Bond investors change their mind after NFP report

2023-09-04

Summary:

Summary:

US job market finally shows enough cracks to embolden some of the world’s largest bond investors to bet the tightening cycle will end sooner than later.

US job market finally shows enough cracks to embolden some of the world’s

largest bond investors to bet the tightening cycle will end sooner than later,

around 1.5 years after the Fed began to increase interest rates.

The Labor Department's report showed the August unemployment rate rose to

3.8% while wage growth slowed. Nonfarm payrolls rose more than expected, though

data for July was revised lower to 157,000 job additions.

The jobs data leaves ‘the bond market comfortable with the view that the Fed

is on hold for now and maybe done for the cycle,’ said Michael Cudzil, a

portfolio manager at PIMCO. ‘If they are done for the hiking cycle, it’s then

about looking at the first cut.’

The employment reports looked like ‘the beginning of the end of the robust

job market and the countdown for how long can the Fed stay on hold,’ said George

Goncalves, head of US macro strategy at MUFG.

Rosenberg, a portfolio manager of BlacRock, said the Fed has to lower

borrowing costs to avoid the real rate – or inflation-adjusted policy rate –

from tightening. ‘It is about restrictive policy for longer, not higher for

longer.’

Financial markets are pricing in a 93% likelihood of such a pause this month,

according to CME's FedWatch tool. But the greenback registered its seventh

consecutive weekly gain.

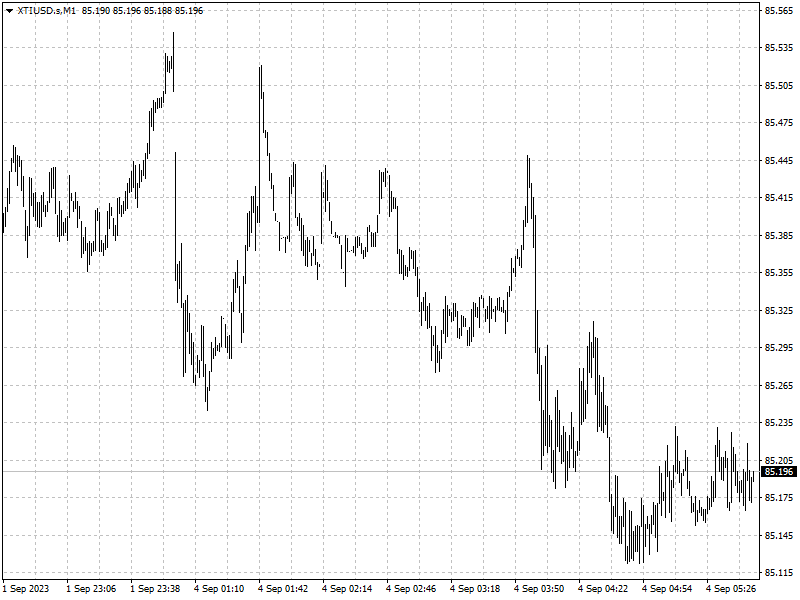

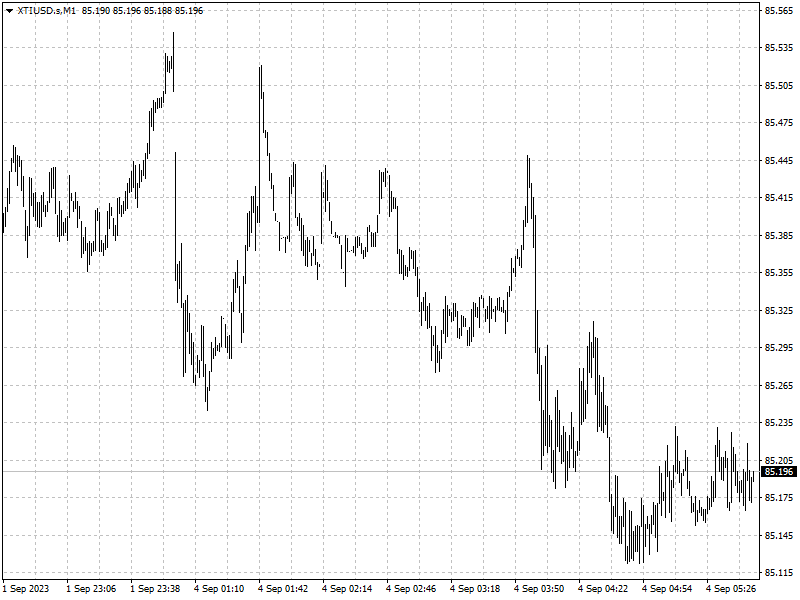

Oil prices jumped to their highest level in over seven months as China’s

manufacturing activity expanded in August and Russia said last week hinted at

further supply cut. A clearance above $87.25 will decisively validate short-term

bullish momentum.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.