The dollar hits a two-month low - EBC Daily Snapshot

2023-11-20

Summary:

Summary:

The dollar slid to a two-month low on Monday, extending a downtrend from last week as traders reaffirmed their belief that US rates have peaked.

EBC Forex Snapshot

20 Nov 2023

The dollar slid to a two-month low on Monday, extending a downtrend from last

week as traders reaffirmed their belief that US rates have peaked.

Focus now turns to when the first rate cut could occur, with futures pricing

in a 30% chance that the Fed could begin to lower rates as early as March,

according to the CME FedWatch tool.

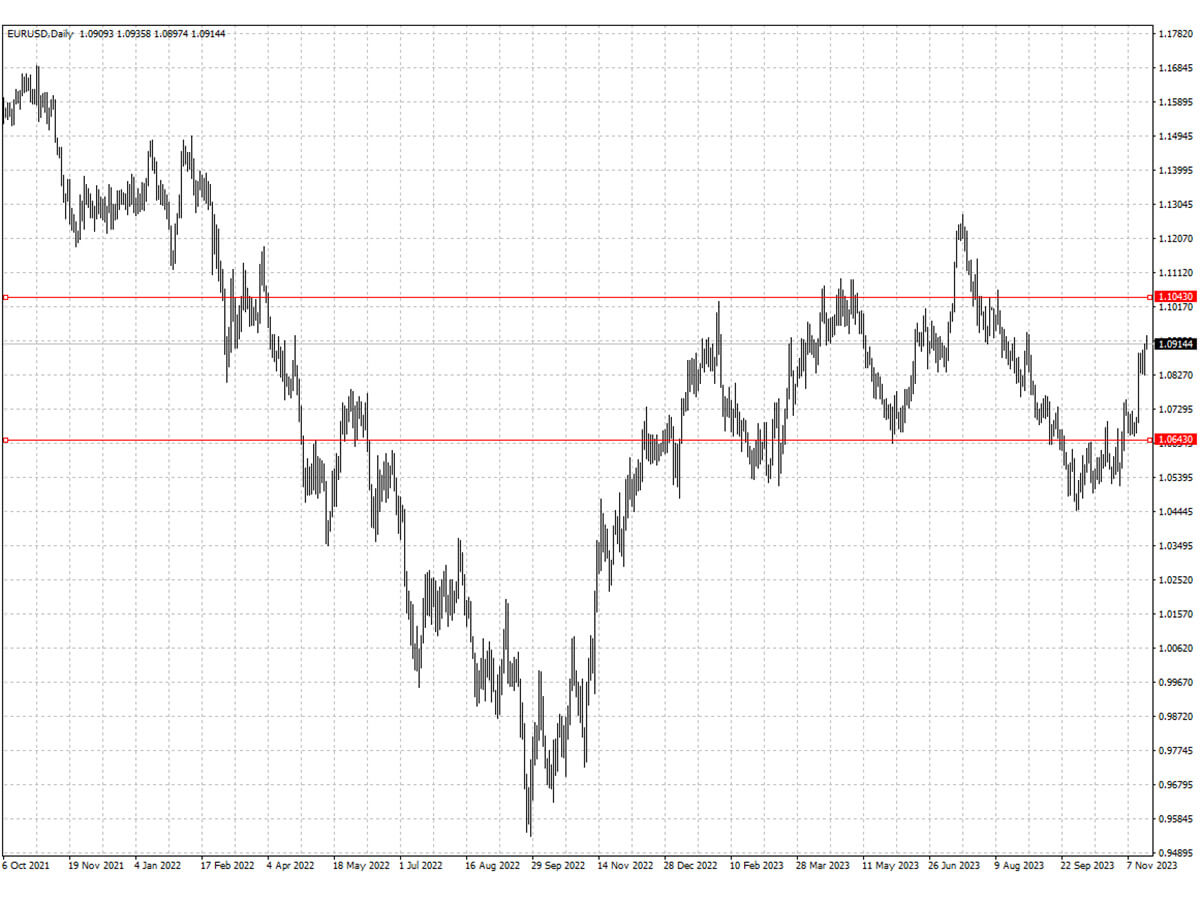

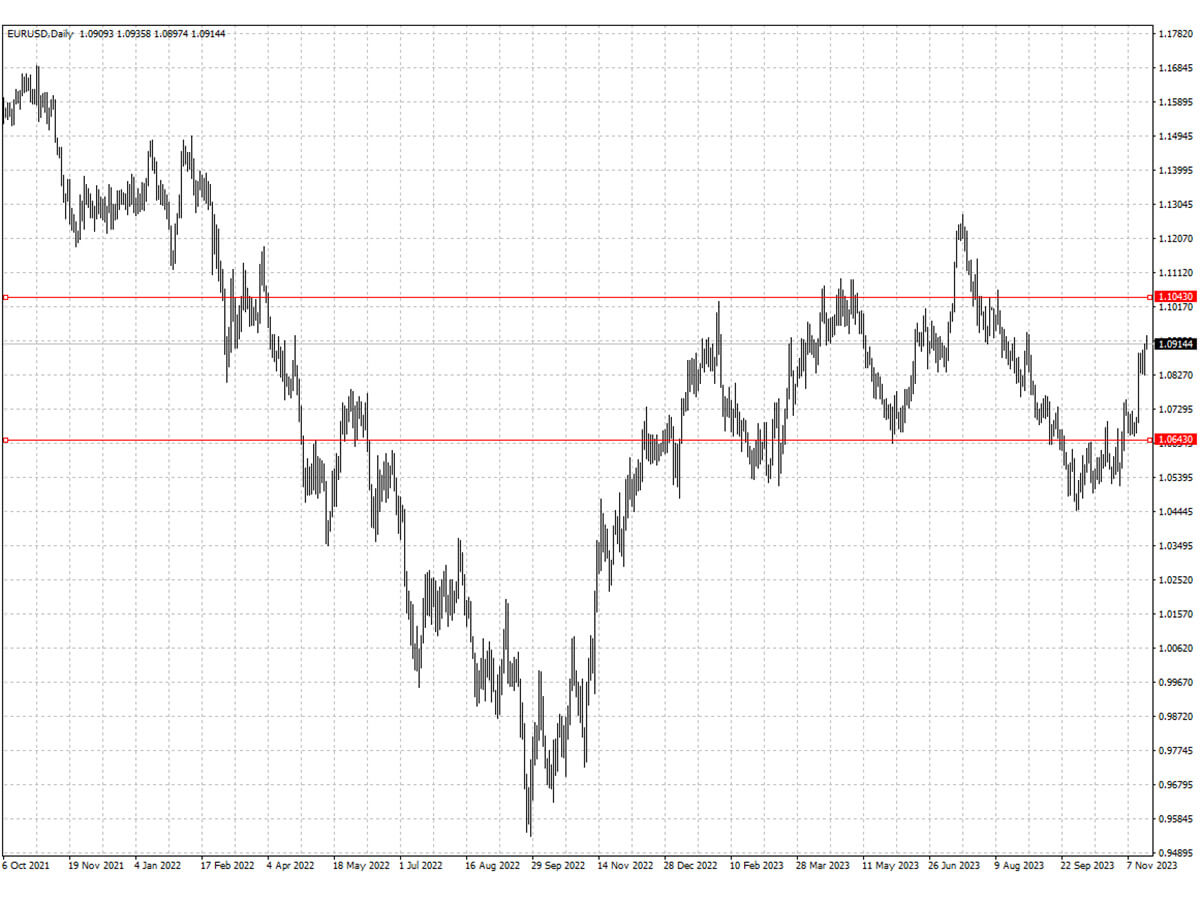

The euro hit its highest since August. ECB President Christine Lagarde said

last week that the EU needs a capital markets union to raise money needed to

meet the challenge confronting the bloc.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 13 Nov) |

HSBC (as of 20 Nov) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0517 |

1.0769 |

1.0643 |

1.1043 |

| GBP/USD |

1.2037 |

1.2428 |

1.2201 |

1.2613 |

| USD/CHF |

0.8745 |

0.9338 |

0.8763 |

0.9029 |

| AUD/USD |

0.6270 |

0.6522 |

0.6366 |

0.6595 |

| USD/CAD |

1.3640 |

1.3899 |

1.3597 |

1.3869 |

| USD/JPY |

147.43 |

151.95 |

148.45 |

151.36 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.