Oil prices edged higher on Monday on expectations that OPEC+ would keep

supplies tight and speculation that the Fed will cease its aggressive interest

rate hike campaign.

Both benchmarks have bounced back from their June lows with Brent adding

about 3 % and WTI advancing more than 6.6% since the beginning of the year.

saudi arabia is widely expected to extend its voluntary 1 million bpd cut for

a fourth consecutive month into October.

The kingdom’s crude exports stood at 5.47 million bpd in the first 27 days of

August, the lowest level since April 2021, UBS said last week.

Global Crude Oil supplies are expected to improve in the next six to eight

weeks because of refinery maintenance, although sour crude will stay tight, said

Russell Hardy, chief executive of the world's largest independent oil trader,

Vitol.

China has been taking advantage of price cycles to build inventories even it

is pushing for electrification and plans to run its electric vehicle fleet on

domestic coal-fired power, he added.

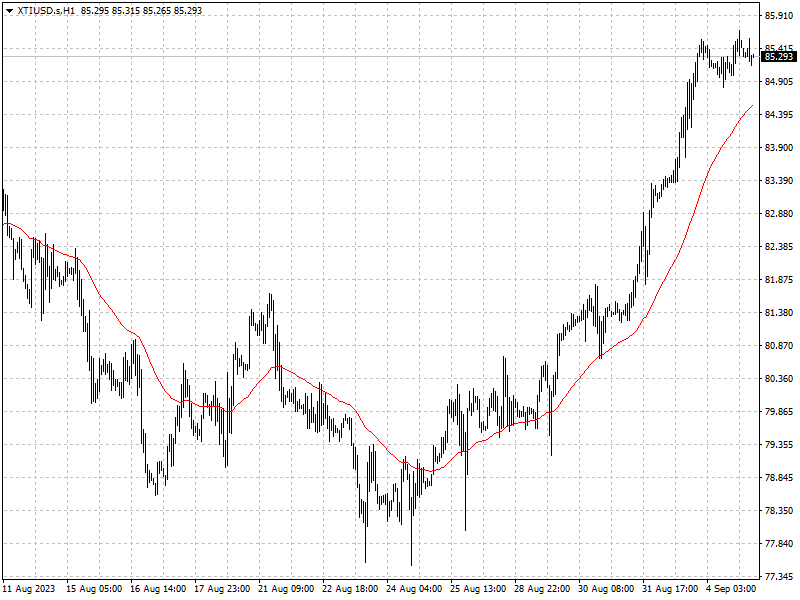

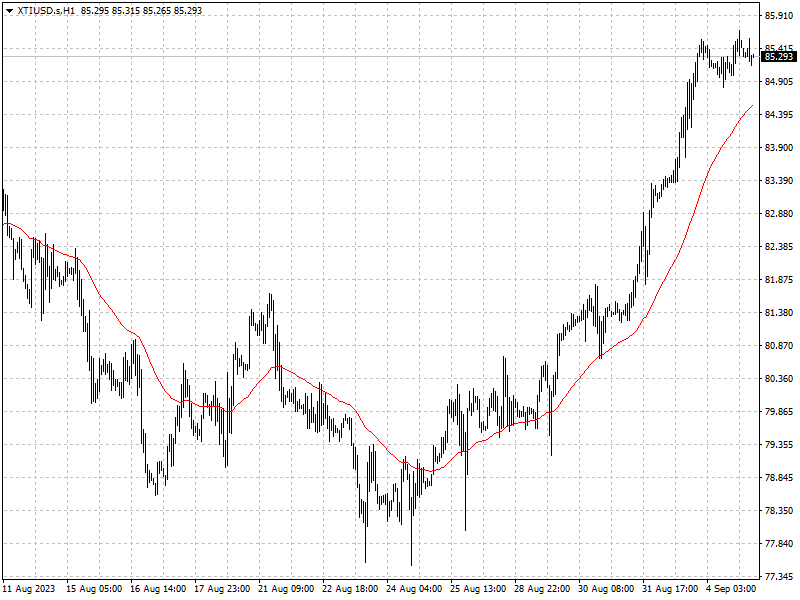

WTI oil settled near the important resistance. RSI edges close to the

overbought territory, but there is enough room for animal spirits without signs

of profit-taking.

The bullish trend scenario that has been supported by the EMA50 since late

August will remain valid and active in the short term.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.