SNB Chairman Thomas Jordan will step down at the end of Q3 after a 12-year

tenure. The technocrat is applauded for his steering the economy through an

ever-changing environment.

He became a rate setter just before the financial crisis taking its toll on

global markets in 2007 and took over from his predecessor scandal-beset Philipp

Hildebrand in 2012.

Jordan said Credit Suisse’s collapse had not influenced his decision in any

way. Regardless of that, his departure has upped the ante for the Swiss franc

that has underperformed its major peers this year.

But the currency soared against the dollar and against the euro over the past

decade although the central bank adopted negative rates in late 2014 to cap the

franc’s appreciation.

The ultra-loose policy was in place until the inflation crisis globally

compelled the SNB to change tact in 2022. Markets currently expect its return to

lower rates later this month on weakening inflation.

Further interest rate hikes are not needed given the bank's latest inflation

forecasts, SNB Jordan said in an interview in January, but “the battle against

inflation is not yet completely won.”

He acknowledged the negative impact of a stronger currency on the Swiss

economy, particularly exporters, while stressing a remote chance of upcoming

recession.

Safe-haven

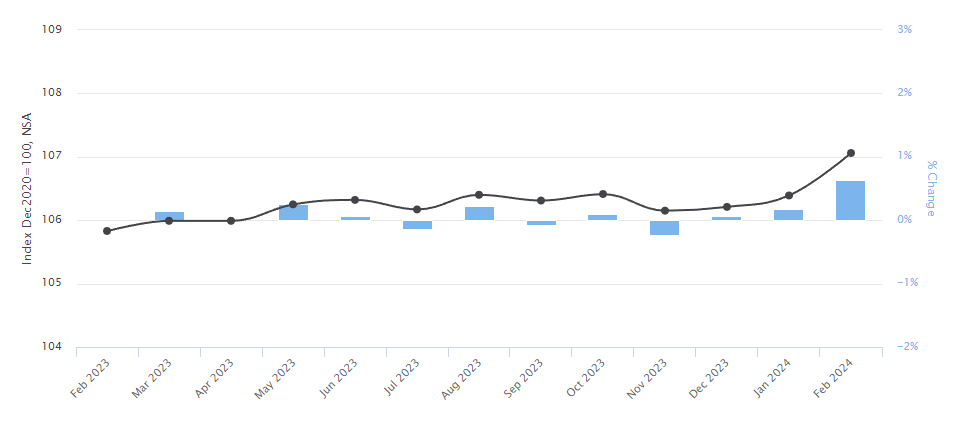

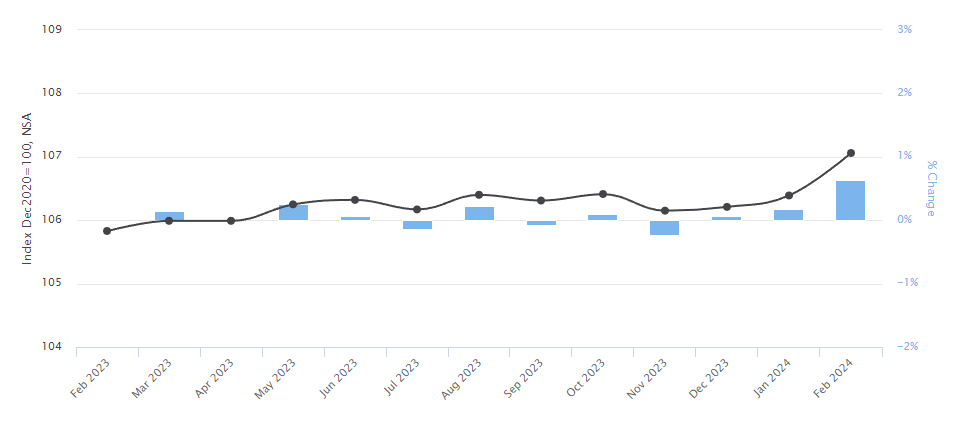

Swiss inflation eased less than anticipated last month and core reading was

even lower., a development that might mute speculation about the SNB lowering

interest rates sooner than later.

Consumer prices rose 1.2% from a year ago, according to the Swiss statistics

office. While that came below the 1.1% median prediction in a Bloomberg survey,

it was down from 1.3% in January.

Unlike the ECB, the SNB has achieved its goal since May 2023. The central

bank in December lowered its forecast price rises to a level of 1.9% in 2024 and

1.6% in 2025, hinting at dissipating price pressures.

Economists noted that the latest reading could point to inflation being lower

than the central bank expected. UBS lowered its estimate to 1.4%, citing

weaker-than-expected second-round effects.

