A day after the presentation of interim Budget, India’s equity benchmarks BSE

Sensex and NSE Nifty closed higher. Goldman Sachs sees the Nifty index hitting

23,500 by the end of 2024.

The 12-month forward price-to-earnings ratio is 22.8 for the Nifty 50, three

times China's and higher even than the S&P 500 valuation at 20.23, according

to LSEG data.

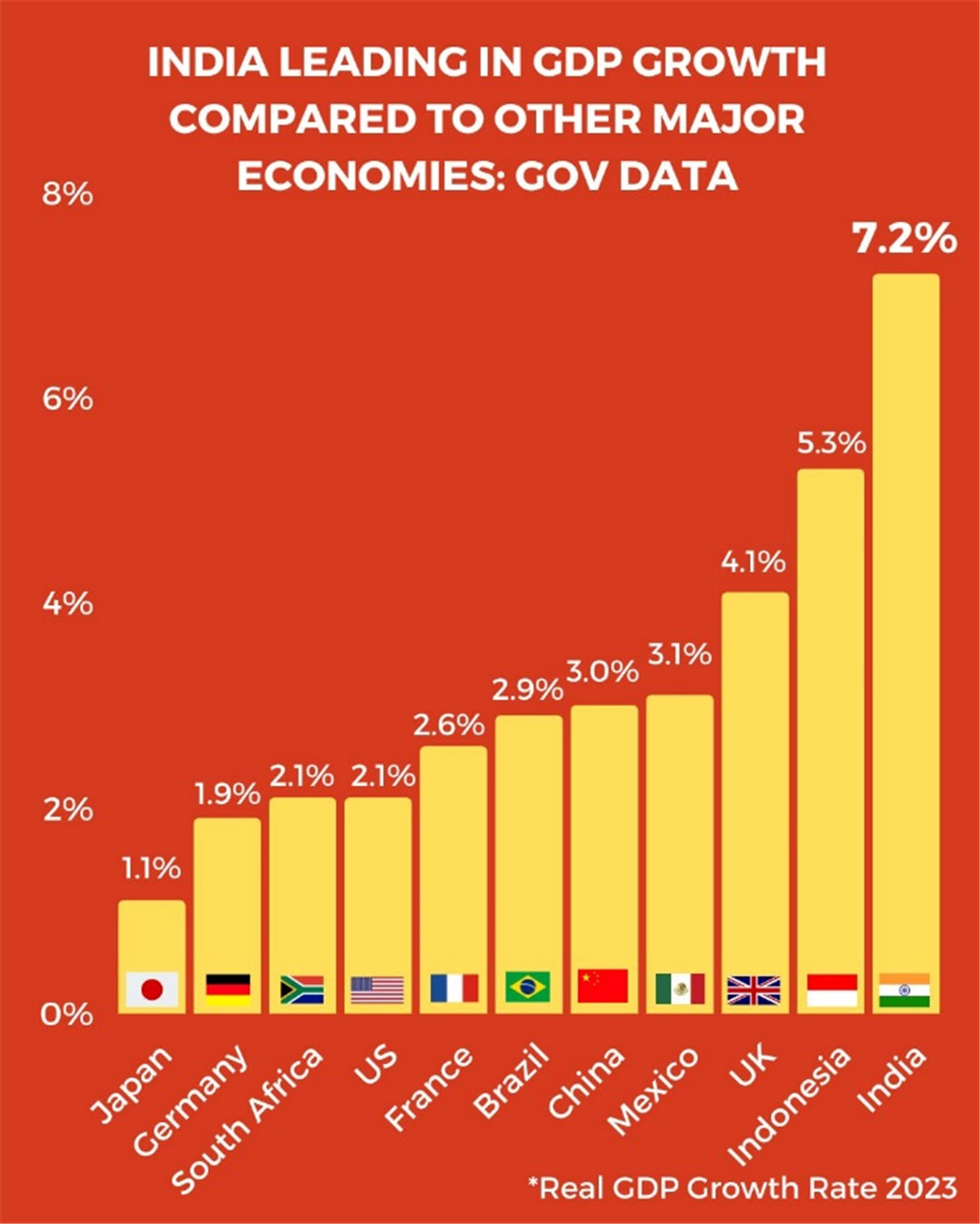

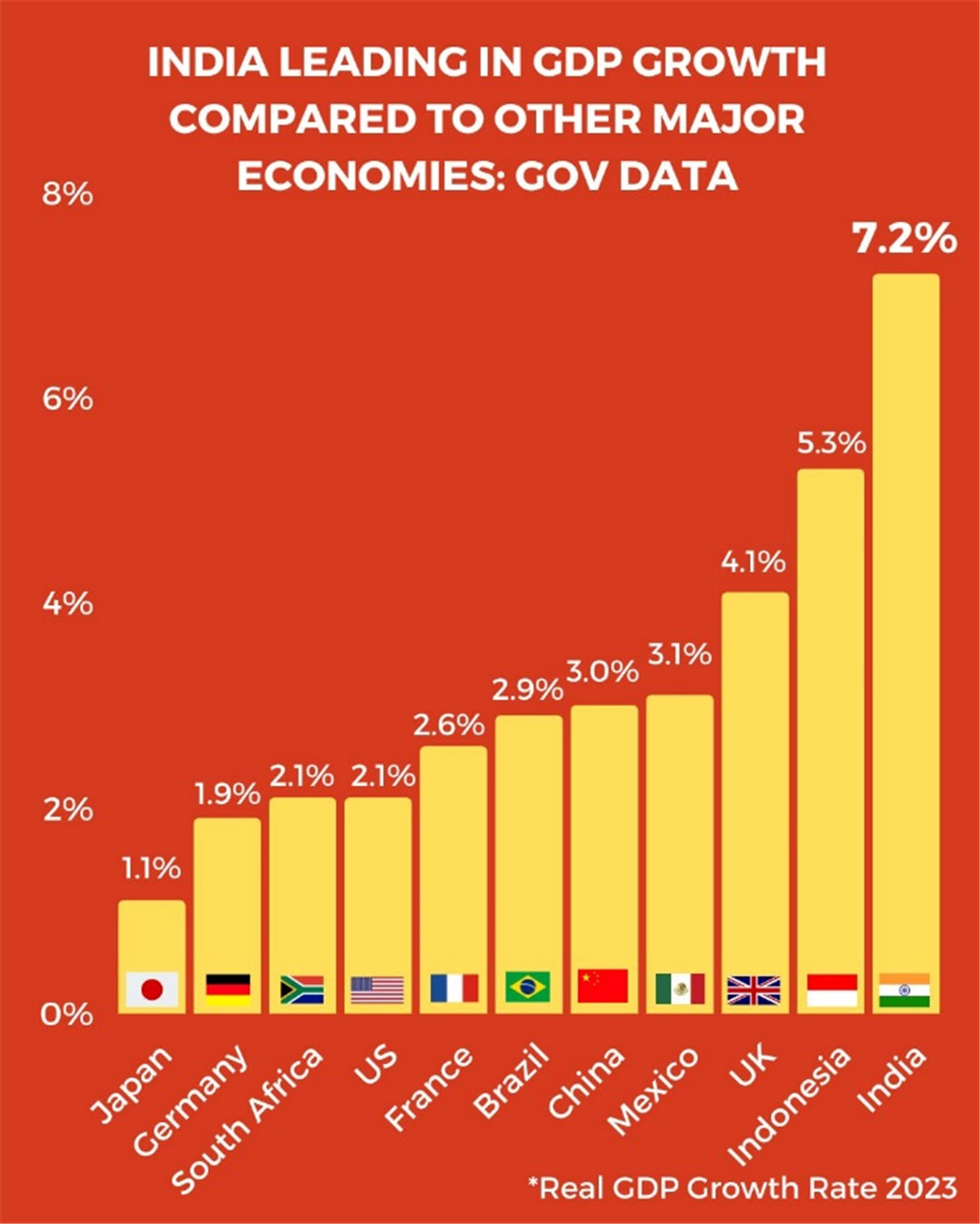

The country is expected to remain the fastest growing major economy this

year. PM Narendra Modi will likely secure his third term and his party is

expected to maintain its majority in parliament.

Indian shares saw an inflow of $21.4 billion globally on a net basis last

year, the largest total in three years, with over 40% of foreign inflows coming

during the last two months of the year.

Interestingly, Japan’s retail investors are pouring money into India while

Japan’s stock market is on fire. Total assets of India equity-focused investment

trusts in Japan grew 11% in January, according to Bloomberg.

Factoring in the gains of Indian stocks on the yen basis, the figures suggest

inflows of about ¥140 billion into India equity funds, while Japanese stock

funds had almost no net inflows.

Those people have grown more interested in areas such as foreign Index Funds

than in ESG fund. They pulled a total of ¥660 billion from ESG funds last year,

four times the outflow in 2022.

However, other investors were not so optimistic on Indian shares for now.

Foreign investors’ January sale of Indian stocks reached its largest monthly

total in a year, as global funds take profit from a recent rally.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.