If you've been exploring trading, especially in markets like stocks or forex, you've probably come across the term Fair Value Gap (FVG). It's one of those concepts that can sound a bit complicated at first, but at its core, it's all about price movements. A Fair Value Gap happens when the market moves so quickly that buyers and sellers don't have time to agree on a fair price, leaving behind a noticeable gap in the chart.

While these gaps can be a signal of potential opportunities, they also come with their own set of risks. Understanding how FVGs work is key to spotting potential trades, but also crucial for managing the risks that come with them.

What is Fair Value Gap (FVG)?

At its core, the Fair Value Gap is a price discrepancy that forms when an asset's price shifts rapidly, often due to news, events, or shifts in market sentiment. Essentially, this gap represents a price level where market participants haven't had the chance to settle on a proper equilibrium. The gap is usually seen in a price chart as an area where there's no trading activity, or very little, between two price points.

In an ideal scenario, prices in a healthy market gradually move up or down as buyers and sellers constantly adjust their positions. However, when an asset's price suddenly shifts due to external factors—like an earnings report, economic announcement, or geopolitical event—it can leave behind a "gap." This is where the term Fair Value Gap comes into play. Traders look for these gaps to identify potential opportunities for entering or exiting positions, hoping that the price will return to fill the gap or move in the expected direction.

In an ideal scenario, prices in a healthy market gradually move up or down as buyers and sellers constantly adjust their positions. However, when an asset's price suddenly shifts due to external factors—like an earnings report, economic announcement, or geopolitical event—it can leave behind a "gap." This is where the term Fair Value Gap comes into play. Traders look for these gaps to identify potential opportunities for entering or exiting positions, hoping that the price will return to fill the gap or move in the expected direction.

How FVG Affects Asset Pricing and Trading

Fair Value Gaps can have a major impact on how assets are priced in the short and long term. When a gap appears, it indicates that there has been a swift change in price without sufficient market consensus. This often occurs during high volatility, which is why FVGs are most commonly spotted during moments of major news announcements or significant market shifts.

For traders, this can be both an advantage and a challenge. On one hand, gaps can signal that the market has overreacted, creating opportunities to capitalise on potential reversals. On the other hand, gaps also represent a risk—especially if the price continues to move in the direction of the gap without "filling" it, potentially leading to more volatility.

Because gaps often occur during significant market events, they tend to be highly relevant for day traders and swing traders, who rely on short-term price movements. They can also serve as indicators for longer-term investors, helping them spot areas where price corrections are likely to occur.

