Gold hovers around one-month high on weak data

2023-08-31

Summary:

Summary:

Gold gained for a 3rd day, backed by weak economic data that might make the Fed lean towards a long-awaited pause.

Gold rose for a third straight session on Wednesday, supported by a fresh

batch of weak economic data which could keep the Fed tilted towards a

long-awaited pause.

Benchmark 10-year yields dropped to their lowest since August 11 while the

dollar slipped to a two-week low.

US private sector added 177,000 jobs in August, well below the estimate for

195,000 and down sharply from July, according to ADP’s monthly report.

This Friday’s jobs report for August will be closely watched for further

confirmation that the tightness in the labour market is ebbing.

Meanwhile second quarter growth rate has been revised down to a 2.1%

annualised pace from 2.4% due to less inventory and non-residential fixed

investment.

Bets on the Fed leaving rates unchanged in September rose to nearly 91%, from

88.5% before the data, while bets of a pause in November rose to nearly 59% from

52% a day earlier, according to the CME Group’s FedWatch tool.

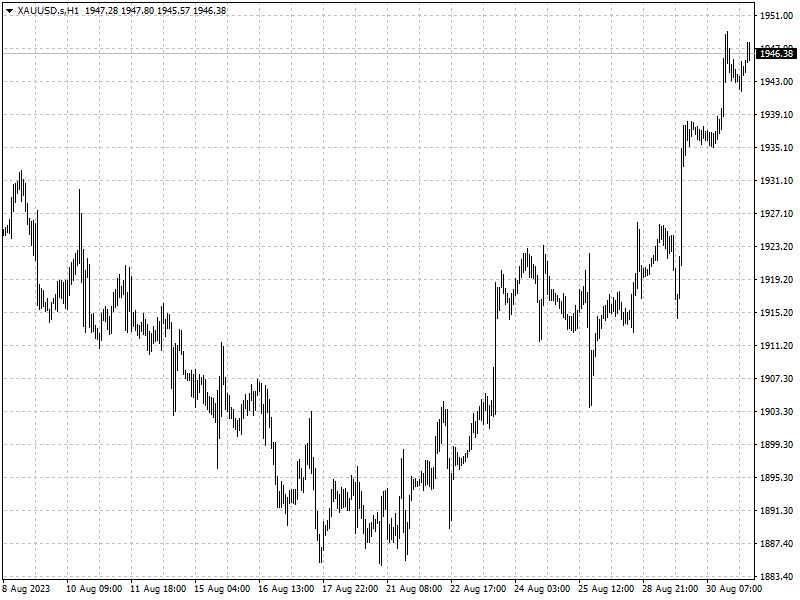

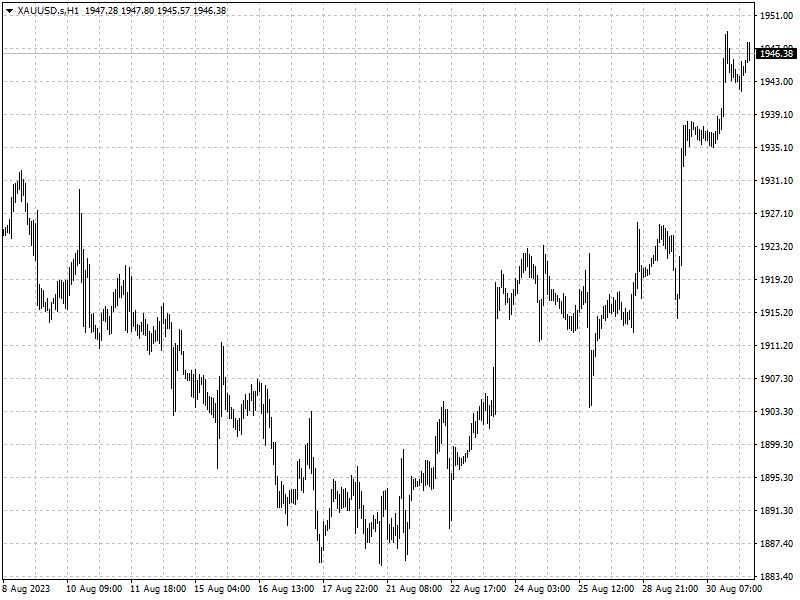

Gold broke out from the upper end of the narrow channel which formed from

late July before dipping into the area around the lows of June and July.

The precious metal is now trading around its one-month high but a climb back

above 1,980 is needed to pave the way for a continued bullish run to retest

2,000 level.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.