Gold has been adrift after it failed to set a new all-time high at the end of

December. A combination of robust economy and inflation in the US outweighs

China’s property woes and ongoing wars.

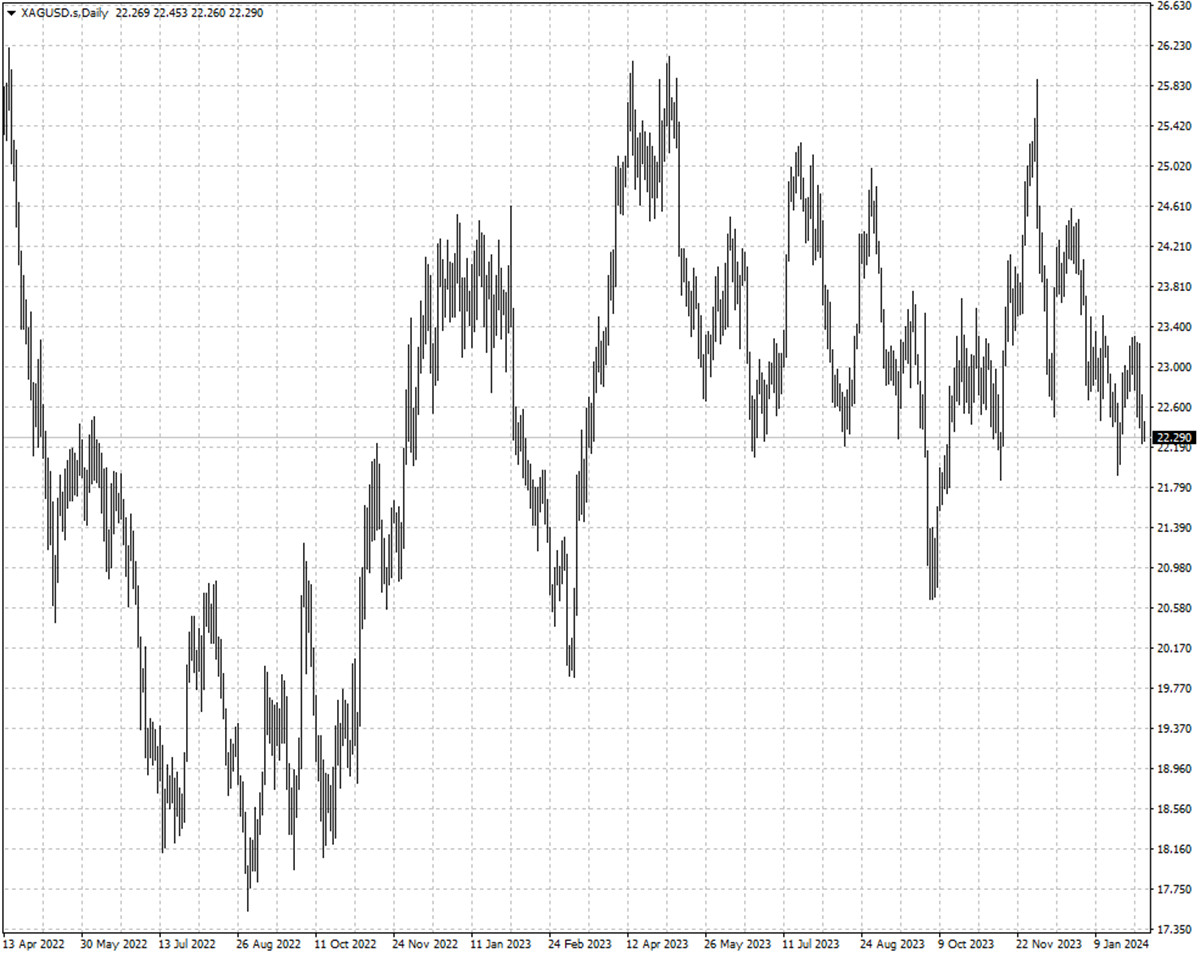

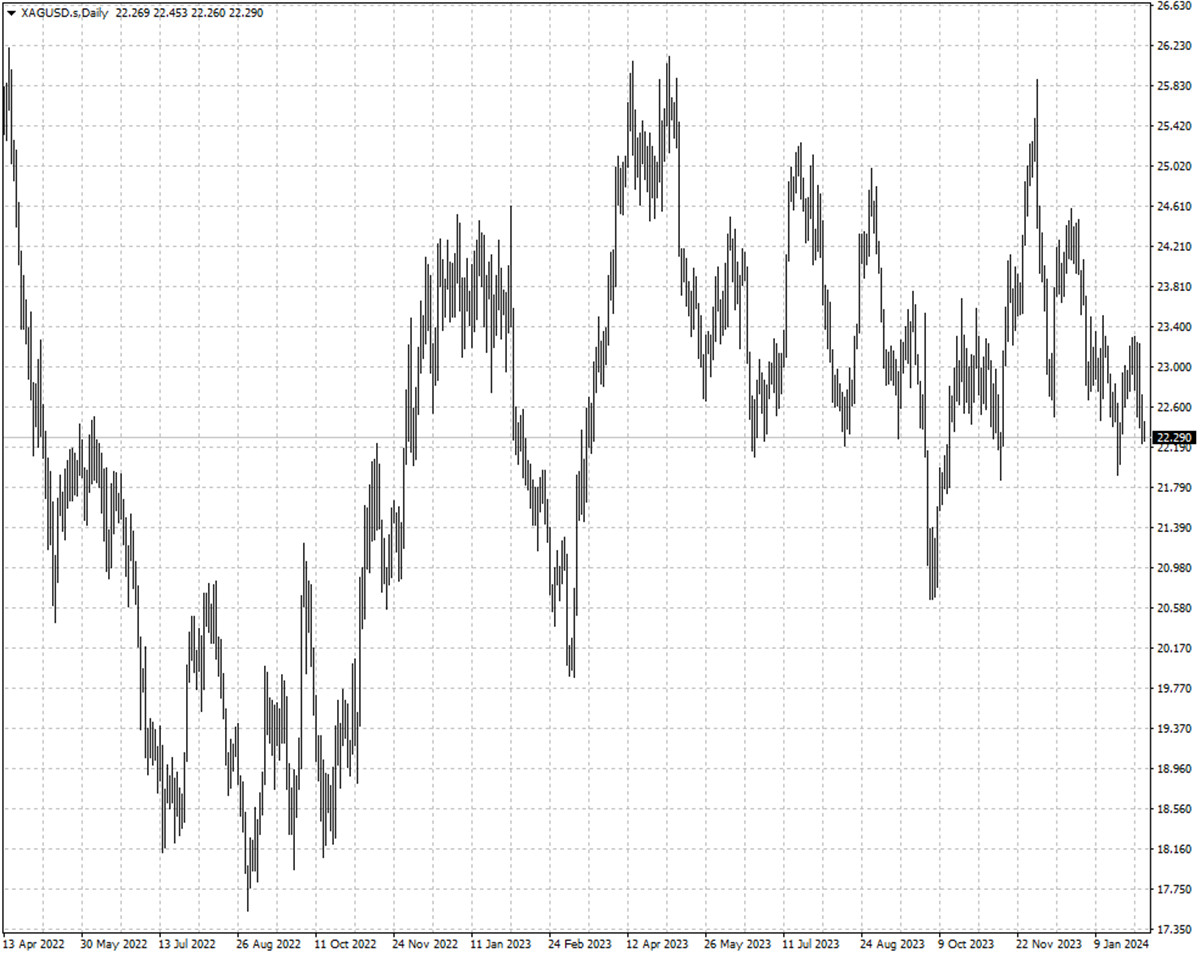

UBS expects both gold and silver to climb higher in 2024 on expectations

several Fed’s rate cuts are cast in stone. Strategist said bullion will hit

$2,200 by the end of this year.

The bank is also optimistic on silver, expecting the metal to outperform gold

after the Fed begins to ease. Silver has lagged behind gold in the last few

years and hence ample room for playing catch-up.

That forecast broadly chimes with the latest survey from the LBMA where

analysts see gold prices achieving a record annual price of $2059 and silver

prices averaging the year around $24.80.

Global silver demand is forecast to reach 1.2 billion ounces in 2024, the

second-highest level recorded, according to the Silver Institute. Stronger

industrial offtake is a principal catalyst for the demand.

A possible rematch between President Joe Biden and his predecessor Donald

Trump looms large in the election year. Maga 2.0 is, on any account, a great

wild card for the Precious metals.

Trump said earlier this month that he would consider imposing a tariff upward

of 60% on all Chinese imports if he regains the presidency. That would plague

the global economy and reignite concerns about supply chain disruption.

In that worst-case scenario, gold is boosted and continues to overshadow its

poor cousin which is more sensitive to industrial demand and macroeconomic

scene.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.