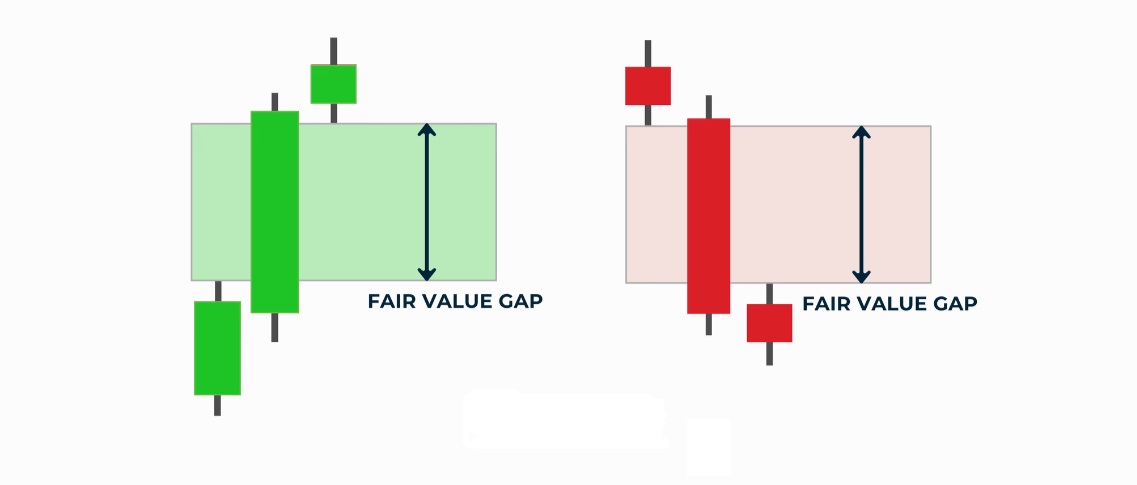

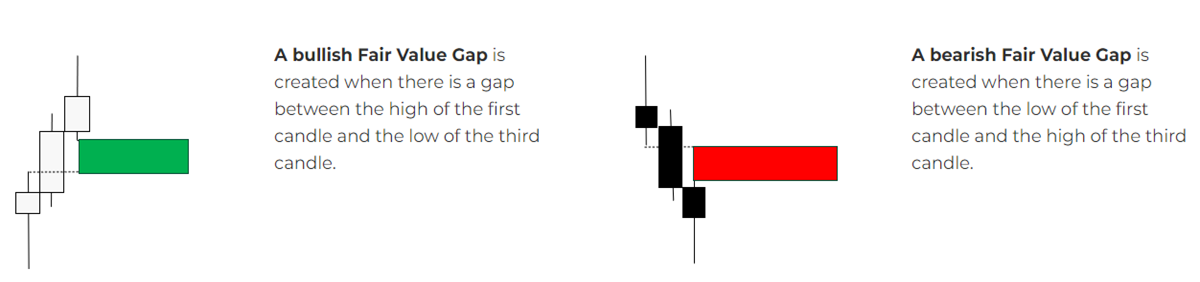

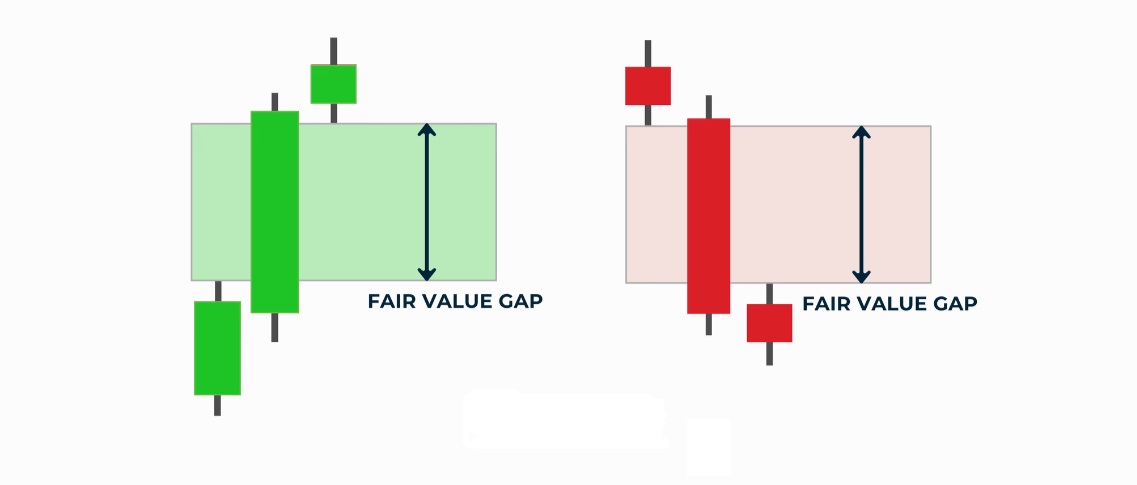

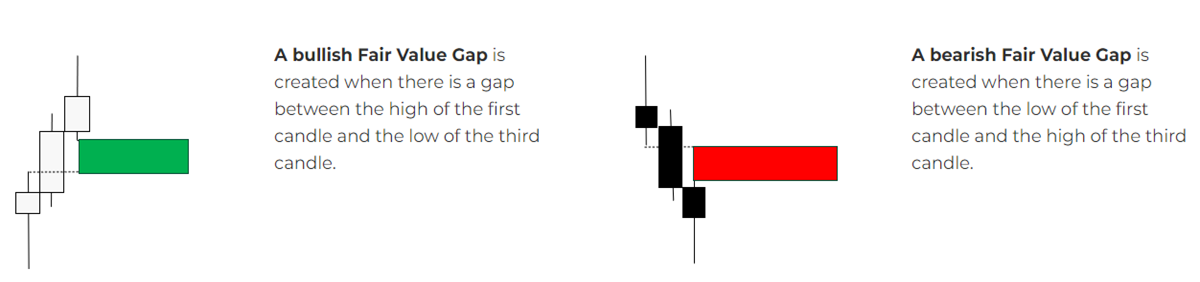

Identifying FVG in Market Charts

Now that we understand what a Fair Value Gap is and how it can impact prices, let's talk about how you can spot one. Typically, identifying a gap on a chart is straightforward. When looking at a candlestick or bar chart, the gap is simply an empty space between the closing price of one candle and the opening price of the next.

