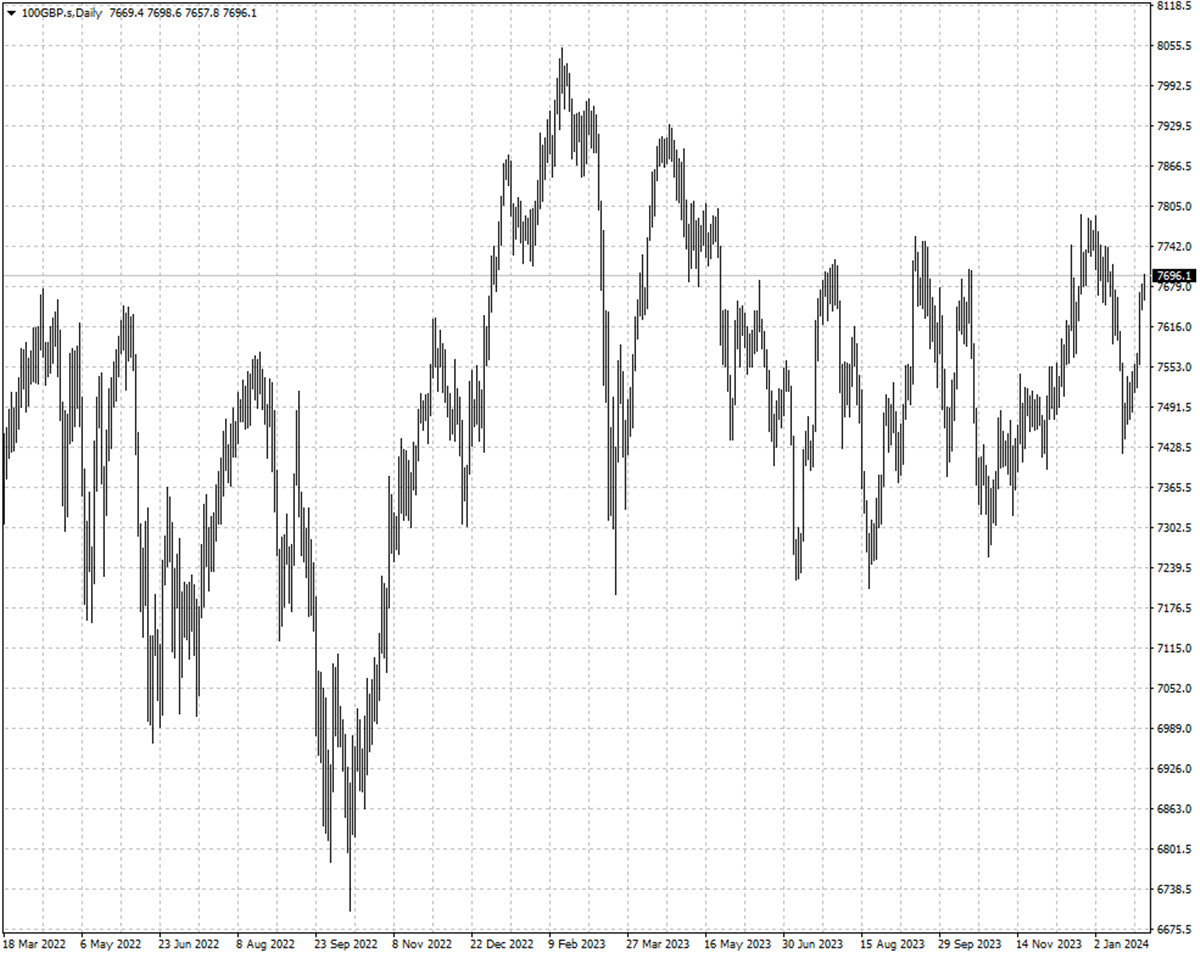

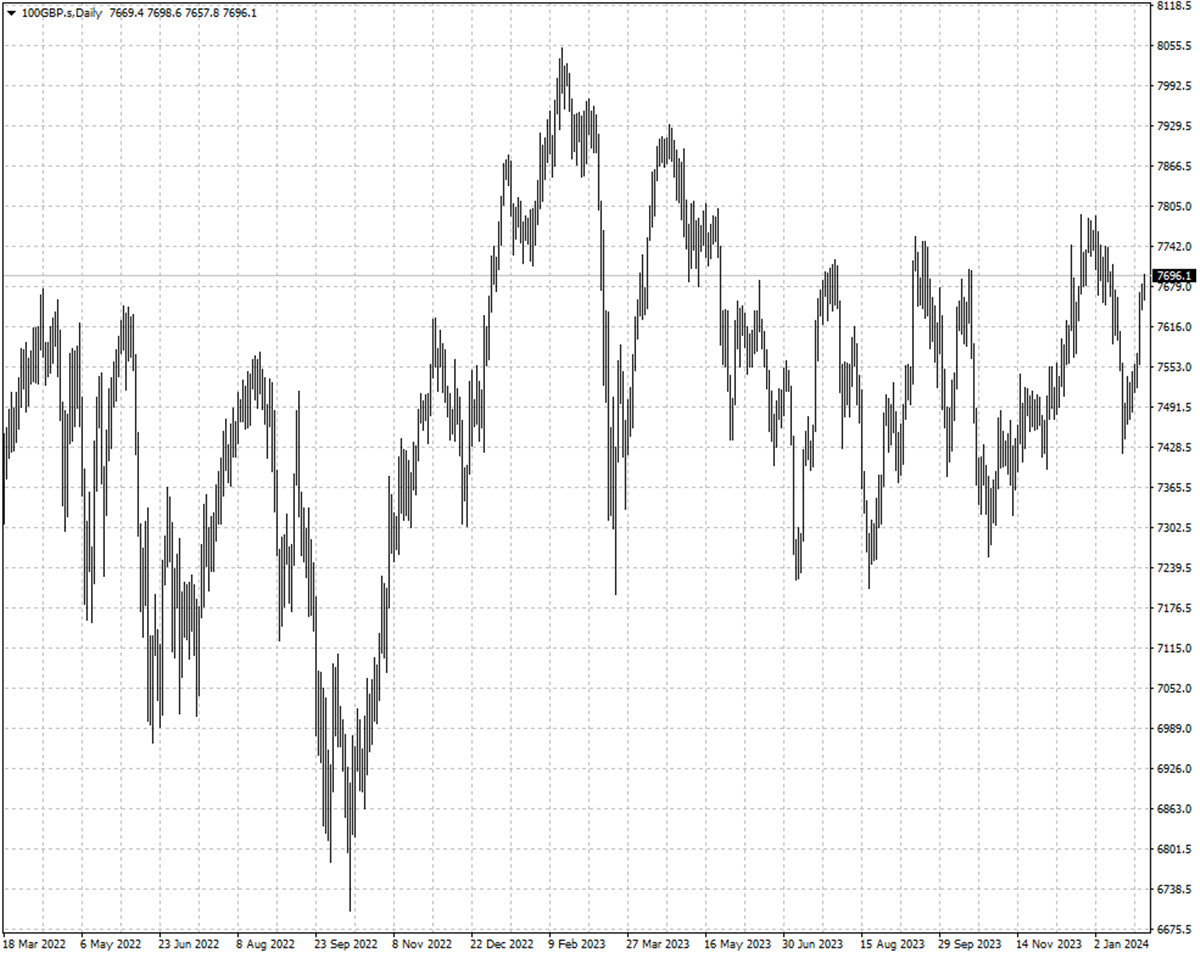

US equities has enjoyed a bright start in 2024, a sign that it may head for

another yearly gain. However, better opportunities seem to exist elsewhere.

UBS Group strategists are concerned that the ability of companies to sustain

high revenue growth becomes increasingly questionable given rising operating

costs and slowing economic growth.

Those analysts say “the US is not as defensive as normal, owing to valuation,

slowdown in GDP and margin risks that are higher than for global markets.”

The S&P 500 is trading at nearly 20 times forward earnings estimates,

well above its long-term average of 15.6. By contrast, MSCI's all-country world

index that excludes the US is trading at 12.8 times below its historic average

of 13.5.

Goldman Sachs Group warned that “the bar is simply too high in February,”

pointing to elevated leverage levels, stretched positioning in futures and a

drop in liquidity.

The bank is least bullish on Europe due to greatest earnings risk but it

pointed out the UK is an abnormally cheap defensive market.

Investment platform AJ Bell found that as of earlier January, 59% of all

analyst ratings were “buy” and just 8% “sell” for FTSE 100 companies – the

highest and lowest figures respectively in at least eight years.

Vanguard's models, which take valuation into account, projects US equity

returns over the next decade at an average annual rate of 4.2% to 6.2%. Ten-year

projections are rosier elsewhere: 7% to 9% annualized return for non-U.S. developed markets.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.