People study economic cycles in order to better participate in financial investments during cyclical fluctuations. And this can't be avoided with the Kondratiev cycle, which is different from other cycles and belongs to the Great Cycle. By grasping it, one is able to grasp the pulse of the times and seize the dividends of the times. And the time is up to 10 years, enough to complete the accumulation of wealth in life. Now let's understand the definition and application value of the Kondratiev cycle.

Definition of the Kondratiev cycle

Definition of the Kondratiev cycle

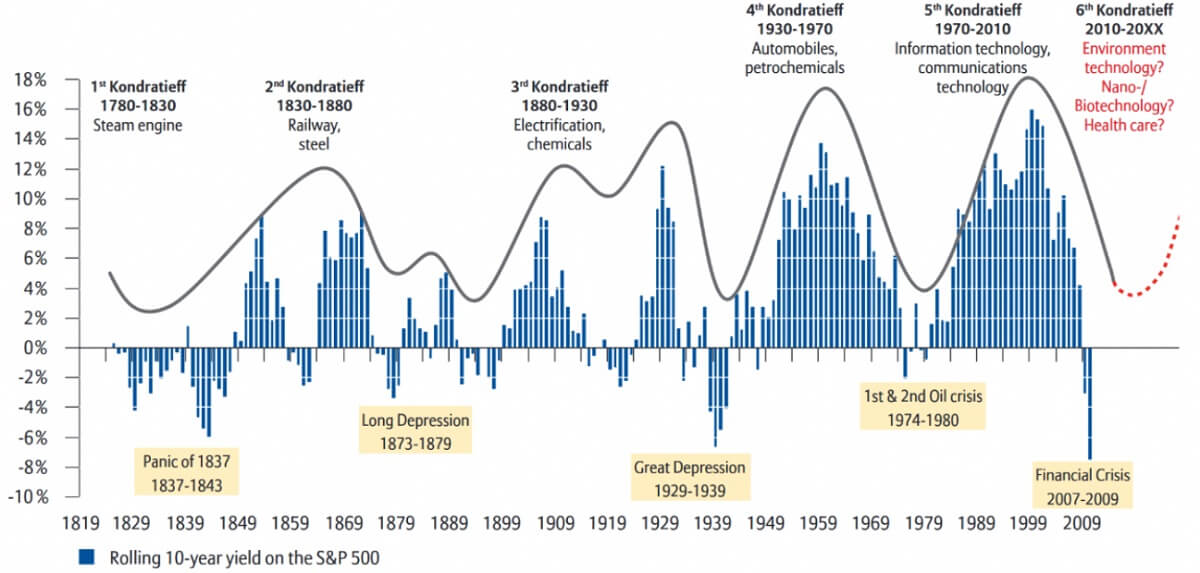

Kondratiev wave, also known as Koznets cycle or long wave cycle, is a concept used in economics to describe the long-term fluctuation of economic activity. This theory of economic cycles was originally developed by Russian economist Nikolai Kondratiev in the 1920s and was named after him.