To put it into perspective, imagine the price of a stock suddenly jumps 10% higher from one day to the next. If the price jump happens without any trades taking place between the closing price of the previous day and the opening price of the next, this creates a gap. Traders would refer to this as a Fair Value Gap, as the gap represents an area where prices were not allowed to settle.

You'll also want to keep an eye on the size of the gap. A small gap may suggest a brief market reaction, while a larger gap could indicate a more substantial shift in sentiment. For a beginner, identifying gaps can take some practice, but once you're familiar with your charting tools, it's relatively easy to spot them.

Common FVG Trading Strategies

Once you know how to identify a Fair Value Gap, the next step is to understand how to trade based on this information. Traders often use Fair Value Gaps in combination with other technical indicators to build their trading strategies. One common strategy is waiting for the price to "fill" the gap.

When the price gaps up or down, many traders expect the market to eventually return to the gap area, a phenomenon called "gap filling." This happens because the market wants to find balance again, and the gap represents an imbalance that needs correction. For instance, if a stock jumps significantly in price, many traders will anticipate that the price will move back to the gap to test that level before moving further.

Another approach is to trade in the direction of the gap. This strategy relies on the idea that the market may continue moving in the direction of the gap, especially if the gap occurs after a significant news event or catalyst. If the gap is caused by strong bullish or bearish sentiment, traders might look for confirmation through other indicators (like moving averages or RSI) before entering a trade.

While gap filling and trend continuation are popular strategies, remember that trading with FVGs can be risky. The market doesn't always behave predictably, and gaps don't always fill, especially in cases of strong momentum.

While gap filling and trend continuation are popular strategies, remember that trading with FVGs can be risky. The market doesn't always behave predictably, and gaps don't always fill, especially in cases of strong momentum.

Risks and Benefits of Trading with FVG

As with any trading strategy, there are both risks and benefits to trading based on Fair Value Gaps. The primary benefit is the potential for high rewards. Because gaps often occur during periods of high volatility, they can present opportunities for significant price moves. If you can correctly predict how the gap will behave, the profit potential can be considerable.

However, there are also risks. The biggest risk is that the gap may not fill, and the price could continue moving away from the gap, leading to potential losses. Moreover, gaps often appear during volatile market conditions, meaning that they can be prone to false signals or abrupt price swings. Traders who are inexperienced may find themselves caught in unpredictable price movements.

Another challenge is determining the right entry and exit points. Since gaps are a product of fast market movements, timing is crucial. Entering too early or too late can lead to missed opportunities or losses, making it important to have a well-thought-out strategy and Risk Management Plan in place.

In conclusion, the Fair Value Gap is an intriguing concept that plays a crucial role in market price behaviour. While identifying and trading FVGs can offer significant opportunities, especially in fast-moving markets, it's essential to approach with caution. As a beginner, it's important to practice spotting gaps, understand the potential strategies, and, most importantly, manage risks carefully. With experience and patience, Fair Value Gaps can become a valuable tool in your trading toolkit, helping you navigate the dynamic world of financial markets with greater insight.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

In an ideal scenario, prices in a healthy market gradually move up or down as buyers and sellers constantly adjust their positions. However, when an asset's price suddenly shifts due to external factors—like an earnings report, economic announcement, or geopolitical event—it can leave behind a "gap." This is where the term Fair Value Gap comes into play. Traders look for these gaps to identify potential opportunities for entering or exiting positions, hoping that the price will return to fill the gap or move in the expected direction.

In an ideal scenario, prices in a healthy market gradually move up or down as buyers and sellers constantly adjust their positions. However, when an asset's price suddenly shifts due to external factors—like an earnings report, economic announcement, or geopolitical event—it can leave behind a "gap." This is where the term Fair Value Gap comes into play. Traders look for these gaps to identify potential opportunities for entering or exiting positions, hoping that the price will return to fill the gap or move in the expected direction. While gap filling and trend continuation are popular strategies, remember that trading with FVGs can be risky. The market doesn't always behave predictably, and gaps don't always fill, especially in cases of strong momentum.

While gap filling and trend continuation are popular strategies, remember that trading with FVGs can be risky. The market doesn't always behave predictably, and gaps don't always fill, especially in cases of strong momentum.