patterns are harder to define.

When Should You Use MACD?

MACD is a go-to for traders who want a reliable, rule-based system for identifying changes in momentum. Its crossover signals are clean and easy to act on. It's useful in trending markets and can also be used to confirm signals from other tools like moving averages or price patterns.

You might prefer MACD if you're not using a wave-based strategy but still want to track momentum and stay on the right side of the trend. It works across different timeframes and market types, from forex to stocks and even crypto.

Pros and Cons of the Elliott Wave Oscillator

The Elliott Wave Oscillator excels at providing insights into wave structure and trend continuation. It helps anticipate turning points with some level of precision. However, it requires more technical knowledge and experience to use effectively. Traders who misuse wave counts may misinterpret the signals and enter trades at the wrong time.

It's best used by those already familiar with Elliott Wave Theory and who have the patience to analyse longer-term Chart Patterns.

MACD's main advantage is simplicity. It is easy to learn, works across various markets, and offers actionable signals. It's a great starting point for beginner traders and a useful confirmation tool for more advanced ones.

However, MACD is a lagging indicator. It reacts to price rather than predicting future movements. This can result in delayed signals, especially in fast-moving markets where early entries are crucial.

Can They Be Used Together?

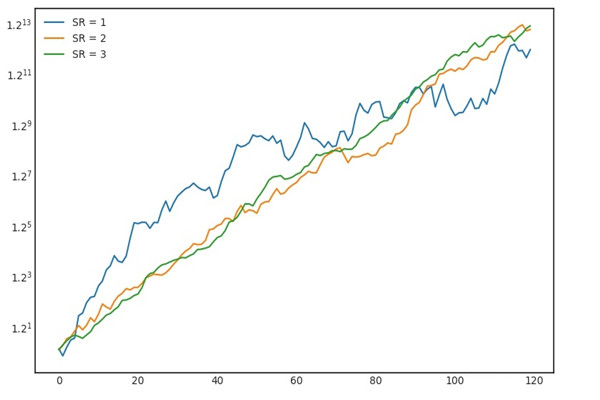

Yes, combining both can give a more complete view of the market. You might use the Elliott Wave Oscillator to determine the wave count and identify where the market is in the trend cycle. Then, you can use MACD to confirm momentum or to refine your entry and exit timing.

For example, if you believe the market is entering wave three and MACD shows a bullish crossover, the signal may be stronger. On the other hand, if you're nearing the end of wave five and MACD shows divergence, it could be a warning to exit or avoid new entries.

Final Verdict

So which one is better — the Elliott Wave Oscillator or MACD? The real answer lies in your trading strategy.

If yo're an analytical trader who enjoys pattern recognition and wave theory, the Elliott Wave Oscillator gives you a deeper layer of market context. If you prefer a simpler, momentum-based approach that is easy to act on, MACD is the better tool.

Many successful traders integrate both, using the Elliott Wave Oscillator for structure and MACD for timing. Whichever you choose, make sure to test thoroughly and tailor your settings to the specific market and timeframe you're working in.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.