Recently, WORLD FINANCE presented an award ceremony to give recognition to

the brokers who demonstrated exceptional service to clients. Despite the

challenging year of 2023 for the Forex industry, some brokers have paved the way

during this challenging yet volatile year 2023 and deserve recognition for their

resilience and excellence through these presented awards by WORLD FINANCE.

With more than 15 distinguished awards for their respective recognitions, EBC

Financial Group, established in the epicentre of the financial industry of

London has won two reputable awards for “Best Trading Execution” and “Best

Foreign Exchange Trading Platform”. EBC Financial Group CEO, Mr. David Barrett

was invited to have an interview session with the WORLD FINANCE on several

topics that are closely related to what is currently happening in the trading

landscape, and the global market liquidity issues.

David Barrett boasts an extensive, 35-year financial market experience.

Throughout the years, he founded several financial consultancy businesses. With

a strong foundation in foreign exchange, fixed income, commodities, and

derivatives, Barrett was also appointed to sales and trading roles for financial

institutions including AIG, NatWest, ABN Amro, and Nomura Securities in the

United States (US). Barrett was invited as a guest and had a fruitful discussion

with WORLD FINANCE on the impact of rising interest rates on global markets, the

US banking crisis, and how derivatives are carving out a role in sustainable

investing.

How have recent market volatility and economic conditions affected liquidity

in global markets?

David Barrett: There can be no doubt that liquidity in all markets has

suffered in the first few months of 2023. Liquidity tends to be driven by

participant confidence, high volumes, efficient price discovery, and the staple

‘fear and greed’ effects, all of which have come under pressure of late. We have

had so many newsworthy events in 2023 already that it is hard to know where to

start but the core disruptor, in my view, has been the sharp rise in rates

across the globe. All markets have spent over a decade learning to live with and

take advantage of, a near-zero rate environment. The rapid move in higher

interest rates over the last 12 months has laid bare how ingrained those low

rates have become.

What are the big trends driving the evolution of the derivatives market?

David Barrett: Technology has opened all markets to a much wider range of

participants in recent years. Retail investor participation in derivatives

markets has increased significantly, with the pandemic accelerating the process.

Western markets have seen volumes increase by 15-30 percent and Middle East and

Asia Pacific regions have seen by 50-60 percent increase on some exchanges. This

huge increase in demand has led to a wider range of derivative products across

global markets

What do you think of the growing trend of sustainable investing?

David Barrett: The focus on sustainable investing has opened a new audience

for derivative trading. Broadly speaking, these products give exposure to

end-users to achieve Environmental, Social, and Governance (ESG) objectives. The

growth in focusing on sustainable investing has led to a strong demand for and

the development of sustainability-linked derivatives and other ESG-oriented

contracts. There are several broad types of derivatives linked to

sustainability, including emission trading, renewable energy and fuel,

sustainable credit derivatives, and sustainable-related Credit Default Swaps

(CDS). while EBC, like other brokers, cares about the experience of its clients

on how they would like to reflect their views on sustainability and ESG

investing. In the future, we will expand our services to include access to CFDs

and derivatives products to meet our client’s requirements and preferences.

How is the regulatory landscape changing, and what does this mean for

derivatives?

David Barrett: Past decade, financial markets have experienced unprecedented

regulatory change. Following the financial crisis, derivatives had a front and

centre seat in the inquisition that followed. While many market participants had

huge failures in how they managed their derivatives exposure, it was equally

clear that regulators had not had the best experience either.

Regulators have pushed hard to remove as much derivative trading as possible

from the over-the-counter (OTC) markets and push it on to exchange execution.

While this consolidation has reduced large firms’ exposure to each other, the

execution and cash usage associated with exchange trading will be a cause of

concern to derivative providers and users alike. Counterparty risk management is

clearly reduced in exchange-cleared derivatives, but the drive to push trades

this way has made innovation and bespoke trades costly and complex to manage.

Both the global financial crisis and the COVID-19 pandemic have shown that due

to the strong interconnectedness of various markets, on-exchange trading does

not mean absolute safety. It could be argued that this is to the detriment of

end users and that we should not fall into thinking using central clearing

counterparties (CCPs) comes without risk.

What has EBC been doing to help clients manage risk and improve liquidity

specifically with this issue in mind?

David Barrett: Volatility and leverage work both ways for clients. As a

well-regulated firm, we are fully aware of our responsibilities in helping

clients understand and manage both. We have tier-one liquidity relationships

that help us manage how we access pricing and how we tailor that pricing to each

client’s needs. Liquidity is as much an art as a science. We deliberately use

fewer, but better quality providers so that our relationships with them remain

close and beneficial to all. Using market-leading technology to deliver

liquidity to clients is just as crucial, and our operational tools give our

clients the information they need to manage their trading exposure and risk.

In addition to providing the best liquidity, it is also very important to use

market-leading technology to match the liquidity to clients. EBC Financial Group

is equipped with tools that provide clients with the information they need to

better manage trading exposure and risk.

Lastly, David said that EBC Group always adheres to the principles of

integrity and respect and puts the client’s financial security first.

