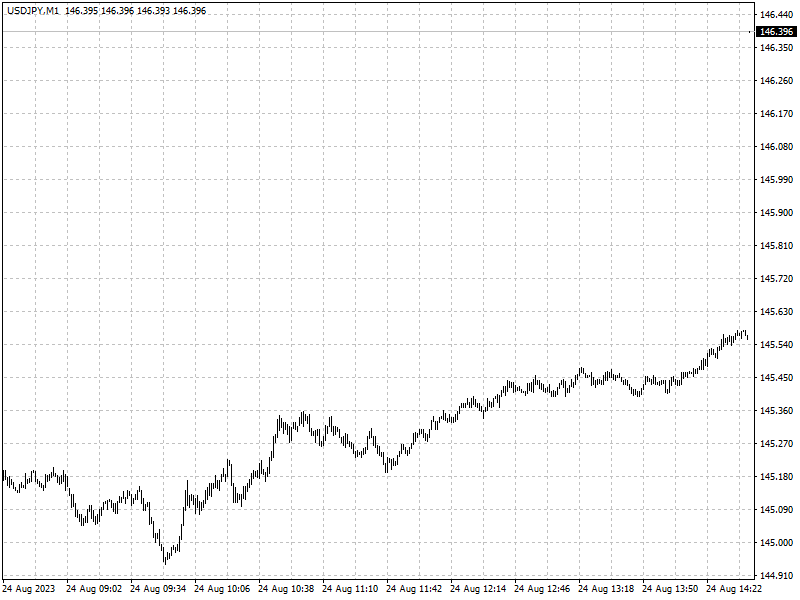

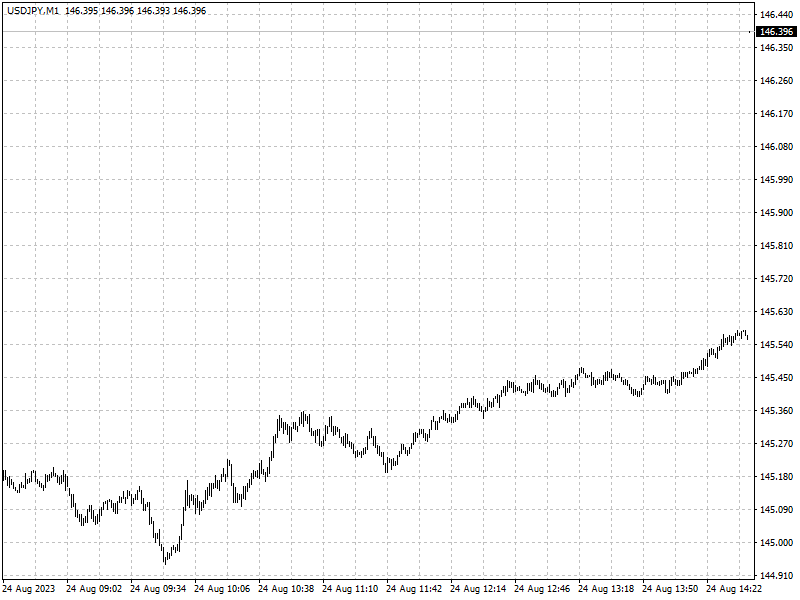

There was little surprise in Jackson Hole as central bankers signaled

interest rates will likely stay higher for longer. The Fed Chair Jerome Powell

indicated that the US could hike interest rates again.

In his address at the symposium, he said that the Fed is ‘prepared to raise

rates further if appropriate,’ even as he stressed that monetary policy will

continue to be set meeting by meeting.

Meanwhile, ECB President Christine Lagarde warned that they are ‘extremely

attentive that greater volatility in relative prices does not creep into

medium-term inflation through wages repeatedly chasing prices’.

The German economy has struggled for three consecutive months and a recent

surveys point to euro zone’s fresh downturn, which raises doubts whether the ECB

could have more rate hikes without causing unbearable pain for businesses and

individuals.

However, Lagarde added that the inflation number would ‘look significant

different from what we have at the moment though dependence on Russian oil and

proximity to the war created unique challenges with regards to taming price

pressures.

Eurozone inflation has halved from last year’s peak of 10.6 per cent, and

economists polled by Reuters forecast it to slow to 5 per cent in August. But

the reading stays well above that in the US which has dipped below 4%.

BOJ Governor Kazuo Ueda did not comment on foreign-exchange rates, but said

price growth remains slower than the central bank’s goal. A widely-anticipated

intervention now seems more unlikely as he tired to defend the existing

ultra-low monetary policy.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.