German wages rose at a record annual pace of 6.6% in the second quarter,

fuelling concerns that euro zone inflation will stay high due to rising labour

costs.

That marks the biggest annual increase ever recorded which exceeded the

country’s consumer price growth rate over the same period for the first time

since 2021.

While rising wage may strengthen consumer spending in favour of the economy,

it puts the ECB under greater strain to tighten its monetary policy next

month.

Nevertheless some factors behind the jump were erratic, such as increases in

the minimum wage and one-off bonuses. It is now too early to tell a wage-price

spiral is shaping up.

Additionally, the GfK said that German consumer confidence index fell from

-24.6 to -25.5 this month, firmly below positive pre-pandemic levels.

Lending to firms in the euro zone expanded by 2.2% year-on-year in July, down

from 3.0% a month earlier, according to an ECB report. The odds of a contraction

in the bloc this quarter is growing.

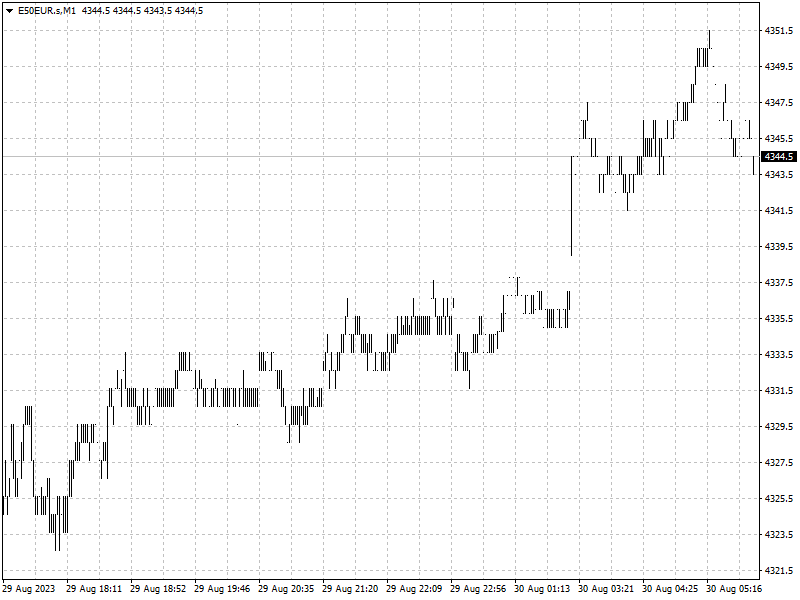

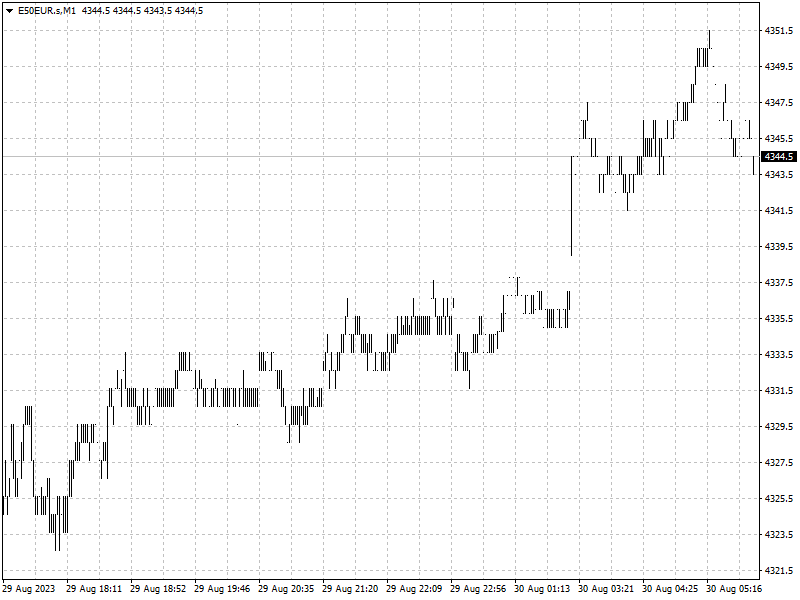

The EURO STOXX 50 notched largest gain in a month, up six of the past seven

trading days. Technical indicators are flashing bullish signals but we need

improving economic data to drive a sustainable rally.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.