EBC Forex Snapshot

21 Nov 2023

The dollar index fell to its lowest in more than two months on Monday,

continuing its downtrend as investors weighed peak interest rates and priced in

a greater than 50% chance of a cut by May.

Richmond Fed President Thomas Barkin said inflation is likely to remain

"stubborn" and force the central bank to keep interest rates higher for longer

than investors currently anticipate.

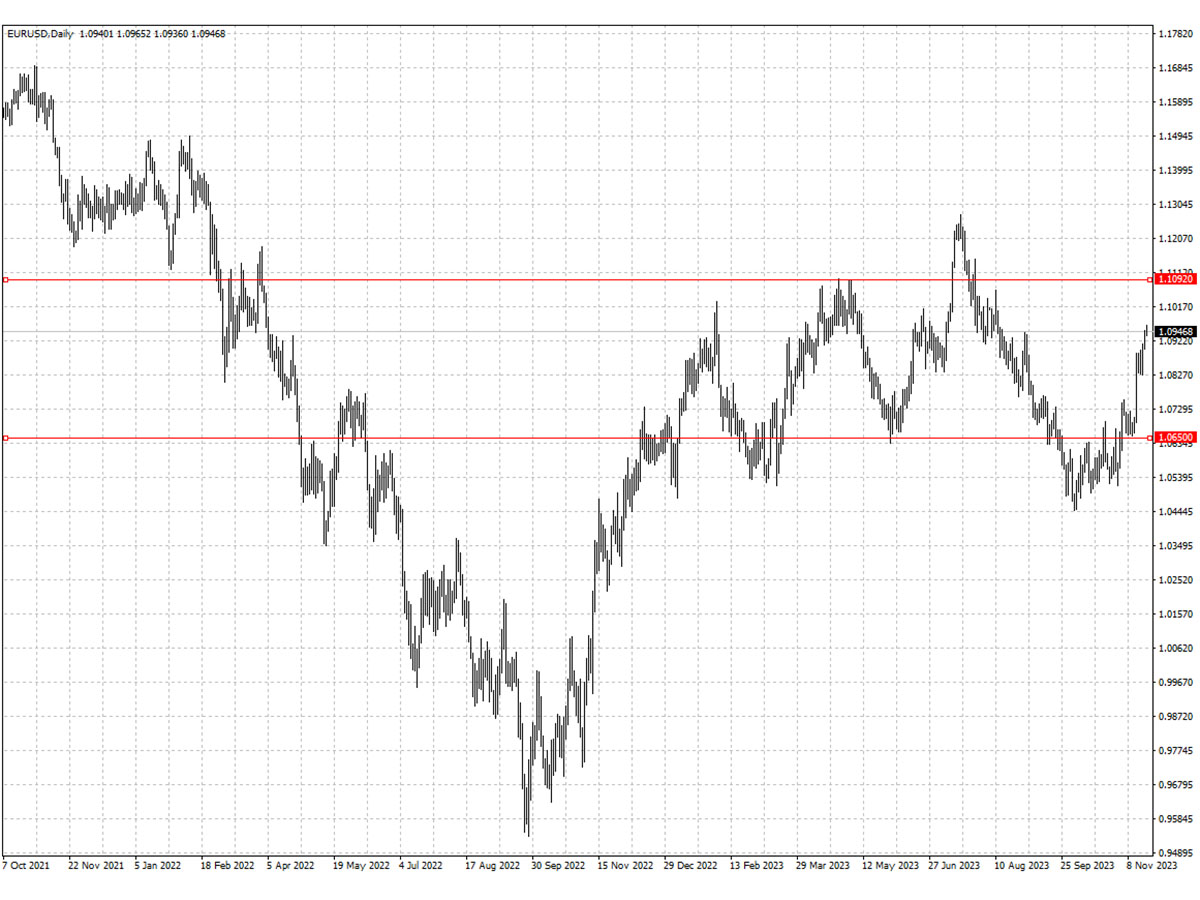

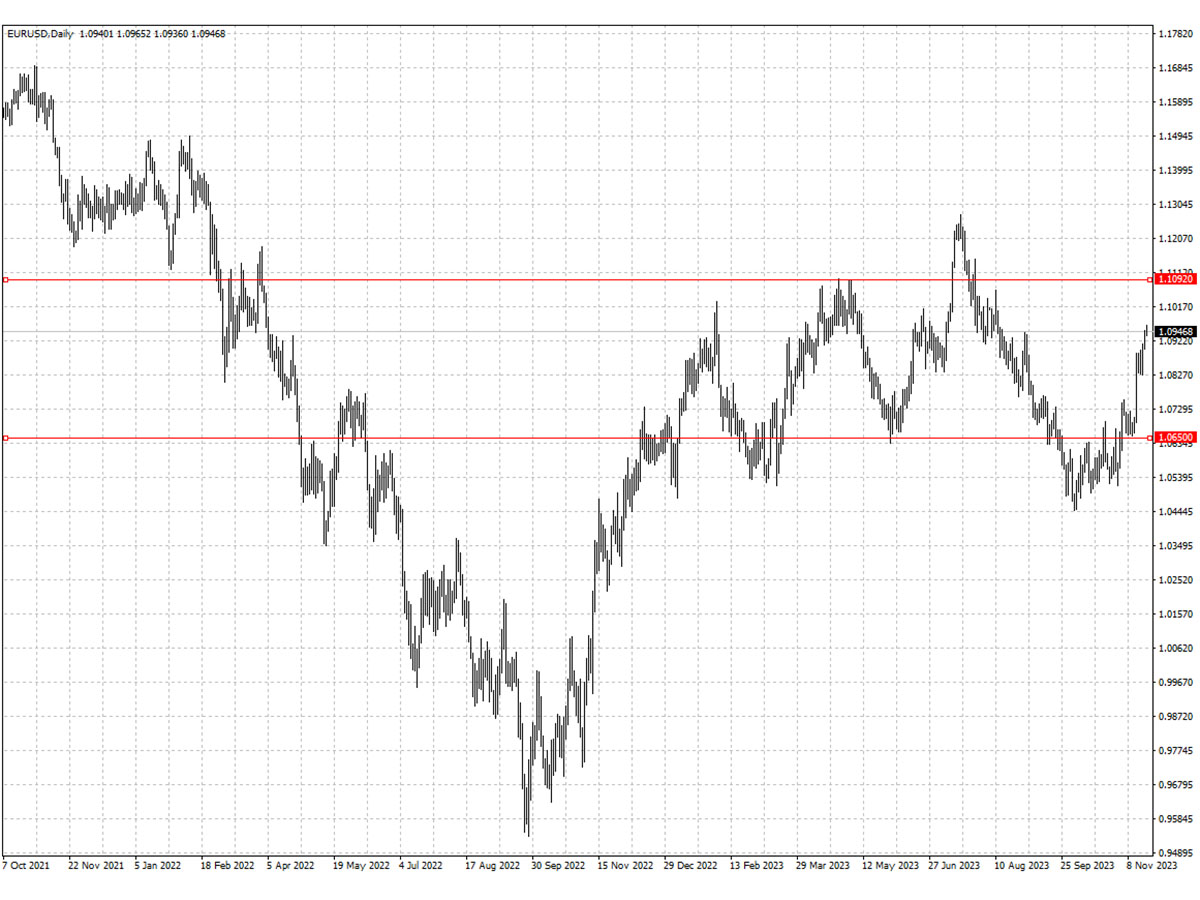

The euro hit its high since mid-Aug against the dollar on expectations that

the ECB may end tightening cycle later than the Fed. Moody’s unexpected upgrade

of Italy’s debt outlook also helped.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 13 Nov) |

HSBC (as of 21 Nov) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0517 |

1.0769 |

1.0650 |

1.1092 |

| GBP/USD |

1.2037 |

1.2428 |

1.2223 |

1.2654 |

| USD/CHF |

0.8745 |

0.9338 |

0.8744 |

0.9032 |

| AUD/USD |

0.6270 |

0.6522 |

0.6389 |

0.6650 |

| USD/CAD |

1.3640 |

1.3899 |

1.3601 |

1.3873 |

| USD/JPY |

147.43 |

151.95 |

146.83 |

150.90 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.