Crude oil is one of the most actively traded commodities in the world, playing a crucial role in the global economy. As a primary energy source, its price fluctuations impact industries, transportation, and financial markets worldwide.

Traders in the forex and futures markets seek to capitalise on volatility, but understanding crude oil trading hours is essential for effective trading. Crude oil trading occurs across different markets, primarily in the forex spot market and futures exchanges like the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE).

Understanding Crude Oil Trading Hours for Forex

The forex market allows traders to speculate on crude oil prices without owning physical barrels of oil. Instead, crude oil is traded as a contract for difference (CFD), enabling traders to profit from price fluctuations. Since the forex market operates 24 hours a day from Sunday evening to Friday evening, crude oil CFDs can be traded continuously from 5:00 PM Eastern Time (ET) until Friday at 5:00 PM ET, offering traders flexibility in entering and exiting trades at any time.

Although the forex market is open 24/5, crude oil liquidity and volatility vary depending on global market sessions. The best trading opportunities arise during the overlap of massive forex trading sessions. The three key forex trading sessions are the Asian session (Tokyo and Sydney), the European session (London), and the U.S. session (New York).

The most active period for crude oil trading in forex occurs during the U.S. and European sessions, especially between 8:00 AM and 2:30 PM ET when crude oil futures trading on NYMEX is also at its peak. Liquidity is highest during these hours, resulting in tighter spreads, reduced slippage, and better trade execution. Traders focusing on crude oil CFDs should align their strategies with these peak trading hours for maximum efficiency.

Crude Oil Trading Hours in the Futures Market

On the flip side, crude oil futures are traded on several major exchanges, with NYMEX being the most significant. Futures contracts are standardised agreements to buy or sell a specific quantity of crude oil at a predetermined price at a future date. Traders, investors, and energy companies widely used these contracts for speculation and hedging. The trading hours for crude oil futures on NYMEX follow a structured schedule.

The main trading session for crude oil futures runs from Sunday evening to Friday afternoon, with a daily break. The electronic trading hours on the CME Globex platform start from Sunday to Friday, 5:00 PM to 4:00 PM Central Time (CT), with a 60-minute break each day.

When the U.S. markets open, crude oil futures trading activity peaks. The release of the Energy Information Administration (EIA) crude oil inventory report on Wednesdays at 10:30 AM ET often triggers high volatility as traders react to supply level changes.

Key Differences Between Forex and Futures Trading Hours for Crude Oil

One of the main differences between forex and futures trading hours for crude oil is the structure of the trading sessions. The forex market operates continuously from Sunday evening to Friday evening, allowing traders to buy and sell crude oil CFDs or spot contracts. However, liquidity and volatility fluctuate throughout the day, with peak activity occurring during the overlap of major financial centres.

In contrast, crude oil futures contracts have a more defined trading schedule, with specific hours for electronic trading and daily breaks. The structured nature of futures trading allows for more predictable price movements, but it also means that traders must be aware of daily session breaks and market closures. Additionally, futures markets are influenced by contract expirations and rollovers, which can affect pricing and trading strategies.

Another important distinction is the impact of trading hours on price volatility. Crude oil futures experience the highest volatility during the U.S. trading session when economic reports and inventory data are released.

In summary, the forex market offers flexibility for traders who want to capitalise on crude oil price fluctuations at any time, while the futures market provides a structured approach with clear session times and liquidity patterns.

Best Time to Trade Crude Oil for Maximum Profitability

Timing plays a crucial role in crude oil trading, as different sessions offer varying levels of liquidity and volatility. The best time to trade crude oil depends on the trader's strategy, risk tolerance, and market preferences. Generally, the most favourable trading hours align with periods of high market activity when price movements are more significant and spreads are tighter.

For forex traders, the ideal time to trade crude oil is during the overlap of the London and New York sessions. This period, typically between 8:00 AM and 12:00 PM ET, sees increased trading volumes, as both European and U.S. markets are active. News releases, economic reports, and geopolitical developments contributed to sharp price movements, providing opportunities for short-term trades and momentum-based strategies.

As for futures traders, the most active period is during the U.S. trading session, particularly between 9:00 AM and 2:30 PM ET. This is when institutional investors, hedge funds, and energy companies are most active in the market, leading to high liquidity and price volatility. Traders focusing on crude oil futures should also pay attention to key economic reports, such as the weekly crude oil inventory data, which can trigger large price swings.

Impact of Global Events on Crude Oil Trading

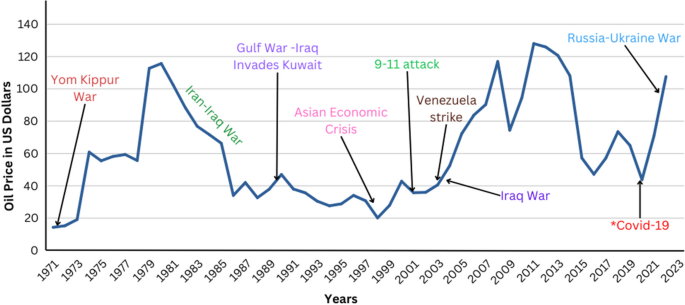

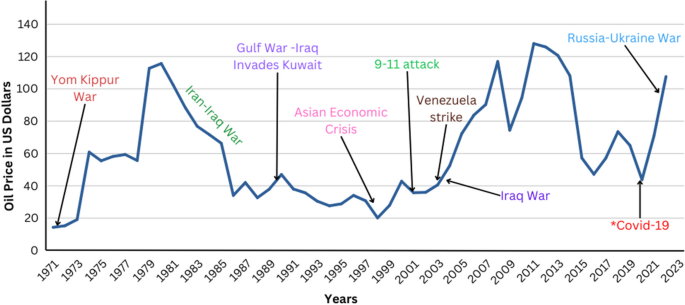

Geopolitical tensions are among the most significant drivers of crude oil price volatility. Countries with major oil reserves, such as those in the Middle East, Russia, and North America, play a crucial role in global supply. Conflicts, wars, and diplomatic disputes can lead to production cuts, supply disruptions, or trade restrictions. When tensions arise, traders fear potential shortages, causing prices to spike.

For example, when conflicts broke out in Iraq and Libya, the two major oil-producing nations, oil prices surged due to the threat of supply interruptions. Similarly, sanctions imposed on countries like Iran and Russia have historically reduced oil exports, leading to supply constraints and increased market uncertainty.

Decisions made by the Organization of the Petroleum Exporting Countries (OPEC) also influence crude oil prices. OPEC and its allies, known as OPEC+, control a significant portion of the world's oil supply and regularly adjust production quotas to stabilise the market. When OPEC announces production cuts to prevent oversupply, prices tend to rise due to reduced output.

Lastly, the COVID-19 pandemic clearly explained how global crises affect crude oil trading. When lockdowns were imposed worldwide in early 2020, oil demand plummeted as transportation and industrial activities halted. This led to an unprecedented collapse in oil prices, with WTI crude oil futures briefly turning negative for the first time in history. Traders holding contracts for physical delivery faced a lack of storage capacity, forcing them to sell at extreme losses. As economies reopened, demand rebounded, pushing oil prices back to pre-pandemic levels.

Conclusion

In conclusion, understanding crude oil trading hours is essential for maximising trading opportunities in the forex and futures markets. The forex market offers flexibility, allowing traders to engage in crude oil trading at any time, while crude oil futures trading follows a structured schedule.

The best crude oil trading opportunities occur when liquidity and volatility are highest, aligning with key economic reports, OPEC meetings, and geopolitical developments. By aligning trading strategies with the most active market hours, traders can improve their chances of making profitable trades while managing risk effectively.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.