Trailing stop loss is a popular trading strategy used by investors to lock in profits while limiting potential losses. By automatically adjusting the stop loss level as the market price moves in your favour, this tool ensures that gains are protected without constant monitoring.

But is a trailing stop loss effective? Let’s explore the benefits, strategies, and real-world examples to help you understand how it can enhance your trading approach.

What Is a Trailing Stop Loss?

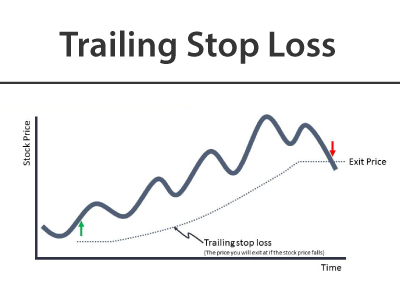

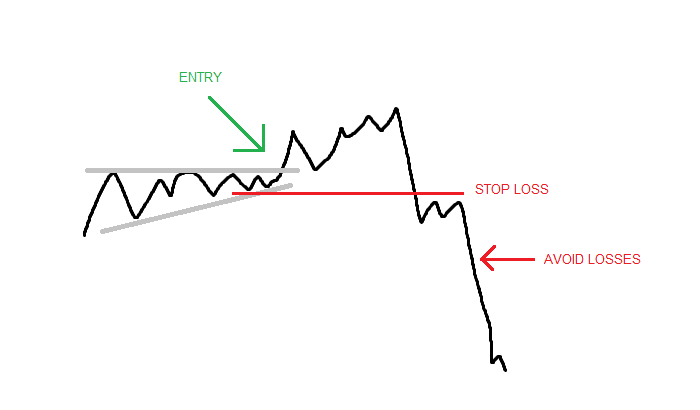

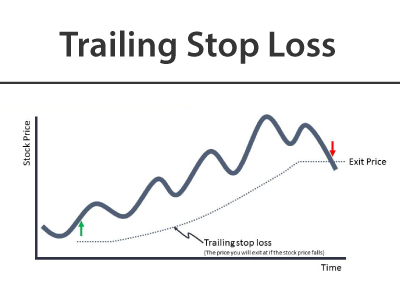

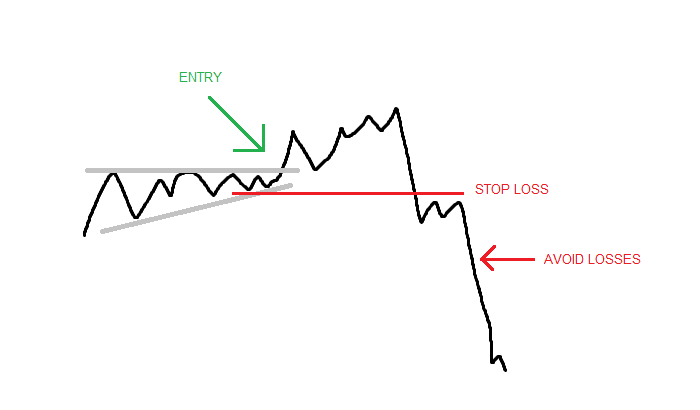

A trailing stop loss is an order set at a percentage or dollar amount away from the current market price. Unlike a fixed stop loss, it moves with the price, maintaining a set distance. This feature makes it ideal for volatile markets where prices can fluctuate significantly.

How It Works:

The stop loss level trails the market price.

Protects profits by adjusting as the price moves favourably.

Limits losses if the price moves unfavourably.

Benefits of Using a Trailing Stop Loss

Using a trailing stop loss offers several advantages for traders, including:

Profit Protection: Automatically locks in gains as the market price rises.

Risk Management: Limits potential losses by adjusting the stop loss level.

No Constant Monitoring: Allows traders to set and forget their stop loss orders.

Flexibility: Can be used in various market conditions and asset classes.

Strategies for Implementing a Trailing Stop Loss

To maximise the effectiveness of a trailing stop loss, consider these strategies:

1) Percentage-Based Trailing Stop

Set a trailing stop loss at a fixed percentage below the current market price. For example, if you set a 10% trailing stop and the stock price is £100, the stop loss would be at £90. As the price rises, the stop loss level adjusts accordingly.

2) Dollar-Based Trailing Stop

Similar to the percentage-based method, but using a fixed dollar amount instead. If you set a £5 trailing stop and the stock price is £50, the stop loss would be at £45. This approach is useful for assets with smaller price fluctuations.

3) Volatility-Based Trailing Stop

Use market volatility to determine the trailing stop level. More volatile assets may require a wider trailing stop to avoid premature sell-offs. Tools like the Average True Range (ATR) can help set appropriate levels based on historical price movements.

4) Time-Based Trailing Stop

Implement a time-based trailing stop, where the stop loss level is adjusted at specific intervals. This method can be particularly useful in markets with predictable patterns. For instance, you might adjust the trailing stop every hour or at the close of each trading day.

Real-World Examples

Case Study 1: An investor buys shares of a tech company at £100 each. Setting a 10% trailing stop, the stop loss level starts at £90. As the stock price rises to £120, the stop loss adjusts to £108, ensuring profits are protected. When the stock eventually drops to £108, the order is executed, and the investor secures a £20 profit per share.

Case Study 2: A trader invests in a cryptocurrency at £500. Using a £50 trailing stop, the stop loss level begins at £450. If the price reaches £700, the stop loss moves to £650, safeguarding the gains. When the price falls to £650, the stop loss order is triggered, locking in a £150 profit per coin.

Case Study 3: A forex trader sets a trailing stop of 20 pips on a currency pair trade. As the exchange rate increases by 50 pips, the stop loss level adjusts accordingly. If the market turns and the rate drops by 20 pips, the position is closed, and the trader retains the gains made during the favourable movement.

Conclusion

Trailing stop loss orders are effective tools for smarter trading. They offer profit protection, risk management, and flexibility without the need for constant monitoring. By understanding and implementing different strategies, traders can optimise their investments and navigate volatile markets more confidently.

Incorporating a trailing stop loss into your trading strategy can significantly enhance your ability to protect gains and limit losses. Experiment with different approaches and adjust based on your risk tolerance and market conditions to achieve the best results for your portfolio. Remember, the key to successful trading is not just about making profits but also about preserving them. A well-planned trailing stop loss strategy can be a game-changer in achieving your financial goals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.