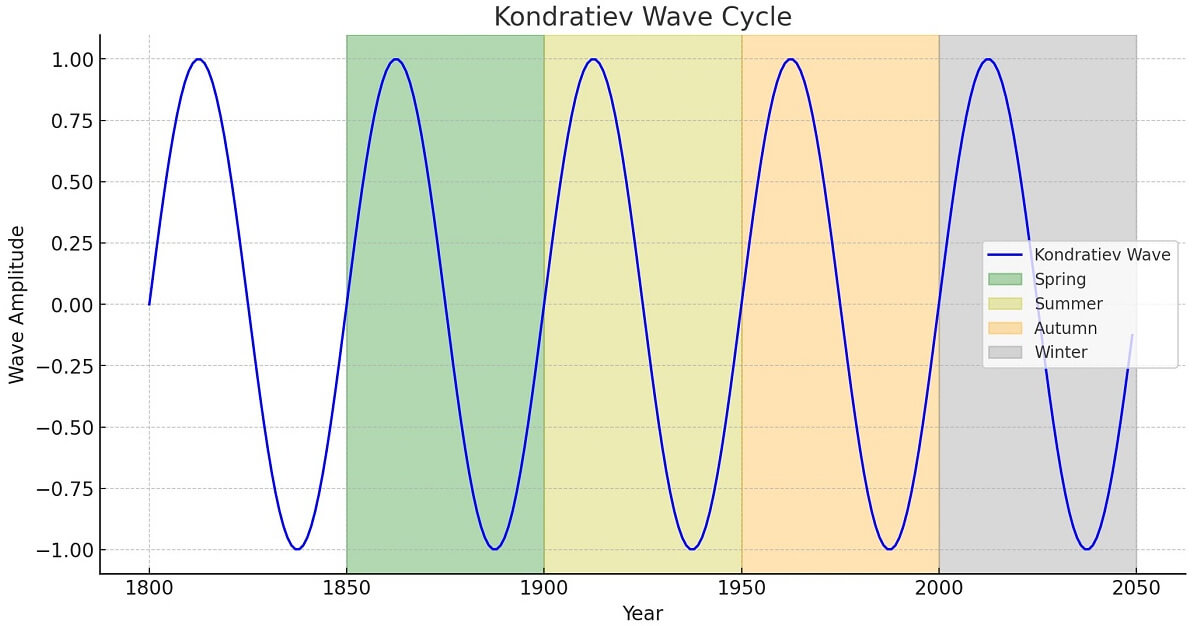

The theory suggests that in developed commodity economies, economic cycles exhibit a longer time span of fluctuations. A complete Kondratiev cycle lasts about 40 to 60 years and consists of several stages, from boom to recession to depression to recovery.

The boom (summer) phase is usually accompanied by a new technological revolution or major innovation that drives rapid economic growth. This phase is characterized by vibrant investment and production activity, booming markets, and optimism among businesses and consumers about future economic prospects. During this period, capital investment accelerates, businesses expand, production and employment rise, consumer spending increases, and the overall economy shows rapid growth.

When the economy becomes overheated, market dynamics are high, and the economy grows too fast, leading to rising inflation. The public's willingness to spend increases, and consumer demand is strong. At the same time, companies see market opportunities and begin to expand their scale of production and operations, as well as increase their borrowing and indebtedness. This rapid growth and high leverage may lead to some degree of risk in the market and may trigger a slight economic pullback.

During the recession (fall) phase, economic growth begins to slow, market demand weakens, investment activity tapers off, and corporate profits begin to fall. As the economy slows, unemployment is likely to rise, consumer confidence will fall, and spending will decrease. There may be an oversupply in the market with an increase in business inventories and excess capacity. Financial markets may be volatile, and asset prices may fall. This phase is usually accompanied by economic uncertainty and volatility, exacerbating overall economic weakness.

When economic growth begins to slow down, the market takes on a state of instability. Due to the rapid growth of the economy in the early stages, the savings rate begins to fall, and the population is less willing to consume and invest. The debt problem of enterprises becomes increasingly prominent, as they may have taken on excessive liabilities during the previous phase of expansion, leading to increased financial pressure.

At the same time, financial bubbles began to form in the markets, with real estate and equity prices peaking. This means that the prices of these assets are overvalued beyond their real value. The formation of such financial bubbles increases the risks in the market, which may lead to sharp fluctuations and crashes in the market in the future.

The depression (winter) phase is the most difficult, with a significant contraction in economic activity, a downturn in markets, and a significant drop in production and consumption. Unemployment rises significantly, leading to a reduction in household incomes and a further decline in consumer demand. The willingness to invest decreases, business confidence is low, and liquidity is tight. Financial markets may be more volatile, bank credit tightens, and the economy enters a state of contraction. This phase usually lasts for a longer period of time and puts greater pressure on society and the economy. However, it is also the stage that lays the foundation for the next round of economic recovery and development.

When the economy enters the recessionary phase, the market faces serious challenges. Stock Prices plummet, and the previously formed financial bubble begins to burst, leading to a large number of corporate bankruptcies. Unemployment rises, savings for the general public plummet, and consumer demand falls further. This economic environment saw investors flee the financial markets in search of safer investment options.

The recovery (spring) phase is the turning point in the Kondratiev cycle, where the economy gradually begins to recover from the trough. Market dynamics gradually increase, and demand begins to pick up, driving an increase in production and investment. Enterprises begin to regain confidence, gradually expanding production and hiring more employees, thus reducing the unemployment rate. Consumer confidence is also starting to pick up, and consumer demand is increasing as the market gradually emerges from the downturn. Financial markets perform positively, liquidity improves, and credit conditions become easier. The recovery phase laid the foundation for the next boom phase, and the economy gradually moved onto a steady growth track.

