Investing in gold has long been considered a prudent strategy for preserving wealth and diversifying an investment portfolio. As a tangible asset with intrinsic value, gold offers a hedge against inflation and economic uncertainty.

As of 2025, with economic uncertainties and market volatility, gold continues to attract seasoned investors. Thus, as a novice reading this, how does one start investing in gold?

Understanding the Appeal of Gold Investment

Before considering doing something, it is crucial to understand the appeal of it. In this instance, gold has maintained its allure as a valuable asset for centuries, primarily due to its intrinsic qualities and historical significance. Unlike paper currencies, gold's value is not directly tied to any single economy, making it a global store of value.

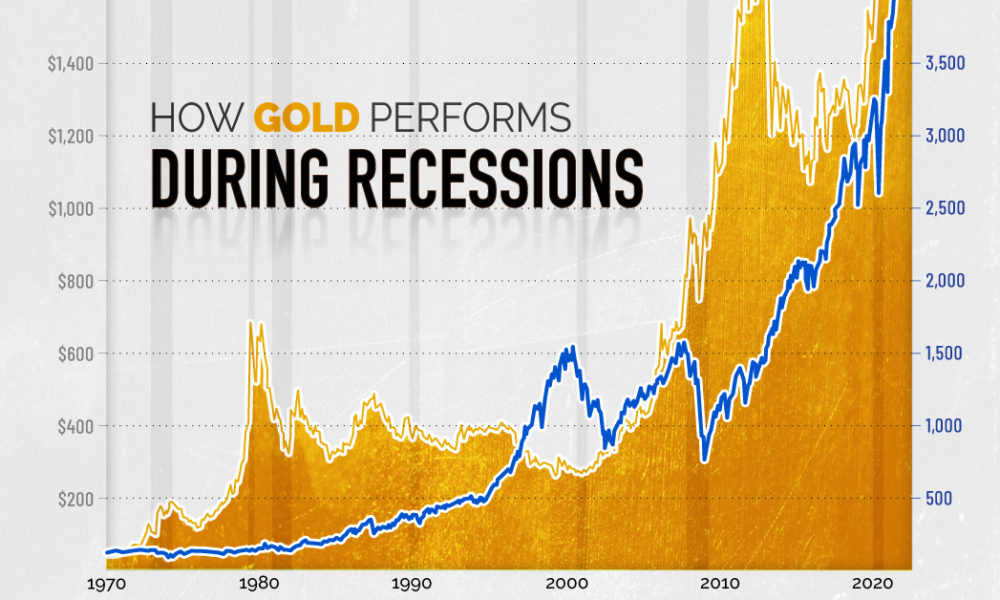

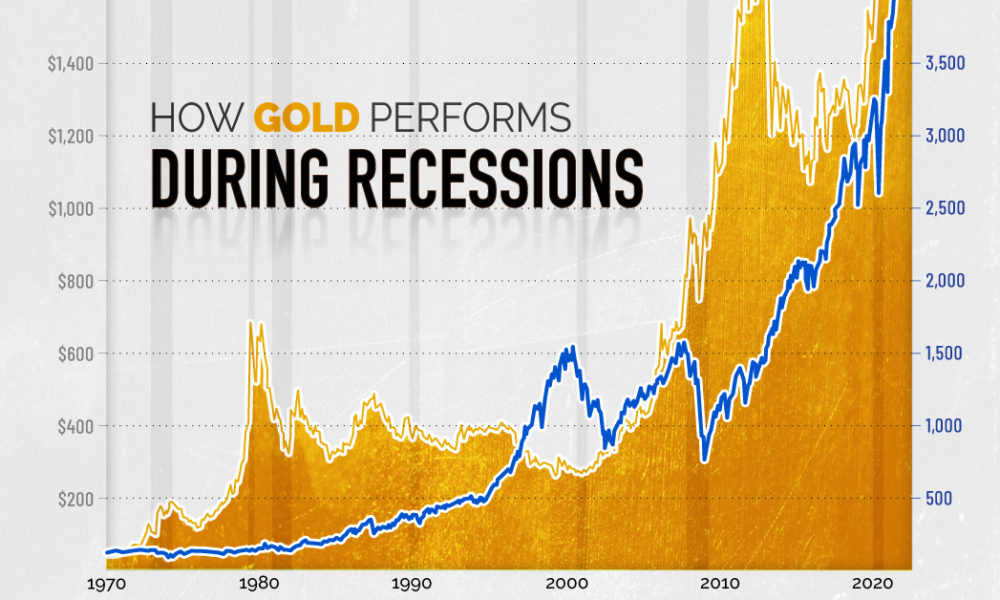

Therefore, investors often turn to gold during economic instability, inflation, or geopolitical tensions, viewing it as a safe-haven asset that can potentially hedge against market downturns.

