Global equity markets and Treasury yields rose on Monday as investors braced

for interest rate decisions from key central banks as well as corporate earnings

that may shed light on the state of the economy.

The Fed will raise rates by 25bps this week to wrap up its tightening cycle,

according to CME Group data. The ECB is expected to maintain a hawkish

stance.

Oil prices rose by more than 2% to a near three-month high buoyed by

tightening supply, rising U.S. gasoline demand, hopes for Chinese stimulus

measures and technical buying.

Commodities

Gold priced in euros hit its highest since July 5 earlier in the day. The

200-day Moving Average had been a key point of technical resistance for both oil

benchmarks since August 2022.

Oil's rise has reflected ‘tightening conditions as Saudi oil output cuts

impact the market ... even as summer demand has been somewhat stronger for

gasoline and jet fuel,’ Citi Research said in a note.

However, the global economic outlook remains mixed. In the U.S., business

activity slowed to a five-month low in July, dragged down by decelerating

service-sector growth, but the data was better than similar surveys out of

Europe.

In the euro zone, business activity shrank much more than expected in as

demand in the bloc's dominant services industry declined while factory output

fell at the fastest pace since COVID-19 first took hold, a survey showed.

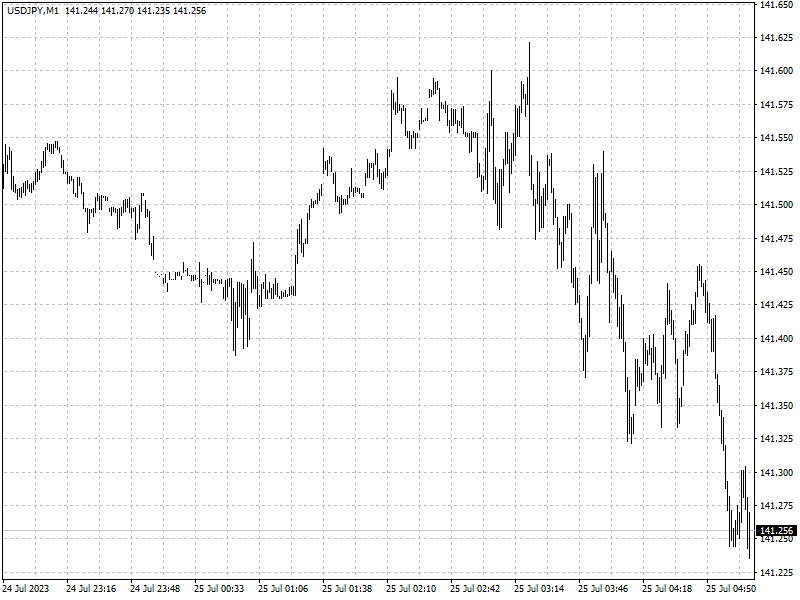

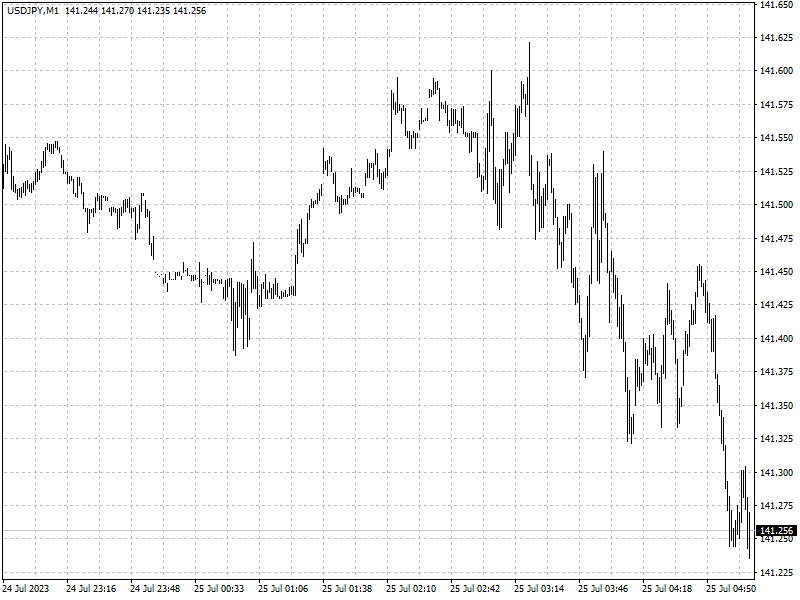

Forex

The BOJ is the most likely of the three central banks to throw up a

market-moving surprise, traders say, with a tweak to its yield curve control

policy seen as a possibility.

Last Friday the Japanese currency dived to as weak as 141.92 per dollar, also

sliding on crosses, following a Reuters report that the BOJ was leaning towards

keeping its yield curve control policy unchanged, though volatility gauges have

spiked as the meeting looms.