The beginning of a new round of economic growth during this phase is usually accompanied by the introduction of new technologies and major innovations, which drive rapid economic growth. Benchmark interest rates usually remain low, allowing businesses to obtain loans at lower costs and expand production and operations. Unemployment remains low, labor market conditions are favorable, and consumers and businesses are optimistic about the future of the economy. The savings rate increases, capital becomes more liquid, and money becomes available for investment.

The Kondratiev cycle is a theory based on long-term economic observations that focuses on larger economic trends as opposed to short-term economic fluctuations. Major changes in production technology, developments in financial markets, changes in national policies, and the impact of global markets are usually involved in such cyclical fluctuations.

Kondratiev Cycles and Technological Revolutions

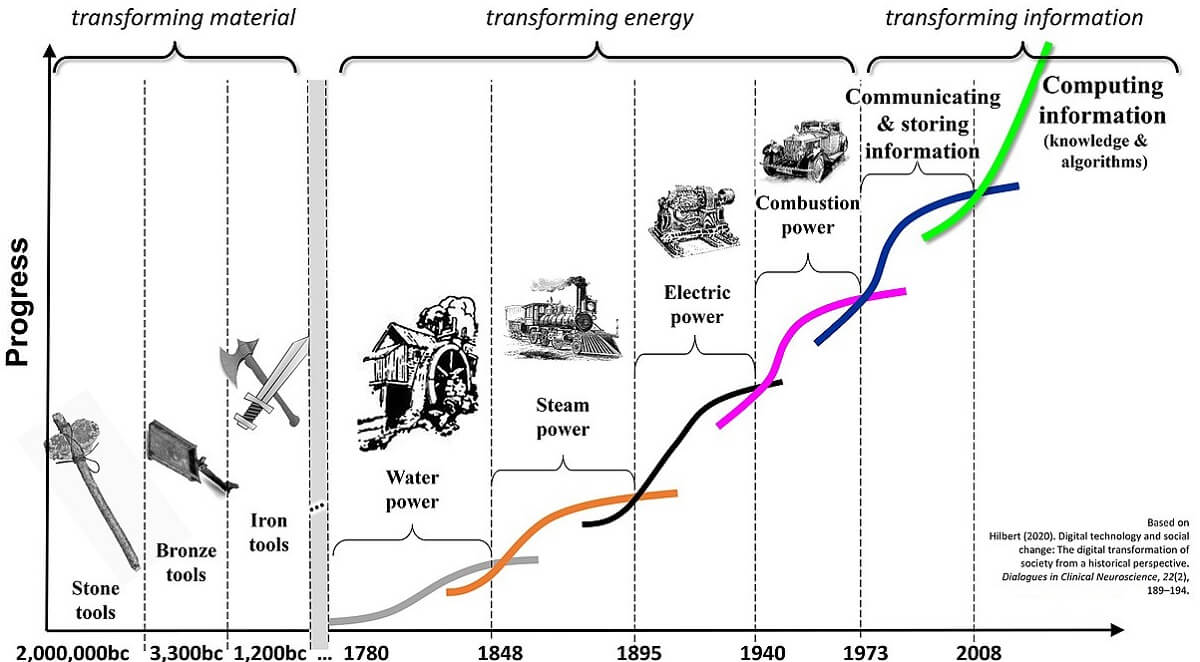

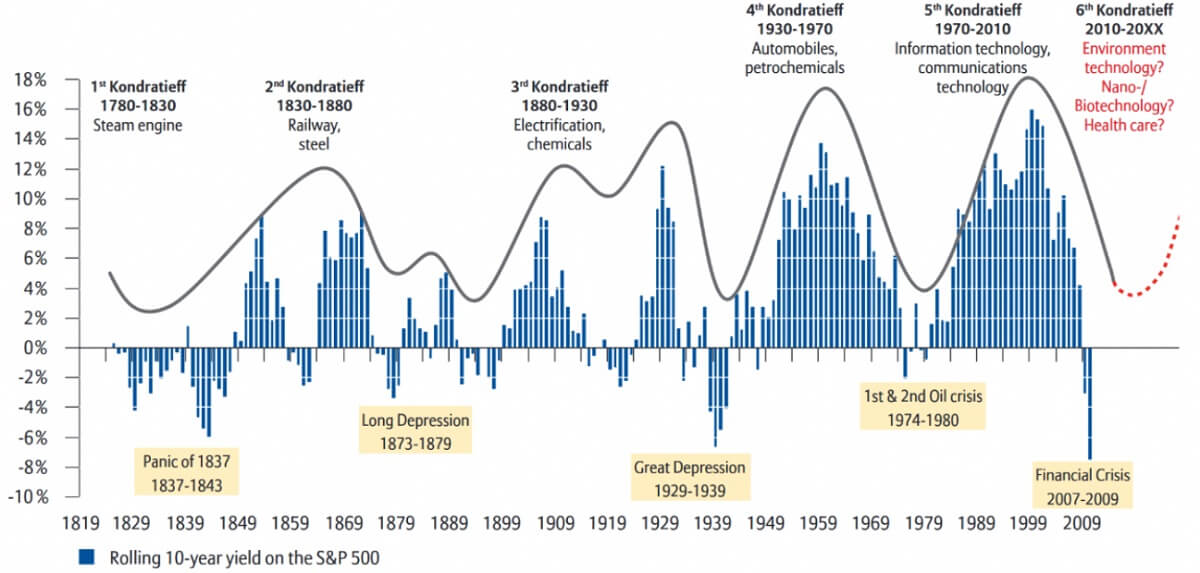

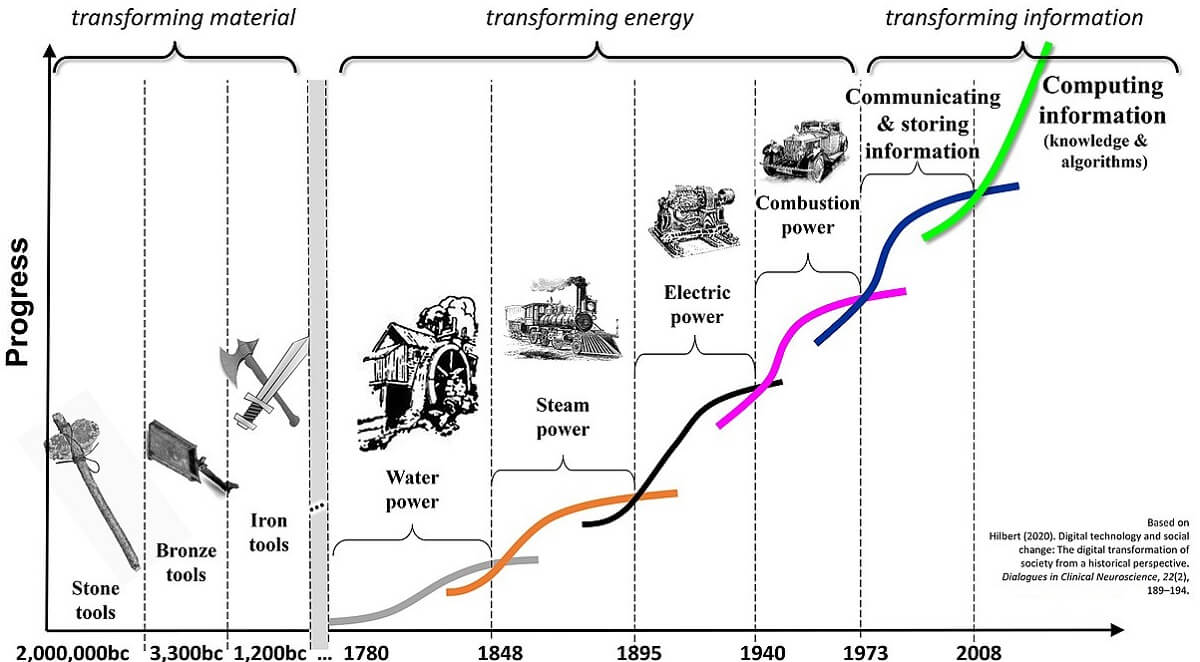

The four phases of the cycle usually correspond to major economic, social, technological, or political changes. Each Kondratiev cycle is usually triggered by a technological revolution or major innovation, which drives rapid economic growth and then gradually enters a downward phase. Since the Industrial Revolution, the world has experienced five Kondratiev cycles, also known as long wave cycles, each driven by technological innovation and economic development.

The Industrial Revolution, which began in 1771. marked the beginning of the first long-wave cycle. Economic development during this period was driven by the steam engine and mechanized technology, which significantly increased productivity. The Industrial Revolution originated in England and then quickly spread to other countries. The use of the steam engine greatly improved manufacturing and transportation, resulting in lower production costs and greater efficiency, which in turn drove economic prosperity. The distinctive feature of this period was the acceleration of industrialization, which brought about the development of factory-based production methods and urbanization. The Industrial Revolution initiated the transformation of the modern economy and set the stage for the subsequent long-wave cycles.

