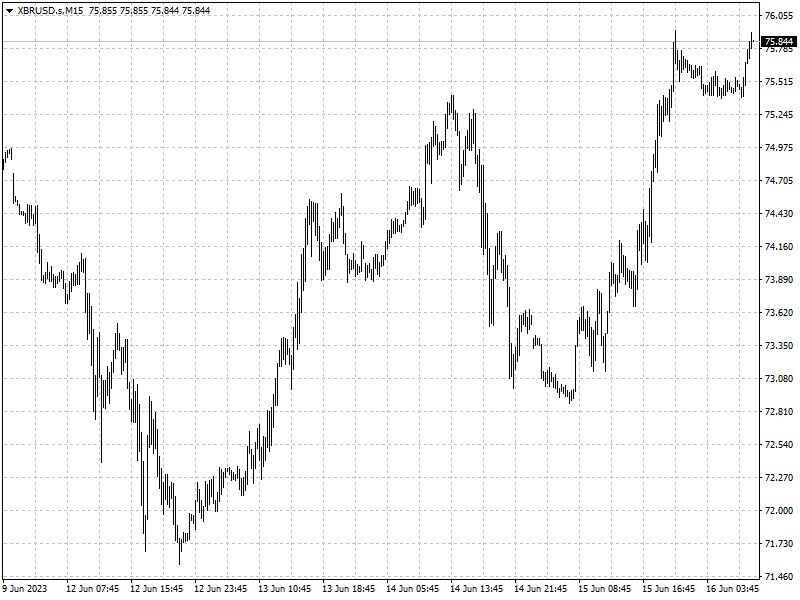

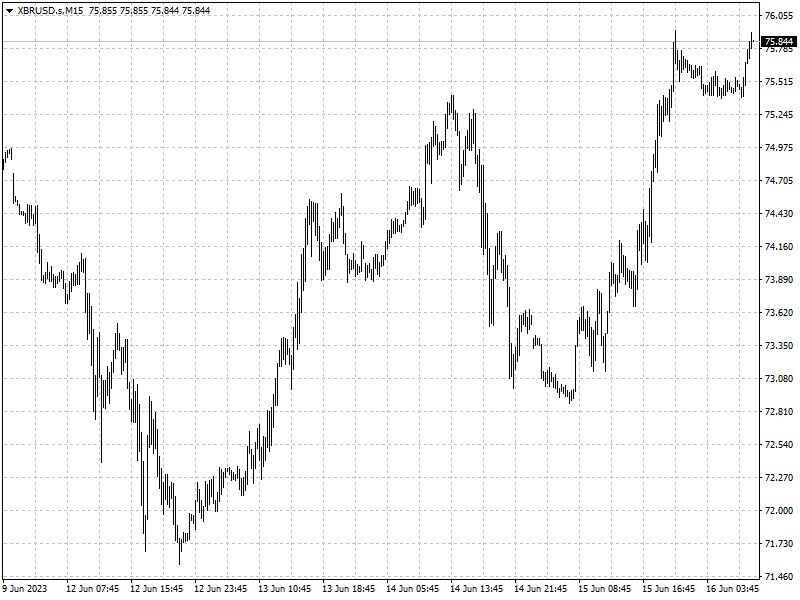

Big swing

Oil traders were on a bumpy road last week. Prices hit over one-month low on

Monday after Goldman Sachs cut oil price forecasts from $95 to $86 for Brent and

from $89 to $81 for WTI.

The benchmarks rebounded over 3% the following trading day on PBoC’s first

rate cut in 10 months which aims to add momentum to the post-pandemic

recovery.

Then came a Wednesday’s drop of 1.5% stemming from the indication that the

Fed will raise interest rates further this year, and again prices were up about

3% on Thursday.

saudi arabia announced earlier this month that it would begin cutting oil

production by 1 million barrels per day in July after it warned that short

sellers will be ‘ouching’.

Nevertheless, traders seem to have ignored the key player in the market. They

raised bets against oil when a rally towards $80 was attempted – a risky

gambit.

Downsides

Two negatives are in sight: the first is that Russian shipments have boomed

in the face of expectations that western sanctions would curtail them. The

second is concern about China’s demand growth.

While they have slipped in the past few months, observed seaborne oil

shipments are still up sharply compared with where they were in May 2022.

Russia’s cargoes, in particular, are soaring. The nation’s crude exports were

within 100,000 barrels a day of a record in the four weeks to June 4.

U.S. Crude Oil stockpiles posted a surprise large build last week, while

gasoline and distillate inventories gained more than expected, the EIA said on

Wednesday.

The EIA lowered its price forecasts in the latest report. It expects Brent

spot prices to average $78.65 per barrel in 2023, versus $85.01 per barrel

previously.

There is also a global concern about industrial production, a close proxy for

diesel demand. Manufacturing has been in contraction worldwide for each of the

last nine months, according to JPMorgan data.

“The producer group is in a multiple bind: demand is looking weaker and

non-OPEC supply stronger by year-end than many analysts had forecast,” Citigroup

Inc. analysts including Francesco Martoccia wrote.

Brent’s prompt spread flipped into contango, and WTI’s contango widened to

its most bearish since February.

Upsides

China’s oil refinery throughput in May rose 15.4% from a year earlier as

refiners brought units back online from planned maintenance and independent

refiners processed cheap imports.

That figures represented the second-highest monthly total on record, exceeded

only by 63.3 million metric tons in March this year.

China’s crude oil imports in May jumped to the third highest level on record,

totalling 51.44 million metric tons, or 12.11 million bpd, according to data

from the General Administration of Customs.

The largest oil importer has issued larger crude-import quotas than a year

earlier, and a stimulus package the nation is considering raised hopes for

higher demand.

Booming oil refining capacity in China and the Middle East looks set to come

up against a “structural dearth of crude in the coming years,” Saad Rahim, chief

economist of trading giant Trafigura Group, said in the company’s interim

report.

The supply cuts by OPEC+, coupled with emerging market demand growth, should

lead to “material draws in inventories later this year” he said, adding that

U.S. shale may not be able to balance the market.

Elsewhere, the U.S. plans to purchase about 12 million barrels of oil this

year as it begins to refill its depleted emergency reserve amid falling crude

prices, according to two people familiar with the matter.

The SPR is at a 40-year-low following a historic 180 million barrel drawdown

last year in response to Russia’s invasion of Ukraine. The sour crude grades

sought by the Energy Department are in high demand.

World oil markets may tighten “significantly” over the next few months and

next year also looks tight, particularly in the second half, with oil

inventories set to decline, the IEA said last week.

But even if the market does turn, it may take time to filter through, as

traders continue to wrestle with the slew of economic concerns and robust

supplies that have hobbled prices for months now.

‘No one wants to take risk in flat price given the macro uncertainty,’ said

Richard Jones, an analyst at consultant Energy Aspects. ‘Ultimately they are

waiting to see physical markets tighten as the cuts take effect.’