Stagflation looms large in Europe

2023-09-01

Summary:

Summary:

Euro weakened as ECB's Isabel Schnabel, known for hawkish stance, cited weaker-than-expected euro zone growth.

The euro ebbed on Thursday after ECB rate-setter Isabel Schnabel, one of the

most hawkish members at the ECB, said euro zone growth was weaker than

predicted.

Overall inflation in the bloc was unchanged at 5.3% in August, defying

expectations for a drop to 5.1% as energy costs rose sharply over the month,

Eurostat data showed.

Services inflation edged lower to 5.5% from 5.6% this month, while other

figures showed unemployment holding at a record-low 6.4% in July.

A sentiment survey by the European Commission released on Wednesday showed

worsening for a fourth month in the wake of a slew of weak data.

Policymakers’ concern that ‘the economy might be entering a phase of

stagflation’ has caused a quandary as they weigh whether pressures are too

persistent to risk a pause in tightening.

Traders are pricing in a 30% chance of another 25bps hike in September while

the implied chance of one final ECB increase this year fell to 70%.

The UK is feeling the same pain. After robust wage data in August, Fitch

Ratings observed an ‘increasing risk that the UK will experience a period of

stagflation — with low growth and rising unemployment coinciding with high

inflation.’

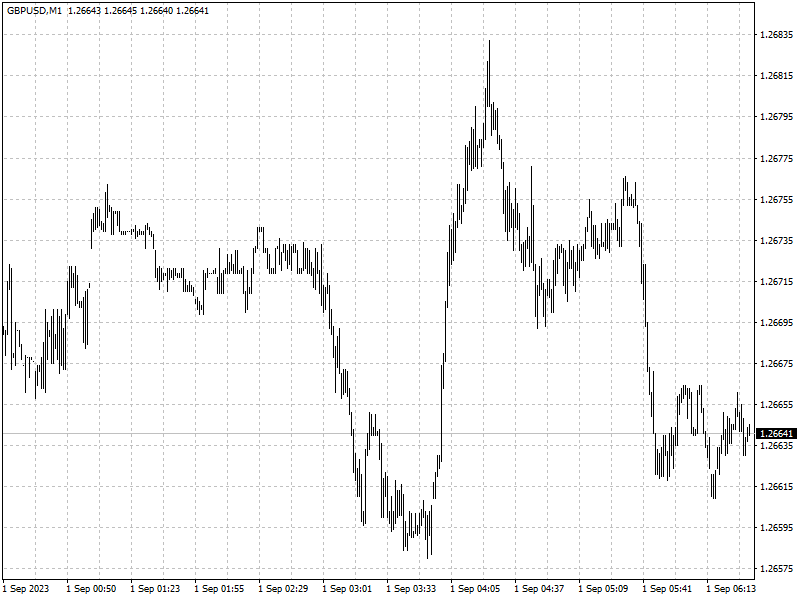

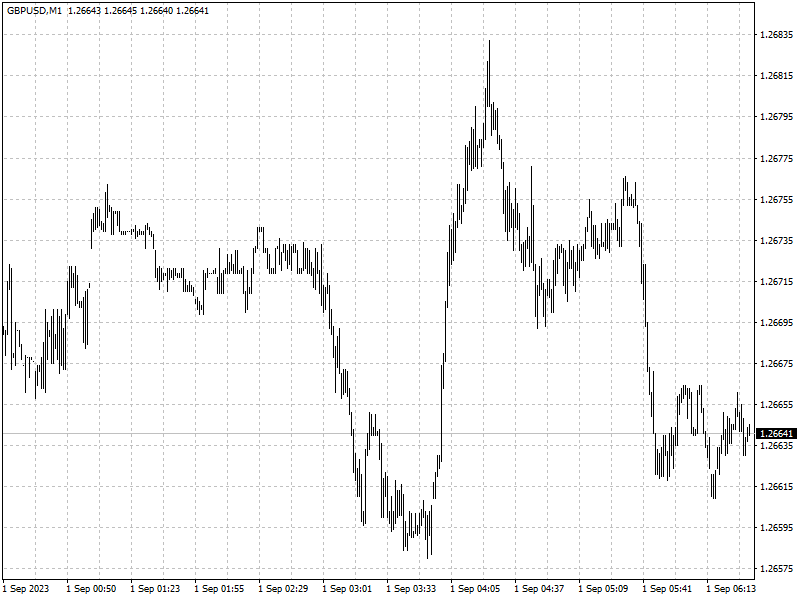

Bets on the country’s peak rate have been slashed to around 5.80%, compared

to a 6.60% peak in early July. Sterling has slipped from a recent peak of 1.3142

seven weeks ago to around 1.267 against the US dollar.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.