Short build-up

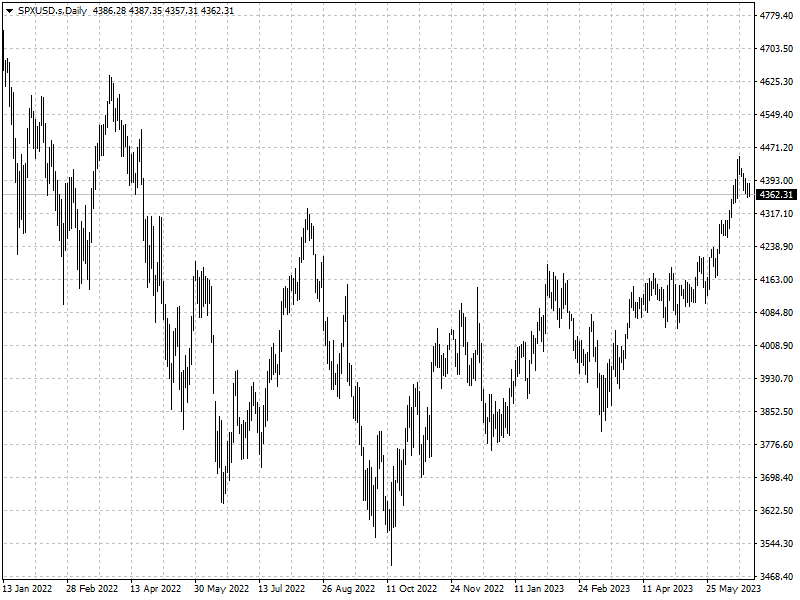

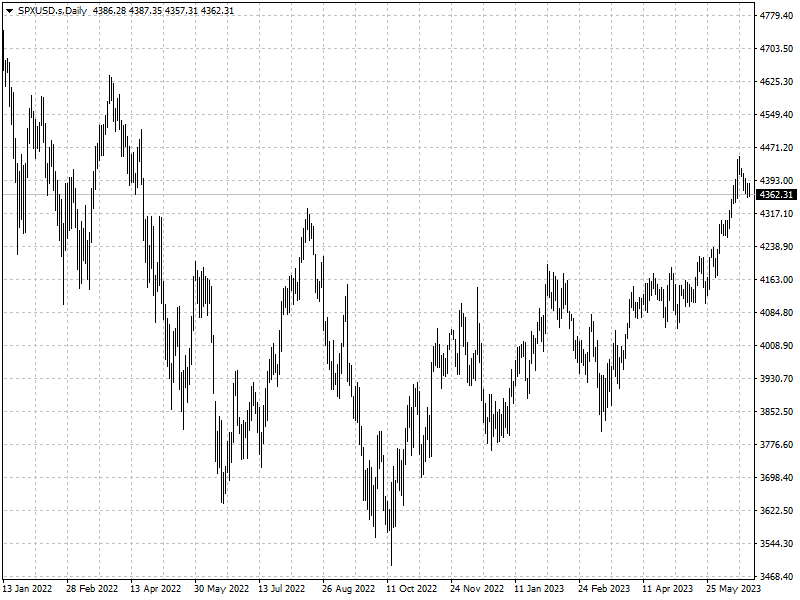

U.S. short interest this month rose to the highest level since April 2022, as

investors bet that the current bull run in stock market is set to falter.

According to data from S3 Partners, the amount spent by short sellers against

US stocks hit $1.02 trillion, as of Friday. Those bets came even as the

continued to rally earlier this month, costing short sellers $101 billion.

This year, Wall Street has been caught up in hype over artificial

intelligence companies, which saw their valuations skyrocket and have brought

more investors into the market due to ‘fear of missing out.‘

The prospect on continued hawkishness from the Fed has added to macroeconomic

risks. A recent Goldman Sachs report put the odds of a recession in the next 12

months at 25%, and warned a downturn could cause a 23% decline in the S&P

500.

Still, if bullish investors win out, short positions could eventually support

market gains, as a short squeeze forces more buying and boosts stocks.

bearish cocktail

The bullish run in the first half of the year will likely lose steam over the

second half as the economy inches closer to a recession, according to

JPMorgan.

A recession could arrive sometime between the end of this year and the first

quarter of 2024 unless the Federal Reserve starts cutting interest rates, the

bank said in a note.

Adding to selling pressure, stock market valuations have surged in recent

months and investor positions in equities has surged amid ‘recession fatigue’ as

evidenced by a recent spike in investment sentiment indicators.

A potential recession is imminent is driven by a weakening consumer, the

expectation that accumulated excess savings from the COVID-19 pandemic will be

fully depleted by October, and that fiscal tailwinds are fading.

Morgan Stanley also adopts a downbeat view for the months ahead as the

present rally is about to stumble thanks to a bearish cocktail of mood,

earnings, and falling inflation.

Falling prices, Morgan Stanley explained, can cut into revenue growth and

weigh on earnings. On top of that, $1.2 trillion in Treasurys will be issued

over the next six months, a bad sign for liquidity.

‘This should begin to hit asset prices by the end of this month and carry

into the fall,’ the bank said. ‘In addition to this domestic dynamic, we think

global M2 (in USD) growth is also likely to flatten out and possibly fall again,

adding one more element to the cocktail that could surprise newly minted

bulls.’

FOMO rally

There is no consensus on Wall Street as always. Bank of America predicted

more upside ahead after the S&P 500 broke various resistance levels and hit

new 52-week highs.

BofA's technical strategist Stephen Suttmeier said that the 14% year-to-date

rally in the S&P 500 has coincided with ‘solid technicals’ that could push

the index into the 4,500 range, or about 5% higher from current levels.

‘The S&P 500 cleared 4,200 in early June to break out from a 4-month

bullish cup and handle. This favors new 52-week highs above the August 2022 peak

at 4,325, which the S&P 500 achieved last week’ Suttmeier said.

He highlighted a technical price objective of 4,580 for the S&P 500, and

added that the recent breakout of the S&P 500's Advance-Decline line,

combined with FOMO among asset managers, confirms that the ongoing rally in

stocks is convincing.

‘We view the breakout above 4,200 on the S&P 500 as a FOMO rally. The net

long position for asset managers in S&P 500 e-mini futures shows a sharp

increase in recent weeks to suggest that FOMO is catching on with institutional

asset managers.’

The resistance levels include 15,196-15,265 for the Nasdaq 100, 34,280-34,712

for the Dow Jones Industrials Average.