After a buoyant week on Wall Street, the S&P 500 soared to a fresh all-time closing high of 6,304.36 on Thursday, marking its sixth peak since late June and sealing a period of notable investor optimism. This milestone was supported by upbeat quarterly earnings from some of the largest US firms, a resilient showing in consumer data, and broadly positive sentiment across the major indices.

S&P 500 Surges To Record High with Wall Street

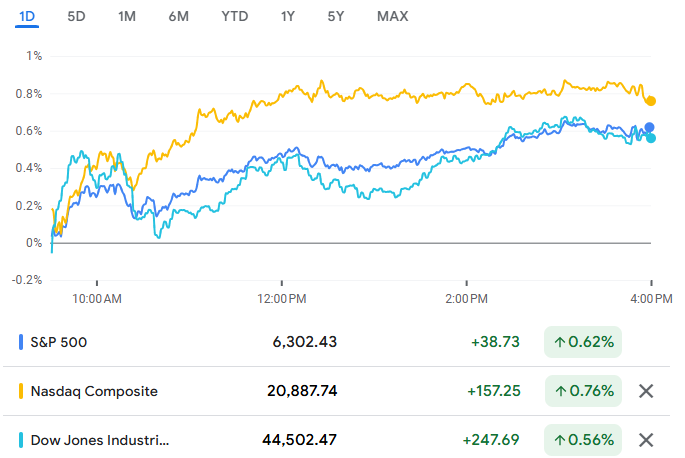

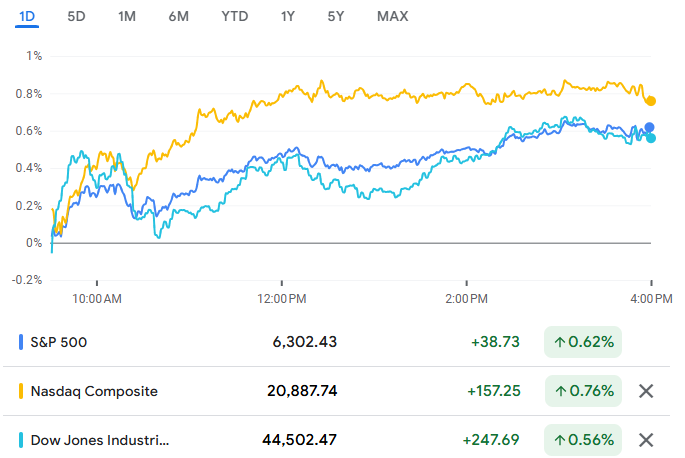

The S&P 500 gained 33.66 points (0.54%) to finish the day at 6,302.43. The tech-heavy Nasdaq Composite also joined the rally, vaulting 153.78 points (0.74%) to settle at 20,887.74, its own record close. Meanwhile, the Dow Jones Industrial Average climbed by 229.21 points (0.52%) to end at 44,502.47.

This surge follows a sequence of gains since a temporary market retreat in April, spurred at the time by increased trade tensions and fresh tariffs from President Trump. The rebound underscores investor confidence now that the major indices have weathered these shocks and regained positive momentum.

Earnings Season Fuels the Rally

The recent acceleration in equities has been largely driven by a robust corporate earnings season. Second-quarter results from giants such as PepsiCo, United Airlines, and several key technology stocks surprised to the upside, with approximately 88% of reporting S&P 500 companies surpassing analyst expectations as of Thursday afternoon.

-

According to FactSet, as of mid-July, the S&P 500 is posting a blended (actual and estimated) quarterly earnings growth rate of 4.8% year-on-year—the lowest since Q4 2023, but still marking the eighth consecutive quarter of earnings growth for the index.

81% of companies have topped revenue forecasts, with aggregate revenues beating estimates by 2.2%.

Sector-wise, gains were led by Communication Services and Information Technology, while Energy continued to lag due to declining profits and revenues.

Strong Consumer Data

The positive theme was reinforced by economic indicators:

-

The US Labour Department reported jobless claims fell by 7,000, totalling 221,000 for the week ending 12 July—lower than anticipated, hinting at continued labour market resilience.

Retail sales advanced by 0.6% in June, well above the expected 0.2%, signalling robust consumer spending even amid persistent inflation concerns and uncertainty in the policy environment.

Consumer sentiment data due this week is also expected to show improvement, with economists forecasting a rise to 61.8 from 60.7 in July.

Market Leadership and Notable Movers

Several bellwether stocks have helped lead the latest push higher:

-

Microsoft advanced 1.2% on the day, maintaining its leadership among mega-cap tech names.

-

Netflix, while reporting after hours, set market expectations high with its forecasted revenue of $11.0 billion and earnings per share of $7.08 for Q2.

The S&P 500's performance continues to be supported by technology and consumer-linked firms posting strong top- and bottom-line growth.

Global Market Context

Investor optimism in the US is shared, in part, by European and Asia-Pacific markets, which also registered gains. However, global sentiment remains cautious due to ongoing trade disputes, President Trump's threats of further tariffs, and political developments such as the potential sacking of Federal Reserve Chair Jerome Powell.

The US dollar strengthened modestly against the yen and euro, as currency traders responded to signs of economic resilience and the uncertain outlook for US monetary policy. In the commodities space, Brent crude oil dipped over 2% to around $69 per barrel after policy developments about Russia and OPEC+ fuelled price swings.

Valuation and the Outlook

The S&P 500's forward 12-month price/earnings ratio is now at 22.3, notably above both its five-year (19.9) and ten-year (18.4) averages, a sign that investors are willing to pay a premium for resilient corporate performance amid ongoing economic and geopolitical uncertainty. Forecasts from leading financial institutions suggest that the S&P 500 could rise an additional 6%—potentially reaching 6,600 in the next six months—if macro conditions steady and the US Federal Reserve implements expected rate cuts.

The earnings outlook for the remainder of 2025 remains positive, with analysts projecting earnings growth rates of 7.3% and 6.5% for Q3 and Q4, respectively. However, upside is expected to moderate if inflation reaccelerates or monetary tightening resumes in response to global price pressures.

Risks and Market Sentiment

Despite the buoyancy in equities, investors remain wary:

-

Ongoing trade tensions and tariff risk continue to shadow the global outlook.

-

Political risks in Washington, particularly involving central bank leadership and future fiscal direction, inject an element of policy unpredictability.

The rally is considered by some analysts to be “narrow,” with top technology stocks accounting for a disproportionate amount of the index’s gains.

Market strategists generally advise staying attuned to earnings quality and economic data releases for signs of any inflection in consumer or corporate sentiment.

Conclusion

The S&P 500's leap to a new record is emblematic of prevailing optimism among investors, supported by a resilient US consumer, robust earnings reports, and relative stability in policy and geopolitical headwinds. With valuation premiums at multi-year highs, however, the next stage of the rally may hinge on continued delivery from both Wall Street's leading companies and the broader US economy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.