For instance, during the 2008 financial crisis and the 2020 COVID-19 pandemic, gold prices experienced significant surges, reflecting its role as a refuge in turbulent times.

Factors to Consider Before Investing

Now you understand gold's appeal, it is time to consider some factors before investing in this supposedly "free money". For example, before adding gold to your investment portfolio, consider the following factors:

Investment Goals: Determine whether you seek short-term gains, long-term wealth preservation, or portfolio diversification.

Risk Tolerance: Understand that while gold is a safe-haven asset, its price can be volatile.

Market Conditions: Stay informed about economic indicators, inflation rates, and geopolitical events that can influence gold prices.

Costs and Fees: Be aware of transaction fees, storage costs, insurance, and management fees associated with gold investments.

Liquidity: Consider how easily you can convert your gold investment into cash when needed.

How to Invest in Gold: 6 Practical Steps to Follow

After understanding one's motives, we have no reason to stop you. However, to ease your journey, listed are six practical steps to follow on how to invest in gold:

Educate Yourself: Gain a thorough understanding of the gold market, including factors influencing gold prices, historical performance, and current market trends. This knowledge will enhance investment decisions and help you anticipate potential market movements.

Set a Budget: Decide how much of your portfolio you want to allocate to gold, keeping in mind diversification principles.

Choose a Reputable Dealer or Broker: Whether purchasing physical gold or financial instruments, selecting a trustworthy dealer or broker is paramount. Conduct due diligence by researching their credentials, customer reviews, and industry reputation to ensure a secure transaction.

Decide on the Form of Gold Investment: Based on your investment objectives, risk tolerance, and practical considerations, choose the most suitable form of gold investment. Each method has its pros and cons, so align your choice with your overall financial strategy.

Consider Storage and Insurance: If opting for physical gold, plan for secure storage solutions and appropriate insurance coverage to protect your investment from theft, loss, or damage. Professional storage services offer enhanced security but come with additional costs.

Monitor Your Investment: Regularly review the performance of your gold investment in the context of your overall portfolio and market conditions. Stay informed about economic indicators and geopolitical events that may impact gold prices, and be prepared to adjust your strategy as needed.

Exploring Methods of Investing in Gold

As we mentioned in step four, there are several avenues through which individuals can invest in gold, each with its unique characteristics, advantages, and considerations:

1) Physical Gold: Investing in physical gold involves purchasing tangible forms such as bullion bars, coins, or jewellery. This method offers direct ownership, and investors favoured it for its perceived security and tangibility. However, it necessitates considerations regarding storage, insurance, and authenticity verification.

Secure storage options include home safes or professional vault services, each with associated costs. Additionally, premiums over the spot price and potential liquidity challenges should be factored into the decision-making process.

2) Gold Exchange-Traded Funds (ETFs) and Mutual Funds: Gold ETFs and mutual funds present viable alternatives for those seeking exposure to gold without the complexities of physical ownership. These financial instruments invest in gold or gold-related assets and are traded on stock exchanges, offering liquidity and ease of transaction.

They allow investors to benefit from gold price movements without dealing with storage or insurance concerns. However, it's crucial to be aware of management fees and that owning shares in these funds does not equate to owning physical gold.

3) Gold Mining Stocks: Investing in shares of companies engaged in gold mining and production is another indirect method. The performance of these stocks is influenced not only by gold prices but also by company-specific factors such as operational efficiency and management practices.

While they offer the potential for dividends and capital appreciation, they also carry risks associated with the mining industry and broader stock market fluctuations.

4) Gold Futures and Options: For more sophisticated investors, gold futures and options provide opportunities to speculate on the future price of gold. These derivative instruments can offer substantial returns but come with high risk due to their complexity and leverage.

We do not recommend this method as only experienced investors who deeply understand the commodities market and risk management strategies could manage the volatility.

5) Gold IRAs: Individual Retirement Accounts that include gold allow investors to hold physical gold or gold-backed assets within a tax-advantaged retirement account. Specific rules and fees apply, so consult with a financial advisor.

Tax Implications and Regulatory Considerations

Lastly, be aware of the tax implications associated with gold investments, which can vary depending on the form of investment and jurisdiction. For example, profits from the sale of physical gold may be subject to capital gains tax, while certain gold ETFs might have different tax treatments.

Consult with a tax professional to understand the specific obligations and benefits applicable to your situation.

Conclusion

In conclusion, investing in gold can be a valuable component of a diversified investment strategy, offering potential benefits such as wealth preservation and risk mitigation. By thoroughly understanding the various methods of gold investment, assessing your financial goals and risk tolerance, and adhering to best practices, it's not a question of how to invest in gold but why I didn't start sooner.

As with any investment, due diligence, continuous education, and prudent management are key to navigating the gold market successfully.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.