Global funds fall for Japanese equities again

2023-08-07

Summary:

Summary:

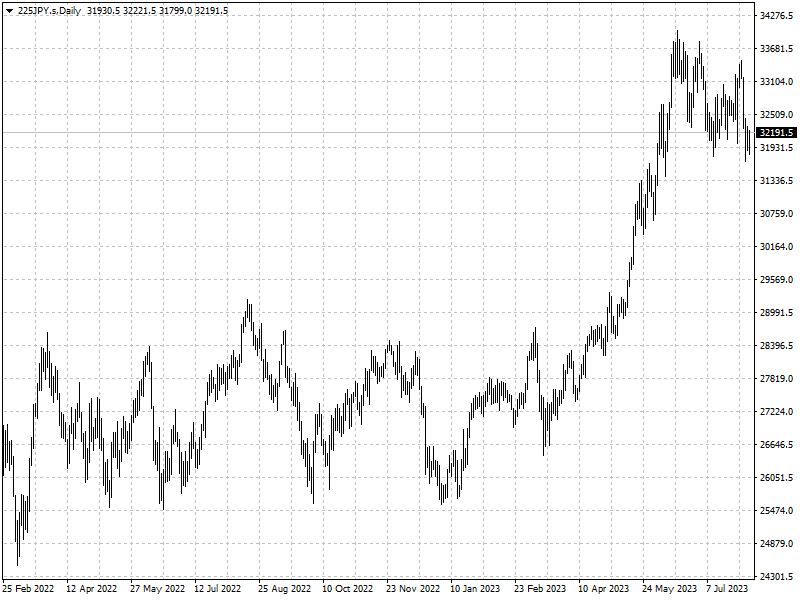

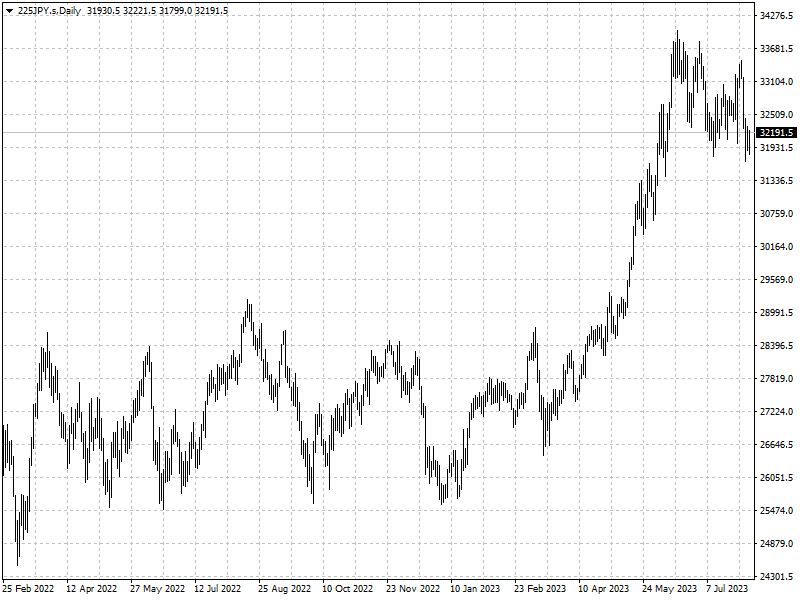

Investor looking to ride crest of Asia boom are not deterred by Japan’s stock market hitting a 33-year high and signs of slowing global growth. Japan’s Nikkei 225 has gained over 23% year-to-date, well ahead of the S&P 500 despite U.S. economic resilience.

Investor looking to ride crest of Asia boom are not deterred by Japan’s stock

market hitting a 33-year high and signs of slowing global growth.

Foreign buying of Japanese equities has exceeded that of Chinese peers for

the first time since 2017, according to a Goldman Sachs Group Inc. report.

Japan’s Nikkei 225 has gained over 23% year-to-date, well ahead of the

S&P 500 despite U.S. economic resilience.

Being second only to China in the Asia Pacific region in terms of size, the

market has been a lucrative alternative for global investors at a time after

Morgan Stanley downgraded China to equal weight from overweight last week.

The ESP growth is far superior to anywhere outside of the U.S., Jonathan

Garner from Morgan Stanley. And ‘the market is trading only about 13 times

forward PE’, according to the bank’s earning estimates, a 7 PE discount to the

S&P 500.

Goldman and Morgan Stanley also agreed that the BOJ’s latest policy

adjustment removes an overhang that will pave the way for stocks to rise

further.

Global funds snapped up 196 billion yen of Japanese stocks in the week ended

July 28, according to official data. They have been buyers in all but one week

since the end of March.

Disclaimer: Investment involves risk. The content of this article is not an

investment advice and does not constitute any offer or solicitation to offer or

recommendation of any investment product.