The steam engine and railroad era, which began in 1829. was the starting point for the second long wave cycle. The core technology of this period was the steam engine, whose applications expanded not only in industry but also facilitated the construction and operation of railroads. The emergence of railroads greatly improved the efficiency and speed of transportation, shortened the distance between regions, and promoted trade and globalization.

The construction of railroads changed the original economic pattern, not only facilitating the movement of goods and people but also bringing new markets and business opportunities. The construction of railroads also facilitated the development of other industries, such as steel, coal, and machinery manufacturing. The technological innovations and infrastructural developments of this period had a profound impact on the global economy and contributed to the early stages of globalization.

The Age of Electricity, Steel, and Heavy Industry, which began in 1875. is the starting point of the third wavelength wave cycle. The core technologies of this period were the widespread use of electricity, advances in steel production, and the development of heavy industry. These technological breakthroughs led to new manufacturing and infrastructure development, which greatly contributed to economic growth around the world.

Advances in electricity technology led to dramatic improvements in all aspects of production and life. Electricity-powered machinery and production lines increased the efficiency and capacity of manufacturing. Innovations in steel production also contributed to the development of construction, transportation, and heavy industry, providing a strong foundation for urbanization and industrialization.

The development of heavy industry led to a boom in areas such as shipbuilding, machine building, and automobile manufacturing. These industries not only created a large number of jobs but also contributed to the deepening of global trade and economic ties. The technological innovations and industrial developments of this period had a lasting impact on the economic landscape around the world, laying the foundations of the modern industrial economy.

The year 1908 marked an important turning point in the fourth wave of the economic cycle, a period that marked the era of oil, electricity, automobiles, and mass production. The widespread use of oil provided new options for energy supply and boosted the transportation and industrial sectors. The use of electricity further contributed to a shift in production methods, increasing efficiency and productivity in manufacturing.

One of the most notable developments during this period was the rise of the automobile manufacturing industry. In 1908. Henry Ford introduced the famous Model T and introduced assembly line production. This mass production technique not only reduced production costs and increased yields but also enabled the widespread popularization of the automobile, which became a major force in changing the social and economic landscape.

The rapid growth of the oil, electricity, and automobile industries drove industrialization and accelerated urbanization and globalization. Together, they have had a profound impact on the entire economic cycle, laying the foundations of the modern industrial economy.

The communications and information age, which began in the 1970s, is the starting point of the fifth-wavelength wave cycle. The core technologies of this period were advances in information technology and communications, in particular the spread of computers and the Internet. The rapid development of these technologies laid the foundation for globalization and the rapid growth of the digital economy.

Innovations in computer technology have changed the production methods and operational models of many industries. Advances in automation, data processing, software development, and other areas have increased the efficiency and competitiveness of enterprises. The popularization of the Internet has made global information transfer and communication faster, changing the way people live and work.

Advances in communications technology, including mobile and fiber-optic communications, have provided powerful support for the flow of information and business transactions on a global scale. The combination of these technologies created entirely new economic opportunities, facilitating the rise of multinational enterprises and the establishment of global supply chains.

The scientific and technological revolution of this period has facilitated the process of globalization, resulting in closer economic ties around the world and the formation of a highly interconnected global economic system. This globalized and digitized economy has had a profound impact on global economic growth and industrial structure.

Overall, Kondratiev cycle theory provides a useful framework for understanding global economic and social trends. By identifying the different phases in the cycle, businesses, investors, and policymakers can better capitalize on opportunities, reduce risks, and promote healthy economic development.

Applied Value of the Five Kondratiev Cycles

Applied Value of the Five Kondratiev Cycles

As a theory that describes the long-term fluctuations of economic activities, the long-wave cycle emphasizes the opportunities and challenges in the economic cycle, which is of great significance to both investors and policymakers. According to the theory of the Kondratiev cycle, individuals and countries can have various opportunities at different stages of the economic cycle.

The United States, for example, experienced an economic boom between 1920 and 1970. driven by the electrification revolution, which created a large number of jobs and demand for new products. The American Dream and a series of important science, technology, and innovation projects, such as the Apollo moon landing program, brought significant economic growth to the United States.

In contrast, from 1970 to 2000. the United States experienced inflation and a recession. Although quantitative easing stimulated the economy in the short term, the subsequent bursting of the Internet bubble led to economic turmoil. During the New Crown Epidemic, the US adopted unlimited quantitative easing, leading to rising inflationary pressures. However, the US remained a leader in technology and continued to lead global innovation.

