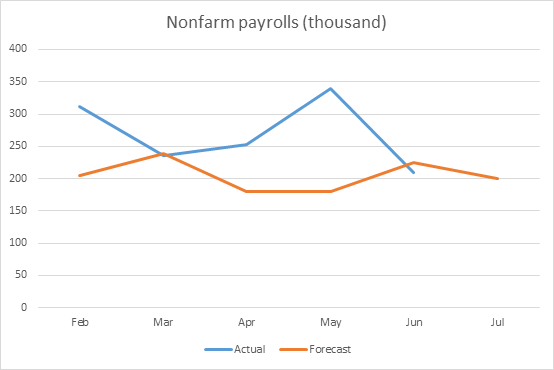

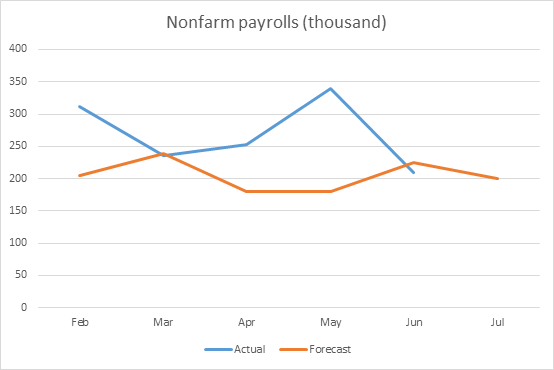

The U.S. added 209,000 jobs in June, slightly missing expectations for

230,000 and down from a downwardly revised 306,000 in May, according to the

monthly employment report from the BLS.

This reading is notable for breaking an unprecedented streak of 14

consecutive months of topping expectation. But average hourly earnings increased

by 0.4% month on month up from 0.3% in May, bringing the annual rate back to

4.4% from 4.3% previously.

ADP said on Wednesday that 324,000 jobs were created in July, almost the

double of economist expectations of around 191,000.

However, whether it signalled job market regained momentum is questionable.

An astounding of 497,000 jobs were created in June, according to ADP, a distinct

divergence from the official figure.

U.S. private sector is expected to add 200,000 jobs in July though the

unemployment rate is seen unchanged at 3.6%.

The dollar’s risk is tilted to the upside given large short position and

growing risk-off sentiment after Fitch Rating’s downgrade of the U.S.’ long-term

rating.

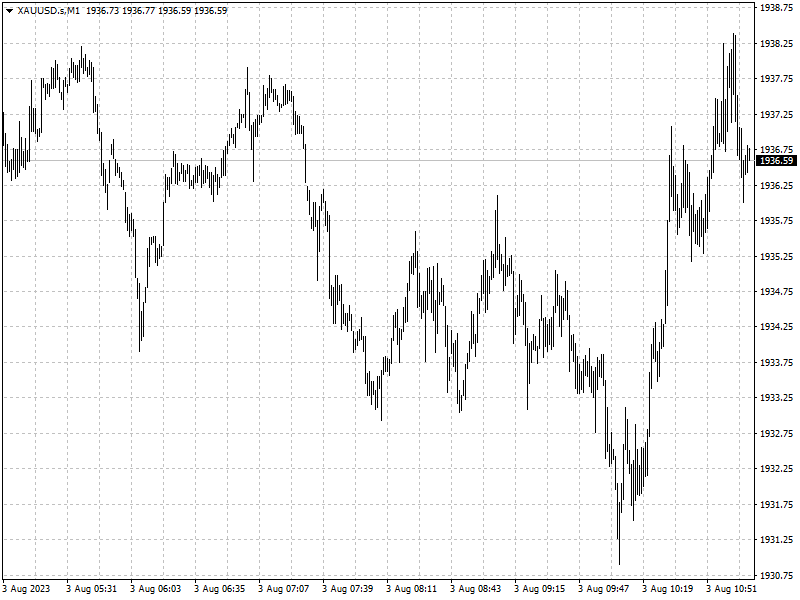

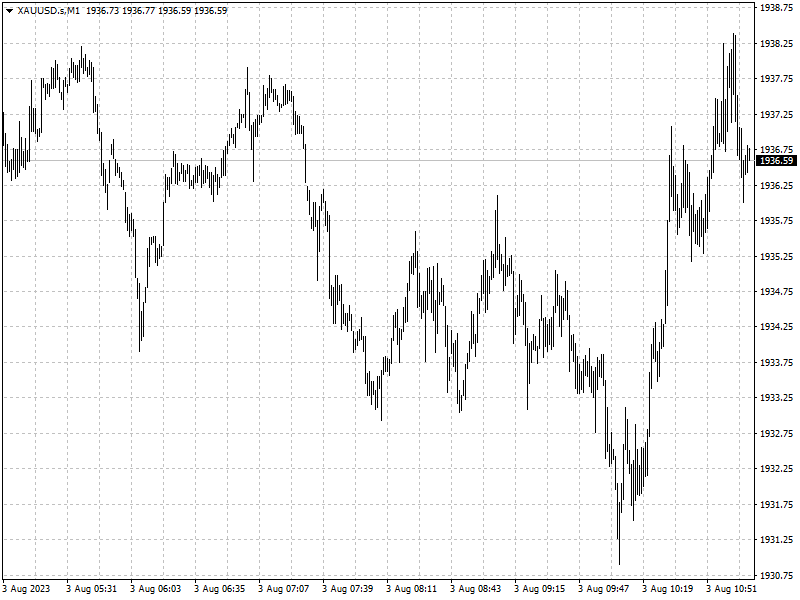

Any gold rally could be short-lived if the actual gain is slightly less than

expected. Conversely, the precious metal will face renewed selling pressure on

another strong jobs report.

Disclaimer: Investment involves risk. The content of this article is not an

investment advice and does not constitute any offer or solicitation to offer or

recommendation of any investment product.