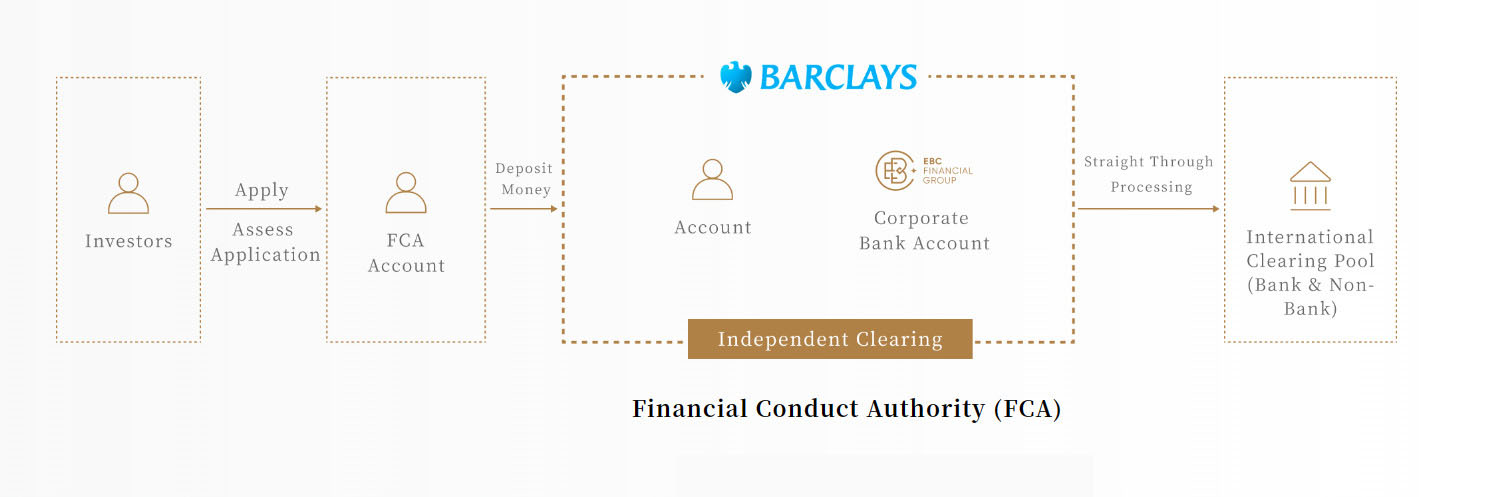

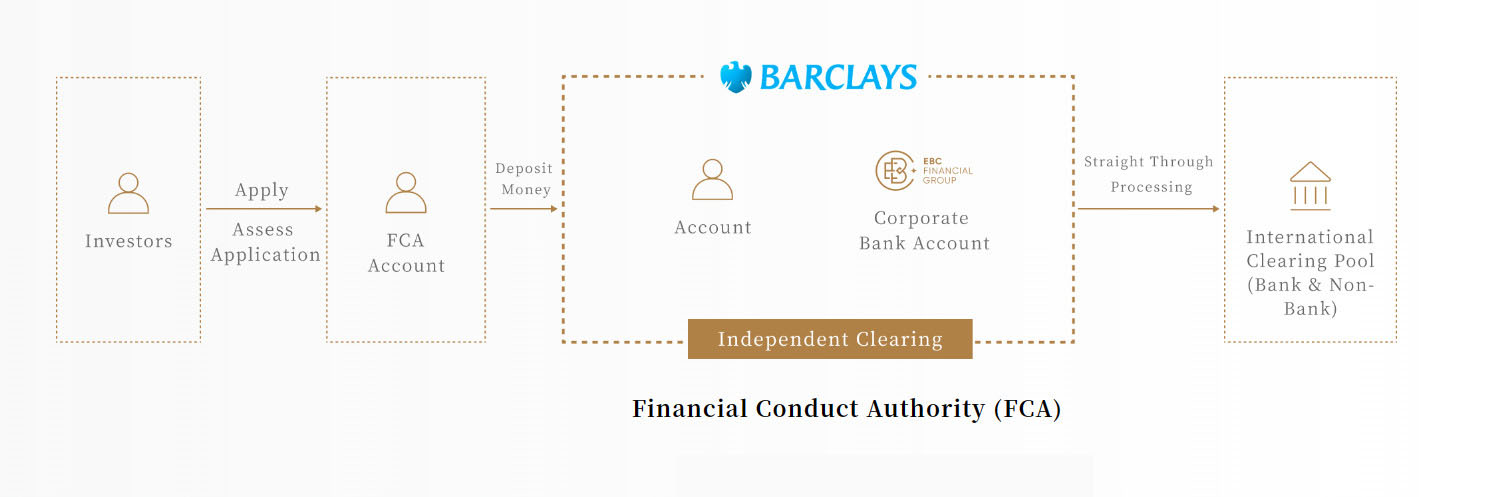

EBC Group is regulated under dual-supervision providers from Britain and

Australia. Strictly follows the compliance requirements of the British Financial

Conduct Authority (FCA), and customer funds are independently managed by

Barclays Bank, UK. At the same time, EBC was covered by insurance worth more

than 10 million US dollars from Lloyds, UK, and AON group annually to minimize

traders from any risks.

EBC has always making effort to create a robust trading environment that

aligns with its development goal, seeking global investment opportunities for

clients, and building a safer and more equipped financial ecosystem.

Exceptional Brilliance Care for Every Committed Trader.