Japan, on the other hand, recovered rapidly after World War II between 1960 and 1990. becoming the world's second-largest economy with an annual GDP growth rate of nearly 10%. In contrast, from 1990 to 2000. Japan's economic bubble burst, and it entered a prolonged recession. Continued quantitative easing by the central bank was ineffective, and the economy fell into a slump. Recently, Japan has continued to face economic stagnation and deflation, but it remains one of the world's important economies.

Between 1982 and 2018. China has risen rapidly since its reform and opening up, achieving sustained high growth and becoming the world's second-largest economy. From 2018 to the present, China has faced challenges such as the global economic slowdown and the impact of the new crown epidemic, but has worked hard to promote domestic consumption and internal and external circulation in response.

As far as individuals are concerned, a person will only encounter one or two Compaq upturns in his or her lifetime, and because of the difference in age and time, the chances of actually being able to participate in them are even fewer. The tycoons and coal bosses of the past were able to gain wealth not because of their personal ability but because they seized the opportunities of the Kondratiev cycle.

Different age groups face different opportunities and challenges in the real estate market. Early home buyers are often able to realize wealth accumulation through property appreciation when they buy a home in a major city. Younger people who enter the market later, on the other hand, usually have to rely on loans and leverage to buy properties and face higher prices and repayment pressures.

It can be seen that each long wave cycle has brought about significant technological and economic changes that have affected the global social and economic landscape. The current sixth long-wave cycle is expected to last until 2050. and the period from 2025 to 2050 will be the upswing phase of the new Kondratiev cycle.

And the current world economy is likely to experience a wave of high growth during this period, which will provide important opportunities for the younger generation to become wealthy. They can capitalize on the opportunities brought about by the times and grow their wealth by seizing the technological and economic changes during this period and investing in emerging industries and innovative fields.

It is important to note that investors should hold different types of assets, such as cash, bonds, and equities, to diversify risk and cope with market volatility during different economic stages. Such a diversified portfolio helps maintain stability during different stages of the economic cycle and provides a cushion during market downturns while reaping the benefits during market booms.

For example, during the boom phase, real estate and commodities become the best investment choices. This is because the prices of real estate and commodities usually rise rapidly during periods of economic overheating, and investors can profit from them. The real estate market is active and demand is strong, while the prices of commodities are driven up by inflation.

In contrast, during the recessionary phase, the best investment choices are the stock market, the bond market, and real estate. Despite the risks involved in these markets, the prices of these assets may continue to rise during the bubble phase, providing opportunities for investors to make profits. However, investors need to be cautious when making investment decisions and pay close attention to market changes to adjust their investment strategies in a timely manner.

During the recessionary phase, safe-haven assets (e.g., gold) perform better. This is because safe-haven assets are usually regarded as value-protection tools during periods of economic instability, and investors hedge against market volatility and risk by holding safe-haven assets. Hedging assets can provide relatively stable returns during economic downturns, protecting investors' capital from sharp market fluctuations.

During the current phase of economic recovery, the best investment choices are usually stocks and real estate. This is because corporate profits and productive activity generally increase during this phase, driving growth in the stock market. At the same time, the real estate market has become more active, appreciating in value due to economic expansion and increased consumer demand. As a result, investors can potentially earn high returns by holding both stocks and real estate during this phase.

It is crucial to adopt different investment strategies at different stages of the economy to help investors gain from market volatility and build wealth at various stages of the economic cycle. In addition, national policymakers can take advantage of the laws of the Kondratiev cycle to formulate effective macroeconomic policies to stabilize economic growth and reduce the negative impacts of cyclical fluctuations.

Definition and Application Value of the Kondratiev Cycle

|

period

|

Definition.

|

Applied Value

|

|

Boom

|

Rapid economic growth and a booming market. |

Invest in real estate and commodities. |

|

Recession

|

Economic growth slows as demand weakens. |

Invest in stocks, bonds, and real estate. |

|

Depression

|

The economy shrinks, and unemployment rises. |

Hold safe-haven assets such as gold. |

|

Recovery

|

The economy slowly recovers as demand rises. |

Invest in stocks and real estate. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Definition of the Kondratiev cycle

Definition of the Kondratiev cycle

Applied Value of the Five Kondratiev Cycles

Applied Value of the Five Kondratiev Cycles