The country’s economy showed resilience over the course of 2023, growing 0.8%

vs 0.5% in the eurozone. Its largest export sector – the pharm and biotech

industry is typically "counter-cyclical."

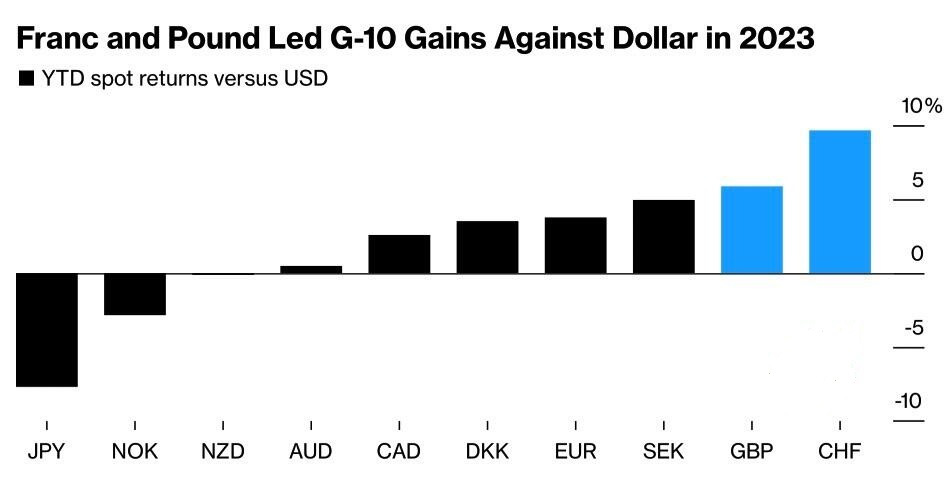

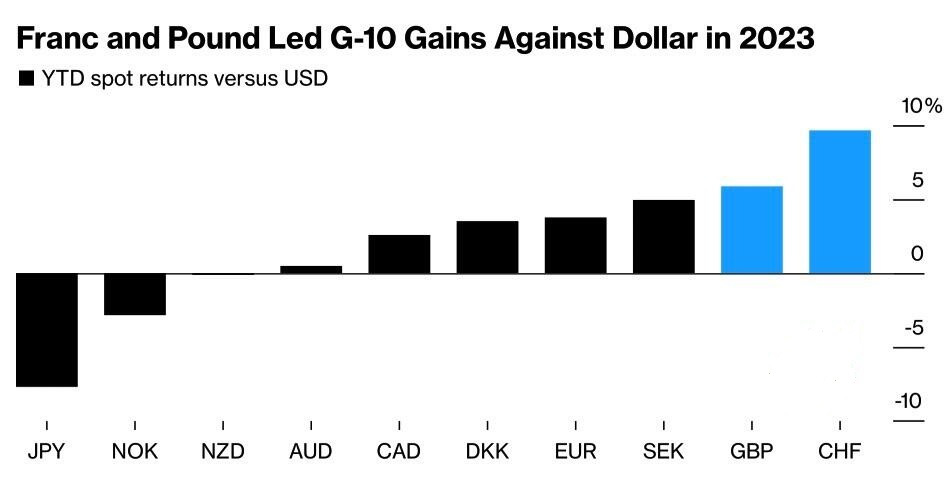

The Swiss franc was the best performing G10 currency last year and hit a

record high against the euro in December, partly due to the SNB’s massive sales

of foreign assets purchased previously.

Growing concerns about potential recessions and geopolitical risks including

the resurgence of the Middle East conflict also added to its strength as

investors flocked to safe-haven assets.

Conviction call

The Swiss franc has become the highest-conviction trade among G10 currencies.

Hedge funds and asset managers added to bets for further weakness for four weeks

in a row.

The latest CFTC data show that funds increased their net short position to

more than 12,000 contracts in the week ending 8 May – the most bearish since Dec

2023.

TD and Securities recommended short positions., Europe’s biggest asset

manager, has turned bearish on the currency and shifted its position on the

franc to underweight.

Andreas Koenig, the head of global FX at Amundi, sees the currency to reach

parity against the euro by the end of this year, a view that is more negative

than the median forecast of a Bloomberg poll for 0.98.

“If Swiss inflation goes even lower and the central bank acknowledges that

and says there is no longer a need for the currency to be strong, the franc can

easily weaken more,” he said.

“The franc is again overvalued,” said David Alexander Meier, an economist at

Julius Baer, the top FX forecaster in the fourth quarter according to data

compiled by Bloomberg.

His argument was declining interest rates would exert further downward

pressure on the franc, especially considering that the SNB is unlikely to resume

foreign-currency reserve purchases.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.